Golden Tag Resources Ltd. (“

Golden Tag” or the

"

Company") (TSX.V: GOG) (OTCQB: GTAGF) is pleased

to announce that the Company has entered into a definitive Asset

Purchase Agreement dated December 7, 2022 (the "

Purchase

Agreement" or “

APA”) with First Majestic

Silver Corp (“

First Majestic” or

“

FMS”) to acquire a 100% interest in the 69,478

hectares La Parrilla Silver Mine Complex (“

La

Parrilla”) in the locality of San Jose de la Parrilla,

Durango, Mexico (the “

Transaction”).

Highlights:

- La Parrilla is a fully permitted

former producing mine complex consisting of five underground

high-grade silver mines, and an open pit

- Demonstrated history of replacing

resources – operated continuously from 2004 until September 2019

when it was placed on care and maintenance due to low silver

prices

- Under FMS ownership the mill

produced 34.3 million (“M”) ounces1 of

(“oz”) silver equivalent

(“Ag.Eq”), with average annual production of

approximately 3.1 M oz of Ag.Eq1, 2

- Excellent infrastructure inclusive

of a 2,000 tonne per day (“tpd”) processing

facility (1,000 tpd flotation and 1,000 tpd cyanidation circuits),

dry stack filter plant with approximately 9 years3 of tailings

capacity available, numerous buildings including a doré refinery,

and a partial underground mining fleet4

- New labour and Ejido agreements in

place

- Historical Measured and Indicated

Mineral Resources of approximately 9.95 M oz Ag.Eq and Inferred

Mineral Resources of approximately 12.51 M oz Ag.Eq5, 6 (see Table

2)

- Located only 45 minutes from

Durango City, paved highway to site

- Large underexplored land package

totaling 69,478 ha

- Debt-free transaction with upfront

consideration of US$20M in equity, and deferred payments totaling

US$13.5M for a total acquisition price of US$33.5M

- Requirement to raise a minimum of

CAD$9M in equity concurrent with the acquisition, with

participation of US$2.7M from First Majestic

- Support received from key existing

shareholders representing 54 million shares

- First Majestic to become strategic

and largest shareholder of Golden Tag, inclusive of standard

support agreements in place until May 2024

Greg McKenzie, President & CEO commented “We

are honoured to partner with First Majestic in the acquisition of

La Parrilla, their first producing silver mine, which has produced

34.3 million oz of Ag.Eq under their ownership. Over the past two

years we have evaluated several opportunities for growth in the

silver space and La Parrilla is a great opportunity. The mine

complex is fully permitted, located only 45 minutes on paved roads

from Durango and, only a few hours from our existing San Diego

project.

This is a transformative acquisition for Golden

Tag and we strongly believe in the upside resource growth potential

of this long-life prolific asset. Our short-term objective is to

commence exploration within and near mine workings in order to

expand the resource base, to support our ultimate goal & vision

of placing the asset back into production.

We would like to thank our key shareholders for

their support on this transaction and look forward to working with

First Majestic to complete the acquisition.”

Figure 1 – Clockwise from top-left 1.

Rosarios Portal; 2. Ag-Pb-Zn vein mineralization, Quebradillas

Cuerpo 460 (1700 elevation); 3. Quebradillas Open Pit

Overview of the La Parrilla

Complex

The property is located in Durango State,

Mexico, approximately 76 kilometres southeast of the capital city

of Durango and is comprised of 41 contiguous mining concessions, in

good standing, covering 69,478 hectares. The property was acquired

by First Majestic in 2004 and became their first silver mine in

2005. When placed on care and maintenance in September 2019, the

complex hosted five underground mines surrounding the mill

including Rosarios, La Rosa, San Jose, Quebradillas and San Marcos,

as well as the Quebradillas open pit (See Figure 1). From 2010-2019

La Parrilla produced approximately 29.6 million oz Ag.Eq as

outlined in Table 1 below.

Table 1 – Historical Production at La

Parrilla from 2010 - 20191

| |

|

|

|

|

|

|

|

|

|

|

|

|

Production |

2010 |

|

2011 |

|

2012 |

|

2013 |

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

2019* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ore processed/ tonnes milled |

303,869 |

|

362,947 |

|

679,788 |

|

788,335 |

|

711,915 |

|

667,702 |

|

610,509 |

|

543,985 |

|

491,637 |

|

167,535 |

|

|

|

Average silver grade (g/t) |

209 |

|

200 |

|

170 |

|

162 |

|

158 |

|

145 |

|

140 |

|

130 |

|

108 |

|

139 |

|

|

|

Recovery (%) |

76 |

% |

77 |

% |

78 |

% |

76 |

% |

79 |

% |

78 |

% |

81 |

% |

76 |

% |

76 |

% |

75 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total silver ounces produced |

1,548,832 |

|

1,793,728 |

|

2,876,810 |

|

3,115,997 |

|

2,876,452 |

|

2,434,095 |

|

2,220,874 |

|

1,730,383 |

|

1,340,385 |

|

557,603 |

|

|

|

Gold ounces produced |

413 |

|

344 |

|

923 |

|

1,051 |

|

982 |

|

1,161 |

|

1,009 |

|

1,014 |

|

963 |

|

0 |

|

|

|

Pounds of lead produced |

4,280,167 |

|

7,888,943 |

|

13,240,889 |

|

18,503,451 |

|

21,259,559 |

|

10,441,510 |

|

10,648,161 |

|

6,544,745 |

|

6,550,602 |

|

4,659,549 |

|

|

|

Pounds of zinc produced |

363,288 |

|

178,767 |

|

4,952,899 |

|

6,723,878 |

|

12,619,352 |

|

17,524,223 |

|

10,577,434 |

|

3,944,232 |

|

5,695,657 |

|

3,691,100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total production - ounces silver equivalent |

1,813,788 |

|

2,057,172 |

|

3,487,392 |

|

4,219,374 |

|

4,673,186 |

|

4,036,398 |

|

3,388,434 |

|

2,517,199 |

|

2,323,056 |

|

1,120,490 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underground development (m) |

7,545 |

|

13,242 |

|

20,606 |

|

12,004 |

|

8,981 |

|

7,371 |

|

9,416 |

|

12,313 |

|

11,443 |

|

6,660 |

|

|

|

Diamond drilling (m) |

1,581 |

|

14,447 |

|

26,204 |

|

10,974 |

|

5,789 |

|

9,750 |

|

15,326 |

|

28,839 |

|

30,713 |

|

24,440 |

|

|

|

*Care and maintenance procedures began in September

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

The metallurgical processing plant at La

Parrilla (see Figure 2) consists of parallel 1,000 tpd flotation

and 1,000 tpd cyanidation leach circuits to treat both oxide and

sulfide ores, for a total capacity of 2,000 tpd, using a

conventional flowsheet. Both ore types are polymetallic containing

silver as their principal economic component as well as significant

amounts of lead and zinc, and minor amounts of gold. Oxide ore is

processed by cyanide leaching to produce doré bars while sulphide

ore is processed by differential flotation to produce a silver-rich

lead concentrate and a zinc concentrate.

Figure 2 – View of the La Parrilla Mill

Complex

During 2018, the last year of open pit

operations, metallurgical recoveries in the cyanidation circuit

were 74% for silver and 81% for gold, and metallurgical recoveries

in the flotation circuit were 76% for silver, 73% for lead and 55%

for zinc. Tailings from both circuits are filtered separately

before being dry‐stacked in the tailings storage facility, which

currently holds approximately 6.5 million tonnes of capacity,

sufficient for nine years of operations at a throughput rate of

2,000 tpd.

Table 2 – La Parrilla Historic Mineral

Resources5,

6

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Category / Area |

Mineral Type |

Tonnage |

Grades |

Metal Content |

|

|

|

kt |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag-Eq (g/t) |

Ag (k Oz) |

Au (k Oz) |

Pb (M lb) |

Zn (M lb) |

Ag-Eq (k Oz) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Measured Quebradillas (UG) |

Sulphides |

15 |

193 |

- |

1.27 |

1.27 |

250 |

90 |

- |

0.4 |

0.4 |

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Measured (UG) |

Sulphides |

15 |

193 |

- |

1.27 |

1.27 |

250 |

90 |

- |

0.4 |

0.4 |

120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicated Rosarios (UG) |

Sulphides |

519 |

179 |

0.08 |

1.71 |

1.33 |

257 |

2,980 |

1.4 |

19.6 |

15.2 |

4,290 |

|

Indicated Quebradillas (UG) |

Sulphides |

321 |

177 |

0.08 |

2.59 |

2.70 |

303 |

1,820 |

0.8 |

18.3 |

19.0 |

3,120 |

|

Indicated San Marcos (UG) |

Sulphides |

188 |

260 |

0.04 |

0.57 |

0.56 |

289 |

1,570 |

0.2 |

2.4 |

2.3 |

1,750 |

|

Total Indicated (UG) |

Sulphides |

1,028 |

193 |

0.07 |

1.78 |

1.62 |

277 |

6,370 |

2.4 |

40.3 |

36.6 |

9,160 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicated Rosarios (UG) |

Oxides |

23 |

300 |

0.04 |

- |

- |

304 |

220 |

- |

- |

- |

220 |

|

Indicated San Marcos (UG) |

Oxides |

53 |

256 |

0.12 |

- |

- |

266 |

440 |

0.2 |

- |

- |

450 |

|

Total Indicated (UG) |

Oxides |

76 |

270 |

0.09 |

- |

- |

278 |

660 |

0.2 |

- |

- |

670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Indicated (UG) |

Oxides + Sulphides |

1,104 |

182 |

0.07 |

1.67 |

1.52 |

261 |

7,030 |

2.6 |

40.3 |

36.6 |

9,830 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Measured & Indicated (UG) |

Oxides + Sulphides |

1,119 |

198 |

0.07 |

1.65 |

1.50 |

277 |

7,120 |

2.6 |

40.7 |

37.0 |

9,950 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Category / Area |

Mineral Type |

Tonnage |

Grades |

Metal Content |

|

Inferred |

|

kt |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag-Eq (g/t) |

Ag (k Oz) |

Au (k Oz) |

Pb (M lb) |

Zn (M lb) |

Ag-Eq (k Oz) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inferred Rosarios (UG) |

Sulphides |

265 |

154 |

0.16 |

1.85 |

1.48 |

245 |

1,310 |

1.4 |

10.8 |

8.6 |

2,090 |

|

Inferred Quebradillas (UG) |

Sulphides |

578 |

214 |

0.08 |

1.85 |

2.65 |

319 |

3,970 |

1.6 |

23.6 |

33.8 |

5,920 |

|

Inferred San Marcos (UG) |

Sulphides |

185 |

304 |

0.03 |

0.25 |

0.22 |

317 |

1,810 |

0.2 |

1.0 |

0.9 |

1,890 |

|

Total Inferred (UG) |

Sulphides |

1,028 |

215 |

0.09 |

1.56 |

1.91 |

299 |

7,090 |

3.2 |

35.4 |

43.3 |

9,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inferred Rosarios (UG) |

Oxides |

280 |

198 |

0.08 |

- |

- |

205 |

1,780 |

0.7 |

- |

- |

1,840 |

|

Inferred Quebradillas (UG) |

Oxides |

43 |

196 |

0.14 |

- |

- |

208 |

270 |

0.2 |

- |

- |

290 |

|

Inferred San Marcos (UG) |

Oxides |

70 |

211 |

0.04 |

- |

- |

214 |

480 |

0.1 |

- |

- |

480 |

|

Total Inferred (UG) |

Oxides |

393 |

200 |

0.08 |

- |

- |

207 |

2,530 |

1.0 |

- |

- |

2,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Inferred (UG) |

Oxides + Sulphides |

1,421 |

211 |

0.09 |

1.13 |

1.38 |

274 |

9,620 |

4.2 |

35.4 |

43.3 |

12,510 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Cautionary Statement: Mineral

Resources that are not Mineral Reserves do not have demonstrated

economic viability. The resource estimate stated in Table 2 is as

reported by First Majestic with an effective date of December 31,

2020. Golden Tag is not treating these estimates as current Mineral

Resources because a Qualified Person on behalf of Golden Tag has

not performed sufficient work5 to classify these estimates as

current resources5, 6.

Notes for Historic Mineral Resources

Estimates:

5. These figures are historic in nature, have not been verified

by Golden Tag and while relevant as the most recent mineral

resource estimates for La Parrilla, should not be relied upon. A

thorough review by Golden Tag’s "Qualified Person" of all historic

data, along with additional exploration and validation work to

confirm results and estimation parameters, would be required in

order to produce a current mineral resource estimate for the La

Parrilla Mine Complex. No more recent estimates or data are

available to Golden Tag.

6. First Majestic reported that its La Parrilla mineral resource

estimates were:

- classified in

accordance with the 2014 Canadian Institute of Mining, Metallurgy

and Petroleum (CIM) Definition Standards on Mineral Resources and

Mineral Reserves

- The Historic

Mineral Resource estimates were updated to December 31, 2020 and

were compliant with NI 43-101 at that time. The estimates were

prepared by FMS Internal QP’s, who have appropriate relevant

qualifications, and experience in geology and resource estimation,

The information provided was compiled by David Rowe, CPG and

reviewed by Ramon Mendoza Reyes, P.Eng., both Internal QP’s for

FMS.

- Sample data was

collected through a cut-off date of December 31, 2020

- cut-off grades

and cut-off values used to report Historic Mineral Resources are

different for all FMS mines. The cut-off grades, values and

economic parameters are listed in the applicable section describing

each mine section of the FMS AIF

- Metal prices

considered for Historic Mineral Resources estimates on December 31,

2020 were $22.50/oz Ag, $1,850/oz Au, $0.90/lb Pb and $1.05/lb

Zn

-

Silver-equivalent grade is estimated considering: metal price

assumptions, metallurgical recovery for the corresponding mineral

type/mineral process and the metal payable of the corresponding

contract of each mine

- Tonnage is

expressed in thousands of tonnes, metal content is expressed in

thousands of ounces. The totals may not add up due to rounding

Please refer to the FMS Annual Information Form

for The Year Ended December 31, 2021 dated March 31, 2022 available

on at www.SEDAR.com.

Transaction Summary

The Company will acquire 100% of the assets of

the La Parrilla Silver Mine Complex from First Majestic and the

remaining employees associated directly with the Complex. In

consideration, Golden Tag will pay to First Majestic the

following:

- 143,673,684 common shares of Golden

Tag (“Consideration Shares”), or US$20M at a

deemed price of C$0.19 per Golden Tag share;

- Deferred payments totaling

US$13.5M, comprised of the following:

- US$2.7M on the earlier of 18 months

post-closing, or upon receipt of certain approvals from the Mexican

government;

- US$5.75M when either (a) 5 million

ounces of Ag.Eq reserves are declared from the La Parrilla claims,

or (b) 22 million ounces of Ag.Eq of measured and indicated

resources are declared, from the La Parrilla claims;

- US$5.05M when a new zone is

discovered on the La Parrilla claims inclusive of a NI 43-101

resource of 12.5 million ounces of Ag.Eq;

Both II and III are payable in cash or common

shares, at the election of Golden Tag.

- FMS may distribute shares held in

excess of a 19.9% issued and outstanding Golden Tag holding (on a

non-diluted basis) pro-rata to its shareholders (“Excess

Shares”).

- After closing, FMS will have a

participation right to maintain its pro-rata interest in Golden Tag

(to a maximum of 19.9%) in any future Golden Tag share issuances,

subject to customary exceptions.

- The Consideration Shares held by

FMS will be subject to the following contractual resale

restrictions, in addition to any securities laws resale

restrictions:

- 25% subject to a 6-month resale

restriction;

- 25% subject to a 12-month resale

restriction;

- 25% subject to a 18-month resale

restriction;

- 25% subject to a 24-month resale

restriction.

- The resale restrictions above will

not apply to the Excess Shares and will be subject to customary

carve-outs in the event of a takeover bid or merger or acquisition

transaction involving the common shares of Golden Tag.

- Shareholders, along with certain

directors and officers of Golden Tag holding a total of 54M shares

(representing approximately 25% of the Golden Tag’s issued and

outstanding shares), have entered into voting and support

agreements with Golden Tag pursuant to which they have agreed,

among other things, to support the Transaction (which creates a new

control person of Golden Tag) and to vote their Golden Tag shares

in favour of the Transaction.

- FMS has also entered into a

standard and customary voting support agreement with Golden Tag for

a period that is the longer of (i) May 24, 2024, or (ii) First

Majestic’s ownership percentage of Golden Tag is greater than or

equal to 19.9%.

Closing of the Transaction is expected to occur

in H1 2023, and is subject to certain conditions including, but not

limited to: (i) the approval of Golden Tag shareholders as a result

of the Transaction creating a new control person; (ii) the

completion by the Company of a Private Placement for minimum gross

proceeds of C$9,000,000, as described below; (iii) the receipt

of all necessary consents, approvals and authorizations (including

the TSX Venture Exchange (the “TSXV”) and the Mexican Antitrust

Commission) for the Transaction; and (iv) other conditions which

are customary for a transaction of this type.

The Company has engaged SRK Consulting (Canada)

Inc. to prepare an independent National Instrument 43-101 resource

report on La Parrilla.

There are no finder’s fee payable in connection

with the Transaction; First Majestic and the Company are arm’s

length parties from each other and the Transaction is an Arm’s

Length Transaction (as such term is defined under the corporate

finance manual of the TSXV).

Financing for the

Acquisition

Concurrent with or prior to the closing of the

Transaction, Golden Tag will complete a private placement to raise

gross aggregate proceeds of C$9 million (the "Private

Placement"), inclusive of US$2.7M subscribed for by First

Majestic. Further details regarding the Private Placement will be

announced once final terms of the Private Placement have been

determined.

Change of Name

On the closing of the Transaction, subject to

regulatory approval, the Company will undertake a rebranding

initiative. Further details will follow.

Financial Advisors and Legal

Counsel

Golden Tag is represented by McMillan LLP as

legal counsel. First Majestic is being advised by National Bank as

financial advisor and Bennett Jones LLP as legal counsel.

Qualified Person

The scientific and technical information in this

document has been reviewed and approved by Bruce Robbins, P.Geo., a

Qualified Person as defined by National Instrument 43-101.

About Golden Tag Resources

Golden Tag Resources Ltd. is a Toronto based

mineral resource exploration company. The Company holds a 100%

interest, subject to a 2% NSR, in the San Diego Project, in

Durango, Mexico. The San Diego property is among the largest

undeveloped silver assets in Mexico and is located within the

prolific Velardeña Mining District. Velardeña hosts several mines

having produced silver, zinc, lead and gold for over 100 years. For

more information regarding the San Diego property please visit our

website at www.goldentag.ca.

For additional information, please

contact: Greg McKenzie, President & CEO Ph:

416-504-2024 greg.mckenzie@goldentag.ca

Cautionary Statement:

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this news

release. Certain statements in this news release are

forward-looking and involve a number of risks and uncertainties.

Such forward-looking statements are within the meaning of the

phrase ‘forward-looking information’ in the Canadian Securities

Administrators’ National Instrument 51-102 – Continuous Disclosure

Obligations. Forward-looking statements are not comprised of

historical facts. Forward-looking statements include estimates and

statements that describe the Company’s future plans, objectives or

goals, including words to the effect that the Company or management

expects a stated condition or result to occur. Forward-looking

statements may be identified by such terms as “believes”,

“anticipates”, “expects”, “estimates”, “may”, “could”, “would”,

“will”, or “plan”. Since forward-looking statements are based on

assumptions and address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Although

these statements are based on information currently available to

the Company, the Company provides no assurance that actual results

will meet management’s expectations. Risks, uncertainties and other

factors involved with forward-looking information could cause

actual events, results, performance, prospects and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Forward-looking information in this

news release includes, but is not limited to, the completion of the

acquisition of the La Parrilla Mine Complex on the terms set out in

the definitive Asset Purchase Agreement, the completion of the

Private Placement on terms anticipated by the Company (or at all),

First Majestic’s distribution of the Excess Shares, the Company’s

plans to prepare a technical report on La Parrilla, to initiate a

rebranding process & change the name of the Company, the

ability to obtain requisite corporate and regulatory approvals,

including but not limited to the approval from the TSXV for the

Transaction and the Private Placement, obtain applicable and

customary approvals from the Mexican government, the Company's

plans and expectations for La Parrilla, the ability of the Company,

upon closing of the Transaction, to incorporate La Parrilla into

the business of the Company, and the ability to eventually place

the asset back into production.

In making the forward-looking statements

included in this news release, the Company has applied several

material assumptions, including that the Company´s financial

condition and development plans do not change because of unforeseen

events, that future metal prices and the demand and market outlook

for metals will remain stable or improve, management’s ability to

execute its business strategy, the receipt of all necessary

approvals, the Company’s and First Majestic’s satisfaction of all

closing conditions with respect to APA, the closing of the Private

Placement, and no unexpected or adverse regulatory changes with

respect to La Parrilla. Forward-looking statements and information

are subject to various known and unknown risks and uncertainties,

many of which are beyond the ability of the Company to control or

predict, that may cause the Company´s actual results, performance

or achievements to be materially different from those expressed or

implied thereby, and are developed based on assumptions about such

risks, uncertainties and other factors set out herein, including,

but not limited to, the risk that the Company is not able to

complete the acquisition of La Parrilla on the terms set out in the

definitive Asset Purchase Agreement (or at all), the risk that the

Company is unable to complete the Private Placement on the terms

anticipated by the Company (or at all), the risk that the Company

is unable to obtain requisite corporate and regulatory approvals,

including but not limited to the approval of the TSXV, the Mexican

government, and shareholder approval, the risk that the Company

will be unable to incorporate La Parrilla into the business of the

Company, the risk that the Company is unable to achieve its goal of

placing La Parrilla back into production, the risk that the

assumptions referred to above prove not to be valid or reliable,

market conditions and volatility and global economic conditions

including increased volitivity and potentially negative capital

raising conditions resulting from the continued or escalation of

the COVID-19 pandemic, risk of delay and/or cessation in planned

work or changes in the Company´s financial condition and

development plans; risks associated with the interpretation of data

(including in respect of third party mineralized material)

regarding the geology, grade and continuity of mineral deposits,

the uncertainty of the geology, grade and continuity of mineral

deposits and the risk of unexpected variations in mineral

resources, grade and/or recovery rates; risks related to gold,

silver and other commodity price fluctuations; employee relations;

relationships with and claims by local communities and indigenous

populations; availability and increasing costs associated with

mining inputs and labour, the speculative nature of mineral

exploration and development, including the risks of obtaining

necessary licenses and permits and the presence of laws and

regulations that may impose restrictions on mining; risks relating

to environmental regulation and liability; the possibility that

results will not be consistent with the Company´s expectations.

Such forward-looking information represents

management´s best judgment based on information currently

available. No forward-looking statement can be guaranteed, and

actual future results may vary materially. Accordingly, readers are

advised not to place undue reliance on forward-looking statements

or information.

TSX Venture Exchange Inc. has in no way passed

upon the merits of the Transaction and has neither approved nor

disapproved the contents of this press release.

1 Per historic operating data filed by FMS on an

annual basis at www.SEDAR.com

2 Average annual production calculated from 2010

– 2018, the last year of full-scale commercial operations

3 Approximately 6.5 million tonnes of tailings

capacity at full run rate of 2,000 tpd

4 Subject to certain maintenance and

rehabilitation expenditures that have yet to be determined in size

and scope

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cb111db5-e804-4d4a-962d-00cf6a7959e6

https://www.globenewswire.com/NewsRoom/AttachmentNg/9f121678-6fac-448a-a5dc-13b3934bef0e

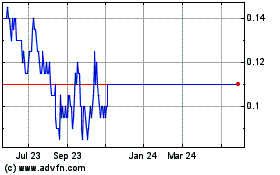

Golden Tag Resources (TSXV:GOG)

Historical Stock Chart

From Oct 2024 to Nov 2024

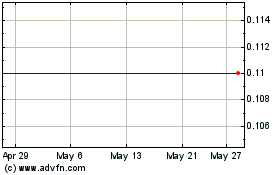

Golden Tag Resources (TSXV:GOG)

Historical Stock Chart

From Nov 2023 to Nov 2024