Fjordland Closes Final Tranche of Financing

15 September 2011 - 3:04AM

Marketwired

Fjordland Exploration Inc. (TSX VENTURE: FEX) (the "Company" or

"Fjordland") reports that the second tranche of the non-brokered

private placement announced on July 5, 2011 has closed for gross

proceeds of $620,300. The Company has issued 3,446,109 non

flow-through units (the "Units") with each Unit consisting of one

common share and one share purchase warrant. Each share purchase

warrant entitles the holder to purchase one common share at a price

of $0.23 until September 12, 2012. The Company paid finders fees

totaling $5,130 in connection with this final portion of the

financing.

The securities issued under this second tranche are subject to a

four month hold period and may not be traded until January 13,

2012.

In connection with the first tranche of the financing, the

Company determined through taxation advisors that it would be

unable to issue T101s or renounce expenditures in respect of the

flow-through portion of the placement, as the shares were likely to

be considered to be 'prescribed shares' under federal tax laws due

to the fact that at the time of their issuance there was an

existing agreement relating to the contemplated spin-out

transaction announced on June 24, 2011. Participants were offered a

refund of $0.05 per unit in settlement of the inability to

renounce, giving the effect of moving the subscriber to a non

flow-through unit. As a result, we report that under the first

tranche the Company issued 1,896,456 Units for gross proceeds of

$341,362. The warrant terms remain the same as previously

announced.

Early Warning Report

Richard C. Atkinson, a director of the Company, acquired an

aggregate 1,550,000 Units at a price of $0.18 per Unit for gross

proceeds of $279,000 in the closing of the second tranche, being

2.01% of the issued capital. The Units were acquired as follows:

Richard C. Atkinson as to 800,000 Units of which 150,000 Units are

held by Carol Atkinson; and Les Entreprises de Richard Atkinson

Ltee. ("LERA") as to 750,000 Units. LERA is a private investment

corporation, the shares of which are held by Mr. Atkinson and

members of his immediate family.

Prior to this transaction Mr. Atkinson owned or controlled

9,215,423 common shares of Fjordland, directly and indirectly.

Mr. Atkinson owns or controls an aggregate of 10,765,423 common

shares of Fjordland, representing 13.98% of the issued and

outstanding common shares of Fjordland, and warrants to acquire

1,550,000 common shares of Fjordland and options to acquire a

further 925,000 common shares of Fjordland, representing

approximately 16.65% of the issued and outstanding shares of

Fjordland, on a partially diluted basis assuming the exercise of

the convertible securities held or controlled by Mr. Atkinson

only.

Mr. Atkinson acquired these securities for investment purposes,

thus depending on the economic or market conditions or matters

relating to Fjordland, Mr. Atkinson may choose to either acquire

additional securities or dispose of securities of Fjordland. The

Company has not provided legal counsel to Mr. Atkinson in regards

to these transactions.

About Fjordland Exploration Inc.

Fjordland Exploration is a mineral exploration company focused

on the discovery of gold, copper and molybdenum deposits in British

Columbia. Of the 28 properties Fjordland owns, the Woodjam North

and Woodjam South properties (totaling 56,150 ha) are part of the

Woodjam Joint Venture between Fjordland (60%) and Cariboo Rose

Resources Ltd (40%); both properties are under separate option

agreements to Gold Fields Horsefly Exploration Corporation.

Fjordland also has a 100% interest in 7 properties known as "Tak"

totaling 52,342 ha in the Woodjam area. Fjordland has a 100%

interest in the 2,192 ha "Milligan" project, adjoining Thompson

Creek Metals Company Inc.'s Mt. Milligan copper-gold deposits on

the west. The Tak-Milligan properties have been optioned to

Capstone Mining Corp. Fjordland and Serengeti Resources Inc. are

38%/62% partners exploring 12 properties (QUEST Project) totaling

56,670 ha in the Quesnel terrane north of Woodjam for precious and

base metals. Fjordland has a 100% interest in 8 properties totaling

60,047 ha in the Iron Range area and has an option agreement on 7

properties totaling 21,222 ha with Kootenay Gold Inc. in

southeastern BC. Fjordland's shares trade on the TSX Venture

Exchange under the symbol "FEX". For more information visit

Fjordland's website at www.fjordlandex.com.

Tom Schroeter, President & CEO

Neither TSX Venture Exchange nor its Regulation Services

providers (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: Fjordland Exploration Inc. John Gomez Investor

Relations 604-893-8365 604-669-8336 (FAX) www.fjordlandex.com

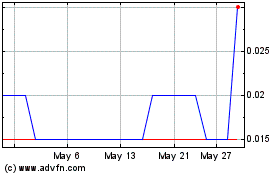

Fjordland Exploration (TSXV:FEX)

Historical Stock Chart

From Jan 2025 to Feb 2025

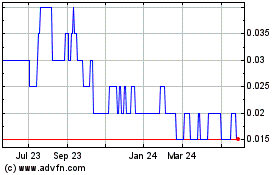

Fjordland Exploration (TSXV:FEX)

Historical Stock Chart

From Feb 2024 to Feb 2025