Jura Completes C$11 Million Credit Facility to Bring Zarghun South Field on Production and Provides Update on Operations

27 February 2013 - 10:53PM

Marketwired Canada

Jura Energy Corporation (TSX:JEC) ("Jura") is pleased to announce that it has

entered into a C$11 million credit facility (the "Facility") with its principal

shareholder, Eastern Petroleum Limited ("EPL"). The Facility provides Jura with

sufficient funding to meet its working interest commitments in order to bring

the company's Zarghun South field on production.

Jura will draw down on the Facility over time to fund its capital expenditures

and operations. The Facility is designed as a bridge to the completion of a

future debt or equity financing, provided that such financing is sourced on

terms favourable to Jura. It is anticipated that the Facility will either be:

(i) repaid in full following the closing of a future financing or (ii) converted

into common shares pursuant to the Conversion Option.

The Facility will be used primarily to fund Jura's estimated US$10.5 million

share of the capital expenditures required to bring the Zarghun South field on

production. As at August 30, 2011, DeGolyer and MacNaughton Canada Limited

("DeGolyer"), Jura's independent reserves evaluator, estimated Jura's share of

the field's gross proved plus probable reserves to be 27.9 Bcf.

Pursuant to the requirement of Pakistan's Tight Gas (Exploration and Production)

Policy 2011 ("Tight Gas Policy"), DeGolyer in its report dated April 30, 2012,

certified 84.5% of The Zarghun South reserves as "Tight Gas Reserves". Jura's

share of gross proved plus probable Tight Gas Reserves is 23.2 Bcf. Production

from these reserves will be entitled to an estimated price of US$6.23/MMBtu

under such Tight Gas Policy (based on US$80 crude). Jura holds a 40% interest in

the Zarghun South Development and Production Lease.

"This facility will fund Jura's commitments for the Zarghun South development

and is a strong indication of our principal shareholder's commitment to the Jura

assets. Zarghun South is Jura's largest asset. Bringing it on production will be

a significant step for Jura and is expected to transform the company into a

cash-generating business. We are looking forward to an exciting 2013," said

Graham Garner, Jura's CEO.

The Facility is repayable at the demand of EPL on the earlier of (i) February

20, 2014 and (ii) ten (10) business days after the closing of a debt or equity

financing by Jura for an aggregate amount in excess of amounts drawn down under

the Facility. The principal amount outstanding at any time under the Facility

carries interest at US Dollar 3-months LIBOR plus 4% (a rate of 4.29% as of the

date of this news release), compounded quarterly. The Facility was approved by

directors of Jura who are unrelated to EPL.

The outstanding principal and interest under the Facility is convertible at the

option of EPL on the basis of one (1) common share in the capital of Jura for

each C$1.00 so converted (the "Conversion Option"). The Conversion Option is

subject to the restriction that, during any six month period, the aggregate

number of common shares issuable to EPL under the Conversion Option shall not

exceed 10% of the number of common shares in the capital of Jura outstanding, on

a non-diluted basis, prior to the date of the first conversion of the Facility.

Jura has received approval from the Toronto Stock Exchange ("TSX") for the

listing on the TSX of the number of common shares that may be issued upon the

exercise of the Conversion Option during a six months period. Should additional

shares become issuable under the Conversion Option, a further application will

be made to the TSX for the listing of such shares on the TSX.

Jura also provided the following update on operations:

Guddu License (Reti-Maru Field)

In January 2013, the Government of Pakistan approved the sale of gas from the

Guddu field to a consortium of four fertilizer manufacturers. The Guddu joint

venture is in the process of negotiating a Gas Sale Agreement and a Gas Pricing

Agreement with the consortium. The sale of gas is anticipated to commence later

this year following (i) the execution of these agreements, (ii) the construction

of a 15.32 km pipeline to the purchaser's facility, and (iii) final regulatory

approvals. Jura holds a 10.6% interest in the Guddu License.

Sara-Suri

Jura has commenced rigless operations in three wells to confirm flow rates from

the previously shut-in Sara-Suri fields. The work to be performed includes a

pressure buildup survey, saturation monitoring, selective perforations,

stimulation, production testing and the running of velocity string in one well.

Jura is the operator of these fields and holds a 60% interest in the Sara-Suri

Development and Production Leases.

Zarghun South

The operator of the Zarghun South field, Mari Petroleum Company Limited, advised

Jura that it has mobilized a drilling rig to perform the recompletion of the

Zarghun South-1 well. Additional work to be completed includes the installation

of surface facilities and 25 MMSCFD gas processing plant. Sui Southern Gas

Company Limited, the purchaser of gas from Zarghun South, will be commencing

construction of a 64.2 km pipeline which will tie the field into the main gas

grid. Gas sales from Zarghun South are anticipated to commence by the fourth

quarter of 2013.

About Jura:

Jura is an international energy company engaged in the exploration, development

and production of petroleum and natural gas properties in Pakistan. Jura is

based in Calgary, Alberta, and listed on the TSX trading under the symbol JEC.

Jura conducts its business in Pakistan through its subsidiaries Frontier

Holdings Limited and Spud Energy Pty Limited.

Cautionary Statements

The estimates of reserves and future net revenue for individual properties may

not reflect the same confidence level as estimates of revenue and future net

revenue for all properties, due to the effects of aggregation. As at August 31,

2011, DeGolyer estimated Jura's share of gross proved plus probable reserves for

all of Jura's properties in Pakistan to be 35Bcf.

Forward Looking Advisory

This news release contains forward-looking information which is not comprised of

historical facts. Forward-looking information in this news release includes

statements with respect to, among other things, the level of costs required to

bring the Zarghun South field on production; expectations with respect to

production and gas sales from the Zarghun South field and the Guddu field and

the timing thereof; execution of agreements for the sale of gas by the Guddu

joint venture and receipt of final regulatory approvals therefore; completion of

pipelines from the Zarghun South field and the Guddu field and the timing

thereof; tie in of the pipeline from the Zarghun South field with the main gas

plant; commencing rigless operations in the Sara-Suri gas fields and the timing

thereof; expectations regarding operations in the Zarghun South field and the

timing thereof, including mobilization of a drilling rig, completion of a

workover of the Zarghun South-2 well and completion of the installation of a gas

processing plant; expected pricing under the Tight Gas Policy; anticipated

method of repayment of the Facility; and expectations regarding the application

by Jura to list additional shares issuable under the Conversion Option on the

TSX. Readers are cautioned that assumptions used in the preparation of such

information may prove to be incorrect. Events or circumstances may cause actual

results to differ materially from those predicted as a result of numerous known

and unknown risks, uncertainties, and other factors, many of which are beyond

the control of Jura. These risks include, but are not limited to: changes in

interest rates applicable to the Facility, failure of other working interest

owners to fund their working interest commitments, general economic, market and

business conditions, commodity prices and exchange rate changes, regulatory

changes, technical issues, new legislation, political and business conditions,

competitive and general economic factors and conditions, uncertainties resulting

from potential delays or changes in plans, the occurrence of unexpected events,

stock market volatility, the ability to access sufficient capital from internal

and external sources and Jura's capability to execute and implement its future

plans. The risks outlined above should not be construed as exhaustive. Readers

are cautioned not to place undue reliance on this forward-looking information as

actual results may differ materially from those expressed or implied in the

forward-looking information. Jura does not assume the obligation to revise or

update this forward-looking information after the date of this release or to

revise such information to reflect the occurrence of future unanticipated

events, except as may be required under applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Jura Energy Corporation

Mr. Graham Garner

CEO

(403) 266-6364

(403) 266-6365 (FAX)

info@juraenergy.com

www.juraenergy.com

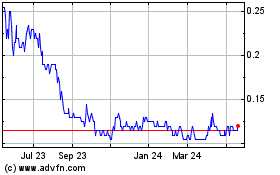

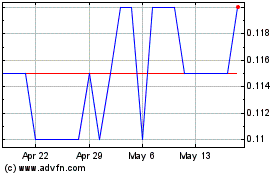

Common Stock (TSXV:EPL)

Historical Stock Chart

From May 2024 to Jun 2024

Common Stock (TSXV:EPL)

Historical Stock Chart

From Jun 2023 to Jun 2024