Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”)

today announces fourth quarter (“Q4 2022”) and full year financial

results. All figures are stated in Canadian dollars unless

otherwise noted.

Key Highlights:

Eagle River

- Eagle River underground mine

processed 223,735 tonnes at an average grade of 11.5 gpt to produce

79,997 ounces with the underground producing 231,000 tonnes of

broken ore.

- Completed additional drilling and

ore development at the Falcon Zone which is improving production

and grade forecasting; results in 2023 so far are showing positive

reconciliation at the Falcon Zone

Kiena

- Successfully commissioned the

pastefill plant and declared commercial production

- Drilling expanded the size of the A

Zones and Footwall Zones, which supports future mine life extension

potential

- Drilling better defined and

expanded the Presqu’ile Zone potentially justifying the

installation of an exploration ramp

Other

- Named to the Globe & Mail's 2022 Report on Business Women

Lead Here list. This annual editorial benchmark identifies

best-in-class executive gender diversity in corporate Canada

- Placed 6th out of 34 TSX-listed

materials companies in the annual Globe and Mail Board Games report

on corporate governance

Warwick Morley-Jepson, Interim CEO commented, “2022 was a

challenging year for Wesdome, and we have leveraged our experiences

to ensure better operational and financial performance going

forward. Production misses at both mines resulted in a net loss of

$14.7 million or ($0.10) per share.

Previously disclosed grade reconciliation issues at the Falcon

zone that impacted 2022 production have been addressed through

additional ore development and drilling. Eagle operations are

recovering well, with 2023 grade so far reconciling higher than

guidance.

At Kiena, despite the challenging backdrop of the fractured

supply chains we are very pleased to have put a second mine into

production, financed almost entirely from internally generated cash

flow. The delays encountered in 2022 are behind us, and all

required equipment is on site. The next milestone is the continued

development of the ramp giving access to mining operations in the A

zone. Ramp advancement will position us to mine in the areas where

the ounces per vertical metre significantly increase, and grade is

expected to improve. Year to date, this project is tracking

slightly ahead of schedule. As well, 2022 saw the hiring of key

technical personnel including a Director, Engineering and

Operations who will support daily mine operations.

Production guidance for 2023 is expected to range between

110,000 – 130,000 ounces with production back end weighted through

the year. Until the ramp reaches the 129 metre level at Kiena,

lower processed grades are expected to continue into

2023. We will continue to supply the mill with lower

grade ore from the Martin, S50, and VC zones to supplement the

Kiena Deep material that will be available to mine, which is mostly

lower grade fringe material and diluted ore from previously mined

areas.

We consider this year to be a transition year as we get Kiena

back on schedule, setting up 2024 to be a stronger year

operationally, as well as financially. In this regard, an

at-the-market equity program was established in December to

accelerate balance sheet de-levering.”

Key operating and financial performance of the full year

2022 results include:

- Gold production of 110,850 ounces is

a 10% decrease over the same period in the previous year (2021:

123,843 ounces):

- Eagle River underground processed

223,734 tonnes at a head grade of 11.5 grams per tonne for 79,997

ounces produced, 19% decrease over the previous year (2021: 99,120

ounces).

- Mishi Open Pit 23,153 tonnes at a

head grade of 3.2 grams per tonne for 2,005 ounces produced (2021:

2,283 ounces).

- Kiena 115,171 tonnes at a head grade

of 7.9 grams per tonne for 28,848 ounces produced, 29% increase

over previous year (2021: 22,440)

- Revenue2 of $265.5 million, a 1%

increase over the previous year (2021: $262.9 million).

- Ounces sold3 were 113,000 at an

average sales price of $2,347/oz (2021: 116,708 ounces at an

average price of $2,250/oz).

- Cash margin1,2,4 of $95.7 million, a

34% decrease over the previous year (2021 - $145.4 million).

- Operating cash flows2,4 decreased by

50% to $65.2 million or $0.46 per share1 as compared to $131.0

million or $0.93 per share for the same period in 2021.

- Free cash outflow of $90.2 million,

net of an investment of $108.9 million in Kiena, or ($0.63) per

share1 (2021: free cash outflow of $21.3 million or ($0.15) per

share).

- Net loss of $14.7 million or ($0.10)

per share (2021: Net income2,4 $131.3 million or $0.94 per share)

and Net loss (adjusted)1 of $5.9 million or ($0.04) per share

(2021: Net income (adjusted)1,2,4 $69.9 million or $0.50 per

share).

- Cash position at the end of the year

of $33.2 million, with total borrowings of $54.7 million drawn on

the senior secured revolving credit facility.Cash costs1,4,5 of

$1,500/oz or US$1,153/oz, a 52% increase over the same period in

2021 (2021: $990/oz or US$789/oz) due to a 9% increase in aggregate

operating costs at Eagle River and the costs of ramping up

operations at Kiena in anticipation of declaring commercial

production;

- AISC1,5 increased by 43% to

$2,020/oz or US$1,552/oz (2021: $1,408 or US$1,123 per ounce) due

to a 9% increase in aggregate operating costs and increased

spending at Eagle River to replace aging infrastructure and the

costs of ramping up operations at Kiena in anticipation of

declaring commercial production.

Key operating and financial performance of Q4 2022

results include:

- Gold production of 35,116 ounces,

which includes a 16% decrease over the same period in the previous

year (Q4 2021: 41,559 ounces):

- Eagle River underground 58,306

tonnes at a head grade of 14.0 grams per tonne for 25,502 ounces

produced, 5% increase over the previous year (Q4 2021: 24,267

ounces).

- Kiena 51,419 tonnes at a head grade

of 5.9 grams per tonne for 9,614 ounces produced, 43% decrease over

the previous year (Q4 2021: 16,929 ounces).

- Revenue of $75.1 million, a 12%

decrease over the previous year (Q4 2021: $85.5 million).

- Ounces sold were 31,500 at an

average sales price of $2,380/oz (Q4 2021: 37,544 ounces at an

average price of $2,275/oz).

- Cash margin1 of $26.5 million, an

44% decrease over the previous year (Q4 2021 - $47.7 million).

- Operating cash flows decreased by

79% to $10.3 million or $0.07 per share1 as compared to $48.2

million or $0.34 per share for the same period in 2021.

- Free cash outflow of $31.6 million,

net of an investment of $26.5 million in Kiena, or ($0.22) per

share1 (Q4 2021: free cash outflow of $3.2 million or ($0.02) per

share).

- Net loss and Net loss (adjusted)1of

$3.5 million or ($0.02) per share (2021: Net income and Net income

(adjusted)1 $24.8 million or $0.18 per share).

- Cash costs1 of $1,540/oz or

US$1,134/oz, a 53% increase over the same period in 2021 (Q4 2021:

$1,005/oz or US$797/oz);

- AISC1 increased by 51% to $2,136/oz

or US$1,573/oz (Q4 2021: $1,412 or US$1,121 per ounce).

- Refer to the Company’s 2022 Annual Management Discussion and

Analysis section entitled “Non-IFRS Performance Measures” for the

reconciliation of these non-IFRS measurements to the financial

statements.

- FY 2021 excludes $3.9 million of revenue from the Kiena bulk

sample, which was processed in Q4 2020 and sold in Q1 2021. The

incidental revenue was credited against the cost of the Kiena

exploration asset.

- FY 2021 excludes 1,793 ounces from the Kiena bulk sample, which

was processed in Q4 2020 and sold in Q1 2021.

- Includes a $0.4 million charge for product inventory costs from

the sale of 1,793 ounces of gold from the Kiena bulk sample, which

was processed in Q4 2020 and sold in Q1 2021.

- In determining the Cash cost per ounce and AISC per ounce, the

total ounces sold includes 1,793 ounces of gold from the Kiena bulk

sample, which was processed in Q4 2020 and sold in Q1 2021.

|

Production Metrics and Exploration Updates |

Performance |

|

Eagle River Complex |

- FY 2022

gold production from the Eagle River Complex decreased by 19% from

FY 2021 to 82,002 ounces of gold, primarily due to lower realized

head grade, as the newly developed Falcon Zone grade was not as

high as expected. Gold production from Mishi was also lower than in

2021 as the stockpiled ore nears depletion. Head grade at the Eagle

River Complex in 2022 averaged 10.7 g/t.

- FY 2022

cash cost of $1,356 (US$1,042) per ounce of gold sold1 increased by

39% or $378 from FY 2021 due to a 21% decrease in ounces sold and a

9% increase in overall aggregate site operating costs resulting

from higher operating costs incurred due to more ore development

metres, waste movement, improvements made to strengthen the

technical and mine management team at site, general maintenance

improvements and inflationary pressures, driven by higher labour

costs and an increase in commodity inputs, including higher fuel

and energy costs.

- FY 2022

AISC of $2,003 (US$1,539) per ounce of gold sold1 increased by 38%

or $547 from FY 2021 due to the higher cash costs, combined with

the replacement of aging site infrastructure and raising of the

tailings storage facility.

- Generated

$79.1 million in cash margin in FY 2022 compared to $127.7 million

in FY 2021 due to the 21% decrease in ounces sold and the 9%

increase in overall aggregate site operating costs.

- The new 355 m

level development is now complete along the western extent of the

mine infrastructure. The development extends 400 m west of the mine

into the volcanic rocks that host the Falcon 7 zone. This

development provides drill platforms to test for gold

mineralization near the Falcon 7 zone further along strike, and for

parallel zones. In the future it will provide access for mining and

will improve operational planning, as it is situated away from the

main mining area at depth.

- Most recently,

surface, and underground drilling from the newly established 355 m

level exploration drift, has defined the up-plunge extent of the

Falcon 7 zone. Highlights of the recent drilling include 11.1 g/t

Au over 3.0 m core length and 26.5 g/t Au over 2.0 m core length

(see press release dated October 5, 2022).

- In addition,

several drill holes have intersected mineralization in subparallel

zones in the hanging wall of the Falcon 7 zone, including a recent

hole that returned 40.3 g/t Au over 1.5 m. One hole, further to the

west along strike from the Falcon 7 zone, near the historic 9 zone,

returned 19.4 g/t au over 0.7 m.

- Additionally,

initial surface drilling within the volcanic rocks, 150 metres east

and down dip of the previously mined 2 Zone intersected altered

volcanic rocks with quartz veining and VG. One hole returned 233.0

g/t Au over 0.4 metres.

|

|

Kiena |

- With the

successful completion of a test pastefill pour on November 30,

2022, commercial production at the Kiena Mine was declared

effective December 1, 2022. The pastefill plant has been performing

well and in line with expectations.

- FY 2022

Kiena ore production increased by 29% from FY 2021 to 28,848 ounces

of gold, primarily due to higher throughput; partially offset by

lower head grade as less ore was sourced from Kiena Deep. Head

grade at Kiena in 2022 averaged 7.9 g/t.

- The 2022

cash cost of $1,839 (US$1,413) per ounce of gold sold increased by

75% or $786 per ounce as compared to $1,052 (US$839) in 2021 and

the AISC of $2,059 (US$1,582) per ounce of gold sold increased by

81% or $922 per ounce as compared to $1,138 (US$908) in 2021

primarily due to ramping up operations in anticipation of declaring

commercial production, which was delayed until December 1, 2022 due

to supply chain challenges in sourcing vital equipment necessary to

deal with challenging ground conditions within the Kiena Deep A

zone. Once a sufficient level of developed reserves is achieved

through the development of the ramp to the higher grade A zone, the

cash cost and AISC are expected to align with the life of mine cash

costs and AISC in the Preliminary Feasibility Study (“PFS”),

excluding the industry-wide cost escalations that have occurred

since its publishing in 2021.

- Generated

$16.6 million in cash margin despite the low ounces produced and

the high cash costs of $1,839 per ounce of gold sold1 as commercial

production was delayed until December 1, 2022 due to supply chain

challenges in sourcing vital equipment necessary to deal with

challenging ground conditions within the Kiena Deep A zone.

- The recent discovery of the South

Limb and Footwall zones show the underexplored exploration

potential of the Kiena Deep zone.`

- Most recently, drilling intersected

two new zones in the hanging wall basalt. This zone consists of

disseminated sulfides in basalt associated with a stockwork of

veinlets composed of quartz ± gold. The second zone consists of a

quartz-cabonate vein with visible gold that returned 2,850 g/t Au

over 1.5 m core length. The discovery of these zones highlights the

potential to add ounces within the basalt, where the rock quality

is significantly better than in the A Zone allowing for increased

development rates (see press release dated November 16,2022).

- From surface, drilling has focused

on the Presqu'île Zone located 2 kilometres west of the Kiena Mine.

Highlights include 24.3 g/t over 3.3 m core length and 30.0 g/t Au

over 9.4 m core length. Given the significant upside that the

Presqu'île zone could represent for Kiena, the Company is currently

evaluating options to fast-track an exploration ramp from surface.

It could also easily be connected to Kiena's existing underground

ramp network, providing access to surface for the existing

operation and enhancements to the mine’s ventilation network (see

press release dated September 8, 2022).

|

Technical Disclosure

The technical content of this release has been

compiled, reviewed and approved by Frédéric Langevin, Eng, Chief

Operating Officer of the Company and Michael Michaud, P.Geo., Vice

President, Exploration of the Company and each a "Qualified Person"

as defined in National Instrument 43-101 -Standards of Disclosure

for Mineral Projects.

Cautionary Note to United States

Investors Concerning Estimates of Reserves and

Resources

The mineral reserve and resource estimates

reported in this news release were prepared in accordance with

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”) as required by Canadian

securities regulatory authorities. The United States Securities and

Exchange Commission (the “SEC”) applies different

standards in order to classify and report mineralization. This news

release uses the terms “measured”, “indicated” and “inferred”

mineral resources, as required by NI 43-101. Readers are advised

that although such terms are recognized and required by Canadian

securities regulations, the SEC does not recognize such terms.

Canadian standards differ significantly from the requirements of

the SEC. Readers are cautioned not to assume that any part or all

of the mineral deposits in these categories constitute or will ever

be converted into mineral reserves. In addition, “inferred” mineral

resources have a great amount of uncertainty as to their existence

and great uncertainty as to their economic and legal feasibility.

It cannot be assumed that all or any part of an inferred mineral

resource exists, is economically or legally mineable or will ever

be upgraded to a higher category of mineral resource.

Wesdome Gold Mines 2022 Fourth Quarter

and Full Year Financial Results Conference Call

February 23, 2023 at 10:00 am ET

- Participants may register for the call at the link below to

obtain dial in details. Preregistration is required for this event.

It is recommended you join 10 minutes prior to the start of the

event.

- Participant Registration Link:

https://register.vevent.com/register/BIcb64cd10b9f843d79897899900fca10c

- Webcast Link:https://edge.media-server.com/mmc/p/oab6ykxp

- The webcast can also be accessed under the news and events

section of the company’s website

ABOUT WESDOMEWesdome is a

Canadian focused gold producer with two high grade underground

assets, the Eagle River mine in Ontario and the recently

commissioned Kiena mine in Quebec. The Company also retains

meaningful exposure to the Moss Lake gold deposit in Ontario

through its equity position in Goldshore Resources Inc. The

Company’s primary goal is to responsibly leverage this operating

platform and high-quality brownfield and greenfield exploration

pipeline to build Canada’s next intermediate gold

producer. Wesdome trades on the Toronto Stock Exchange under

the symbol “WDO,” with a secondary listing on the OTCQX under the

symbol “WDOFF.”

For further information, please

contact:

| Warwick

Morley-Jepson |

or |

Lindsay

Carpenter Dunlop |

| Interim CEO |

|

VP Investor Relations |

| 416-360-3743 ext. 2029 |

|

416-360-3743 ext. 2025 |

| w.morley-jepson@wesdome.com |

|

lindsay.dunlop@wesdome.com |

220 Bay St, Suite 1200Toronto, ON, M5J 2W4

Toll Free: 1-866-4-WDO-TSXPhone: 416-360-3743,

Fax: 416-360-7620Website: www.wesdome.com

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking

information” which may include, but is not limited to, statements

with respect to the benefits of achieving commercial production at

Kiena, the Company’s expected capital expenditure in 2023, the

timing around reaching the Kiena Deep A Zone, the Company’s ability

to be cash flow positive and its annual production run rate. Often,

but not always, forward-looking statements can be identified by the

use of words such as “plans”, “expects”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or

“believes” or variations (including negative variations) of such

words and phrases, or state that certain actions, events or results

“may”, “could”, “would”, “might” or “will” be taken, occur or be

achieved. Forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Forward-looking statements contained herein are made as

of the date of this press release and the Company disclaims any

obligation to update any forward-looking statements, whether as a

result of new information, future events or results or otherwise.

There can be no assurance that forward-looking statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. The

Company undertakes no obligation to update forward-looking

statements if circumstances, management’s estimates or opinions

should change, except as required by securities legislation.

Accordingly, the reader is cautioned not to place undue reliance on

forward-looking statements.

Wesdome Gold Mines

Ltd.Summarized Operating and Financial

Data(Unaudited, expressed in thousands of Canadian

dollars, except per share and per unit amounts and otherwise

indicated)

| |

|

Three Months

Ended |

Years

Ended |

|

| |

|

December 31, |

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

Operating data |

|

|

|

|

|

|

|

|

|

|

Milling (tonnes) |

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

58,306 |

|

|

56,159 |

|

|

223,734 |

|

|

228,759 |

|

|

| Mishi |

|

0 |

|

|

6,215 |

|

|

23,153 |

|

|

36,508 |

|

|

| Kiena |

|

51,419 |

|

|

38,000 |

|

|

115,171 |

|

|

68,470 |

|

|

| Throughput

2 |

|

109,725 |

|

|

100,374 |

|

|

362,058 |

|

|

333,737 |

|

|

| Head

grades (g/t) |

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

14.0 |

|

|

13.7 |

|

|

11.5 |

|

|

13.8 |

|

|

| Mishi |

|

0.0 |

|

|

2.1 |

|

|

3.2 |

|

|

2.4 |

|

|

| Kiena |

|

5.9 |

|

|

14.1 |

|

|

7.9 |

|

|

10.4 |

|

|

|

Recovery (%) |

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

97.4 |

|

|

97.8 |

|

|

96.9 |

|

|

97.5 |

|

|

| Mishi |

|

0.0 |

|

|

88.1 |

|

|

83.5 |

|

|

82.4 |

|

|

| Kiena |

|

98.1 |

|

|

98.1 |

|

|

98.3 |

|

|

98.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Production (ounces) |

|

|

|

|

|

|

|

|

|

| Eagle

River |

|

25,502 |

|

|

24,267 |

|

|

79,997 |

|

|

99,120 |

|

|

| Mishi |

|

0 |

|

|

363 |

|

|

2,005 |

|

|

2,283 |

|

|

| Kiena |

|

9,614 |

|

|

16,929 |

|

|

28,848 |

|

|

22,440 |

|

|

|

Total gold produced 2 |

|

35,116 |

|

|

41,559 |

|

|

110,850 |

|

|

123,843 |

|

|

|

Total gold sales (ounces) 4 |

|

31,500 |

|

|

37,544 |

|

|

113,000 |

|

|

118,501 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Eagle River Complex (per ounce of gold sold)

1 |

|

|

|

|

|

|

|

| Average

realized price |

$ |

2,384 |

|

$ |

2,279 |

|

$ |

2,354 |

|

$ |

2,250 |

|

|

| Cash

costs |

|

1,302 |

|

|

1,017 |

|

|

1,356 |

|

|

978 |

|

|

| Cash

margin |

$ |

1,082 |

|

$ |

1,262 |

|

$ |

998 |

|

$ |

1,272 |

|

|

| All-in

Sustaining Costs 1 |

$ |

2,039 |

|

$ |

1,608 |

|

$ |

2,003 |

|

$ |

1,456 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Mine

operating costs/tonne milled 1 |

$ |

515 |

|

$ |

391 |

|

$ |

436 |

|

$ |

357 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average 1

USD → CAD exchange rate |

|

1.3578 |

|

|

1.2603 |

|

|

1.3013 |

|

|

1.2535 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Cash costs

per ounce of gold sold (US$) 1 |

$ |

959 |

|

$ |

807 |

|

$ |

1,042 |

|

$ |

780 |

|

|

| All-in

Sustaining Costs (US$) 1 |

$ |

1,502 |

|

$ |

1,276 |

|

$ |

1,539 |

|

$ |

1,162 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Kiena Mine

(per ounce of gold sold) 1 |

|

|

|

|

|

|

|

|

|

| Average

realized price |

$ |

2,371 |

|

$ |

2,267 |

|

$ |

2,331 |

|

$ |

2,249 |

|

|

| Cash costs

3, 5 |

|

2,063 |

|

|

983 |

|

|

1,839 |

|

|

1,052 |

|

|

| Cash

margin |

$ |

308 |

|

$ |

1,284 |

|

$ |

492 |

|

$ |

1,197 |

|

|

| All-in

Sustaining Costs 1, 3, 5 |

$ |

2,348 |

|

$ |

1,051 |

|

$ |

2,059 |

|

$ |

1,138 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Mine

operating costs/tonne milled 1 |

$ |

352 |

|

$ |

335 |

|

$ |

518 |

|

$ |

325 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average 1

USD → CAD exchange rate |

|

1.3578 |

|

|

1.2603 |

|

|

1.3013 |

|

|

1.2535 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Cash costs

per ounce of gold sold (US$) 1 |

$ |

1,519 |

|

$ |

780 |

|

$ |

1,413 |

|

$ |

839 |

|

|

| All-in

Sustaining Costs (US$) 1 |

$ |

1,729 |

|

$ |

834 |

|

$ |

1,582 |

|

$ |

908 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

Financial Data |

|

|

|

|

|

|

|

|

|

| Cash margin

1 |

$ |

26,466 |

|

$ |

47,681 |

|

$ |

95,674 |

|

$ |

145,354 |

|

|

| Net

income |

$ |

(3,527 |

) |

$ |

24,762 |

|

$ |

(14,706 |

) |

$ |

131,288 |

|

|

| Net income

adjusted 1 |

$ |

(3,527 |

) |

$ |

24,762 |

|

$ |

(5,856 |

) |

$ |

69,903 |

|

|

| Earnings

before interest, taxes, depreciation and amortization 1 |

$ |

21,309 |

|

$ |

44,235 |

|

$ |

55,617 |

|

$ |

132,199 |

|

|

| Operating

cash flow |

$ |

10,267 |

|

$ |

48,160 |

|

$ |

65,206 |

|

$ |

130,958 |

|

|

| Free cash

flow |

$ |

(31,609 |

) |

$ |

(3,172 |

) |

$ |

(90,174 |

) |

$ |

(21,291 |

) |

|

| Per share

data |

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

(0.02 |

) |

$ |

0.18 |

|

$ |

(0.10 |

) |

$ |

0.94 |

|

|

| Adjusted net

income 1 |

$ |

(0.02 |

) |

$ |

0.18 |

|

$ |

(0.04 |

) |

$ |

0.50 |

|

|

| Operating

cash flow 1 |

$ |

0.07 |

|

$ |

0.34 |

|

$ |

0.46 |

|

$ |

0.93 |

|

|

| Free cash

flow 1 |

$ |

(0.22 |

) |

$ |

(0.02 |

) |

$ |

(0.63 |

) |

$ |

(0.15 |

) |

|

| |

|

|

|

|

|

|

|

|

|

- Refer to the Company’s 2022 Annual Management Discussion and

Analysis section entitled “Non-IFRS Performance Measures” for the

reconciliation of these non-IFRS measurements to the financial

statements.

- Totals for tonnage and gold ounces may not add due to

rounding.

- FY 2021 includes a $0.4 million charge for product inventory

costs from the sale of 1,793 ounces of gold from the Kiena bulk

sample, which was processed in Q4 2020.

- FY 2021 includes 1,793 ounces of gold from the Kiena bulk

sample, which was processed in Q4 2020

- In determining the Cash cost per ounce and AISC per ounce, the

total ounces sold includes 1,793 ounces of gold from the Kiena bulk

sample, which was processed in Q4 2020 and sold in Q1 2021.

Wesdome Gold Mines

Ltd.Statements of Financial

Position(Expressed in thousands of Canadian dollars)

| |

|

|

|

|

|

| |

|

As at December 31, 2022 |

|

As at December 31, 2021 |

|

|

Assets |

|

|

|

|

|

| Current |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

33,185 |

|

|

$ |

56,764 |

|

|

|

Receivables and prepaids |

|

|

12,755 |

|

|

|

13,793 |

|

|

|

Inventories |

|

|

22,119 |

|

|

|

17,918 |

|

|

|

Income and mining tax receivable |

|

|

6,494 |

|

|

|

- |

|

|

|

Share consideration receivable |

|

|

2,994 |

|

|

|

4,560 |

|

|

| Total

current assets |

|

|

77,547 |

|

|

|

93,035 |

|

|

| |

|

|

|

|

|

| Restricted

cash |

|

|

1,176 |

|

|

|

657 |

|

|

| Deferred

financing costs |

|

|

1,411 |

|

|

|

758 |

|

|

| Mining

properties, plant and equipment |

|

|

525,860 |

|

|

|

212,394 |

|

|

| Mines under

development |

|

|

- |

|

|

|

214,089 |

|

|

| Exploration

properties |

|

|

1,139 |

|

|

|

1,139 |

|

|

| Marketable

securities |

|

|

960 |

|

|

|

1,860 |

|

|

| Share

consideration receivable |

|

|

2,576 |

|

|

|

10,729 |

|

|

| Investment

in associate |

|

|

8,458 |

|

|

|

19,058 |

|

|

| Total

assets |

|

$ |

619,127 |

|

|

$ |

553,719 |

|

|

| |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

| Current |

|

|

|

|

|

|

Payables and accruals |

|

$ |

54,734 |

|

|

$ |

40,093 |

|

|

|

Borrowings |

|

|

54,697 |

|

|

|

- |

|

|

|

Income and mining tax payable |

|

|

- |

|

|

|

5,490 |

|

|

|

Current portion of lease liabilities |

|

|

6,160 |

|

|

|

7,789 |

|

|

| Total

current liabilities |

|

|

115,591 |

|

|

|

53,372 |

|

|

| |

|

|

|

|

|

| Lease

liabilities |

|

|

3,126 |

|

|

|

6,786 |

|

|

| Deferred

income and mining tax liabilities |

|

|

82,950 |

|

|

|

77,195 |

|

|

|

Decommissioning provisions |

|

|

18,941 |

|

|

|

21,191 |

|

|

| Total

liabilities |

|

|

220,608 |

|

|

|

158,544 |

|

|

| |

|

|

|

|

|

|

Equity |

|

|

|

|

|

| Equity

attributable to owners of the Company |

|

|

|

|

|

|

Capital stock |

|

|

205,361 |

|

|

|

187,911 |

|

|

|

Contributed surplus |

|

|

7,359 |

|

|

|

5,859 |

|

|

|

Retained earnings |

|

|

186,939 |

|

|

|

201,645 |

|

|

|

Accumulated other comprehensive loss |

|

|

(1,140 |

) |

|

|

(240 |

) |

|

| Total equity

attributable to owners of the Company |

|

|

398,519 |

|

|

|

395,175 |

|

|

| Total

liabilities and equity |

|

$ |

619,127 |

|

|

$ |

553,719 |

|

|

| |

|

|

|

|

|

Wesdome Gold Mines

Ltd.Statements of Income (Loss) and Comprehensive

Income (Loss)(Unaudited, expressed in thousands of

Canadian dollars except for per share amounts)

| |

Three Months

Ended |

|

Years

Ended |

| |

December 31, |

|

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

75,035 |

|

|

$ |

85,505 |

|

|

$ |

265,483 |

|

|

$ |

262,907 |

|

| Cost

of sales |

|

(61,997 |

) |

|

|

(45,945 |

) |

|

|

(214,371 |

) |

|

|

(145,619 |

) |

|

Gross profit |

|

13,038 |

|

|

|

39,560 |

|

|

|

51,112 |

|

|

|

117,288 |

|

| |

|

|

|

|

|

|

|

|

Other expenses |

|

|

|

|

|

|

|

| Corporate

and general |

|

2,309 |

|

|

|

2,817 |

|

|

|

11,823 |

|

|

|

10,614 |

|

| Stock-based

compensation |

|

857 |

|

|

|

533 |

|

|

|

3,311 |

|

|

|

2,604 |

|

| Exploration

and evaluation |

|

1,926 |

|

|

|

471 |

|

|

|

14,369 |

|

|

|

471 |

|

| Reversal of

impairment charges |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(58,563 |

) |

| Impairment

charge on exploration properties |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,507 |

|

| Loss (gain)

on disposal of mining equipment |

|

242 |

|

|

|

- |

|

|

|

303 |

|

|

|

(3 |

) |

| Total other

expenses (income) |

|

5,334 |

|

|

|

3,821 |

|

|

|

29,806 |

|

|

|

(37,370 |

) |

| |

|

|

|

|

|

|

|

|

Operating income |

|

7,704 |

|

|

|

35,739 |

|

|

|

21,306 |

|

|

|

154,658 |

|

| |

|

|

|

|

|

|

|

| Gain on sale

of Moss Lake exploration properties |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

34,330 |

|

| Impairment

of investment in associate |

|

- |

|

|

|

- |

|

|

|

(11,800 |

) |

|

|

- |

|

| Fair value

adjustment on share consideration receivable |

|

1,005 |

|

|

|

1,038 |

|

|

|

(6,386 |

) |

|

|

1,947 |

|

| Interest

expense |

|

(1,279 |

) |

|

|

(339 |

) |

|

|

(2,446 |

) |

|

|

(1,194 |

) |

| Accretion of

decommissioning provisions |

|

(242 |

) |

|

|

(146 |

) |

|

|

(860 |

) |

|

|

(556 |

) |

| Share of

loss of associate |

|

(1,264 |

) |

|

|

(393 |

) |

|

|

(1,652 |

) |

|

|

(497 |

) |

| Loss on

dilution of ownership |

|

188 |

|

|

|

- |

|

|

|

(481 |

) |

|

|

- |

|

| Other income

(expenses) |

|

490 |

|

|

|

(124 |

) |

|

|

(872 |

) |

|

|

(363 |

) |

| Income

(loss) before income and mining taxes |

|

6,602 |

|

|

|

35,775 |

|

|

|

(3,191 |

) |

|

|

188,325 |

|

| |

|

|

|

|

|

|

|

|

Income and mining tax expense |

|

|

|

|

|

|

|

|

Current |

|

999 |

|

|

|

4,720 |

|

|

|

5,600 |

|

|

|

13,375 |

|

|

Deferred |

|

9,130 |

|

|

|

6,293 |

|

|

|

5,915 |

|

|

|

43,662 |

|

| Total income

and mining tax expense |

|

10,129 |

|

|

|

11,013 |

|

|

|

11,515 |

|

|

|

57,037 |

|

| |

|

|

|

|

|

|

|

| Net

(loss) income |

$ |

(3,527 |

) |

|

$ |

24,762 |

|

|

$ |

(14,706 |

) |

|

$ |

131,288 |

|

| |

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

Change in fair value of marketable

securities |

|

360 |

|

|

|

(240 |

) |

|

|

(900 |

) |

|

|

(240 |

) |

|

Total comprehensive (loss) income |

$ |

(3,167 |

) |

|

$ |

24,522 |

|

|

$ |

(15,606 |

) |

|

$ |

131,048 |

|

| |

|

|

|

|

|

|

|

|

(Loss) Earnings per share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.02 |

) |

|

$ |

0.18 |

|

|

$ |

(0.10 |

) |

|

$ |

0.94 |

|

|

Diluted |

$ |

(0.02 |

) |

|

$ |

0.17 |

|

|

$ |

(0.10 |

) |

|

$ |

0.92 |

|

| |

|

|

|

|

|

|

|

|

Weighted average number of common |

|

|

|

|

|

|

|

|

shares (000s) |

|

|

|

|

|

|

|

|

Basic |

|

142,782 |

|

|

|

141,156 |

|

|

|

142,391 |

|

|

|

140,195 |

|

|

Diluted |

|

142,782 |

|

|

|

143,200 |

|

|

|

142,391 |

|

|

|

142,787 |

|

| |

|

|

|

|

|

|

|

Wesdome Gold Mines

Ltd.Statements of Total Equity(Expressed

in thousands of Canadian dollars)

| |

|

|

|

|

|

|

Accumulated |

|

|

| |

|

|

|

|

|

|

Other |

|

|

| |

Capital |

|

Contributed |

|

Retained |

|

Comprehensive |

Total |

| |

Stock |

|

Surplus |

|

Earnings |

|

Loss |

|

Equity |

| |

|

|

|

|

|

|

|

|

|

|

Balance, December 31, 2020 |

$ |

179,540 |

|

|

$ |

6,472 |

|

|

$ |

70,357 |

|

|

$ |

- |

|

|

$ |

256,369 |

|

| Net income

for the year ended |

|

- |

|

|

|

- |

|

|

|

131,288 |

|

|

|

- |

|

|

|

131,288 |

|

|

December 31, 2021 |

|

|

|

|

|

|

|

|

|

| Other

comprehensive loss |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(240 |

) |

|

|

(240 |

) |

| Exercise of

options |

|

5,154 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

5,154 |

|

| Value

attributed to options exercised |

|

2,431 |

|

|

|

(2,431 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Value

attributed to RSUs exercised |

|

786 |

|

|

|

(786 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Stock-based

compensation |

|

- |

|

|

|

2,604 |

|

|

|

- |

|

|

|

- |

|

|

|

2,604 |

|

| Balance,

December 31, 2021 |

$ |

187,911 |

|

|

$ |

5,859 |

|

|

$ |

201,645 |

|

|

$ |

(240 |

) |

|

$ |

395,175 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net loss for

the year ended |

$ |

- |

|

|

$ |

- |

|

|

$ |

(14,706 |

) |

|

$ |

- |

|

|

$ |

(14,706 |

) |

|

December 31, 2022 |

|

|

|

|

|

|

|

|

|

| Other

comprehensive loss |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(900 |

) |

|

|

(900 |

) |

|

At-the-Market offering: |

|

|

|

|

|

|

|

|

|

|

Common shares issued for cash |

|

13,080 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

13,080 |

|

|

Agents' fees and issuance costs |

|

(472 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(472 |

) |

| Exercise of

options |

|

3,031 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

3,031 |

|

| Value

attributed to options exercised |

|

1,173 |

|

|

|

(1,173 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Value

attributed to RSUs exercised |

|

638 |

|

|

|

(638 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Stock-based

compensation |

|

- |

|

|

|

3,311 |

|

|

|

- |

|

|

|

- |

|

|

|

3,311 |

|

| Balance,

December 31, 2022 |

$ |

205,361 |

|

|

$ |

7,359 |

|

|

$ |

186,939 |

|

|

$ |

(1,140 |

) |

|

$ |

398,519 |

|

| |

|

|

|

|

|

|

|

|

|

Wesdome Gold Mines

Ltd.Statements of Cash Flows(Unaudited,

expressed in thousands of Canadian dollars)

| |

Three Months

Ended December 31, |

|

Years Ended

December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

|

| |

|

|

|

|

|

|

|

|

|

Operating Activities |

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(3,527 |

) |

|

$ |

24,762 |

|

|

$ |

(14,706 |

) |

|

$ |

131,288 |

|

|

|

Depreciation and depletion |

|

13,428 |

|

|

|

8,121 |

|

|

|

44,562 |

|

|

|

28,066 |

|

|

|

Stock-based compensation |

|

857 |

|

|

|

533 |

|

|

|

3,311 |

|

|

|

2,604 |

|

|

|

Accretion of decommissioning provisions |

|

242 |

|

|

|

146 |

|

|

|

860 |

|

|

|

556 |

|

|

|

Deferred income and mining tax expense |

|

9,130 |

|

|

|

6,293 |

|

|

|

5,915 |

|

|

|

43,662 |

|

|

|

Amortization of deferred financing cost |

|

133 |

|

|

|

84 |

|

|

|

401 |

|

|

|

412 |

|

|

|

Interest expense |

|

1,279 |

|

|

|

339 |

|

|

|

2,446 |

|

|

|

1,194 |

|

|

|

Reversal of impairment charges |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(58,563 |

) |

|

|

Gain on sale of Moss Lake exploration properties |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(34,330 |

) |

|

|

Impairment charge on exploration properties |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

7,507 |

|

|

|

Loss (gain) on disposal of mining equipment |

|

242 |

|

|

|

- |

|

|

|

303 |

|

|

|

(3 |

) |

|

|

Impairment of investment in associate |

|

- |

|

|

|

- |

|

|

|

11,800 |

|

|

|

- |

|

|

|

Fair value adjustment on share consideration

receivable |

|

(1,005 |

) |

|

|

(1,038 |

) |

|

|

6,386 |

|

|

|

(1,947 |

) |

|

|

Share of loss of associate |

|

1,264 |

|

|

|

393 |

|

|

|

1,652 |

|

|

|

497 |

|

|

|

Loss on dilution of ownership |

|

(188 |

) |

|

|

- |

|

|

|

481 |

|

|

|

- |

|

|

|

Foreign exchange loss (gain) on borrowings |

|

(1,009 |

) |

|

|

(8 |

) |

|

|

451 |

|

|

|

(23 |

) |

|

|

Net changes in non-cash working capital |

|

(6,956 |

) |

|

|

11,726 |

|

|

|

18,928 |

|

|

|

21,403 |

|

|

|

Mining and income tax paid |

|

(3,623 |

) |

|

|

(3,191 |

) |

|

|

(17,584 |

) |

|

|

(11,365 |

) |

|

| Net

cash from operating activities |

|

10,267 |

|

|

|

48,160 |

|

|

|

65,206 |

|

|

|

130,958 |

|

|

| |

|

|

|

|

|

|

|

|

|

Financing Activities |

|

|

|

|

|

|

|

|

|

Proceeds from At-the-Market offering |

|

13,080 |

|

|

|

- |

|

|

|

13,080 |

|

|

|

- |

|

|

|

Agents' fees and issuance costs |

|

(632 |

) |

|

|

- |

|

|

|

(632 |

) |

|

|

- |

|

|

|

Proceeds from revolving credit facility |

|

28,279 |

|

|

|

- |

|

|

|

69,163 |

|

|

|

- |

|

|

|

Repayment of revolving credit facility |

|

- |

|

|

|

- |

|

|

|

(14,810 |

) |

|

|

- |

|

|

|

Repayment of lease liabilities |

|

(11,929 |

) |

|

|

(11,823 |

) |

|

|

(8,898 |

) |

|

|

(8,778 |

) |

|

|

Exercise of options |

|

4,110 |

|

|

|

5,493 |

|

|

|

3,031 |

|

|

|

5,154 |

|

|

|

Deferred financing costs |

|

5,678 |

|

|

|

4,935 |

|

|

|

(1,053 |

) |

|

|

(342 |

) |

|

|

Interest paid |

|

(1,279 |

) |

|

|

(339 |

) |

|

|

(2,446 |

) |

|

|

(1,194 |

) |

|

| Net

cash from (used in) financing activities |

|

37,307 |

|

|

|

(1,734 |

) |

|

|

57,435 |

|

|

|

(5,160 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Investing Activities |

|

|

|

|

|

|

|

|

|

Additions to mining properties |

|

(20,948 |

) |

|

|

(12,375 |

) |

|

|

(45,328 |

) |

|

|

(42,867 |

) |

|

|

Additions to mines under development |

|

(18,242 |

) |

|

|

(35,455 |

) |

|

|

(100,635 |

) |

|

|

(76,337 |

) |

|

|

Additions to exploration properties |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(23,267 |

) |

|

|

Purchase of exploration property |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(1,000 |

) |

|

|

Cash proceeds on sale of Moss Lake, net of transaction

costs |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

11,762 |

|

|

|

Investment in marketable securities |

|

- |

|

|

|

(2,100 |

) |

|

|

- |

|

|

|

(2,100 |

) |

|

|

Funds held against standby letter of credit |

|

- |

|

|

|

- |

|

|

|

(519 |

) |

|

|

- |

|

|

|

Proceeds on disposal of mining equipment |

|

60 |

|

|

|

- |

|

|

|

262 |

|

|

|

73 |

|

|

|

Net changes in non-cash working capital |

|

- |

|

|

|

(9,205 |

) |

|

|

- |

|

|

|

1,222 |

|

|

| Net

cash used in investing activities |

|

(39,130 |

) |

|

|

(59,135 |

) |

|

|

(146,220 |

) |

|

|

(132,514 |

) |

|

| |

|

|

|

|

|

|

|

|

| Increase

(decrease) in cash and cash equivalents |

|

8,444 |

|

|

|

(12,709 |

) |

|

|

(23,579 |

) |

|

|

(6,716 |

) |

|

| Cash and

cash equivalents - beginning of period |

|

24,741 |

|

|

|

69,473 |

|

|

|

56,764 |

|

|

|

63,480 |

|

|

| Cash and

cash equivalents - end of year |

$ |

33,185 |

|

|

$ |

56,764 |

|

|

$ |

33,185 |

|

|

$ |

56,764 |

|

|

| |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents consist of: |

|

|

|

|

|

|

|

|

|

Cash |

$ |

33,185 |

|

|

$ |

56,764 |

|

|

$ |

33,185 |

|

|

$ |

56,764 |

|

|

|

|

$ |

33,185 |

|

|

$ |

56,764 |

|

|

$ |

33,185 |

|

|

$ |

56,764 |

|

|

|

|

|

|

|

|

|

|

|

|

PDF

Available: http://ml.globenewswire.com/Resource/Download/aefa4829-b8c6-46cc-9c4e-386901079d1c

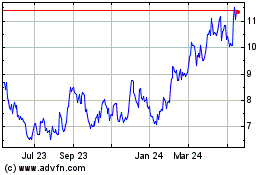

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Oct 2024 to Nov 2024

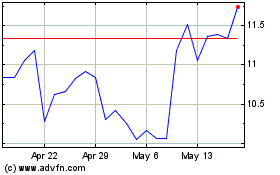

Wesdome Gold Mines (TSX:WDO)

Historical Stock Chart

From Nov 2023 to Nov 2024