Cornish Metals Closes First Tranche of Fundraising

08 February 2025 - 5:00AM

Cornish Metals Inc. (

AIM/TSX-V:

CUSN) (“Cornish Metals” or the “Company”), a mineral

exploration and development company focused on advancing its 100%

owned and permitted South Crofty tin project in Cornwall, United

Kingdom, is pleased to announce that it has closed the first

tranche of the Fundraising previously announced on January 28, 2025

(the “Launch Announcement”). Proceeds of the Fundraising will be

principally used to ensure that the Company can continue with its

path to development through completing the shaft refurbishment and

de-watering process, the start of early project works, ordering

long lead items and completion of the project finance process and

up to the point of the formal final investment decision at its

South Crofty Tin Mine. Capitalised terms in this announcement have

the same meaning as in the Launch Announcement unless otherwise

indicated.

On February 7, 2025, Cornish Metals issued a

total of 133,817,678 common shares, comprising: 97,742,899 First

Tranche Placing Shares; 34,722,222 First Tranche VBR Subscription

Shares; and 1,352,557 First Tranche Director Subscription Shares,

raising gross proceeds of £10,705,414 (approximately C$19,133,787).

In connection with closing of the first tranche of the Fundraising,

total commission payable to the Placing Agents in respect of the

First Tranche Placing Shares is £390,972 (approximately C$698,784).

All C$ equivalents of the amounts referred to in this announcement

have been calculated using the Bank of Canada's closing exchange

rate for January 24, 2025 of C$1.7873/£1.

For further details of the Fundraising, please

refer to: (i) the Launch Announcement; (ii) the news release dated

January 28, 2025 (Titled: “Result of Fundraising”); and (iii) the

news release dated January 31, 2025 (Titled: “Results of Retail

Offer”), copies of which are available on the Company’s profile on

SEDAR+ at www.sedarplus.ca.

Participation by the Participating Directors

constitutes a “related party transaction” within the meaning of

Policy 5.9 of the rules and policies of the TSX-V and Multilateral

Instrument 61-101 — Protection of Minority Security Holders in

Special Transactions (“MI 61-101”). Vision Blue Resources is also

deemed to be a “related party” of the Company pursuant to MI 61-101

given that it holds more than 10% of the Company’s issued share

capital. The “related party transaction” requirements under Policy

5.9 of the TSX-V and MI 61-101 do not apply to the Participation

Right, since the subscription by Vision Blue of the VBR

Participation Right Shares satisfies the exclusion from such

requirements under Section 5.1(h)(iii) of MI 61-101. In connection

with the Director Participations, the Company is relying on: (i)

the exemption from the formal valuation requirement in section

5.5(b) of MI 61-101 as a result of the Common Shares only being

listed on the TSX-V and being admitted for trading on AIM; and (ii)

the exemption from the minority approval requirement in section

5.7(1)(a) of MI 61-101 as neither the fair market value of the

Common Shares to be distributed to, nor the fair market value of

the consideration to be received from, insofar as it involves

interested parties (being, Vision Blue in respect of the Additional

VBR Subscription and the Director Participations), exceeds 25% of

the Company’s market capitalization.

In accordance with applicable Canadian

securities legislation, the First Tranche Placing Shares, the First

Tranche VBR Subscription Shares and the First Tranche Director

Subscription Shares will be subject to a hold period of four months

which expires on June 8, 2025, such hold period will only apply to

trades (as defined under applicable Canadian securities

legislation) of such shares in Canada or through a market in

Canada, such as the TSX-V.

ON BEHALF OF THE BOARD OF

DIRECTORS

“Don Turvey”Don Turvey

For additional information please contact:

|

Cornish Metals |

|

Fawzi HananoIrene Dorsman |

investors@cornishmetals.com info@cornishmetals.com |

|

|

|

|

Tel: +1 (604) 200 6664 |

|

|

|

|

|

|

SP Angel Corporate Finance LLP (Nominated Adviser,

Joint Bookrunner & Joint

Broker) |

|

Richard Morrison Charlie Bouverat Grant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

|

Hannam & Partners(Joint Bookrunner and

Financial

Adviser) |

|

Matthew HassonAndrew Chubb Jay Ashfield |

cornish@hannam.partners Tel: +44

207 907 8500 |

|

|

|

|

|

|

Canaccord Genuity limited(Co-Manager) |

|

James AsensioCharlie HammondSam Lucas |

Tel: +44 207 523 8000 |

|

|

|

|

|

|

Cavendish Capital Markets Limited(Joint

Broker) |

|

Derrick LeeNeil McDonaldLeif Powis |

Tel: +44 131 220 6939Tel: +44 207 220 0500 |

|

|

|

|

|

|

BlytheRay(Financial PR) |

|

Tim Blythe Megan Ray |

tim.blythe@blytheray.com megan.ray@blytheray.comTel: +44 207 138

3204 |

|

|

|

|

|

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

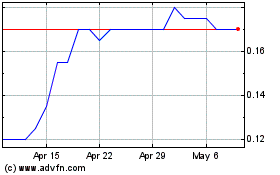

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Mar 2024 to Mar 2025