TSX VENTURE COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: September 4, 2009

TSX Venture Tier 2 Companies

A Cease Trade Order has been issued by the British Columbia Securities

Commission on September 4, 2009, against the following Companies for

failing to file the documents indicated within the required time period:

Period

Symbol Company Failure to File Ending (Y/M/D)

("PXR") Prominex Resource comparative financial 09/04/30

Corp. statements

management's discussion 09/04/30

& analysis

("RRE") Reg Technologies comparative financial 09/04/30

Inc. statements

management's discussion 09/04/30

& analysis

("SNO") Snowfield Development comparative financial 09/04/30

Corp. statements

management's discussion 09/04/30

& analysis

Upon revocation of the Cease Trade Order, the Company's shares will

remain suspended until the Company meets TSX Venture Exchange

requirements. Members are prohibited from trading in the securities of

the company during the period of the suspension or until further notice.

TSX-X

------------------------------------------------------------------------

ALDRIN RESOURCE CORP. ("ALN")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement, Private

Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. (the "Exchange") has accepted for filing

property option agreements between Aldrin Resources Corp. (the

"Company") and Ryanwood Exploration Inc. ("Ryanwood") both dated June

26, 2009 (the "Agreements") under which Ryanwood has granted to the

Company an option to acquire a 100% interest in each of the Ind Property

and the Brew Property both located in the Dawson Mining District, Yukon

Territory.

The Company may earn the 100% interest in the Brew Property by paying to

Ryanwood a total of $425,000 over a four year period ending June 26,

2013. The Company must also incur exploration expenditures totaling

$1,500,000 on or before November 15, 2012 and issue Ryanwood a total of

1,250,000 common shares before June 26, 2013.

The Company may earn the 100% interest in the Ind Property by paying to

Ryanwood a total of $575,000 over a four year period ending June 26,

2013. The Company must also incur exploration expenditures totaling

$1,500,000 on or before November 15, 2012 and issue Ryanwood a total of

1,500,000 common shares on or before June 26, 2013.

The Company's 100% interest in both the Brew and Ind Properties is

subject to a net smelter return royalty of 2.0%. Aldrin is entitled to

purchase 50% of the NSR on each property for $2 million.

Private Placement-Non-Brokered:

The Exchange has accepted for filing documentation with respect to a

Non-Brokered Private Placement announced July 6, 2009:

Number of Shares: 2,500,000 shares

Purchase Price: $0.13 per share

Warrants: 2,500,000 share purchase warrants to

purchase 2,500,000 shares

Warrant Exercise Price: $0.19 for a one year period

Number of Placees: 3 placees

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

TSX-X

------------------------------------------------------------------------

ASHBURTON VENTURES INC. ("ABR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced July 22, 2009:

Number of Shares: 4,850,000 shares

Purchase Price: $0.10 per share

Warrants: 4,850,000 share purchase warrants to

purchase 4,850,000 shares

Warrant Exercise Price: $0.12 for an eighteen month period

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Behzad Manavi-Tehrani P 20,000

Azim Dhalla P 20,000

Brock Daem P 15,000

Harley Mayers P 200,000

Rider Capital Corp. P 50,000

Mike England Y 220,000

Finders' Fees: $12,000 and 120,000 broker warrants payable

to Bolder Investment Partners Ltd.

$2,600 and 26,000 broker warrants payable

to Union Securities Ltd.

$11,000 and 110,000 broker warrants payable

to PI Financial Corp.

$9,000 and 90,000 broker warrants payable

to Northern Securities Inc.

$500 and 5,000 broker warrants payable to

Global Securities Corporation

- Each broker warrant is exercisable at

$0.10 for a twelve month period

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

TSX-X

------------------------------------------------------------------------

ATI AIRTEST TECHNOLOGIES INC. ("AAT")

BULLETIN TYPE: Halt

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Effective at 6:17 a.m. PST, September 8, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

ATI AIRTEST TECHNOLOGIES INC. ("AAT")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Effective at 8:30 a.m. PST, September 8, 2009, shares of the Company

resumed trading, an announcement having been made over Canada News Wire.

TSX-X

------------------------------------------------------------------------

BEAR CREEK MINING CORPORATION ("BCM.WT.A")

BULLETIN TYPE: Warrant Expiry-Delist

BULLETIN DATE: September 8, 2009

TSX Venture Tier 1 Company

Effective at the opening, September 10, 2009, the Share Purchase

Warrants of the Company will trade for cash. The Warrants expire

September 15, 2009 and will therefore be delisted at the close of

business September 15, 2009.

TRADE DATES

September 10, 2009 - TO SETTLE - September 11, 2009

September 11, 2009 - TO SETTLE - September 14, 2009

September 14, 2009 - TO SETTLE - September 15, 2009

September 15, 2009 - TO SETTLE - September 15, 2009

The above is in compliance with Trading Rule C.2.18 - Expiry Date:

Trading in the warrants shall be for cash for the three trading days

preceding the expiry date and also on expiry date. On the expiry date,

trading shall cease at 12 o'clock noon E.T. and no transactions shall

take place thereafter except with permission of the Exchange.

TSX-X

------------------------------------------------------------------------

BLACKBURN VENTURES CORP. ("BBV.P")

BULLETIN TYPE: Regional Office Change, Remain Halted

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Vancouver to

Calgary.

Trading in the shares of the Company will remain halted.

TSX-X

------------------------------------------------------------------------

C2C GOLD CORPORATION ("CCN")

BULLETIN TYPE: Halt

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Effective at 6:08 a.m. PST, September 8, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

------------------------------------------------------------------------

C2C GOLD CORPORATION ("CCN")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Effective at 8:00 a.m. PST, September 8, 2009, shares of the Company

resumed trading, an announcement having been made over Canada News Wire.

TSX-X

------------------------------------------------------------------------

GOLDEN DORY RESOURCES CORP. ("GDR")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Effective at 8:15 a.m. PST, September 8, 2009, shares of the Company

resumed trading, an announcement having been made over Market News

Publishing.

TSX-X

------------------------------------------------------------------------

GRANVILLE PACIFIC CAPITAL CORP. ("GE")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to a

Contract of Purchase and Sale dated July 30, 2009 between Granville

Pacific Capital Corp. (the 'Company') and an arm's-length party (the

'Purchaser') wherein the Company has agreed to sell to the Purchaser a

property known as the Bear Creek Lodge located in Surrey, British

Columbia. In consideration, the Purchaser has agreed to pay the Company

$6,600,000. This transaction was announced in the Company's press

release dated September 4, 2009.

TSX-X

------------------------------------------------------------------------

GRENVILLE GOLD CORPORATION ("GVG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second and final tranche of a Non-Brokered Private Placement

announced June 2, 2009:

Number of Shares: 1,483,576 shares

Purchase Price: $0.05 per share

Warrants: 1,483,576 share purchase warrants to

purchase 1,483,576 shares

Warrant Exercise Price: $0.10 for a two year period

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Melvin Rokosh Y 100,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. (Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.)

TSX-X

------------------------------------------------------------------------

JBZ CAPITAL INC. ("JBZ.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated September 8, 2009,

effective at 6:25 a.m. PST, September 8, 2009 trading in the shares of

the Company will remain halted pending receipt and review of acceptable

documentation regarding the Qualifying Transaction pursuant to Listings

Policy 2.4.

TSX-X

------------------------------------------------------------------------

IVRNET INC. ("IVI")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 657,895 bonus shares at a deemed price of $0.152 to the following

insider in consideration of a personal guarantee of a loan of $500,000:

Shares

David Snell 657,895

TSX-X

------------------------------------------------------------------------

LARGO RESOURCES LTD. ("LGO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced August 14, 2009:

Number of Shares: 4,000,000 shares

Purchase Price: $0.10 per share

Warrants: 2,000,000 share purchase warrants to

purchase 2,000,000 shares

Warrant Exercise Price: $0.15 until February 26, 2011

Number of Placees: 2 placees

Finder's Fee: A $24,000 cash commission and 240,000

finders' warrants payable to Byron

Securities Ltd., Toronto, ON. Each finder's

warrant entitles the holder to acquire one

common share at $0.10 until February 26,

2011.

Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.

For further details, please refer to the Company's' news release dated

August 26, 2009.

TSX-X

------------------------------------------------------------------------

LAURENT VENTURE CAPITAL CORPORATION ("LAU.P")

BULLETIN TYPE: CPC-Information Circular

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's CPC

Information Circular dated August 28, 2009, for the purpose of mailing

to shareholders and filing on SEDAR.

CORPORATION DE CAPITAL DE RISQUE LAURENT ("LAU.P")

TYPE DE BULLETIN: SCD - Circulaire de sollicitation de procurations

DATE DU BULLETIN: Le 8 septembre 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot par la societe, d'une

circulaire de sollicitation de procurations de SCD datee du 28 aout

2009, pour les fins d'envoi aux actionnaires et depot sur SEDAR.

TSX-X

------------------------------------------------------------------------

MOLYCOR GOLD CORP. ("MOR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second and final tranche of a Non-Brokered Private Placement

announced July 29, 2009 and amended September 3, 2009:

Number of Shares: 6,097,000 shares

Purchase Price: $0.08 per share

Warrants: 6,097,000 share purchase warrants to

purchase 6,097,000 shares

Warrant Exercise Price: $0.12 for a two year period

Number of Placees: 33 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Dan Koyich Y 100,000

Finders' Fees: $400 cash payable to Carol & Leanna Morgan

$1,000 cash payable to Ken Reser

$1,700 cash payable to John Chalcraft

$5,816 cash payable to James Elbert

$1,680 cash payable to John Davies

$21,200 cash and 265,000 Agent's Warrants

exercisable at $0.08 for two years payable

to Jennings Capital Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may

later extend the expiry date of the warrants, if they are less than the

maximum permitted term.

TSX-X

------------------------------------------------------------------------

NORTHERN ABITIBI MINING CORP. ("NAI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced August 26, 2009:

Number of Shares: 1,332,833 common shares

1,818,181 flow-through shares

Purchase Price: $0.15 per common share

$0.165 per flow-through share

Warrants: 666,416 share purchase warrants to purchase

666,416 common shares

909,088 flow-through share purchase

warrants to purchase 909,088 common shares

Warrant Exercise Price: $0.22 per share for a period of two years

$0.23 per share for a period of two years

Number of Placees: 18 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Units

Jean Pierre Jutras Y 30,393 FT

Shane Ebert Y 30,303 FT

Mark Wayne P 182,000 FT

Greg McKenzie P 151,516 FT

TSX-X

------------------------------------------------------------------------

RADIANT ENERGY CORPORATION ("RDT")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue an aggregate of 3,196,000 non-transferable bonus shares to certain

lenders in consideration of CDN$799,000 in secured non-convertible loans

made to the Company.

Insider(s) Shares

David Williams 400,000

Hara Enterprises Limited

(Gregory O'Hara) 748,000

John Marsh 748,000

TSX-X

------------------------------------------------------------------------

THE PHOENICIAN FUND CORPORATION I ("PO.P")

BULLETIN TYPE: Notice - QT Not Completed - Approaching 24 Months of

Listing

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

The shares of the Company were listed on TSX Venture Exchange on October

5, 2007. The Company, which is classified as a Capital Pool Company

('CPC'), is required to complete a Qualifying Transaction ('QT') within

24 months of its date of listing, in accordance with Exchange Policy

2.4.

The records of the Exchange indicate that the Company has not yet

completed a QT. If the Company fails to complete a QT by its 24-month

anniversary date of October 5, 2009 the Company's trading status may be

changed to a suspension without further notice, in accordance with

Exchange Policy 2.4, Section 14.6.

TSX-X

------------------------------------------------------------------------

TYPHOON EXPLORATION INC. ("TYP")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement, announced on September 1,

2009:

Number of Shares: 1,333,400 flow-through common shares and

333,200 common shares

Purchase Price: $0.12 per share

Warrants: 333,200 share purchase warrants to purchase

333,200 common shares.

Warrants Exercise Price: $0.15 for a period of 18 months.

Insider / Pro Group Participation:

Insider equals Y /

Name Pro Group equals P / Number of Shares

David McDonald Y 166,660

The Company has confirmed the closing of the above-mentioned Private

Placement.

EXPLORATION TYPHON INC. ("TYP")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 8 septembre 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le

1er septembre 2009:

Nombre d'actions: 1 333 400 actions ordinaires accreditives

et 333 200 actions ordinaires

Prix: 0,12 $ par action

Bons de souscription: 333 200 bons de souscription permettant de

souscrire a 333 200 actions ordinaires.

Prix d'exercice des bons: 0,15 $ pour une periode de 18 mois.

Participation des inities / Groupe Pro:

Initie egale Y /

Nom Groupe Pro egale P / Nombre d'actions

David McDonald Y 166 660

La societe a confirme la cloture du present placement prive mentionne.

TSX-X

------------------------------------------------------------------------

VALENTINE VENTURES CORP. ("VVN.P")

BULLETIN TYPE: Miscellaneous

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Further to the Exchange's Bulletin of November 3, 2008 and the Company's

press release of March 18, 2009, the Company which is a Capital Pool

Company ('CPC') is required to complete a Qualifying Transaction ('QT')

by October 9, 2009.

The records of the Exchange indicate that the Company has not yet

completed a QT. If the Company fails to complete a QT by October 9,

2009 the Company's trading status may be changed to a halt or suspension

without further notice, in accordance with Exchange Policy 2.4 Section

14.6.

TSX-X

------------------------------------------------------------------------

VICTORIA GOLD CORP. ("VIT")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Brokered Private Placement announced June 29, 2009:

Number of Shares: 4,231,055 flow-through shares

Purchase Price: $0.45 per share

Agent's Fee: A cash commission of $128,378 and 285,285

broker warrants payable to Sandfire

Securities Inc., Toronto, ON. Each broker

warrant entitles the holder to acquire one

common share at $0.45 until August 6, 2010.

For further details, please refer to the Company's news release dated

August 6, 2009.

TSX-X

------------------------------------------------------------------------

WCB CAPITAL LTD. ("WCB.P")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Vancouver to

Toronto.

TSX-X

------------------------------------------------------------------------

WHITE PINE RESOURCES INC. ("WPR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced August 10, 2009:

Number of Shares: 4,874,999 flow-through shares and 725,000

non flow-through shares

Purchase Price: $0.45 per flow-through share

$0.40 per non flow-through share

Warrants: 362,499 share purchase warrants to purchase

362,499 shares

Warrant Exercise Price: $0.65 until August 25, 2011

Number of Placees: 17 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

John Tait Y 333,333

David M. Beatty P 222,222

Michael Wayne Y 25,000

John Gunther P 100,000

Ned Goodman P 111,111

Finder's Fee: An aggregate cash commission of $161,443

and 316,874 finders' warrants payable to

Primary Capital Inc., PowerOne Capital

Markets Limited, Jones, Gable & Company

Limited and Raymond James Ltd. Each

finder's warrant entitles the holder to

acquire one common share at $0.45 until

August 25, 2011.

Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.

For further details, please refer to the Company's news release dated

August 25, 2009.

TSX-X

------------------------------------------------------------------------

NEX COMPANIES

AIRIQ INC. ("IQ.H")

BULLETIN TYPE: New Listing-Shares, Transfer and New Addition to NEX

BULLETIN DATE: September 8, 2009

NEX Company

Effective at the opening Wednesday, September 9, 2009, the shares of the

Company will commence trading on NEX.

The Company has been delisted from trading on Toronto Stock Exchange

effective at the close on September 8, 2009. The Company no longer

meets Toronto Stock Exchange minimum listing requirements and also does

not meet the requirements of a TSX Venture Tier 2 company.

As of September 9, 2009, the Company is subject to restrictions on share

issuances and certain types of payments as set out in the NEX policies.

The symbol extension differentiates NEX symbols from Tier 1 or Tier 2

symbols within the TSX Venture market.

Corporate Jurisdiction: Canada Business Corporations Act

Capitalization: Unlimited common shares with no par value

of which 160,813,408 common shares are

issued and outstanding

Escrowed Shares: 0 common shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: IQ.H

CUSIP Number: 009120 10 6

Agent's Warrants: Nil

Company Contact: Donald Gibbs, CFO

Company Address: 1815 Ironstone Manor, Unit 10

Pickering, Ontario L1W 3W9

Company Phone Number: (905) 831-6444

Company Fax Number: (905) 831-0567

TSX-X

------------------------------------------------------------------------

ULDAMAN CAPITAL CORP. ("ULD.H")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: September 8, 2009

NEX Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement:

Number of Shares: 7,905,000 shares

Purchase Price: $0.03 per share

Number of Placees: 33 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

SNJ Capital Ltd. (Sokhie Puar) Y 250,000

Bijay Singh Y 500,000

John Anderson Y 330,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private

placement and setting out the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly.

TSX-X

------------------------------------------------------------------------

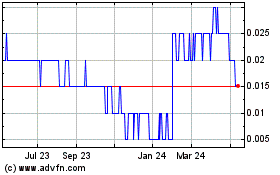

ATI Airtest Technologies (TSXV:AAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

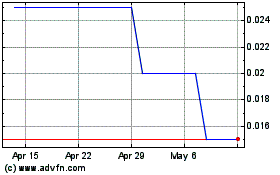

ATI Airtest Technologies (TSXV:AAT)

Historical Stock Chart

From Feb 2024 to Feb 2025