ATHABASCA OIL SANDS CORP. ANNOUNCES AGREEMENT TO ACQUIRE EXCELSIOR ENERGY LIMITED

14 September 2010 - 12:14AM

PR Newswire (Canada)

CALGARY, Sept. 13 /CNW/ -- /NOT FOR DISTRIBUTION TO UNITED STATES

NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES/

CALGARY, Sept. 13 /CNW/ - Athabasca Oil Sands Corp. (TSX: ATH)

(AOSC) and Excelsior Energy Limited (Excelsior) (TSXV: ELE) are

pleased to announce they have entered into an arrangement agreement

whereby AOSC will acquire all of the issued and outstanding common

shares ("Excelsior Shares") of Excelsior (the "Transaction") by way

of Plan of Arrangement under the Business Corporations Act

(Alberta). Under the Transaction, Excelsior's shareholders will

receive, for each Excelsior Share held, at the election of the

holder, either (i) $0.36 cash; or (ii) 0.0347 of a common share of

AOSC ("AOSC Shares"). Holders of Excelsior common share purchase

warrants ("Excelsior Warrants") who do not exercise their Excelsior

Warrants prior to closing of the Transaction will exchange their

Excelsior Warrants for warrants to purchase AOSC Shares based on

the same ratio applied to the Excelsior Shares, and expiring on the

second anniversary of the closing of the Transaction. Excelsior

currently has 281,175,755 Excelsior Shares outstanding and

104,165,666 Excelsior Warrants outstanding at exercise prices

ranging from $0.30 to $0.32 per Excelsior Share. The equity value

of the transaction is approximately $144 million on a fully diluted

basis, with an attributed value to Excelsior's oil sands assets and

proprietary technology of approximately $89 million. The Boards of

Directors of both AOSC and Excelsior have unanimously approved the

Transaction. All of the directors and officers of Excelsior, and

certain significant Excelsior security holders beneficially owning

or controlling an aggregate of approximately 19% of the Excelsior

Shares on a non-diluted basis, and 44% of the Excelsior Warrants,

have agreed to vote their securities in favour of the Transaction.

Sveinung Svarte, president and CEO of AOSC says, "The addition of

Excelsior's high quality assets to those of AOSC at Hangingstone is

in line with the strategy we have presented to our investors and

creates a world-class, stand-alone project. The Transaction will

result in a project of critical size and an accelerated development

of the area. It also gives us ownership of their proprietary COGD

(Combustion Overhead Gravity Drainage) technology." Dr. David

Winter, president and CEO of Excelsior commented, "Our asset base,

centred around the Hangingstone property is a great fit with AOSC's

current high quality oil sands assets, which have tremendous upside

potential. We believe this Transaction provides for a more

efficient development of the consolidated Hangingstone project and

allows Excelsior's shareholders to benefit from the upside

potential in a strong, well financed oil sands focused company."

Highlights of the Transaction Through the Transaction, AOSC is

acquiring concentrated, high quality oil sands leases at

Hangingstone and West Surmont, and consolidating AOSC's current

acreage position in the Hangingstone area. The acquisition of

Excelsior is consistent with AOSC's strategy of amassing a suite of

large, critical sized assets which provide optimal long-term

development potential for AOSC. The key attributes of Excelsior

include: - Contingent resources of approximately 183 MMbbls (best

estimate) (1); - Net cash of approximately $25 million (prior to

exercise of any Excelsior stock options or Excelsior Warrants); -

Approximately 26,607 net undeveloped acres of land on two

contiguous blocks in the Hangingstone and West Surmont areas of the

Athabasca oil sands region; - Operatorship, with high working

interests of 75% at Hangingstone and 64.3% at West Surmont; and -

Patent for the Combustion Overhead Gravity Drainage (COGD)

proprietary technology; project approval for a 1,000 bbl/d

experimental pilot is expected in the latter half of 2010 with

subsequent implementation and commissioning in early 2011. (1)

Estimate of contingent resources as per the McDaniel &

Associates report as at December 31, 2009 for Hangingstone and the

McDaniel & Associates report as at December 31, 2008 for West

Surmont. Following the closing of the Transaction, AOSC will have

113,007 net undeveloped acres of land in the Hangingstone area. The

combined Hangingstone acreage allows for both potential independent

development by AOSC, as well as potential joint venture development

opportunities. Details of the Arrangement The Transaction will be

completed pursuant to a plan of arrangement which requires the

approval of at least two-thirds of the votes cast by Excelsior

securityholders at a special meeting to be called to consider the

Transaction along with customary regulatory, court and other

approvals. An Information Circular outlining the Transaction is

expected to be mailed to Excelsior security holders in early

October 2010, with the meeting anticipated to take place in early

November 2010, with closing to follow shortly thereafter. The

arrangement agreement provides that Excelsior will pay AOSC a

non-completion fee of $4 million in certain circumstances. The

arrangement agreement also provides for, among other things,

customary non-solicitation covenants and that AOSC has the right to

match any such superior proposal. Board Approvals The Boards of

Directors of both AOSC and Excelsior have unanimously approved the

Transaction. The Board of Directors of Excelsior has concluded that

the Transaction is in the best interests of Excelsior and its

security holders and has resolved to recommend that Excelsior

security holders vote their Excelsior Shares and Excelsior Warrants

in favour of the Arrangement. Financial Advisors GMP Securities

Limited and Peters & Co. Limited acted as exclusive financial

advisors to AOSC in respect of the Transaction. CIBC World Markets

Inc. and Raymond James Ltd. acted as exclusive financial advisors

to Excelsior in respect of the Transaction. CIBC World Markets Inc.

has provided an opinion to the Board of Directors of Excelsior to

the effect that, as of the date thereof and subject to the

assumptions, limitations and qualifications contained therein, the

consideration to be received by Excelsior Shareholders pursuant to

the Transaction is fair, from a financial point of view, to

Excelsior Shareholders. About AOSC AOSC is a dynamic, young company

formed to develop and produce bitumen in the Athabasca region of

northeastern Alberta. It was incorporated in 2006 with a goal to

use the latest technology to produce bitumen in a sound,

progressive and safe manner. AOSC Shares are listed on the Toronto

Stock Exchange under the trading symbol ATH. AOSC has a current

market capitalization of approximately $4 billion, net working

capital of more than $1.9 billion, as of June 30, 2010. About

Excelsior Excelsior is an early stage, oil sands company, with 58

operated sections on two contiguous blocks in the Hangingstone and

West Surmont areas of the Athabasca Oil Sands Region near Fort

McMurray, Alberta. The properties contain high-quality, bitumen

reservoirs. The company has also developed a proprietary in situ

combustion technology (Combustion Overhead Gravity Drainage or

COGD) which has potential to improve economic and environmental

impact in the development and recovery of heavy oil and bitumen.

Excelsior shares are listed on the TSX Venture Exchange under the

trading symbol ELE. Reader Advisory This News Release contains

forward-looking information that involves various risks,

uncertainties and other factors. All information other than

statements of historical fact is forward-looking information. The

use of any of the words "anticipate", "plan", "continue",

"estimate", "expect", "may", "will", "project", "should",

"believe", "predict", "pursue" and "potential" and similar

expressions are intended to identify forward-looking information.

Information in this News Release relating to "reserves" and

"resources" are deemed to be forward-looking information, as they

involve the implied assessment, based on certain estimates and

assumptions, that the reserves and resources described exist in the

quantities predicted or estimated, and that the reserves and

resources described can be profitably produced in the future. The

forward-looking information is not historical fact, but rather is

based on AOSC's and Excelsior's current plans, objectives, goals,

strategies, estimates, assumptions and projections about industry,

business and future financial results. This information involves

known and unknown risks, uncertainties and other factors that may

cause actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that these expectations will prove to be correct and such

forward-looking information should not be unduly relied upon. This

information speaks only as of the date of this News Release. In

particular, this News Release contains forward-looking information

pertaining to expectations of management regarding the proposed

Transaction, including the timing of completion of the Transaction

and the terms thereof, operating and financial metrics of the

Transaction, potential benefits resulting from the Transaction;

operational and business plans subsequent to the Transaction; and

the pro-forma effect of the Transaction on AOSC's resources and

undeveloped land position. With respect to such forward-looking

information, assumptions have been made regarding, among other

things: the completion of the Transaction on the terms and on the

schedule outlined above; ability to obtain qualified staff and

equipment in a timely and cost-efficient manner; the regulatory

framework governing royalties, taxes and environmental matters; the

applicability of technologies for the recovery and production of

reserves and resources; capital expenditures; sources of funding;

future debt levels; geological and engineering estimates in respect

of reserves and resources; and the geography of the companies'

operating areas. Actual results could differ materially from those

anticipated in this forward-looking information as a result of,

among other things, the following: the Transaction may not close

when planned or at all or on the terms and conditions set forth

herein; the failure of AOSC and Excelsior to obtain the necessary

security holder, Court, regulatory and other third party approvals

or satisfy the other conditions to proceed with the Transaction;

incorrect assessment of the value of the Transaction; failure to

realize the anticipated benefits of the Transaction; fluctuations

in commodity prices and foreign exchange and interest rates;

general economic, market and business conditions; dependence on

joint venture partners and the terms of joint venture arrangements;

variations in; factors affecting potential profitability;

uncertainties inherent in estimating quantities of reserves and

resources; uncertainties inherent in bitumen recovery processes;

delays in development schedules and potential cost overruns;

increases in operating costs making projects uneconomic; the effect

of diluent and natural gas supply constraints and increases in the

costs thereof; gas over bitumen issues; environmental risks and

hazards and the cost of compliance with environmental regulations;

failure to obtain or retain key personnel; substantial capital

requirements; failure to obtain regulatory approvals or maintain

compliance with regulatory requirements; compliance with,

government laws and regulations and the effect of changes in such

laws and regulations; changes to royalty regimes; political risks;

failure to accurately estimate abandonment and reclamation costs;

risks inherent in oil sands operations, including those related to

exploration, development and production of oil sands reserves and

resources, including the production of oil sands reserves and

resources using in-situ technologies; the potential for management

or third party estimates and assumptions to be inaccurate; long

term reliance on third parties and third party infrastructure;

failure by counterparties; availability of drilling equipment and

access to company assets; aboriginal claims; seasonality; hedging

risks; insurance risks; potential litigation; competition; failure

to meet specific requirements to maintain licenses or leases; risks

arising from future acquisition activities including failure to

realize the anticipated benefits of acquisitions. Readers are

cautioned that the foregoing list of factors is not exhaustive.

Additional information on these and other factors that could affect

the operations or financial results of AOSC or Excelsior, as well

as information respecting the significant assumptions relating to

AOSC's and Excelsior's reserves and resources, are included in

reports on file with applicable securities regulatory authorities

and may be accessed through the SEDAR website (www.sedar.com). The

forward-looking information in this News Release is expressly

qualified by this cautionary statement. Neither AOSC nor Excelsior

undertakes any obligation to publicly update or revise any

forward-looking information except as required by applicable

securities laws. This news release does not constitute an offer to

sell or the solicitation of an offer to buy any securities within

the United States. The securities to be offered have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, or any state securities laws, and may not be offered or

sold in the United States absent registration or an applicable

exemption from the registration requirements of such Act or other

laws. Neither the TSX Venture Exchange nor its Regulation Service

Provider (as such term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release. Athabasca Oil Sands Corp., Sveinung

Svarte, President and Chief Executive Officer, Tel: (403) 237-9349,

Email: ssvarte@aosc.com; or Heather Douglas, Vice President,

Communications & External Affairs, Tel: (403) 532-7408, Email:

hdouglas@aosc.com; Excelsior Energy Limited, Dr. David Winter,

President and Chief Executive Officer, Tel: (403) 537-1015, Email:

d.winter@excelsior-energy.com; Mary Kennedy, Vice President,

Finance & CFO, (403) 537-1015 (Ext 103), Email:

m.kennedy@excelsior-energy.com

Copyright

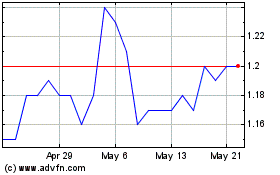

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Elemental Altus Royalties (TSXV:ELE)

Historical Stock Chart

From Jul 2023 to Jul 2024