Consolidated Financial

Highlights

|

(in thousands of dollars except per share

amounts) |

Three months ended |

Year ended |

|

December 31, 2023 |

December 31, 2022 |

December 31, 2023 |

December 31, 2022 |

|

Net earnings |

$ |

4,289 |

$ |

4,245 |

$ |

22,042 |

$ |

18,666 |

|

Basic and diluted earnings per share |

$ |

0.18 |

$ |

0.17 |

$ |

0.90 |

$ |

0.76 |

Operating Data

|

|

Three months ended |

Year ended |

|

|

December 31, 2023 |

December 31, 2022 |

December 31, 2023 |

December 31, 2022 |

|

Canadian Full Privilege Golf Members |

|

|

15,256 |

15,417 |

|

Championship rounds – Canada |

129,000 |

150,000 |

1,087,000 |

1,177,000 |

|

18-hole equivalent championship golf courses – Canada |

|

|

35.5 |

37.5 |

|

18-hole equivalent managed championship golf courses – Canada |

|

|

2.0 |

2.0 |

|

Championship rounds – U.S. |

52,000 |

70,000 |

254,000 |

269,000 |

|

18-hole equivalent championship golf courses – U.S. |

|

|

6.5 |

8.0 |

The following is an analysis of net earnings:

| |

|

Year

Ended |

Year Ended |

|

|

(thousands of Canadian dollars) |

|

December 31,

2023 |

December 31, 2022 |

|

|

|

|

|

|

|

|

Operating revenue |

|

$ |

225,865 |

|

$ |

186,512 |

|

|

| Direct

operating expenses (1) |

|

|

185,804 |

|

|

137,936 |

|

|

|

|

|

|

|

|

| Net

operating income (1) |

|

|

40,061 |

|

|

48,576 |

|

|

| |

|

|

|

|

| Amortization

of membership fees |

|

|

4,604 |

|

|

4,294 |

|

|

| |

|

|

|

|

| Depreciation

and amortization |

|

|

(14,192 |

) |

|

(17,856 |

) |

|

| |

|

|

|

|

| Interest,

net and investment income |

|

|

8,973 |

|

|

806 |

|

|

| |

|

|

|

|

| Other

items |

|

|

(7,896 |

) |

|

(7,998 |

) |

|

| |

|

|

|

|

|

Income taxes |

|

|

(9,508 |

) |

|

(9,156 |

) |

|

| |

|

|

|

|

|

Net earnings |

|

$ |

22,042 |

|

$ |

18,666 |

|

|

| |

|

|

|

|

The following is a breakdown of net

operating income (loss) by segment:

| |

|

Year

Ended |

Year Ended |

|

(thousands of Canadian dollars) |

|

December 31,

2023 |

December 31, 2022 |

|

|

|

|

|

| Net

operating income (loss) by segment |

|

|

|

|

Canadian golf club operations |

|

$ |

42,730 |

|

$ |

48,521 |

|

|

US golf club operations |

|

|

|

|

(2023 - US $4,043,000: 2022 - US $2,940,000) |

|

|

5,463 |

|

|

3,742 |

|

|

Corporate and other |

|

|

(8,132 |

) |

|

(3,687 |

) |

|

|

|

|

|

|

Net operating income (1) |

|

$ |

40,061 |

|

$ |

48,576 |

|

|

|

|

|

|

Operating revenue is calculated as

follows:

| |

|

Year

Ended |

Year Ended |

|

|

(thousands of Canadian dollars) |

|

December 31, 2023 |

December 31, 2022 |

|

|

|

|

|

|

|

|

Annual dues |

|

$ |

69,399 |

$ |

68,105 |

|

| Golf |

|

|

44,817 |

|

44,594 |

|

| Corporate

events |

|

|

7,595 |

|

7,850 |

|

| Food and

beverage |

|

|

30,859 |

|

31,057 |

|

|

Merchandise |

|

|

14,083 |

|

13,547 |

|

| Real

estate |

|

|

54,594 |

|

15,811 |

|

| Rooms and

other |

|

|

4,518 |

|

5,548 |

|

|

|

|

|

|

|

| Operating

revenue |

|

$ |

225,865 |

$ |

186,512 |

|

|

|

|

|

|

|

Direct operating expenses are calculated as

follows:

| |

|

Year

Ended |

Year Ended |

|

|

(thousands of Canadian dollars) |

|

December 31,

2023 |

December 31,

2022 |

|

|

|

|

|

|

|

|

Operating cost of sales |

|

$ |

19,890 |

$ |

18,686 |

|

| |

|

|

|

|

| Real estate

cost of sales |

|

|

59,895 |

|

16,394 |

|

| |

|

|

|

|

| Labour and

employee benefits |

|

|

63,579 |

|

60,927 |

|

| |

|

|

|

|

|

Utilities |

|

|

7,445 |

|

7,707 |

|

| |

|

|

|

|

|

Selling, general and administrative expenses |

|

5,124 |

|

5,616 |

|

| |

|

|

|

|

| Property

taxes |

|

|

3,136 |

|

3,116 |

|

| |

|

|

|

|

|

Insurance |

|

|

4,415 |

|

3,650 |

|

| |

|

|

|

|

| Repairs and

maintenance |

|

|

5,482 |

|

5,150 |

|

| |

|

|

|

|

| Turf

operating expenses |

|

|

4,230 |

|

4,312 |

|

| |

|

|

|

|

| Fuel and

oil |

|

|

1,513 |

|

1,746 |

|

| |

|

|

|

|

|

Other operating expenses |

|

|

11,095 |

|

10,632 |

|

| |

|

|

|

|

|

Direct Operating Expenses (1) |

|

$ |

185,804 |

$ |

137,936 |

|

| |

|

|

|

|

(1) Please see Non-IFRS Measures

2023 Consolidated Operating

Highlights

Operating revenue increased 21.1% to

$225,865,000 in 2023 from $186,512,000 in 2022 due to the revenue

from 31 Highland Gate home sales in 2023 (2022 – 10).

Direct operating expenses increased 34.7% to

$185,804,000 in 2023 from $137,936,000 in 2022 due to the cost of

sales from the 31 Highland Gate home sales in 2023 (2022 – 10), as

well as above normal increases in labour and certain operating

expenses. It continues to be a challenging environment in being

able to manage labour costs due to the above normal minimum wage

increases and a competitive environment for hiring staff.

Net operating income for the Canadian golf club

operations segment decreased 11.0% to $42,730,000 in 2023 from

$48,521,000 in 2022 due to the conclusion of ClubLink's lease of

The Country Club which expired as of December 31, 2022, as well as

above normal increases in labour and certain operating expenses.

There has also been a noticeable decline in traffic in the Muskoka,

Ontario tourist region this summer which has affected the results

of the Company's resorts which operate in this area.

Depreciation and amortization decreased 20.0% to

$14,192,000 in 2023 from $17,856,000 in 2022 due to the conclusion

of The Country Club lease which has also resulted in a decline in

depreciation of right-of-use assets.

Interest, net and investment income increased to

income of $8,973,000 in 2023 from $806,000 in 2022 due to a

decrease in borrowings and an increase in distributions from the

Company’s investment in Automotive Properties REIT. On September 1,

2022, the Company paid off several non-revolving mortgages in

advance of their due dates resulting in an expense of $2,604,000

which includes prepayment penalties and other costs.

Other items consist of the following income

(loss) items:

| |

Year

Ended |

Year Ended |

|

| |

December 31, 2023 |

December 31, 2022 |

|

|

|

|

|

|

|

Foreign exchange gain |

$ |

659 |

|

$ |

247 |

|

|

| Unrealized

loss on investment in marketable securities |

|

(20,763 |

) |

|

(15,754 |

) |

|

| Contingent

contractual obligation |

|

6,620 |

|

|

- |

|

|

| Gain on sale

of investments in joint venture |

|

6,437 |

|

|

- |

|

|

| Gain on

property, plant and equipment |

|

1,182 |

|

|

376 |

|

|

| Equity

income (loss) from investments in joint ventures |

|

(123 |

) |

|

457 |

|

|

| Gain (loss)

on real estate fund investments |

|

(510 |

) |

|

6,356 |

|

|

| Allowance on

loans receivable |

|

(150 |

) |

|

- |

|

|

| Demolition

of Woodlands clubhouse |

|

(262 |

) |

|

- |

|

|

| Insurance

proceeds |

|

187 |

|

|

580 |

|

|

| Other |

|

(1,173 |

) |

|

(260 |

) |

|

|

|

|

|

|

| Other

items |

$ |

(7,896 |

) |

$ |

(7,998 |

) |

|

|

|

|

|

|

At December 31, 2023, the Company recorded

unrealized losses of $20,763,000 on its investment in marketable

securities (December 31, 2022 - loss of $15,754,000). This loss is

attributable to the fair market value adjustments of the Company's

investment in Automotive Properties REIT. The Company also recorded

losses of $510,000 (December 31, 2022 - gain of $6,356,000) on fair

market value adjustments of its real estate fund investments in

relation to Florida and southeastern US real estate.

The contingent contractual obligation of

USD$5,000,000 (CDN$6,620,000) originating from the sale of White

Pass in 2018 expired in July 2023 and as such has been reversed

since it had not been expended.

On September 20, 2023, the Company completed the

divestiture of its investment in the Geranium real estate

management company along with other non-Highland Gate joint

ventures in which it was a co-investor with the Geranium Group.

These assets were purchased by the Company’s co-investors with

Geranium. Total proceeds for the transaction were $12,500,000

including deferred proceeds of $5,300,000. A gain of $6,437,000 was

recorded as a result of the transaction.

Net earnings increased to $22,042,000 in 2023

from $18,666,000 in 2022 due to the increase in interest, net and

investment income as described above. Basic and diluted earnings

per share increased to 90 cents per share in 2023, compared to 76

cents in 2022.

Non-IFRS Measures

TWC uses non-IFRS measures as a benchmark

measurement of our own operating results and as a benchmark

relative to our competitors. We consider these non-IFRS measures to

be a meaningful supplement to net earnings. We also believe these

non-IFRS measures are commonly used by securities analysts,

investors and other interested parties to evaluate our financial

performance. These measures, which included direct operating

expenses and net operating income do not have standardized meaning

under IFRS. While these non-IFRS measures have been disclosed

herein to permit a more complete comparative analysis of the

Company’s operating performance and debt servicing ability relative

to other companies, readers are cautioned that these non-IFRS

measures as reported by TWC may not be comparable in all instances

to non-IFRS measures as reported by other companies.

The glossary of financial terms is as

follows:

Direct operating expenses =

expenses that are directly attributable to company’s business units

and are used by management in the assessment of their performance.

These exclude expenses which are attributable to major corporate

decisions such as impairment. Net operating income

= operating revenue – direct operating expenses

Net operating income is an important metric used

by management in evaluating the Company’s operating performance as

it represents the revenue and expense items that can be directly

attributable to the specific business unit’s ongoing operations. It

is not a measure of financial performance under IFRS and should not

be considered as an alternative to measures of performance under

IFRS. The most directly comparable measure specified under IFRS is

net earnings.

Eligible Dividend

Today, TWC Enterprises Limited announced an

eligible cash dividend of 7.5 cents per common share to be paid on

April 1, 2024 to shareholders of record as at March 15, 2024. This

is a 50% increase to the previous quarterly dividend of 5 cents per

common share.

Corporate Profile

TWC is engaged in golf club operations under the

trademark, “ClubLink One Membership More Golf.” TWC is Canada’s

largest owner, operator and manager of golf clubs with 44 18-hole

equivalent championship and 2 18-hole equivalent academy courses

(including two managed properties) at 34 locations in Ontario,

Quebec and Florida.

For further information please contact:

Andrew Tamlin Chief Financial Officer 15675

Dufferin Street King City, Ontario L7B 1K5 Tel: 905-841-5372 Fax:

905-841-8488 atamlin@clublink.ca

Management’s discussion and analysis, financial

statements and other disclosure information relating to the Company

is available through SEDAR and at www.sedar.com and on the Company

website at

www.twcenterprises.ca

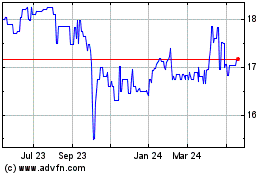

TWC Enterprises (TSX:TWC)

Historical Stock Chart

From Dec 2024 to Jan 2025

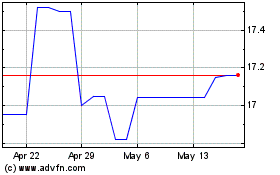

TWC Enterprises (TSX:TWC)

Historical Stock Chart

From Jan 2024 to Jan 2025