Bitcoin Well Inc. (“

Bitcoin Well”

or the “

Company”) (

TSXV: BTCW; OTCQB:

BCNWF), the non-custodial bitcoin business on a mission to

enable independence, is pleased to announce that it has closed its

previously announced commercially reasonable efforts private

placement offering of an aggregate of 13,352,797 units of the

Company (“

Units”) at a price of $0.175 per Unit

(the “

Issue Price”) for aggregate gross proceeds

of $2,336,740 (the “

Offering”), which includes the

exercise of the majority of the Agent’s Option (as defined below).

Each Unit consists of one common share of the Company (a

“

Common Share”) and one-half of one common share

purchase warrant of the Company (each whole warrant, a

“

Warrant”). Each Warrant entitles the holder

thereof to purchase one Common Share at a price of $0.275 per

share, subject to adjustment in certain events, at any time until

March 22, 2027.

“I am excited to welcome all of our new

shareholders to the mission of enabling independence” said Adam

O’Brien, founder and CEO of Bitcoin Well. “This financing is a

small but crucial step in our journey to spread the adoption of

Bitcoin and enable independence. The Bitcoin Portal continues to

grow and we expect the funds from this financing will allow us to

accelerate its growth.”

The Offering was completed pursuant to the terms

of an agency agreement dated March 22, 2024 between the Company and

Haywood Securities Inc. as lead agent and sole bookrunner (the

“Agent”). Prior to the closing of the Offering,

the Agent exercised its option (the “Agent’s

Option”) to sell an additional 1,352,797 Units at the

Issue Price.

The Company intends to use the net proceeds of

the Offering for sales and marketing, working capital and general

corporate purposes.

In connection with the Offering, the Company

paid to the Agent: (i) a cash commission of $156,556; (ii)

non-transferrable compensation options of the Company exercisable

at any time prior to March 22, 2027 to acquire up to 894,603 units

of the Company (“Compensation Option Units”) at a

price equal to the Issue Price, subject to adjustment in certain

events; and (iii) 428,571 units of the Company (the

“Corporate Finance Fee Units”). The Compensation

Option Units and the Corporate Finance Fee Units have the same

terms as the Units sold in the Offering.

The Units sold under the Offering were issued

and sold pursuant to the listed issuer financing exemption under

Part 5A of National Instrument 45-106 - Prospectus Exemptions (the

“Listed Issuer Financing Exemption”). A copy of

the offering document under the Listed Issuer Financing Exemption

dated March 4, 2024 (the “Offering Document”) is

available under the Company’s profile at www.sedarplus.ca and on

the Company’s website at bitcoinwell.com/investors. All Units

issued pursuant to the Listed Issuer Financing Exemption are not

subject to resale restrictions in Canada in accordance with

applicable Canadian securities laws and the policies of the TSX

Venture Exchange (the "TSXV"), other than the

Units issued to directors, which are subject to a hold period under

TSXV policies expiring July 23, 2024. All other securities not

issued pursuant to the Listed Issuer Financing Exemption, including

the Compensation Options, are subject to a statutory hold period in

accordance with applicable Canadian securities laws, expiring on

July 23, 2024. The Offering remains subject to the final acceptance

of the TSXV.

Certain directors subscribed for Units in the

Offering. These subscriptions constitute related party transactions

under Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions (“MI

61-101”). These transactions are exempt from the formal

valuation and minority shareholder approval requirements of MI

61-101 pursuant to sections 5.5(a) and 5.7(1)(a) of MI 61-101 as

the fair market value of the Units subscribed for by related

parties and the consideration paid therefor does not exceed 25% of

the Company’s market capitalization.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities being offered have not been, nor will they

be, registered under the U.S. Securities Act of 1933, as amended

(the “1933 Act”) or under any U.S. state

securities laws, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the 1933 Act, as amended, and

applicable state securities laws.

About Bitcoin Well

Bitcoin Well is on a mission to enable

independence. We do this by making bitcoin useful to everyday

people to give them the convenience of modern banking and the

benefits of bitcoin. We like to think of it as future-proofing

money. Our existing Bitcoin ATM and Online Bitcoin Portal business

units drive cash flow to help fund this mission.

Join our investor community and follow us on

Nostr, LinkedIn, Twitter and YouTube to keep up to date with our

business.

Bitcoin Well contact

information

To book a virtual meeting with our Founder &

CEO Adam O’Brien please use the following link:

https://bitcoinwell.com/meet-adam

For additional investor & media information, please

contact:Tel: 1 888 711 3866ir@bitcoinwell.com

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Forward-looking

information Certain statements contained in this news

release may constitute forward-looking information. Forward-looking

information is often, but not always, identified by the use of

words such as "anticipate", "plan", "estimate", "expect", "may",

"will", "intend", "should", or the negative thereof and similar

expressions. All statements herein other than statements of

historical fact constitute forward-looking information, including

but not limited to statements in respect of: TSX Venture Exchange

approval of the Offering; use of proceeds from the Offering;

Bitcoin Well’s growth and acceleration; the adoption of Bitcoin;

and Bitcoin Well’s business plans, strategy and outlook.

Forward-looking information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. Bitcoin Well actual results could

differ materially from those anticipated in this forward-looking

information as a result of inability to obtain TSX Venture Exchange

approval, regulatory decisions, competitive factors in the

industries in which Bitcoin Well operates, prevailing economic

conditions, and other factors, many of which are beyond the control

of Bitcoin Well.

Bitcoin Well believes that the expectations

reflected in the forward-looking information are reasonable, but no

assurance can be given that these expectations will prove to be

correct and such forward-looking information should not be unduly

relied upon. Any forward-looking information contained in this news

release represents Bitcoin Well expectations as of the date hereof,

and is subject to change after such date. Bitcoin Well disclaims

any intention or obligation to update or revise any forward-looking

information whether as a result of new information, future events

or otherwise, except as required by applicable securities

legislation. For more information, see the Cautionary Note

Regarding Forward Looking Information found in the Bitcoin Well

quarterly Management Discussion and Analysis.

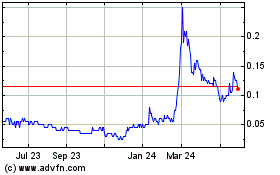

Bitcoin Well (TSXV:BTCW)

Historical Stock Chart

From Dec 2024 to Jan 2025

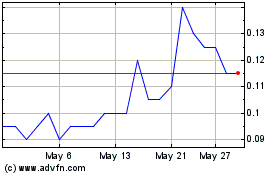

Bitcoin Well (TSXV:BTCW)

Historical Stock Chart

From Jan 2024 to Jan 2025