Acceleware® Ltd. (“Acceleware” or the “Company”) (TSX-V: AXE), a

leading innovator of transformative technologies targeting the

decarbonization of industrial heating, today announced its

financial and operating results for the year ended December 31,

2023 (all figures are in Canadian dollars unless otherwise noted).

Acceleware’s year end results reflect contributions from the

Company’s two business units, radio frequency (“RF”) heating for

industrial applications using the Company’s proprietary Clean Tech

Inverter (“CTI”) including enhanced oil recovery (“RF XL”), and

high-performance computing ("HPC”) scientific software. This news

release should be read in conjunction with the Company’s audited

financial statements and the accompanying notes for the year ended

December 31, 2023 and management’s discussion and analysis (“MDA”)

thereto, all of which are available on Acceleware’s website at

www.acceleware.com or on www.sedarplus.ca.

HIGHLIGHTS

Financial highlights for the three and twelve

months ended December 31, 2023:

|

|

|

Three Months Ended |

Twelve Months Ended |

|

|

|

Dec 31, 2023 |

Dec 31, 2022 |

|

Dec 31, 2023 |

|

Dec 31, 2022 |

|

|

Revenue |

$ |

43,590 |

73,056 |

|

279,011 |

|

328,293 |

|

| Comprehensive income/

(loss) |

|

617,748 |

(1,345,913 |

) |

(2,045,373 |

) |

(5,142,168 |

) |

|

Gross R&D expenditures |

|

684,437 |

1,219,553 |

|

2,872,982 |

|

5,674,180 |

|

|

Deferred revenue increase |

|

-- |

200,000 |

|

-- |

|

1,300,000 |

|

|

Government assistance |

|

2,064,434 |

900,000 |

|

2,618,242 |

|

2,229,025 |

|

|

|

Acceleware is piloting RF XL at its

commercial-scale RF XL pilot project at Marwayne, Alberta (the “RF

XL Pilot”). During 2023, the RF XL Pilot was shut down for

maintenance related to the RF XL heating well (the “Workover”). In

late Q3, 2023 Acceleware encountered subsurface challenges in

redeploying upgraded components during the Workover. In the three

months ended December 31, 2023 (“Q4 2023”), encouraged by positive

results to date, the Company worked closely with industry partners

to determine the most appropriate next steps in the Workover. It

was determined that the most practical path forward involves a

redeployment of all subsurface components incorporating the

multiple improvements and upgrades that Acceleware has made to the

RF XL downhole system. Acceleware is actively sourcing an

additional $5 million of funding to complete the redeployment. The

redeployment is expected to enable higher power to be distributed

in the reservoir for a sustained period in a second phase of

heating. Please refer to the RF XL PILOT UPDATE section below for

more information, and to the MDA for a complete RF XL Pilot

update.

On November 6, 2023, Acceleware announced

non-dilutive, non-repayable funding from the Clean Resource

Innovation Network (“CRIN”) of up to $3 million for the RF XL

Pilot. The funding is paid upon completion of certain milestones

and is reimbursement for costs incurred between January 1, 2022 and

March 31, 2024. This funding is intended to accelerate clean

technology development and commercialization for the oil and gas

industry. There was $2,064,434 received in Q4 2023.

Acceleware continued to invest in developing and

protecting new intellectual property with the total number of

patents issued, allowed, applied for, or in development growing

from 44 at the end of 2022 to a total of 60 now.

RF XL PILOT UPDATE

Operations at Acceleware’s RF XL Pilot began in

early March 2022, and successfully operated until July 2022. At

that time, the fibre optic distributed temperature sensing (“DTS”)

system in the heating well was damaged during a maintenance

operation. After the DTS break, RF power was reduced for safety and

a plan for the Workover was developed. The Workover commenced in

October 2022, and included numerous upgrades of critical RF XL

components. During redeployment of the system in Q1 2023 and Q3

2023 Acceleware identified degradation of some additional downhole

components due to water ingress. The Company has now determined

with our industry partners that the most practical path forward

involves a redeployment of all subsurface components.

During the successful operation of the RF XL

Pilot, performance data shows that the operation of the Clean Tech

Inverter (“CTI”) met or exceeded specifications. The CTI is the

radio frequency (“RF”) electronic ‘engine’ critical to RF XL Pilot

success. A primary objective of the RF XL Pilot was to demonstrate

the operation of the CTI and its effectiveness in transmitting RF

energy downhole to increase temperature and improve oil production.

Significant milestones achieved include:

- Acceleware drilled

and completed the first of its kind multilateral heating well and

associated production well in a previously produced heavy oil

reservoir.

- The RF XL system (including the

CTI) demonstrated unprecedented performance with the longest

continuous run (142 days) and highest power (up to 250 kW) of any

RF heating system.

- Maximum design current was

transmitted from the CTI, through the proprietary transmission

line, and radiated to the reservoir.

- Increased reservoir temperature and

oil production were observed in the RF XL Pilot.

- The temperature profile and oil

production increase matched simulated predictions given the levels

of power radiated.

Additionally, critical components of the

proprietary RF XL subsurface technology functioned as designed and

expected.

The Workover was undertaken to address the DTS

failure, during which time the engineering team took the

opportunity to examine downhole components. As the Workover

progressed, an issue was discovered with the downhole RF XL system

resulting from water ingress into the RF transmission line during

deployment and operation of the RF XL Pilot. Some moisture had been

anticipated and was initially addressed via the RF XL Pilot’s

nitrogen purge and pressurization system which is designed to

remove and prevent the return of fluids. Further analysis following

the Workover suggests that this system was not able to manage the

moisture levels encountered, resulting in degradation of some

proprietary downhole components. For clarity, the moisture ingress

issue pertained to tubing connections, not to core RF XL technology

nor RF XL electronics. Acceleware has recreated the problem in lab

tests and has designed and tested a solution. The damage is

believed to be the primary impediment to Acceleware’s ability to

achieve full power in the first phase of heating at the RF XL

Pilot. As mentioned on November 22, 2023, Acceleware planned to

develop several solutions to this challenge and proceed with the

option with the highest probability of success and the lowest risk.

The Acceleware team, in consultation with industry partners, has

developed what is believed to be a permanent, resilient solution

for the issue.

Acceleware now plans to continue a second phase

of heating after a significant subsurface upgrade plan to address

the moisture ingress issue. Subsurface components not removed

during the Workover will be removed, refurbished, or upgraded, and

then redeployed along with the components already upgraded during

the original Workover program.

QUARTER IN REVIEW

Revenue of $0.04 million was generated in the

three months ended December 31, 2023 (“Q4 2023”) compared to $0.1

million in the three months ended December 31, 2022 (“Q4 2022”) and

$0.1 million in the previous quarter ended September 30, 2023 (“Q3

2023”). Revenue was lower in Q4 2023 and Q3 2023 due to less demand

in the HPC segment for FDTD maintenance compared to Q4 2022. There

continues to be variability in the RF Heating segment for revenue

related to services in applying CTI to industrial heating. While

interest has increased in the intelligent electric heating service

offering, there was no revenue in Q4 2023 or Q3 2023. Acceleware

did not receive any data revenue payments during Q4 2023 or Q3 2023

but received $0.2 million in Q4 2022 for the RF XL Pilot. These

payments, when received, are recorded in deferred revenue. Data

revenue equal to the amount recorded in deferred revenue will be

recognized as revenue at the end of the RF XL Pilot or when the

data contracts are terminated, whichever is earlier.

Total comprehensive income for Q4 2023 was $0.6

million compared to a comprehensive loss of $1.3 million for Q4

2022 and a comprehensive loss of $1.3 million for Q3 2023.

Comprehensive income was higher in Q4 2023 due to receipt of

government assistance from CRIN relating to costs incurred from

January 1, 2022 to June 30, 2023 and lower R&D spending. These

increases are offset by higher interest costs related to current

liabilities funding the Company’s working capital. Comprehensive

income/(loss) in all periods was impacted by changes in value of

the derivative financial instruments embedded within the

convertible debenture. The changes in derivative value are driven

primarily by the fluctuation in the Company’s share price.

Gross R&D expenses incurred in Q4 2023 were

$0.7 million compared to $1.2 million in Q4 2022 and $0.8 million

in Q3 2023. R&D spending was lower in Q4 2023 compared to Q4

2022 and Q3 2023 due to a change in the nature of the Workover

activities. Most of the Workover activity in Q4 2023 was related to

lab engineering, designing and testing, data analysis, and partner

consultations. Government assistance received in Q4 2023 was $2.1

million and nil in Q4 2022 and $0.1 million in Q3 2023. While the

ERA, SDTC and Alberta Innovates grants for the RF XL Pilot were

completed in 2023, CRIN awarded up to $3 million and the Company

received approximately $2.0 million of that in the year ended

December 31, 2023.

General and administrative (“G&A”) expenses

incurred in Q4 2023 were $0.6 million compared to $0.6 million in

Q4 2022 and $0.6 million in Q3 2023. There were higher non-cash

payroll related costs incurred in Q4 2023 due to the timing of

option grants, higher professional fees and lower salaries as the

Company continues to prioritize cost control given uncertain

economic conditions.

YEAR IN REVIEW

Revenue of $0.3 million was generated from the

Company’s software, maintenance and services revenue streams for

the year ended December 31, 2023 compared to $0.3 million for the

year ended December 31, 2022. Although revenue is more diversified

in 2023 with a significant contribution from services revenue,

revenue was lower due to lower demand for HPC software and

maintenance revenue. Services revenue relates to RF simulation and

experimental studies paid by customers interested in applying CTI

for their industrial heating needs. Industries outside heavy oil

have also become interested in utilizing CTI for industrial

heating, including mining, agriculture, and hydrogen. Acceleware

did not receive any non-refundable milestone cash payments during

the year ended December 31, 2023 compared to $1.3 million received

during the year ended December 31, 2022. When received, these

payments are recorded in deferred revenue.

Total comprehensive loss for the year ended

December 31, 2023 was $2.0 million compared to $5.1 million for the

year ended December 31, 2022 due to lower R&D spending for the

RF XL Pilot and higher government grant funding. There are

fluctuations in both periods related to changes in fair value of

the derivative financial instruments embedded in the convertible

debentures and interest expense due to short- and long-term debt

financing.

Gross R&D expenses for the year ended

December 31, 2023 were $2.9 million compared to $5.7 million

incurred during the year ended December 31, 2022 due to lower cost

R&D activity on the Workover during the year ended December 31,

2023. There was a significant amount of non-recurring installation

costs for the RF XL Pilot incurred in the early part of 2022.

Federal and provincial government assistance of $2.6 million was

recognized in the year ended December 31, 2023 compared to $2.2

million for the year ended December 31, 2022. The Government of

Alberta’s Innovation Employment Grant (“IEG”) to support research

and development was effective January 1, 2021 and provides a grant

of up to 20% of eligible R&D expenses incurred in Alberta. This

new grant effectively replaced Alberta’s 10% scientific research

and experimental development refundable tax credit that was

eliminated as at December 31, 2019. The Company met the eligibility

criteria, claimed eligible R&D expenditures and received $0.4

million in Q1 2023 related to 2021 eligible expenditures and $0.1

million in Q3 2023 related to 2022 eligible expenditures and $nil

in Q4 2022. As at December 31, 2023 and 2022 there was $nil million

government assistance receivable. Government assistance offsets

gross R&D costs.

General and administrative (“G&A”) expenses

incurred during the year ended December 31, 2023 were $2.0 million

compared to $2.1 million for the year ended December 31, 2022.

While salaries were lower as the Company continues to prioritize

cost management, there were higher legal and related professional

fees for the equity offerings and higher non-cash payroll related

costs for option grants.

As at December, 2023, Acceleware had negative

working capital of $2.0 million (December 31, 2022 – negative

working capital of $0.6 million) including cash and cash

equivalents of $1.0 million (December 31, 2022 – $1.1 million). As

at December 31, 2023 there is $1.2 million included in working

capital for amounts due to management for services provided

(December 31, 2022 - $0.8 million). The negative working capital

for both periods is attributable to the timing of receipt and

recognition of government and partner funding and related R&D

spending. Not included in working capital is $2.6 million of

funding that is committed but not yet received (December 31, 2022 -

$2.4 million). Every funder, except ERA and SDTC, reimburses

Acceleware for the RF XL Pilot costs in arrears, after the spending

has occurred. The Company actively manages its cash flow

requirements with a combination of cash generated from operations,

external funding, and capital raising activities.

ABOUT ACCELEWARE:

Acceleware is an innovator of clean-tech

decarbonization technologies comprised of two business units: Radio

Frequency Heating Technology and Seismic Imaging Software.

Acceleware is piloting RF XL, its patented

low-cost, low-carbon production technology for heavy oil and oil

sands that is materially different from any heavy oil recovery

technique used today. Acceleware's vision is that electrification

of heavy oil and oil sands production can be made possible through

RF XL, supporting a transition to much cleaner energy production

that can quickly bend the emissions curve downward. With clean

electricity, Acceleware’s RF XL technology could eliminate

greenhouse gas (GHG) emissions associated with heavy oil and oil

sands production. RF XL uses no water, requires no solvent, has a

small physical footprint, can be redeployed from site to site, and

can be applied to a multitude of reservoir types. Acceleware is

also actively developing partnerships for RF heating of other

industrial applications using the Company’s proprietary CTI.

Acceleware and Saa Dene Group (co-founded by Jim

Boucher) have created Acceleware | Kisâstwêw to raise the profile,

adoption, and value of Acceleware technologies. The shared vision

of the partnership is to improve the environmental and economic

performance of the energy sector by supporting ideals that are

important to Indigenous peoples, including respect for land, water,

and clean air.

The Company’s seismic imaging software solutions

are state-of-the-art for high fidelity imaging, providing the most

accurate and advanced imaging available for oil exploration in

complex geologies. Acceleware is a public company listed on

Canada’s TSX Venture Exchange under the trading symbol “AXE”.

NOTE REGARDING FORWARD-LOOKING

INFORMATION AND OTHER ADVISORIES

This news release contains “forward-looking

information” within the meaning of Canadian securities legislation.

Forward-looking information generally means information about an

issuer’s business, capital, or operations that are prospective in

nature, and includes disclosure about the issuer’s prospective

financial performance or financial position.

The forward-looking information in this press

release can be identified by terms such as “believes”, “estimates”,

“plans”, “potential”, and “will”, and includes information about,

the expected commercialization of RF XL, the expected cost of

the RF XL Pilot, the timing of the execution of the

RF XL Pilot and the redeployment, expected financing required

for the RF XL Pilot redeployment, and the anticipated

economic and societal benefits of the RF XL technology. Acceleware

assumes that current cost estimates are accurate, current

timelines will not be delayed by either internal or external

causes, that research and development effort including the

commercial-scale test plans will result in commercial-ready

products, and that future capital raising efforts will be

successful.

Actual results may vary from the forward-looking

information in this press release due to certain material risk

factors. These risk factors are described in detail in Acceleware’s

continuous disclosure documents, which are filed on SEDAR at

www.sedar.com.

Acceleware assumes no obligation to update or

revise the forward-looking information in this press release,

unless it is required to do so under Canadian securities

legislation.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described in this release in the United States. The securities have

not been and will not be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws and may not be offered or sold within the

United States or to U.S. persons unless registered under the U.S.

Securities Act and applicable state securities laws or an exemption

from such registration is available.

DISCLAIMER

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For more information:Geoff ClarkTel: +1 (403)

249-9099geoff.clark@acceleware.com

Acceleware Ltd.435 10th Avenue SECalgary, AB,

T2G 0W3CanadaTel: +1 (403) 249-9099www.acceleware.com

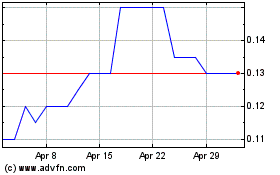

Acceleware (TSXV:AXE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Acceleware (TSXV:AXE)

Historical Stock Chart

From Feb 2024 to Feb 2025