Cornish Metals Inc. (

TSX-V/AIM:

CUSN) (“Cornish Metals” or the “Company”), a mineral

exploration and development company focused on advancing the South

Crofty tin project to a production decision, located in Cornwall,

United Kingdom, is pleased to announce that it has released its

unaudited financial statements and management, discussion and

analysis (“MD&A”) for the nine months ended October 31, 2023.

The reports are available under the Company’s profile on SEDAR+

(www.sedarplus.ca) and on the Company’s website

(www.cornishmetals.com).

Highlights for the nine months ended

October 31, 2023 and for the period ending December 13,

2023

(All figures expressed in Canadian dollars

unless otherwise stated)

-

Commissioning of the water treatment plant (“WTP”) completed at the

end of October 2023 with discharge of treated water to the Red

River commencing shortly thereafter in accordance with permitted

standards (news release dated October 25, 2023);

-

Good progress is being made on the mine dewatering with the water

level falling faster than expected in the first month of dewatering

(news release dated December 6, 2023);

- Updated Mineral

Resource Estimate (“MRE”) for South Crofty mine released in

September 2023 showing a 31.6% increase to contained tin in the

Indicated Mineral Resource category for the Lower Mine (news

release dated September 13, 2023);

- Drill program to

collect samples for metallurgical testwork as part of the South

Crofty Feasibility Study completed in June 2023 with assay results

reported (news release dated July 3, 2023);

- Ore sorting

testwork completed with excellent results: 55% mass rejection with

less than 3% metal loss (XRT: -50mm to +15mm size fraction) and 50%

mass rejection with less than 5% metal loss (HLS: -15mm to +0.85mm

size fraction) (news release dated October 8, 2023);

-

Metallurgical testwork results confirm the potential to upgrade the

mineralization of the South Crofty mine and enable process design

optimization work on the size of the mineral processing plant (news

release dated October 8, 2023);

- Two submersible

pumps installed in New Cook’s Kitchen (“NCK”) shaft with the pumps

and variable speed drives successfully commissioned in July 2023

(news releases dated June 26, 2023 and July 18, 2023);

- Fifteen-month

power supply contract agreed for the provision of 100% renewably

generated power thereby providing certainty over power costs during

the mine dewatering phase (news release dated July 18, 2023);

- Two single drum

winders for the shaft re-access delivered to site by early November

2023 with their installation underway;

- Remedial work

underway on the south headframe above NCK shaft and the winder

building in readiness for the installation of the main winder;

- Work on the

Feasibility Study continues and is well underway, and

-

Commencement of follow-up exploration drill program at the Wide

Formation target in the Carn Brea exploration area (news release

dated September 19, 2023).

Richard Williams, CEO of Cornish Metals,

stated, “Looking back on 2023, I want to commend the

Cornish Metals team for the outstanding progress that has been

achieved at South Crofty with some very important milestones being

met, in particular, the commissioning of the water treatment plant

and the subsequent commencement of mine dewatering that is tracking

ahead of expectations. This progress would not have been achieved

without the support of suppliers, the community and other local

stakeholders.

Looking ahead to 2024, we can look forward to

another busy year. The continuation of dewatering at deeper levels

will allow access to the mine for the first time in over 25 years.

We remain focussed on our objective to complete the dewatering of

South Crofty within 18 months from commencement.

The expected completion of the Feasibility Study

will move South Crofty a stage further towards a construction

decision. I also look forward to reporting on the results of the

drill program at the Wide Formation which, if successful, will

benefit the economics of South Crofty with the potential to

increase production and extend the mine life.

The financial position of the Company remains

healthy and we appreciate the continuing support and advice from

our major shareholder, Vision Blue Resources.”

Financial highlights for the nine months

ended October 31, 2023 and October 31, 2022

|

|

Nine months ended (unaudited) |

|

|

October 31, 2023 |

|

October 31, 2022 |

|

|

(Expressed in Canadian dollars) |

|

|

|

Total operating expenses |

$3,281,200 |

|

$2,616,299 |

|

|

Loss for the period |

$1,571,831 |

|

$3,557,556 |

|

|

Net cash (used in) operating activities |

$(1,761,034) |

|

$(3,047,818) |

|

|

Net cash (used in) investing activities |

$(23,335,112) |

|

$(5,760,776) |

|

|

Net cash provided by (used in) financing activities |

$(723) |

|

$61,456,627 |

|

|

Cash at end of the period |

$31,579,386 |

|

$57,840,129 |

|

- Increase in

operating costs impacted by higher insurance costs attributable to

more site-based activities primarily relating to the construction

of the WTP and related dewatering work;

- Interest income

of $1.5 million arising from increased interest rates being

received on higher cash balance following the Offering;

- Expenditure of

$12.4 million incurred during the period on the construction of the

WTP and related dewatering equipment, as well as new or replacement

equipment for the mine;

- Other project

related costs of $8.4 million incurred during the period relating

to the advancement of South Crofty to a potential construction

decision, primarily for the metallurgical drill program and

planning activities for dewatering and shaft re-access;

- Costs of $0.8

million incurred for the continuation of the exploration program at

Carn Brea which re-commenced in June 2023; and

- Recognition of

foreign currency translation gain of $1.6 million for those assets

located in the UK when translated into Canadian dollars for

presentational purposes.

Outlook

As described above, the proceeds raised from the

Offering completed in May 2022 are being used to advance the South

Crofty tin project to a potential construction decision within 30

months from closing of the Offering.

Within 30 months from the closing of the

Offering, the Company’s objectives are as follows:

- Commence

dewatering of the mine and thereafter complete the dewatering of

the mine within 18 months;

- Complete a

Feasibility Study using all reasonable commercial efforts; and

- Commence basic

and detailed engineering studies, construction of the processing

plant, refurbishment of underground facilities and other on-site

early works.

The follow up exploration drill program at the

Wide Formation target at Carn Brea South will also continue subject

to the receipt of satisfactory drill results.

Subject to the availability of financing,

consideration will also be given to continuing with the Company’s

exploration program at United Downs and evaluating other high

potential, exploration targets within transport distance of the

planned processing plant site at South Crofty.

ABOUT CORNISH METALS

Cornish Metals is a dual-listed company (AIM and

TSX-V: CUSN) focused on advancing the South Crofty high-grade,

underground tin Project through to a construction decision, as well

as exploring its additional mineral rights, all located in

Cornwall, United Kingdom.

- South Crofty is

a historical, high-grade, underground tin mine that started

production in 1592 and continued operating until 1998 following

over 400 years of continuous production;

- The Project

possesses Planning Permission for underground mining (valid to

2071), to construct new processing facilities and all necessary

site infrastructure, and an Environmental Permit to dewater the

mine;

- South Crofty has

the 4th highest grade tin Mineral Resource globally and benefits

from existing mine infrastructure including multiple shafts that

can be used for future operations;

- Tin is a

Critical Mineral as defined by the UK, USA, and Canadian

governments, with approximately two-thirds of the tin mined today

coming from China, Myanmar and Indonesia;

- There is no

primary tin production in Europe or North America;

- Tin is an

enabler of the energy transition – responsible sourcing of critical

minerals and security of supply are key factors in the energy

transition and technology growth;

- South Crofty

benefits from strong local community and regional and national

government support.

- Cornish Metals

has a growing team of skilled people, local to Cornwall, and the

Project could generate 250 – 300 direct jobs.

An updated Mineral Resource was completed in

September 2023 with a 39% increase in tonnes and 32% increase in

contained tin in the Indicated category for the Lower Mine (see

news release dated September 13, 2023) as summarised below:

|

South Crofty Summary (JORC 2012) Mineral Resource

Estimate |

|

Area |

Classification |

Mass(kt) |

Grade |

Contained Tin /Tin

Equivalent(kt) |

|

Lower Mine |

Indicated |

2,896 |

1.50% Sn |

43.6 |

|

Inferred |

2,626 |

1.42% Sn |

37.4 |

|

Upper Mine |

Indicated |

260 |

0.99% SnEq |

2.6 |

|

Inferred |

465 |

0.91% SnEq |

4.2 |

The Mineral Resource Estimate for South Crofty

is available in a report titled “South Crofty Tin Project - Mineral

Resource Update NI 43-101 Technical Report”, dated October 27,

2023, co-authored by Mr. N. Szebor (MCSM, MSc, BSc, CGeol, EurGeol,

FGS) and Mr. R. Chesher (FAusIMM(CP), RPEQ, MTMS) of AMC

Consultants, and can be accessed through the above link and on the

Company’s SEDAR+ page.

TECHNICAL INFORMATION

The technical information in this news release

has been compiled by Mr. Owen Mihalop. Mr. Mihalop has reviewed and

takes responsibility for the data and geological interpretation.

Mr. Owen Mihalop (MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng) is Chief

Operating Officer for Cornish Metals Inc. and has sufficient

experience relevant to the style of mineralization and type of

deposit under consideration and to the activity which he is

undertaking to qualify as a Competent Person as defined under the

JORC Code (2012) and as a Qualified Person under NI 43-101. Mr.

Mihalop consents to the inclusion in this announcement of the

matters based on his information in the form and context in which

it appears.

ON BEHALF OF THE BOARD OF

DIRECTORS

“Richard D. Williams”Richard D. Williams,

P.Geo

For additional information please contact:

|

Cornish Metals |

Fawzi HananoIrene Dorsman |

investors@cornishmetals.cominfo@cornishmetals.com |

|

|

|

Tel: +1 (604) 200 6664 |

|

SP Angel Corporate Finance LLP(Nominated Adviser

& Joint Broker) |

Richard MorrisonCharlie BouveratGrant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

|

|

|

|

Hannam & Partners(Joint Broker) |

Matthew HassonAndrew ChubbJay Ashfield |

cornish@hannam.partnersTel: +44

207 907 8500 |

|

|

|

|

|

|

|

|

|

BlytheRay(Financial PR) |

Tim BlytheMegan Ray |

tim.blythe@blytheray.commegan.ray@blytheray.comTel: +44 207 138

3204 |

|

|

|

|

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Caution regarding forward looking

statements

This news release contains "forward-looking

statements" including, but not limited to, statements in connection

with the expected use of proceeds of the Offering, including in

respect of certain work programs, expected construction, including

in respect of the WTP, and the potential completion of a

Feasibility Study on the South Crofty mine and the timing thereof,

the exploration program at United Downs and other exploration

opportunities surrounding the South Crofty tin project, expected

recruitment of various personnel, and expectations respecting tin

pricing and other economic factors. Forward-looking statements,

while based on management’s best estimates and assumptions at the

time such statements are made, are subject to risks and

uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to receipt

of regulatory approvals, risks related to general economic and

market conditions; risks related to the COVID-19 global pandemic

and any variants of COVID-19 which may arise; risks related to the

availability of financing when required and on terms acceptable to

the Company and the potential consequences if the Company fails to

obtain any such financing, such as a potential disruption of the

Company’s exploration program(s); the timing and content of

upcoming work programs; actual results of proposed exploration

activities; possible variations in Mineral Resources or grade;

failure of plant, equipment or processes to operate as anticipated;

accidents, labour disputes, title disputes, claims and limitations

on insurance coverage and other risks of the mining industry;

changes in national and local government regulation of mining

operations, tax rules and regulations.

Although Cornish Metals has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements, there may be other factors that cause results not to be

as anticipated, estimated or intended. There can be no assurance

that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. Cornish Metals undertakes

no obligation or responsibility to update forward-looking

statements, except as required by law.

Market Abuse Regulation (MAR)

Disclosure

The information contained within this

announcement is deemed by the Company to constitute inside

information pursuant to Article 7 of EU Regulation 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 as amended.

| CONSOLIDATED

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITION |

| |

| (Unaudited) |

| (Expressed in

Canadian dollars) |

|

|

|

|

October 31, 2023 |

|

January 31, 2023 |

|

| |

|

|

| ASSETS |

|

|

| Current |

|

|

|

Cash |

$ |

31,579,386 |

|

$ |

55,495,232 |

|

|

Marketable securities |

|

2,636,751 |

|

|

2,718,936 |

|

|

Receivables |

|

1,004,604 |

|

|

656,407 |

|

|

Prepaid expenses |

|

314,331 |

|

|

371,977 |

|

| |

|

35,535,072 |

|

|

59,242,552 |

|

| |

|

|

| Deposits |

|

84,600 |

|

|

54,165 |

|

| Property, plant and

equipment |

|

22,209,962 |

|

|

9,721,352 |

|

| Exploration and

evaluation assets |

|

44,966,254 |

|

|

33,088,129 |

|

| |

|

|

|

|

$ |

102,795,888 |

|

$ |

102,106,198 |

|

|

|

|

|

| |

|

|

| LIABILITIES |

|

|

| |

|

|

| Current |

|

|

|

Accounts payable and accrued liabilities |

$ |

2,573,144 |

|

$ |

2,494,642 |

|

|

Lease liability |

|

- |

|

|

642 |

|

| |

|

2,573,144 |

|

|

2,495,284 |

|

| NSR

liability |

|

9,506,886 |

|

|

9,149,804 |

|

| |

|

12,080,030 |

|

|

11,645,088 |

|

| SHAREHOLDERS’

EQUITY |

|

|

|

Capital stock |

|

128,394,652 |

|

|

128,377,152 |

|

|

Share subscriptions received in advance |

|

- |

|

|

17,500 |

|

|

Capital contribution |

|

2,007,665 |

|

|

2,007,665 |

|

|

Share-based payment reserve |

|

592,272 |

|

|

384,758 |

|

|

Foreign currency translation reserve |

|

970,103 |

|

|

(648,962 |

) |

|

Deficit |

|

(41,248,834 |

) |

|

(39,677,003 |

) |

| |

|

|

| |

|

90,715,858 |

|

|

90,461,110 |

|

| |

|

|

|

|

$ |

102,795,888 |

|

$ |

102,106,198 |

|

|

CONSOLIDATED CONDENSED INTERIM STATEMENTS OF LOSS AND

COMPREHENSIVE LOSS |

|

|

|

(Unaudited) |

|

(Expressed in Canadian dollars) |

|

|

|

|

|

Nine months ended |

|

|

|

October 31, 2023 |

|

October 31, 2022 |

|

|

|

|

|

|

|

EXPENSES |

|

|

|

|

Travel and marketing |

|

$ |

488,797 |

|

$ |

399,321 |

|

|

Depreciation |

|

|

- |

|

|

443 |

|

|

Insurance |

|

|

511,899 |

|

|

99,295 |

|

|

Office, miscellaneous and rent |

|

|

148,925 |

|

|

74,615 |

|

|

Professional fees |

|

|

794,167 |

|

|

500,737 |

|

|

Generative exploration expense |

|

|

5,433 |

|

|

96,108 |

|

|

Regulatory and filing fees |

|

|

73,171 |

|

|

144,468 |

|

|

Share-based compensation |

|

|

130,136 |

|

|

- |

|

|

Salaries, directors’ fees and benefits |

|

|

1,128,672 |

|

|

1,301,312 |

|

|

|

|

|

|

|

Total operating expenses |

|

|

(3,281,200 |

) |

|

(2,616,299 |

) |

|

|

|

|

|

|

Interest income |

|

|

1,456,697 |

|

|

136,216 |

|

|

Foreign exchange gain (loss) |

|

|

394,980 |

|

|

(1,907,824 |

) |

|

Gain on the disposal of royalty |

|

|

- |

|

|

318,147 |

|

|

Unrealized gain (loss) on marketable securities |

|

|

(147,296 |

) |

|

512,204 |

|

|

|

|

|

|

|

Loss before income taxes |

|

|

(1,576,819 |

) |

|

(3,557,556 |

) |

|

Income tax recovery |

|

|

4,988 |

|

|

- |

|

|

Loss for the period |

|

|

(1,571,831 |

) |

|

(3,557,556 |

) |

|

|

|

|

|

|

Foreign currency translation |

|

|

1,619,065 |

|

|

(2,365,115 |

) |

|

Total comprehensive income (loss) for the

period |

|

$ |

47,234 |

|

$ |

(5,922,671 |

) |

|

|

|

|

|

|

Basic and diluted income (loss) per share |

|

$ |

0.00 |

|

$ |

(0.01 |

) |

|

|

|

|

|

|

Weighted average number of common shares

outstanding: |

|

|

535,268,881 |

|

|

430,111,396 |

|

|

CONSOLIDATED CONDENSED INTERIM STATEMENTS OF CASH

FLOWS |

|

|

|

(Unaudited) |

|

(Expressed in Canadian dollars) |

|

|

|

|

For the Nine months ended |

|

|

October 31, 2023 |

|

October 31, 2022 |

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

Loss for the period |

$ |

(1,571,831 |

) |

$ |

(3,557,556 |

) |

|

Items not involving cash: |

|

|

|

Depreciation |

|

- |

|

|

443 |

|

|

Share-based compensation |

|

130,136 |

|

|

- |

|

|

Gain on the disposal of royalty |

|

- |

|

|

(318,147 |

) |

|

Unrealized loss (gain) on marketable securities |

|

147,296 |

|

|

(512,204 |

) |

|

Foreign exchange loss (gain) |

|

(394,980 |

) |

|

1,907,824 |

|

|

Income tax recovery |

|

(4,988 |

) |

|

- |

|

|

|

|

|

|

Income taxes paid |

|

(11,012 |

) |

|

- |

|

|

|

|

|

|

Changes in non-cash working capital items: |

|

|

|

Increase in receivables |

|

(348,196 |

) |

|

(565,408 |

) |

|

Decrease in prepaid expenses |

|

105,201 |

|

|

69,395 |

|

|

Increase (decrease) in accounts payable and accrued

liabilities |

|

187,340 |

|

|

(72,165 |

) |

|

|

|

|

|

Net cash used in operating activities |

|

(1,761,034 |

) |

|

(3,047,818 |

) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

Acquisition of property, plant and equipment |

(11,817,289 |

) |

(1,569,968 |

) |

|

Acquisition of exploration and evaluation assets |

(11,489,073 |

) |

(4,181,597 |

) |

|

Increase in deposits |

(28,750 |

) |

(9,211 |

) |

|

|

|

|

|

Net cash used in investing activities |

|

(23,335,112 |

) |

|

(5,760,776 |

) |

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

Proceeds from the Offering |

|

- |

|

|

65,135,746 |

|

|

Proceeds from option and warrant exercises |

|

- |

|

|

227,000 |

|

|

Share issue costs |

|

- |

|

|

(3,966,076 |

) |

|

Proceeds from the disposal of royalty |

|

- |

|

|

63,147 |

|

|

Lease payments |

|

(723 |

) |

|

(3,190 |

) |

|

|

|

|

|

Net cash provided by (used in) financing activities |

|

(723 |

) |

|

61,456,627 |

|

|

|

|

|

|

Impact of foreign exchange on cash |

|

1,181,023 |

|

|

(1,730,608 |

) |

|

|

|

|

|

Change in cash during the period |

|

(23,915,846 |

) |

|

50,917,425 |

|

|

Cash, beginning of the period |

|

55,495,232 |

|

|

6,922,704 |

|

| |

|

|

|

Cash, end of the period |

$ |

31,579,386 |

|

$ |

57,840,129 |

|

|

|

|

|

|

Cash paid during the period for interest |

$ |

- |

|

$ |

- |

|

|

|

|

|

|

Cash paid during the period for income taxes |

$ |

11,012 |

|

$ |

- |

|

CONSOLIDATED CONDENSED INTERIM

STATEMENTS OF CHANGES IN SHAREHOLDERS’

EQUITY

(Unaudited) (Expressed in Canadian dollars)

|

|

|

Share |

|

|

Foreign |

|

|

| |

Capital stock |

subscriptions |

|

Share-based |

currency |

|

|

| |

Number of |

|

received in |

Capital |

payment |

translation |

|

Shareholders’ |

|

|

shares |

Amount |

advance |

contribution |

reserve |

reserve |

Deficit |

equity – total |

|

Balance at January 31, 2022 |

285,850,157 |

$ |

56,846,350 |

|

$ |

- |

|

$ |

2,007,665 |

$ |

630,265 |

$ |

(174,123) |

|

$ |

(38,599,036) |

|

$ |

20,711,121 |

|

|

Share issuance pursuant to the Offering |

225,000,000 |

|

65,135,746 |

|

|

- |

|

|

- |

|

- |

|

- |

|

|

- |

|

|

65,135,746 |

|

|

Share issue costs |

- |

|

(3,966,076) |

|

|

- |

|

|

- |

|

- |

|

- |

|

|

- |

|

|

(3,966,076) |

|

|

Warrant exercises |

900,000 |

|

87,000 |

|

|

25,000 |

|

|

- |

|

- |

|

- |

|

|

- |

|

|

112,000 |

|

|

Option exercises |

575,000 |

|

115,000 |

|

|

- |

|

|

- |

|

- |

|

- |

|

|

- |

|

|

115,000 |

|

|

Shares issued pursuant to property option agreement |

20,298,333 |

|

9,844,692 |

|

|

- |

|

|

- |

|

- |

|

- |

|

|

- |

|

|

9,844,692 |

|

|

Foreign currency translation |

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

(2,365,115) |

|

|

- |

|

|

(2,365,115) |

|

|

Loss for the period |

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

- |

|

|

(3,557,556) |

|

|

(3,557,556) |

|

|

Balance at October 31, 2022 |

532,623,490 |

$ |

128,062,712 |

|

$ |

25,000 |

|

$ |

2,007,665 |

$ |

630,265 |

$ |

(2,539,238) |

|

$ |

(42,156,592) |

|

$ |

86,029,812 |

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 31, 2023 |

535,020,712 |

$ |

128,377,152 |

|

$ |

17,500 |

|

$ |

2,007,665 |

$ |

384,758 |

$ |

(648,962) |

|

$ |

(39,677,003) |

|

$ |

90,461,110 |

|

|

Warrant exercises |

250,000 |

|

17,500 |

|

|

(17,500) |

|

|

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

|

Foreign currency translation |

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

1,619,065 |

|

|

- |

|

|

1,619,065 |

|

|

Share-based compensation |

- |

|

- |

|

|

- |

|

|

- |

|

207,514 |

|

- |

|

|

- |

|

|

207,514 |

|

|

Loss for the period |

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

- |

|

|

(1,571,831) |

|

|

(1,571,831) |

|

|

Balance at October 31, 2023 |

535,270,712 |

$ |

128,394,652 |

|

$ |

- |

|

$ |

2,007,665 |

$ |

592,272 |

$ |

970,103 |

|

$ |

(41,248,834) |

|

$ |

90,715,858 |

|

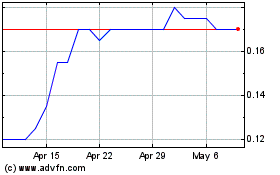

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Mar 2024 to Mar 2025