Athabasca Minerals Inc. Announces 2017 Year End Results

21 April 2018 - 6:31AM

Athabasca Minerals Inc. (“Athabasca” or the “Corporation”)

(TSXV:ABM) is pleased to announce its financial results for the

fourth quarter and year ended December 31, 2017. The Corporation’s

audited financial statements and management’s discussion and

analysis (“MD&A”) for the year ended December 31, 2017 are

available on SEDAR at www.sedar.com and on the Athabasca Minerals

Inc. website at www.athabascaminerals.com.

2017 Highlights

- Revenue for the year ended December 31, 2017 increased by 1% to

$7,476,457 versus $7,375,156 in the prior year;

- Working capital of $5.3 million; current debt of $0.5 million;

non-current debt $29,284;

- Gross profit increased by 59% for the year ended December 31,

2017 to $1,643,444 versus $1,033,443 in the prior year;

- Appointed Mr. Robert Beekhuizen, Chief Executive Officer on

June 19, 2017;

- Appointed Mr. Lucas Murray, Chief Financial Officer on October

5, 2017;

- Appointed Mr. John Halliwell, Board of Directors on December 1,

2017;

- Continued meetings and discussion with frac sand supply chain

and logistics companies, equipment suppliers and interested parties

to consider the feasibility of the Firebag Frac Sand

Project;

- Revised Corporation’s organizational structure and management

team to optimize costs as well as strengthen development,

reclamation and project management capabilities;

- Successfully defended Syncrude’s application for a preservation

order, with the Corporation receiving a favourable decision of the

Court of Queen’s Bench of Alberta on January 24, 2017;

- Received “Overholding Tenancy” status from Alberta Environment

& Parks (“AEP”) with instruction to continue operations in the

near term until Closure Plan for Susan Lake gravel pit is approved

by AEP;

Financial Highlights

|

($ thousands of CDN, except per share amounts and tonnes sold) |

Three MonthsQ4 2017 |

Three MonthsQ4 2016 |

Twelve MonthsDec 31, 2017 |

Twelve MonthsDec 31, 2016 |

|

Aggregate management fees - net |

$1,267 |

$1,038 |

$3,769 |

$3,341 |

|

Aggregate sales revenue |

$977 |

$547 |

$3,707 |

$4,034 |

|

Revenue |

$2,243 |

$1,585 |

$7,476 |

$7,375 |

|

Gross profit |

$1,077 |

$26 |

$1,643 |

$1,033 |

|

Total loss and comprehensive loss |

$(729) |

$(915) |

$(2,687) |

$(2,220) |

|

|

|

|

|

|

|

Total aggregate tonnes sold (MT) |

937,892 |

909,725 |

3,073,108 |

3,082,437 |

|

Loss per share, basic and fully diluted ($

per share) |

$(0.022) |

$(0.0.28) |

$(0.081) |

$(0.067

) |

2018 Operational Outlook

Over the next 12 months, the Corporation is

actively addressing and working on various strategic and

operational initiatives relating to the following:

- Resolution of the Syncrude lawsuit;

- Conclude the Susan Lake Management Renewal Contract and execute

the closure program of the Susan Lake Gravel Pit (still pending

approval by Alberta Environment & Parks);

- Optimize corporate overheads and expenses;

- Preserve the Corporation’s cash position, including the

disposition of non-core or low-priority assets;

- Sell existing stockpiled inventories of sand and gravel;

- Negotiate royalty agreements to monetize Pelican Hill Pit and

Emerson Pit;

- Establish Supplier-of-Choice relationships for 3rd party

crushing services for Athabasca’s corporate pits;

- Advance the Firebag Frac Sand project venture – initiate site

development activities to retain permits and pursue potential

partnerships (processing and logistics) to support a pilot project

with an offsite staging area;

- Expand the role and functionality of strategic inventory

staging and distribution hubs (e.g. Conklin, Poplar Creek, and

potentially House River area) to augment corporate pits limited by

winter access roads;

- Selectively pursue conventional aggregate companies for

potential acquisition;

- Develop an aggregates marketing arm to broker sales of 3rd

party inventories to a larger market and expanded customer base in

Western Canada; and

- Front-end development planning for Richardson Project (large

scale aggregate deposit in the Ft. McMurray area).

About Athabasca Minerals

The Corporation is a resource company involved

in the management, exploration and development of aggregate

projects. These activities include contracts works, aggregate pit

management, aggregate production and sales from corporate-owned

pits, new aggregate development and acquisitions of sand and gravel

operations. The Corporation also has industrial mineral land

holdings for the purpose of locating and developing sources of

industrial minerals and aggregates essential to high growth

economic development.

For further Information on Athabasca, please

contact:

Dean StuartT: 403-617-7609E: dean@boardmarker.net

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this

release.

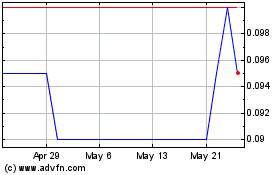

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

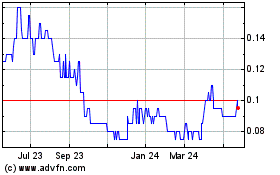

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025