Talisker Resources Ltd. (“

Talisker” or the

“

Company”) (TSX: TSK, OTCQX: TSKFF) is pleased to

announce the acquisition of the Golden Hornet Project

(“

Golden Hornet”) post completion of the

previously announced option agreement. In connection with the

acquisition of Golden Hornet, Talisker also negotiated the purchase

of the 2% Net Smelter Royalty granted to Rich River Exploration

Ltd. in connection with the option agreement for total aggregate

consideration of $100,000, with 1% being purchased for cancellation

by Talisker in consideration for the payment of $38,000 in cash and

$12,000 through the issuance of 36,363 shares of Talisker at a

price of $0.33 per share (the “

Royalty Purchase”),

and the other 1% being purchased by Osisko Gold Royalties Ltd

(“

Osisko”) pursuant to a first right of refusal

granted under the royalty purchase agreement entered into between,

among others, the Company and Osisko, in December 2021 (the

“

RPA”) (see news release of December 6, 2021).

In accordance with the terms of the RPA and the

completion of the option agreement, Talisker and Osisko have

entered into a royalty agreement whereby Osisko will now hold a 2%

net smelter returns royalty on all production from Golden Hornet,

the Blue Jay and the Barnato properties.

Terry Harbort, CEO of Talisker stated, “Although

we remain squarely focused on the transition to gold production at

Bralorne, it is good to remind our shareholders of Talisker’s

extensive exploration portfolio in British Columbia and the

excellent results received from Golden Hornet, Talisker’s first

greenfields drill program.”

Golden Hornet is an advanced stage exploration

project where a 2022 drill program intersected high-grade gold in

the first four holes demonstrating the potential for a large,

kilometre scale mineralized system. Highlights of the initial drill

program include:

- Discovery of high-grade

fault-controlled quartz-sulphide breccias and veins, highlighted by

8.88 g/t Au, 0.42% Cu and 14.99 g/t Ag over 5.1 metres within a

broader zone of 2.59 g/t Au over 21.5 metres in GH-DDH-21-004.

- Hole GH-DDH-21-003 intercepted

11.58 g/t Au, 0.37% Cu and 11.1 g/t Ag over 1.05 metres.

- Drilling also intersected broader

zones of mineralization, including 9.99 g/t Au over 0.5 metres

within 0.82 g/t Au over 10.3 metres (GH-DDH-21-003) and 0.96 g/t Au

over 6.67 metres (GH-DDH-21-001).

- A total of 4,853 metres of NQ

drilling was completed in 14 holes to a maximum depth of 431

metres.

- Ten holes drilled in the central

Hornet Zone (3,568 metres) intersected semi-massive sulphide

mineralization in every hole.

- Four holes drilled in the Iron

Canyon Zone (1,015 metres), a 1,000-metre step-out to the

northwest, intersected semi-massive and breccia-hosted sulphide

mineralization in every hole.

For further information, please contact:

Terry HarbortPresident and

CEOterry.harbort@taliskerresources.com+1 416 357 0227

Qualified Person

The scientific and technical information

contained in this press release has been reviewed and approved by

Leonardo de Souza (BSc, AusIMM (CP) Membership 224827), Talisker’s

Vice President, Exploration and Resource Development, who is a

“qualified person” within the meaning of National Instrument 43-101

– Standards of Disclosure for Mineral Projects.

About Talisker Resources Ltd.

Talisker (taliskerresources.com) is a junior

resource company involved in the exploration and development of

gold projects in British Columbia, Canada. Talisker’s flagship

asset is the high-grade, fully permitted Bralorne Gold Project

where the Company is currently transitioning into underground

production at the Mustang Mine. Talisker projects also include the

Ladner Gold Project, an advanced stage project with significant

exploration potential from an historical high-grade producing gold

mine and the Spences Bridge Project where the Company holds ~85% of

the emerging Spences Bridge Gold Belt, and several other

early-stage Greenfields projects.

Caution Regarding Forward Looking

Statements

Certain statements contained in this press

release constitute forward-looking information. These statements

relate to future events or future performance. The use of any of

the words “could”, “intend”, “expect”, “believe”, “will”,

“projected”, “estimated” and similar expressions and statements

relating to matters that are not historical facts are intended to

identify forward-looking information and are based on Talisker’s

current belief or assumptions as to the outcome and timing of such

future events. Various assumptions or factors are typically applied

in drawing conclusions or making the forecasts or projections set

out in forward-looking information. Those assumptions and factors

are based on information currently available to Talisker. Although

such statements are based on reasonable assumptions of Talisker’s

management, there can be no assurance that any conclusions or

forecasts will prove to be accurate. In particular, the Company

advises that it does not have defined mineral reserves and it has

not based its production decision on a feasibility study of mineral

reserves, demonstrating economic and technical viability, and, as a

result, there may be an increased uncertainty of achieving any

particular level of recovery of minerals or the cost of such

recovery, including increased risks associated with developing a

commercially mineable deposit.

Forward looking information involves known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance, or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking information. Such

factors include risks inherent in the exploration, development and

operation of mineral deposits, including risks relating to changes

in project parameters as plans continue to be redefined, risks

relating to variations in grade or recovery rates, risks relating

to changes in mineral prices and the worldwide demand for and

supply of minerals, risks related to increased competition and

current global financial conditions, access and supply risks,

reliance on key personnel, operational risks regulatory risks,

including risks relating to the acquisition of the necessary

licenses and permits, financing, capitalization and liquidity

risks, title and environmental risks and risks relating to the

failure to receive all requisite shareholder and regulatory

approvals. Furthermore, historically, projects that are in

production without defined mineral reserves have a much higher risk

of economic and technical failure. There is no guarantee that

production will begin as anticipated or at all or that anticipated

production costs will be achieved.

The forward-looking information contained in

this release is made as of the date hereof, and Talisker is not

obligated to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by applicable securities laws. Because of the

risks, uncertainties and assumptions contained herein, investors

should not place undue reliance on forward-looking information. The

foregoing statements expressly qualify any forward-looking

information contained herein.

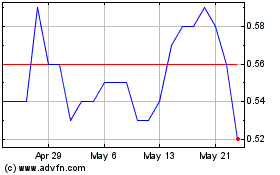

Talisker Resources (TSX:TSK)

Historical Stock Chart

From Jan 2025 to Feb 2025

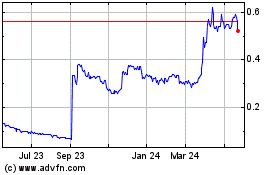

Talisker Resources (TSX:TSK)

Historical Stock Chart

From Feb 2024 to Feb 2025