Consolidated Uranium Inc. (“CUR”, the “Company”,

“Consolidated Uranium”) (TSXV: CUR) (OTCQX: CURUF) is

pleased to announce that the Ontario Superior Court of Justice has

granted the final order (the “

Final Order”) in

connection with the previously announced plan of arrangement under

the Business Corporations Act (Ontario) (the

“

Merger” or the “

Arrangement”),

pursuant to which, among other things, IsoEnergy Ltd.

(“

IsoEnergy”) (TSXV:ISO) will acquire all of the

issued and outstanding common shares of Consolidated Uranium not

already held by IsoEnergy or its affiliates (the “

CUR

Shares”) in exchange for 0.500 of a common share of

IsoEnergy (each whole share, an “

IsoEnergy Share”)

for each CUR Share held. As previously announced, the

Arrangement was approved by the Company’s shareholders at a special

meeting held on November 28, 2023.

The Company is also pleased to announce that it

has received written notice from the Committee on Foreign

Investment in the United States that it has concluded its review of

the Arrangement and determined that there are no unresolved

national security concerns with respect to the Arrangement.

Closing of the Arrangement remains subject to

satisfaction of certain customary closing conditions, including

stock exchange and regulatory approvals. Subject to the

satisfaction of these closing conditions, the parties currently

expect to complete the Arrangement on or around December 5,

2023.

Further details regarding the Arrangement, including the

principal closing conditions and the anticipated benefits for

Shareholders, can be found in the Company’s management proxy

circular dated October 23, 2023 in respect of the Meeting, which

can be found under the Company’s SEDAR+ profile at

www.sedarplus.ca.

Ben Lomond Option Agreement

Under the terms of the option agreement between

the Company and Mega Uranium Ltd. (“Mega”) dated

May 14, 2020, as amended (the “Option Agreement”),

pursuant to which the Company acquired the Ben Lomond project in

Australia, Mega is entitled to receive certain payments contingent

upon the attainment of certain milestones tied to the spot price of

uranium. As the Ux U3O8 Monthly Average Price exceeded USD$75/lb

(the “Pricing Threshold”), Mega is entitled

receive payment of an additional $800,000, payable in CUR Shares at

the election of CUR. As a result of the Pricing Threshold having

been met, CUR intends to deliver to Mega aggregate consideration of

$800,000 to be satisfied by the issuance of 400,000 Common Shares

at a deemed price of $2.00 per share, being the volume-weighted

average price of the CUR Shares for the five-day period ending on

November 27, 2023, being the day on which the Pricing Threshold was

achieved. All CUR Shares issued pursuant to the Option

Agreement are subject to final approval of the TSX Venture Exchange

(the “TSXV”) and will be subject to a hold period

expiring four months and one day from the applicable date of

issuance.

About Consolidated Uranium

Inc.

Consolidated Uranium Inc. (TSXV: CUR) (OTCQX:

CURUF) was created in early 2020 to capitalize on an anticipated

uranium market resurgence using the proven model of diversified

project consolidation. To date, the Company has acquired or has the

right to acquire uranium projects in Australia, Canada, Argentina,

and the United States each with significant past expenditures and

attractive characteristics for development.

The Company is currently advancing its portfolio

of permitted, past-producing conventional uranium and vanadium

mines in Utah and Colorado, with a toll milling arrangement in

place with Energy Fuels Inc., a leading U.S.-based uranium mining

company. These mines are currently on stand-by, ready for rapid

restart as market conditions permit, positioning CUR as a near-term

uranium producer.

For More Information, Please Contact:

Philip WilliamsChairman and

CEOpwilliams@consolidateduranium.comToll-Free:

1-833-572-2333Twitter: @ConsolidatedUr

http://www.consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. These forward-looking statements or information may

relate to the anticipated closing of the Arrangement, the issuance

of the CUR Shares pursuant to the Option Agreement and the approval

of the TSXV in connection therewith, and the Company’s ongoing

business plan, exploration and work program.

Forward-looking statements are necessarily based

upon a number of assumptions that, while considered reasonable by

management at the time, are inherently subject to business, market

and economic risks, uncertainties and contingencies that may cause

actual results, performance or achievements to be materially

different from those expressed or implied by forward-looking

statements. Such assumptions include, but are not limited to,

assumptions regarding the completion of the Arrangement including

receipt of required regulatory, and stock exchange approvals, the

ability of Consolidated Uranium and IsoEnergy to satisfy, in a

timely manner, the other conditions to the closing of the

Arrangement, other expectations and assumptions concerning the

Arrangement, and that general business and economic conditions will

not change in a material adverse manner. Although Consolidated

Uranium has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information.

Such statements represent the current views of

Consolidated Uranium with respect to future events and are

necessarily based upon a number of assumptions and estimates that,

while considered reasonable by Consolidated Uranium, are inherently

subject to significant business, economic, competitive, political

and social risks, contingencies and uncertainties. Risks and

uncertainties include, but are not limited to the following:

inability of Consolidated Uranium and IsoEnergy to complete the

Arrangement, a material adverse change in the timing of any

completion and the terms and conditions upon which the Arrangement

is completed; inability to satisfy or waive all conditions to

closing the Arrangement; the TSX Venture Exchange not providing

final approval to the Arrangement and all required matters related

thereto; changes to Consolidated Uranium’s and/or IsoEnergy’s

current and future business plans and the strategic alternatives

available thereto; treatment of the Arrangement under applicable

competition laws and the Investment Canada Act; regulatory

determinations and delays. Other factors which could materially

affect such forward-looking information are described in the risk

factors in Consolidated Uranium’s most recent annual information

form, the management information circular in connection with the

Meeting and in Consolidated Uranium’s other filings with the

Canadian securities regulators which are available on the Company’s

profile on SEDAR+ at www.sedarplus.ca. Consolidated Uranium does

not undertake to update any forward-looking information, except in

accordance with applicable securities laws.

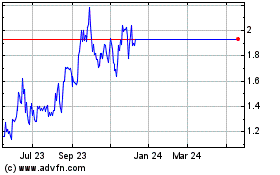

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Oct 2024 to Nov 2024

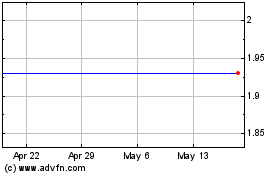

Consolidated Uranium (TSXV:CUR)

Historical Stock Chart

From Nov 2023 to Nov 2024