Athabasca Minerals Inc. Receives Favourable NI 43-101 Technical Report in Support of its Duvernay Premium Domestic Sand Proje...

10 September 2019 - 9:01PM

Athabasca Minerals Inc. (“AMI” or the “Corporation”) (TSX Venture:

ABM) is pleased to announce the completion of a Technical Report

prepared in accordance with the requirements of National Instrument

43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”)

for the White Rabbit Property associated with AMI’s Duvernay

Premium Domestic Sand Project (“Duvernay Project”).

AMI’s Duvernay Project encompasses 356 hectares

(878 acres) of largely contiguous, and privately-owned, properties.

The underlying sand deposit was delineated based on 49 drill holes,

using a rotary auger rig, and the retrieval of over 200 stratum

samples which were subject to a comprehensive lab testing program.

The sand samples were tested to assess suitability for use as a

hydraulic fracturing proppant, as conducted by AGAT Laboratories,

Ltd. (“AGAT”), Stim-Lab, Inc. (“Stim-Lab”), Loring Laboratories,

Ltd. (“Loring”) and Turnkey Processing Solutions Sand Laboratory

(“TPS”).

The Technical Report establishes that AMI’s

Duvernay Project contains a sand resource of:

- fine-to-coarse grain sands with pay thickness from 0.4 meters

to 21.6 meters;

- 24.7 million metric tonnes (MT) measured resource, with an

additional 5.6 million MT indicated resource, and a further 4.9

million MT inferred resource.

A breakdown of measured, indicated and inferred

resources by mesh size is as follows:

|

Category |

Mineral Resources |

|

20 / 40 Mesh |

40 / 70 Mesh |

70 / 140 Mesh |

140 / 170 Mesh |

Total(Combined) |

|

Measured Resource – million MT |

3.4 |

11.2 |

9.0 |

1.1 |

24.7 |

|

Indicated Resource – million MT |

0.6 |

2.5 |

2.2 |

0.3 |

5.6 |

|

Measured & Indicated – million MT |

4.0 |

13.7 |

11.2 |

1.4 |

30.3 |

|

Measured & Indicated (%) |

13.2% |

45.2% |

37.0% |

4.6% |

|

|

Inferred Resource – million MT |

0.5 |

2.1 |

2 |

0.3 |

4.9 |

The Technical Report was prepared by Mr. William

A. Turner, MSc. P.Geol, and Mr. A.C. (Chris) Hunter, P. Geo., of

Stantec Consulting Ltd., in Calgary, Alberta; both of whom meet the

requirements of qualified persons under NI 43-101 definitions. Mr.

Turner and Mr. Hunter, as independent consultants contracted by the

Corporation, are the Qualified Persons responsible for the above

noted technical content of this release and have reviewed and

approved it accordingly. A full copy of the Technical Report is

expected to be made available on SEDAR and the Corporation’s

website within 45 days.

AMI’s Duvernay premium domestic sand is

comprised of ‘40/70’ and ‘70/140’ mesh fractions of 45.2% and 37%

respectively for combined 82.2% of the highest demand proppant

grades used in well completions in the Duvernay formation. Sand

properties compare favorably in quality to Tier-1 ‘Northern White’

sand imported from the United States which is dominant in the

Western Canadian market.

A comparison of AMI’s Duvernay premium sand by

crush resistance and mesh fraction size to that of Northern White

imported sand is shown below:

|

Category |

Mineral Resource – Mesh Size |

|

20 / 40 |

30 / 50 |

40 / 70 |

70 / 140 |

50 / 140 |

|

Mesh |

Mesh |

Mesh |

Mesh |

Mesh |

|

Crush Resistant Tests |

26 |

54 |

70 |

67 |

2 |

|

AMI Duvernay – Premium Domestic Crush Resistance (Average

K-Value) |

5K |

6K |

7K |

9K |

9K |

|

Wisconsin ‘Northern White’ Average Crush Resistance (K-Value

range) |

~4-7K |

~6-8K |

~7-10K |

~9-10K |

~9-12K |

The Corporation’s Management is pleased with the

large volume of premium domestic sand found in-place with over 30.3

million tonnes of measured and indicated resource. Furthermore, the

volume of premium domestic sand could have additional upside given

that several bore holes in the delineation program remained in sand

for the full depth of drilling, without intersecting bedrock or any

other underlying formation.

The favourable results from the NI 43-101

bolsters the Corporation’s conviction to progress development of

its Duvernay Project, and introduce premium domestic sand as a

value-added alternative to imported Tier-1 American sand. In

anticipation of these positive results, AMI has completed front-end

engineering of the sand processing facility, as prepared by a

highly experienced and reputable design-build contractor, and has

engaged environmental consultants to prepare the regulatory

applications for submission in the coming weeks. The Corporation is

budgeting to construct a safe, efficient, technically-advanced

facility capable of year-round operations, that balances capital

cost with design standard, plant capacity and asset life.

The Corporation advises that it is not basing

its production decision on a feasibility study of mineral reserves

demonstrating economic and technical viability, and as a result

there is increased uncertainty and there are multiple technical and

economic risks associated with this production decision.

These risks, among others, include areas that are analyzed in more

detail in a feasibility study, such as applying economic analysis

to reserves, and other specialized studies in areas such as mining

and recovery methods, market analysis, and environmental and

community impacts.

Chief Executive Officer, Robert Beekhuizen,

states: “We are extremely excited about the quality and size of

this deposit. It confirms the availability of local premium

domestic sand capable of displacing imported Wisconsin ‘Northern

White’ sand transported some 2400 kilometres into Western Canada.

AMI’s Duvernay Project has excellent fundamentals and is

strategically well-situated for commercial development. It can

easily access adjacent and nearby infrastructure, including paved

roads, natural gas, water, and power lines in close proximity, with

access to a skilled construction workforce in the area. The

Duvernay Project also offers security of delivery with

uninterrupted trucking that shortens the logistics supply chain to

about one-tenth the distance to wellsite locations compared to

Wisconsin sand sources. We look forward to developing a robust

project that generates economic opportunities in terms of jobs,

local benefits, and royalties for the Province of Alberta.”

AMI is addressing partnering, financing and

offtake strategies that aim to keep project development on pace for

product delivery in first-half 2021.

The Corporation is also planning further

delineation drilling in Q4-2019 for its proposed Montney in-Basin

Premium Sand Project. The project resource encompasses a large

geographic area (some 150,00 hectares) straddling the Alberta-BC

border. Additional drilling permit applications have been submitted

with approvals expected in the coming weeks. A NI 43-101 Report

will similarly follow thereafter.

About Athabasca Minerals

The Corporation is an integrated group of

aggregates companies involved in resource development, aggregates

marketing and midstream supply-logistics solutions. Business

activities include aggregate production, pit management services,

sales from corporate-owned and third-party pits, acquisitions of

sand and gravel operations, and new venture development. Athabasca

Minerals is the parent company of Aggregates Marketing Inc. – a

midstream technology-based business providing integrated supply and

transportation solutions for industrial and construction markets.

It is also the parent company of AMI Silica Inc. – a subsidiary

positioning to become a leading supplier of premium domestic

in-basin sand with regional deposits in Alberta and NE British

Columbia. It is the joint venture owner of the Montney In-Basin and

Duvernay Basin Frac Sand Projects. Additionally, the Corporation

has industrial mineral leases, such as those supporting the

Richardson Quarry Project, that are strategically positioned for

future development in industrial regions of high potential

aggregates demand.

For further information on Athabasca,

please contact:Dean StuartT: 403-617-7609E:

dean@boardmarker.net

Robert Beekhuizen T: 587-525-9610

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

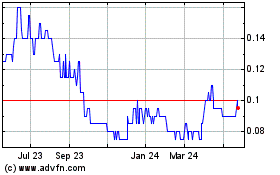

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Jan 2025 to Feb 2025

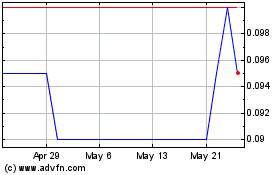

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Feb 2024 to Feb 2025