Cornish Metals Inc. (

AIM/TSX-V:

CUSN) (“Cornish Metals” or the “Company”), is pleased to

report that it has filed a technical report pursuant to National

Instrument 43-101 – Standards for Disclosure for Mineral Projects

(“NI 43-101”) for its 100% owned and permitted South Crofty tin

project in Cornwall, United Kingdom under Cornish Metals’ profile

on Sedar+ (www.sedarplus.com). The Company’s news release dated

April 30, 2024 summarises the positive results of the Preliminary

Economic Assessment (“PEA”).

The technical report, titled “South Crofty PEA”

(the “Technical Report”) was prepared by AMC Consultants (UK)

Limited on behalf of Cornish Metals. The Qualified Persons (“QPs”)

for the PEA are Mr Nicholas Szebor, MCSM, CGeol, EurGeol, FGS,

Regional Manager (UK) and Principal Geologist (AMC); Mr Dominic

Claridge, FAusIMM, Principal Mining Engineer (AMC); Ms Angela

Collins, Dip BA MRTPI, Principal Planner (SLR); Mr Barry Balding,

P.Geo., EurGeol, Technical Director – Mining Advisory Europe (SLR);

Mr Steve Wilson, ACSM, C.Eng., FIMMM, Managing Director: Europe

(P&C); Mr Mike Hallewell, FIMMM, FSAIMM, FMES, C.Eng.

(Independent Consultant); and Dr Barrie O’Connell, ACSM, FIMMM,

C.Eng. (Independent Consultant). QPs under NI 43-101 and Competent

Persons as defined under the JORC Code (2012).

ABOUT CORNISH METALS

Cornish Metals is a dual-listed mineral

exploration and development company (AIM and TSX-V: CUSN) focused

on advancing the South Crofty high-grade, underground tin project

through to a construction decision, as well as exploring its

additional mineral rights, located in Cornwall, United Kingdom.

- South Crofty is

a historical, high-grade, underground tin mine that started

production in 1592 and continued operating until 1998 following

over 400 years of continuous production;

- The Project

possesses Planning Permission for underground mining (valid to

2071), to construct new processing facilities and all necessary

site infrastructure, and an Environmental Permit to dewater the

mine;

- South Crofty has

one of the highest grade tin Mineral Resources globally and

benefits from existing mine infrastructure including multiple

shafts that can be used for future operations;

- The 2024

Preliminary Economic Assessment for South Crofty validates the

Project’s potential (see news release dated April 30, 2024):

- US$201 million

after-tax NPV8% and 29.8% IRR

- 3-year after-tax

payback

- 4,700 tonnes

average annual tin production in years two through six

- Life of mine

all-in sustaining cost of US$13,660 /tonne of payable tin

- Total after-tax

cash flow of US$626 million from start of production

- Tin is a

Critical Mineral as defined by the UK, American, and Canadian

governments;

- Approximately

two-thirds of the tin mined today comes from China, Myanmar and

Indonesia;

- There is no

primary tin production in Europe or North America;

- Tin connects

almost all electronic and electrical infrastructure, making it

critical to the energy transition – responsible sourcing of

critical minerals and security of supply are key factors in the

energy transition and technology growth;

- South Crofty

benefits from strong local community, regional and national

government support.

- Cornish Metals

has a growing team of skilled people, local to Cornwall, and the

Project could generate up to 320 direct jobs.

TECHNICAL INFORMATION

This news release has been reviewed and approved

by Mr Owen Mihalop, MCSM, BSc (Hons), MSc, FGS, MIMMM, CEng, Chief

Operating Officer for Cornish Metals Inc. who is the designated

Qualified Person under NI 43-101 and a Competent Person as defined

under the JORC Code (2012). Mr. Mihalop consents to the inclusion

in this announcement of the matters based on his information in the

form and context in which it appears.

ON BEHALF OF THE BOARD OF

DIRECTORS

“Kenneth A. Armstrong”Kenneth A. Armstrong

P.Geo.

Engage with us directly at our investor hub.

Sign up at: https://investors.cornishmetals.com/link/KyzDLr

For additional information please contact:

|

Cornish Metals |

Fawzi HananoIrene Dorsman |

investors@cornishmetals.com info@cornishmetals.com |

|

|

|

Tel: +1 (604) 200 6664 |

|

|

|

|

|

SP Angel Corporate Finance LLP (Nominated Adviser

& Joint

Broker) |

Richard Morrison Charlie Bouverat Grant Barker |

Tel: +44 203 470 0470 |

|

|

|

|

|

Cavendish Capital Markets Limited |

Derrick Lee |

Tel: +44 131 220 6939 |

|

(Joint Broker) |

Neil McDonald |

|

|

|

Leif Powis |

Tel: +44 207 220 0500 |

|

|

|

|

|

Hannam & Partners(Financial

Adviser) |

Matthew HassonAndrew Chubb Jay Ashfield |

cornish@hannam.partners Tel: +44

207 907 8500 |

|

|

|

|

|

BlytheRay(Financial PR) |

Tim Blythe Megan Ray |

tim.blythe@blytheray.com megan.ray@blytheray.comTel: +44 207 138

3204 |

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Caution regarding forward looking

statements

This news release contains certain

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”). Forward-looking

statements include predictions, projections, outlook, guidance,

estimates and forecasts and other statements regarding future

plans, the realisation, cost, timing and extent of mineral resource

or mineral reserve estimates, estimation of commodity prices,

currency exchange rate fluctuations, estimated future exploration

expenditures, costs and timing of the development of new deposits,

success of exploration activities, permitting time lines,

requirements for additional capital and the Company’s ability to

obtain financing when required and on terms acceptable to the

Company, future or estimated mine life and other activities or

achievements of Cornish Metals, including but not limited to:

mineralisation at South Crofty, mine dewatering and NCK Shaft

refurbishment expectations; the development, operational and

economic results of the PEA, including cash flows, capital

expenditures, development costs, extraction rates, recovery rates,

mining cost estimates; estimation of mineral resources; statements

about the estimate of mineral resources; magnitude or quality of

mineral deposits; anticipated advancement of the South Crofty

project mine plan; future operations; the completion and timing of

future development studies; anticipated advancement of mineral

properties or programmes; Cornish Metals’ exploration drilling

programme, exploration potential and project growth opportunities

for the South Crofty tin project and other Cornwall mineral

properties and the timing thereof, timing and results of Cornish

Metals’ feasibility study, the Company’s ability to evaluate and

develop the South Crofty tin project and other Cornwall mineral

properties, strategic vision of Cornish Metals and expectations

regarding the South Crofty mine, timing and results of projects

mentioned. Forward-looking statements are often, but not always,

identified by the use of words such as “seek”, “anticipate”,

“believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”,

“project”, “target”, “schedule”, “budget” and “intend” and

statements that an event or result “may”, “will”, “should”,

“could”, “would” or “might” occur or be achieved and other similar

expressions and includes the negatives thereof. All statements

other than statements of historical fact included in this news

release, are forward-looking statements that involve various risks

and uncertainties and there can be no assurance that such

statements will prove to be accurate and actual results and future

events could differ materially from those anticipated in such

statements.

Forward-looking statements are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to receipt

of regulatory approvals, risks related to general economic and

market conditions; risks related to the availability of financing;

the timing and content of upcoming work programmes; actual results

of proposed exploration activities; possible variations in Mineral

Resources or grade; outcome of the current Feasibility Study;

projected dates to commence mining operations; failure of plant,

equipment or processes to operate as anticipated; accidents, labour

disputes, title disputes, claims and limitations on insurance

coverage and other risks of the mining industry; changes in

national and local government regulation of mining operations, tax

rules and regulations. The list is not exhaustive of the factors

that may affect Cornish’s forward-looking statements.

Cornish Metals’ forward-looking statements are

based on the opinions and estimates of management and reflect their

current expectations regarding future events and operating

performance and speak only as of the date such statements are made.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ from

those described in forward- looking statements, there may be other

factors that cause such actions, events or results to differ

materially from those anticipated. There can be no assurance that

forward-looking statements will prove to be accurate and

accordingly readers are cautioned not to place undue reliance on

forward-looking statements. Accordingly, readers should not place

undue reliance on forward-looking statements. Cornish Metals does

not assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable law.

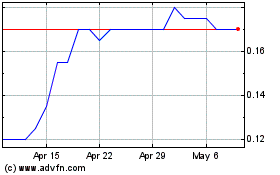

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Cornish Metals (TSXV:CUSN)

Historical Stock Chart

From Mar 2024 to Mar 2025