Claim Post Resources Inc. Announces Non-Brokered Private Placement

22 February 2013 - 3:00AM

Marketwired Canada

Claim Post Resources Inc. (TSX VENTURE:CPS) (the "Company") announces that it

intends to complete a non-brokered private placement offering (the "Offering")

of up to 35,000,000 units (the "Units") at a price of $0.10 per Unit for gross

proceeds of up to $3,500,000. Each Unit is comprised of one (1) common share and

one (1) common share purchase warrant (a "Warrant"). Each Warrant is exercisable

at an exercise price of $0.15 per share for a period of three (3) years from the

date of issuance.

The proceeds received from the Offering will be used (i) to fund the acquisition

of a silica sand quarry project located near Seymourville, 200km NE of Winnipeg,

Manitoba (Canada) (see press release of August 27, 2012); (ii) to carry out a

3000 m drilling program towards completing a resource definition in accordance

with NI 43-101; (iii) to complete marketing and engineering studies on the

project; (iv) for the down payment on industrial land in Winnipeg for a frac

sand loading terminal (v) for general working capital purposes.

All securities issued will be subject to a four (4) month hold period from the

date of closing. The Offering is subject to the approval of the TSX Venture

Exchange.

The Seymourville Silica Sand deposit was discovered in 1977 and was drilled by

Manitoba government geologists in 1981 and again in 1989 indicating a potential

resource of 45 million tons of high silica sand (Manitoba Energy and Mines

website) of which an estimated 70% is on the Char Crete leases. The deposit is

hosted within a 25m high hill composed mainly of Lake Winnipeg Formation which

is the on-shore extension of the Historical Black Island silica deposit. The 99%

pure silica sand was evaluated to feasibility in the 1980's to make 500 tons per

day of plate glass (Manitoba Open File Report OF 96-4); the current market is as

frac sand for the Western Canadian oil and gas markets. The historical estimates

are not current and do not meet the standards prescribed by NI 43-101. The

Company has not completed the work necessary to have the historical estimate

verified by a QP. The Company is not treating the estimate as a current NI

43-101 defined resource and the historical estimate should not be relied upon.

The President of Claim Post Resources, Charles Gryba, stated: "We are

concentrating on de-risking the Seymourville frac sand project. On completion of

the next phase of financing; our first priority will be to start a drilling

program and the API - ISO testwork towards completing a NI 43-101 report.

Obtaining an option on the Winnipeg industrial property is suitable for setting

up a frac sand terminal for transport via rail and is already permitted for a 24

hour per day operation, simplifying the independent economic studies."

Claim Post's frac sand deposit is approximately 1,000 km closer to the Canadian

market in comparison to Wisconsin deposits where 75 percent of the US frac sand

is mined and processed. Transportation savings is one key component to making

any industrial mineral profitable and this is especially true in the cost

competitive natural frac sand market.

The Seymourville deposit has 20 - 40 mesh and 40 - 70 mesh natural sand used for

the fracking in the Bakken oil formations located in Southern Manitoba and

Saskatchewan and also 40 - 70 mesh and 100 mesh sizes suitable for natural gas

fracking in the world class Montney, Horn River and Laird River basins.

Horizontal drilling and fracking in the US and Western Canada has been very

successful and the tonnage of frac sand used may continue to grow as LNG plants

are built for export of natural gas to Asian markets and other Canadian shale

deposits are re-drilled for light oil production. Canadian frac sand deposits

are very rare as recent glaciations has either destroyed the deposit or mixed in

other non API spec sand.

Claim Post Resources Inc. is a Canadian based mineral exploration company and a

reporting issuer in Ontario, Alberta and British Columbia. The Company currently

holds a 100% interest in the mineral rights to about 1145 staked claim units and

63 patented claims (approx. 200 km sq. or 72 sq. miles), wholly within the city

limits of Timmins, Ontario. The Company also has 51% ownership rights in 9

quarry leases near Seymourville, Manitoba. There are 45,788,831 common shares of

the Company issued and outstanding.

Statements in this release that are forward-looking reflect the Company's

current views and expectations with respect to its performance, business, and

future events. Such statements are subject to various risks and assumptions,

some, but not necessarily all, are disclosed elsewhere in the Company's periodic

filings with Canadian securities regulators. Such statements and information

contained herein represent management's best judgment as of the date hereof

based on the information currently available; however actual results and events

may vary significantly. The Company does not assume the obligation to update any

forward-looking statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Claim Post Resources Inc.

Charles Gryba

President and Director

416-801-6366

Claim Post Resources Inc.

Peter Gryba

Corporate Affairs

416-203-3776

www.claimpostresources.com

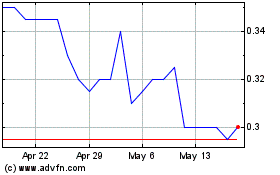

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

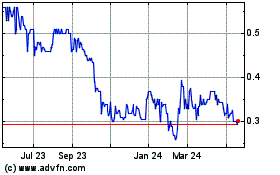

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025