Emgold Completes Acquisition and Expands its Buckskin Rawhide Gold Property, Nevada

07 February 2012 - 12:00AM

Marketwired Canada

Emgold Mining Corporation (TSX VENTURE:EMR)(OTCBB:EGMCF)(FRANKFURT:EML) (the

"Company" or "Emgold") is pleased to announce that it has signed a Lease and

Option to Purchase Agreement with Jeremy C. Wire to acquire the PC and RH

mineral claims, located 0.3 miles west of Emgold's existing Buckskin Rawhide

Property, in Mineral County, Nevada. The PC and RH claims (henceforth called

"Buckskin Rawhide West"), comprise 21 unpatented lode mining claims totaling 420

acres.

This acquisition expands Emgold's Buckskin Rawhide gold-silver property (the

"Property") to 73 unpatented mining claims totaling 1,460 acres. Forty-six of

these claims are under a lease and option to purchase agreement with Nevada

Sunrise, LLC and the remaining six claims were staked by Emgold. The Property

now consists of two non-contiguous claim blocks - Buckskin Rawhide and Buckskin

Rawhide West. These claim blocks are separated by claims owned by Pilot Gold

Corporation that are part of the adjacent Regent Property (see figure at

http://www.emgold.com/s/MapsBuckskin.asp?ReportID=504362).

The Buckskin Rawhide Property is located approximately 40 miles southeast of

Fallon in the Rawhide Mining District. It is adjacent to the Rawhide Mine

operated by Rawhide Mining Company. The Rawhide Mine, formerly operated by

Kennecott Minerals, is reported by Kennecott to have produced 1.47 million

ounces of gold and 11.7 million ounces of silver from the years 1988 to 2005.

The location of the Buckskin Rawhide Property in the vicinity of Rawhide Mine

does not mean that a resource will be identified on the Buckskin Rawhide

Property, but the presence of mineralized structures on the Buckskin Rawhide,

Regent, and Rawhide properties and historic mine workings in the area indicate

the potential for discovery.

Both the Buckskin Rawhide and Buckskin Rawhide West areas have volcanic-hosted

epithermal gold-silver targets with geology similar to the nearby Rawhide Mine.

The limited exploration done on the Buckskin Rawhide West property includes

geologic mapping and soil and rock sampling. Potential exists for discovery of

high grade veins and low grade bulk disseminated gold targets on the Property

through further exploration.

President and CEO of Emgold, David Watkinson, stated, "This is a strategic

acquisition by Emgold, given our continuing exploration success at Buckskin

Rawhide. The Buckskin Rawhide Property has potential for development as a

stand-alone property or for synergistic development with adjacent properties,

including one of which is the Rawhide Mine. We look forward to continuing

exploration on the property with the ultimate goal of developing an NI 43-101

compliant gold and silver resource."

Buckskin Rawhide Property Geology and Exploration

The Buckskin Rawhide Property is situated within the Walker Lane structural zone

and gold belt of western Nevada. The Walker Lane is a regional shear zone of

right lateral strike slip faulting and a known gold trend that hosts large and

small historic and currently operating gold-silver mines, including mines of the

Comstock Lode, Tonopah Mining District and Rawhide Mining District. Buckskin

Rawhide Property geology and mineralization are associated with lithologic units

and structures of the Rawhide Caldera, as well as structures from the Walker

Lane and Basin and Range.

The Buckskin Rawhide Property is an early-stage exploration property that is

prospective for both high grade vein and disseminated gold exploration targets.

Geology mapping, geophysics and geochemical prospecting have been applied to

define structures and mineralization. The Property will be explored for

volcanic-hosted epithermal gold-silver targets similar to those at the nearby

Rawhide Mine.

Since acquiring the Buckskin Rawhide Property, Emgold has made two important

discoveries: the Black Eagle High Grade Vein Target and the Chicago Mountain

Bulk Disseminated Target. The Black Eagle High Grade Vein Target was disclosed

by Emgold in news releases of January 12 and April 20, 2011, and the Chicago

Mountain Bulk Disseminated Target was disclosed by Emgold in the news release of

October, 4, 2011. The most recent Emgold news release dated January 30, 2012

provided an update of exploration activities at both Black Eagle and Chicago

Mountain. The acquisition of Buckskin Rawhide West gives Emgold a third

exploration target on the Property.

Buckskin Rawhide West Target

The geology of Buckskin Rawhide West exploration target is similar Buckskin

Rawhide. Host rocks include volcanic flow-dome complexes composed of andesite

and latite, overlain by rhyolitic and dacitic tuff-breccias and pyroclastic

deposits. Opalite sinter is present, suggesting that Buckskin Rawhide West may

be situated near the top of a hot springs system, possibly the same system that

formed the Rawhide Mining District. North to northeast-trending faults, which

are present on the claim block, indicate the existence of structures that trend

parallel to those at Buckskin Rawhide. Geophysical methods used historically to

delineate those structures included ground magnetics, VLF/EM, and radiometric

surveys.

Plans are to conduct preliminary exploration work, consisting of geologic

mapping and sampling of the Buckskin Rawhide West Target in 2012, using existing

funds to complete the work.

Note that sample results on the Buckskin Rawhide Property are preliminary in

nature and are not conclusive evidence of the likelihood of the occurrence of a

mineral deposit. However, the results do justify further exploration of the

Property.

Details of the Lease Option and Purchase Agreement

Buckskin Rawhide West consists of 21 unpatented mineral lode claims totaling 420

acres, under the jurisdiction of the BLM. The claims are under a lease and

option to purchase agreement to acquire 100% of the claims from Jeremy C. Wire,

who is the registered owner of the claims. The acquisition is subject to

approval by the TSX Venture Exchange.

Emgold has agreed to lease the property from Mr. Wire, subject to the following

payments:

Table 1

Advance Royalty Payments

---------------------------------------------

Year Advance Royalty Payment

---------------------------------------------

2012 US$10,000 (1)

---------------------------------------------

2013 US$10,000 (2)

---------------------------------------------

2014 US$10,000 (2)

---------------------------------------------

2015 US$20,000 (3)

---------------------------------------------

2016 US$30,000 (3)

---------------------------------------------

2017 US$30,000 (3)

---------------------------------------------

2018 US$30,000 (3)

---------------------------------------------

Note: (1) An initial lease payment paid 50% in cash and 50% in Emgold common

shares. (2) Lease payments may be paid in cash or Emgold common shares, at the

discretion of Emgold. (3) Lease payments may be paid in cash or Emgold common

shares, at the discretion of the Lessor. Shares will be issued at "market value"

which means the volume weighted closing price of the shares on the TSX Venture

Exchange or the most senior stock exchange or quotation system on which the

shares are then listed or quoted for fifteen (15) trading days ending on the

date that is five (5) business days before the applicable payment.

During the lease period, Emgold may conduct exploration and, if warranted,

complete a NI 43-101 Technical Report on the Property. On making the above

payments and completion of the Technical Report, Emgold will acquire 100%

ownership of the property. In the event that commercial production occurs, Mr.

Wire will be entitled to a two percent Net Smelter Royalty on production from

the property. Emgold will retain the right to purchase this royalty for $1

million, less any advance royalty payments already made.

Information Regarding Emgold

Emgold is currently in the advanced stage of permitting the Idaho-Maryland

Project, located in Grass Valley, CA. The Idaho-Maryland Mine was once the

second largest underground gold mine in California and is reported to have

produced 2.4 million ounces of gold at an average recovered grade of 0.43 ounce

per ton. Emgold has a number of earlier stage exploration properties including

the Buckskin Rawhide Property in Nevada, and the Stewart Property and the Rozan

Property in British Columbia.

For more information about Emgold, the Idaho-Maryland Gold Project and the

Buckskin Rawhide, Stewart, and Rozan Properties, please visit www.emgold.com.

Company filings are available at www.sedar.com.

The scientific or technical information contained in this news release has been

reviewed and approved by Mr. Robert Pease, P.Geo., Chief Geologist of the

Company, a Qualified Person as defined in National Instrument 43-101.

On behalf of the Board of Directors

David G. Watkinson, P.Eng., President & CEO

This release was prepared by the Company's management. This news release

includes certain statements that are "forward-looking statements" within the

meaning of applicable securities laws including statements regarding the

Company's planned work programs, expected results and potential mineralization

and resources on the Buckskin Rawhide Property. Forward-looking statements are

based on certain assumptions of the Company, including that the Company has

adequate capital to fund its proposed exploration programs, that actual results

of exploration and development activities are consistent with management's

expectations, that assumptions relating to mineral resource estimates are

accurate, the assumption that metal prices remain at current values, and that

the Company is able to procure equipment and supplies for its planned work

programs Although the Company believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions, such statements

are not guarantees of future performance and actual results or developments may

differ materially from those in the forward-looking statements. Factors that

could cause actual results to differ materially from those in forward-looking

statements include exploration results that are different than those

anticipated, inability to raise or otherwise secure capital to fund planned

programs, changes to metal prices, the price of the Company's shares, the costs

of labour, equipment and other costs associated with exploration, availability

of drilling equipment and operators, development and mining operations,

exploitation and exploration successes, continued availability of capital and

financing, and general economic, market or business conditions. Investors are

cautioned that any such statements are not guarantees of future performance and

actual results or developments may differ materially from those projected in the

forward-looking statements. The Company does not intend to update or revise any

forward-looking information whether as a result of new information, future

events or otherwise, except as required by law. For more information on the

Company, investors should review the Company's filings that are available at

www.sedar.com or the Company's website at www.emgold.com.

U.S. 20-F Registration: 000-51411

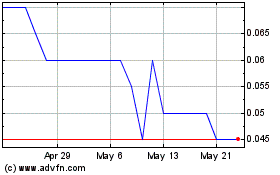

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Emergent Metals (TSXV:EMR)

Historical Stock Chart

From Feb 2024 to Feb 2025