Athabasca Minerals Closes Private Placement of Units

19 November 2018 - 11:01PM

Athabasca Minerals Inc. (“

Athabasca” or the

“

Corporation”) (TSX Venture: ABM) is pleased to

announce that it has closed, subject to final TSX Venture Exchange

acceptance, a non-brokered private placement

(“

Financing”) of 5,100,000 units

(“

Units”) at a price of $0.20 per Unit, for gross

proceeds of $1,020,000. Each Unit consists of one common share

(“

Common Share”) and one-half of one Common Share

purchase warrant (“

Warrant”), with each Warrant

entitling the holder to purchase one additional Common Share at an

exercise price of $0.35 per share for a period of two years after

the closing. No commission, brokers fees or finders’ fees

will be paid in conjunction with the closing of the Financing.

Proceeds from the Financing will be used to

advance business development associated with the Corporation’s

subsidiary, AMI Silica Inc., including engineering for the Firebag

frac sand project, identifying additional premium domestic silica

sand resources in Western Canada, hiring project and sales

personnel, and for general corporate purposes. All securities

issued in connection with the Financing are subject to a hold

period that expires on March 16, 2019.

Robert Beekhuizen, Chief Executive Officer of

Athabasca Minerals, and President of AMI Silica Inc stated, “This

private placement demonstrates renewed investor interest and

confidence in the Corporation’s restructured business model,

strategic plan, and the advancements achieved during 2018.”

Various directors and officers purchased Units

under the financing. These purchases are considered “related party

transactions” under Canadian securities laws. Athabasca is relying

on exemptions from the formal valuation and minority approval

requirements of Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions (“MI

61-101”) and TSXV Policy 5.9, in respect of these

purchases. No new insiders were created, nor has any change of

control occurred, as a result of the Financing. A material change

report was not filed at least 21 days prior to the closing of the

Financing as contemplated by MI 61-101. The Corporation believes

that this shorter period was reasonable and necessary in the

circumstances as the closing of the Financing occurred shortly

before the issuance of this news release announcing the closing of

the Financing.

About Athabasca Minerals

The Corporation is an integrated aggregates

company involved in resource development, aggregates marketing and

midstream supply-logistics solutions. Business activities include

aggregate production, pit management services, sales from

corporate-owned and third-party pits, acquisitions of sand and

gravel operations, and new venture development. The Corporation

also has industrial mineral land exploration licenses that are

strategically positioned for future development in industrial

regions of high potential

demand.

For further Information on Athabasca, please

contact:

Dean StuartT: 403-617-7609E: dean@boardmarker.net

Robert BeekhuizenT: 780-465-5696

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this

release.

NOT FOR DISTRIBUTION IN THE U.S.

OR DISSEMINATION THROUGH U.S. NEWSWIRE

SERVICES

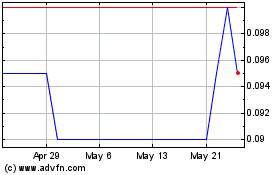

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

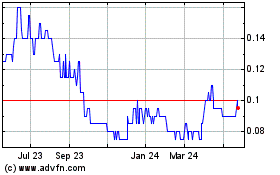

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025