Consolidated Uranium Inc. (the "Company", “CUR” or

“Consolidated Uranium”) (TSXV: CUR) (OTCQB: CURUF) is

pleased to share an open letter from Chairman and Chief Executive

Officer, Philip Williams, to shareholders of the Company.

Dear Fellow Shareholders:

As we begin 2023, I wanted to take a moment to

reflect on our Company’s achievements over the past year and set

out our objectives for the upcoming year and beyond.

Industry Dynamics Still Point to a

Bright Future

Given the relative weakness in uranium prices

and the poor performance of uranium equities over the second half

of 2022, it may be hard to look at 2023 with a great deal of

optimism. However, we at CUR believe the future continues to look

bright for the sector and that 2023 may turn out to be a pivotal

year for the nuclear industry and by extension the uranium

sector.

Uranium spot prices now sit at US$47.60 per

pound versus US$43.25 per pound a year ago, representing an

increase of 10%, however this only tells half of the story. In

April spot prices peaked at US$63.75 dropping back to US$50.00 in

May and staying relatively range bond over the balance of 2022.

This performance mirrored global equity markets, showing the

commodity is not immune to overall market conditions. The long-term

price indicator of Uranium now sits at US$53.00 per pound up from

US$45.00 per pound or an increase of 18% from one year ago.

Although both of these prices are important, two other recent

values point toward higher prices going forward:

- The first is US$56.20 per pound,

which is the current level of TradeTech’s production cost

indicator, defined as the weighted average life-of-mine cost needed

to support additional uranium production required to sustain the

global nuclear fuel industry. Given inflationary pressures on many

of the key inputs in the mining industry, while we could argue that

the cost of uranium production is actually higher, this number

indicates that uranium prices, both spot and long term, need to

rise dramatically in order to support required future

production.

- The second is US$70.50 per pound,

which is the price the US Government recently agreed to pay when

purchasing 100,000 pounds of uranium as part of creating its

Uranium Reserve Program. This price was the highest reported as

part of the program which included five different sellers, and we

believe it is a clear signal that the price required to support

much needed new production in the US is likely above of US$70.00

per pound.

Turning to the nuclear industry, this is where

things get very interesting. Over the past year it seemed that a

week didn’t go by without a significant announcement relating to

new nuclear build plans or reactor life extensions, international

acceptance for nuclear power and small modular reactor news, with

most of these announcements underpinning a strong demand for

nuclear going forward. This anecdotal positive demand for nuclear

power was quantified by the International Atomic Energy Agency (the

“IAEA”) in its projections for Nuclear Power Growth published in

September 2022 where, for the second year in a row, the IAEA

revised upwards its annual projections. In its high case scenario,

the IAEA now sees world nuclear generating capacity more than

doubling by 2050 to 873 gigawatts net electrical (GWe),

representing an increase of 10% compared with last year’s report.

This is the scenario we are preparing for at Consolidated

Uranium.

Dual Track Business Model Takes

Shape

In our 2021 year end letter to shareholders, we

outlined the dual track business plan for the year consisting of

both continued, opportunistic project acquisitions as well as

project level work to advance the existing portfolio. I’m pleased

to report that both objectives were achieved in 2022:

- On the acquisition front, we added

several key projects in Australia where we now have 6 projects in

Queensland located in the key uranium areas in the state. We also

announced our first foray into South Australia which we view as a

premier uranium mining jurisdiction with a mine currently operating

and several exciting exploration and development projects. Most

significantly, we announced the acquisition of Virginia Energy

Resources Inc., owner of the Coles Hill project in Virginia which

ranks as the largest undeveloped uranium project in the United

States. Following completion of the acquisition of Virginia Energy,

which is expected in late January, CUR’s portfolio will boast

exposure to one of the largest uranium endowments of any of its

peers.

- On the project advancement front,

our main focus for the year was the drill programs at our three

past-producing mines located in Utah, United States. This work,

while still underway, led to the completion of a NI 43-101 mineral

resource estimate for the Tony M project and highlighted several

recommended work programs for the project, which we intend to

pursue in 2023. In Argentina, our team has completed a large-scale

surface program aimed at identifying mineralization beyond the area

of the historic mineral resource estimate. We expect that the

results from this work program will be released in the first

quarter of 2023.

Looking forward, the roadmap for the Company is

to become a globally significant, multi-asset, diversified miner

and developer of uranium projects. We created the graphic below to

illustrate our strategy (Figure 1). It shows the three categories

our current projects fit in: Near Term Production Potential, Medium

Term Exploration and Development and Long Term Call Options. Our

goal is to continue adding to the Near Term Production Potential

category through either the advancement of our existing projects

from the other two categories or through additional M&A

activity. As we move toward this goal, we recognize that certain

existing projects may be better suited for additional spin-out

transactions, as we did with Labrador Uranium Inc. (LUR:CSE) early

in 2022.

Figure 1: CUR Strategy and Portfolio

Roadmap

2023 Promises to be Another Pivotal Year

for CUR

With another busy and successful year completed

we turn our attention to 2023. Major themes we expect to see this

year include continued M&A in the sector and continued focus

from investors and end users on diversifying away from higher risk

geopolitical countries. In addition, we believe that the increased

view of nuclear, and therefore uranium, as a key source of

low-carbon, base load power generation will land uranium on the

radar of a larger audience of investors, including both generalists

and clean energy transition funds. In closing, I can confidently

reiterate the following highlights from last years letter to our

shareholders, which continue to be representative of our strategy

and investment case:

- CUR is in the right sector at the

right time; uranium is currently in a bull trend and has the

potential to deliver robust returns for equity investors;

- CUR has the right team, which

together boasts decades of uranium, M&A, exploration and mine

development expertise;

- CUR has the right portfolio, a

diversified, fast growing portfolio of projects located in top tier

mining and uranium jurisdictions with significant past expenditures

and near-term production potential; and

- CUR has a proven track record. In

less than three years, the Company has executed multiple M&A

transactions, secured multiple financings and has increased market

recognition as measured by market capitalization and trading

liquidity.

I would like to thank all of you for your

continued support and joining us on this journey.

Yours truly,

Philip Williams, Chairman and Chief Executive

Officer

Grant of Compensation

Securities

Pursuant to CUR’s long term incentive plan, the

Company has granted certain officers, directors, employees and

consultants options to purchase an aggregate of 1,125,000 common

shares of the Company and an aggregate of 225,000 restricted share

units. The options are exercisable at a price of $1.62 per common

share for a period of five years and vest over three years as

follows: one-third vesting immediately, one-third vesting after one

year and one-third vesting after two years. The restricted share

units, each of which entitles the holder to receive one common

share of the Company, vest over three years as follows: one-third

vesting after one year, one-third vesting after two years and

one-third vesting after three years. The options and restricted

share units are subject to approval of the TSX Venture

Exchange.

About Consolidated Uranium

Consolidated Uranium Inc. (TSXV: CUR) (OTCQB:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures and

attractive characteristics for development. Most recently, the

Company completed a transformational strategic acquisition and

alliance with Energy Fuels Inc., a leading U.S.-based uranium

mining company, and acquired a portfolio of permitted,

past-producing conventional uranium and vanadium mines in Utah and

Colorado. These mines are currently on stand-by, ready for rapid

restart as market conditions permit, positioning CUR as a near-term

uranium producer.For More Information, Please

Contact

Philip WilliamsChairman

and CEO pwilliams@consolidateduranium.com

Toll-Free: 1-833-572-2333Twitter:

@ConsolidatedUr www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

“Forward-Looking” Information

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including expectations regarding Uranium prices

and the potential to deliver robust returns for equity investors,

expectations regarding world nuclear capacity, expectations

regarding potential value creation from project acquisitions and

advancement, expectations regarding project-level activities and

new M&A activity, the Company’s ongoing business plan and

approval of the TSX Venture Exchange. Generally, but not always,

forward-looking information and statements can be identified by the

use of words such as “plans”, “expects”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or

“believes” or the negative connotation thereof or variations of

such words and phrases or state that certain actions, events or

results “may”, “could”, “would”, “might” or “will be taken”,

“occur” or “be achieved” or the negative connotation thereof. Such

forward-looking information and statements are based on numerous

assumptions, including that general business and economic

conditions will not change in a material adverse manner, that

financing will be available if and when needed and on reasonable

terms, and that third party contractors, equipment and supplies and

governmental and other approvals required to conduct the Company’s

planned exploration and development activities will be available on

reasonable terms and in a timely manner. Although the assumptions

made by the Company in providing forward-looking information or

making forward-looking statements are considered reasonable by

management at the time, there can be no assurance that such

assumptions will prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves, reliance on key management

and other personnel, potential downturns in economic conditions,

actual results of exploration activities being different than

anticipated, changes in exploration programs based upon results,

and risks generally associated with the mineral exploration

industry, environmental risks, changes in laws and regulations,

community relations and delays in obtaining governmental or other

approvals and the risk factors with respect to Consolidated Uranium

set out in CUR’s annual information form in respect of the year

ended December 31, 2021 filed with the Canadian securities

regulators and available under CUR’s profile on SEDAR at

www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/39dbf044-b17f-4ad6-b20c-53017ef5c3d3

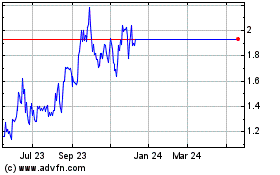

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024