IBEX Technologies Inc. (TSX VENTURE:IBT), today reported its financial results

for the third quarter ended April 30, 2009.

Solely for the convenience of the reader, selected financial results expressed

in Canadian dollars on the financial statements, have been translated into U.S.

dollars at the April 30, 2009 month-end rate C$1.00 equals US$ 0.8382. This

translation should not be construed as an application of the recommendations

relating to the accounting for foreign currency translation, but rather as

supplemental information for the reader.

HIGHLIGHTS FOR THE QUARTER:

- Record sales of over million dollars in the quarter.

- Sales increased 51% vs. year ago and 8% vs. the previous quarter.

- Net earnings, exclusive of foreign exchange, increased 18% vs. year ago.

- Working capital increased 7% vs. previous quarter

"IBEX had another excellent quarter in both profits and sales" said Paul Baehr,

IBEX CEO "with sales driven by real growth and a favourable foreign currency

exchange rate".

FINANCIAL RESULTS FOR THE THIRD QUARTER

Sales for the quarter ended April 30, 2009 totaled $1,072,603 (US$899,056) an

increase of 51% as compared to $712,997 to the same period in the prior year,

and representing an increase of 8% vs. the previous quarter.

Sales of enzymes increased by 30% vs. the previous year, although down by 6% vs.

the very strong previous quarter. Most of this increase traces to continued

strong demand for the point of care disposables sold by IBEX customers, but

gains are also seen in the use of our enzymes in manufacturing quality control.

Sales of arthritis assays increased by 125% vs. year ago, and increased 56% vs.

the previous quarter.

Net earnings for the quarter ended April 30, 2009 were $242,582 (US$203,332), or

$0.01 per share, compared to net earnings of $259,269, or $0.01 per share, for

the same period year ago, (a decrease of 6%) with increasing revenues offset by

a $117,725 negative charge to the foreign exchange account.

Net earnings for the third quarter declined 16% versus the second quarter,

however, excluding foreign exchange swings, net earnings were $360,307, up 18%

over year ago, 8% versus the second quarter and up 135% when compared with first

quarter. The two first quarters benefited from a $168,617 gain in foreign

exchange due to the increased strength of the US currency, while the current

quarter recorded a foreign exchange loss of $117,725 due to a decline in the

value of the US dollar vs. the last quarter.

Expenses during the quarter increased 22% vs. year-ago but decreased by 11% vs.

the previous quarter. This increase is mainly attributable to the increase in

the level of business activity vs. year ago.

Cash, Cash Equivalents, and Marketable Securities increased 15% during the

quarter to $2,118,086. The Company's working capital was $2,557,888 as at the

end of the third quarter ended April 30, 2009 and up from $2,390,884 as at the

end of the prior quarter ending January 31, 2009.

Financial Summary for the quarters ending

April 30, April 30,

2009 2008

Revenues $1,072,603 $712,997

Earning Before Interests, Tax, Depreciation

& Amortization $265,103 $266,932

Depreciation & Amortization $26,470 $15,763

Net Earnings $242,582 $259,269

Profit per Share $0.01 $0.01

Cash, Cash Equivalents & Marketable Securities $2,118,086 $1,398,745

Working Capital $2,557,888 $1,629,408

Outstanding shares at report date (Common

Shares) 24,703,244 24,703,244

LOOKING FORWARD

IBEX has been successful in bringing its existing business to profitability and

is now turning its attention to pursuing growth opportunities, including further

growing its base business, and maximizing shareholder value through strategic

initiatives with companies where increased market strength and synergies might

be obtained.

While the Company expects the last quarter of Fiscal 2009 to be profitable, it

will not benefit from the same level of foreign exchange gains, nor will it see

the same level of sales (the third quarter was an exceptionally good quarter,

the fourth quarter is typically the smallest quarter).

ABOUT IBEX

The Company manufactures and markets a series of proprietary enzymes

(heparinases and chondroitinases) for use in pharmaceutical research by our

customers, as well Heparinase I, which is used in many leading hemostasis

monitoring devices.

IBEX also manufactures and markets a series of arthritis assays which are widely

used in pharmaceutical research by our customers. These assays are based on the

discovery and increasing role of a number of specific molecular biomarkers

associated with collagen synthesis and degradation.

For more information, please visit the Company's web site at www.ibex.ca.

Safe Harbor Statement

All of the statements contained in this news release, other than statements of

fact that are independently verifiable at the date hereof, are forward-looking

statements. Such statements, based as they are on the current expectations of

management, inherently involve numerous risks and uncertainties, known and

unknown. Some examples of known risks are: the impact of general economic

conditions, general conditions in the pharmaceutical industry, changes in the

regulatory environment in the jurisdictions in which IBEX does business, stock

market volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual future

results may differ materially from the anticipated results expressed in the

forward-looking statements. IBEX disclaims any intention or obligation to update

these statements.

CONSOLIDATED BALANCE SHEETS

April 30 July 31,

UNAUDITED 2009 2008

-------------------------------------------------------------------------

$ $

ASSETS

Current assets

Cash and cash equivalents 2,118,086 372,096

Marketable securities (note 3) - 1,195,168

Accounts receivable 792,302 337,621

Inventories 235,403 292,755

Prepaid expenses 96,186 90,206

-------------------------------------------------------------------------

Sub-total current assets 3,241,977 2,287,846

Property and equipment 383,773 238,809

-------------------------------------------------------------------------

Total assets 3,625,750 2,526,655

-------------------------------------------------------------------------

-------------------------------------------------------------------------

LIABILITIES

Current liabilities

Accounts payable and accrued liabilities 680,042 455,354

-------------------------------------------------------------------------

Total liabilities 680,042 455,354

-------------------------------------------------------------------------

SHAREHOLDERS' EQUITY

Capital stock 52,660,078 52,660,078

Contributed surplus 401,553 396,252

Deficit (50,115,923) (50,985,029)

-------------------------------------------------------------------------

Total shareholders' equity 2,945,708 2,071,301

-------------------------------------------------------------------------

Total liabilities and shareholders' equity 3,625,750 2,526,655

-------------------------------------------------------------------------

-------------------------------------------------------------------------

-------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF DEFICIT

-------------------------------------------------------------------------

For the nine months ended April 30 (unaudited) 2009 2008

-------------------------------------------------------------------------

$ $

Balance - Beginning of period (50 985 029) (51,328,637)

Transition adjustment on adoption of financial

instrument standard (note 2) - (4,711)

-------------------------------------------------------------------------

Restated balance - Beginning of period (50,985,029) (51,333,348)

Net earning for the period 869,106 158,622

-------------------------------------------------------------------------

Balance - End of period (50,115,923) (51,174,727)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

CONSOLIDATED STATEMENTS OF EARNING AND COMPREHENSIVE INCOME

Three months ended Nine months ended

UNAUDITED April 30 April 30

-------------------------------------------------------------------------

2009 2008 2009 2008

-------------------------------------------------------------------------

$ $ $ $

Revenue 1,072,603 712,997 2,680,591 1,816,800

-------------------------------------------------------------------------

Operating expenses

Net research and

development

expenditure

(note 7) - 39,427 - 39,427

Selling, general

and

administrative

expenses and

cost of goods

sold (688,335) (466,525) (1,825,255) (1,661,519)

Amortization of

property and

equipment (26,470) (15,763) (58,488) (49,677)

Other interest

and bank charges (3,223) (3,266) (14,434) (7,703)

Foreign exchange

gain (loss) (117,725) (15,749) 50,892 (22,646)

Gain on sale of

assets 1,783 - 12,172 -

Investment income 3,949 8,124 23,628 36,857

-------------------------------------------------------------------------

Total operating

expenses (830,021) (453,752) (1,811,485) (1,665,261)

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Net earning before

Income tax 242,582 259,245 869,106 151,540

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Current income tax - (24) - (7,082)

-------------------------------------------------------------------------

Net earning and

other comprehensive

income 242,582 259,269 869,106 158,622

-------------------------------------------------------------------------

Net earning and other

comprehensive income

per share

Basic and diluted $0.01 $0.01 $0.04 $0.01

-------------------------------------------------------------------------

-------------------------------------------------------------------------

See accompanying notes

CONSOLIDATED CASH FLOW STATEMENTS

Three months ended Nine months ended

April 30 April 30

-------------------------------------------------------------------------

UNAUDITED 2009 2008 2009 2008

-------------------------------------------------------------------------

$ $ $ $

-------------------------------------------------------------------------

Cash flows provided by

(used in):

Operating activities

Net profit for the

period 242,582 259,269 869,106 158,622

Items not affecting

cash -

Amortization of

property and

equipment 26,470 15,763 58,488 49,678

Stock-based

compensation costs 349 17,150 5,300 24,824

Gain on disposal

of property and

equipment (1,783) - (12,172) -

-------------------------------------------------------------------------

Cash flow relating

to operating

activities 267,618 292,182 920,722 233,124

-------------------------------------------------------------------------

Net changes in

non-cash working

capital items -

Decrease (increase)

in accounts

receivable (6,637) 26,770 (454,687) 155,371

Decrease (increase)

in inventories 93,307 (58,963) 57,353 (8,737)

Decrease (increase)

in prepaid expenses (30,460) (45,903) (5,979) 1,949

Increase (decrease)

in accounts payable

and accrued

liabilities 41,888 119,689 224,693 (429,061)

-------------------------------------------------------------------------

Net changes in

non-cash working

capital balances

relating to operations 98,098 41,593 (178,620) (280,478)

-------------------------------------------------------------------------

Cash flow relating

to operating

activities 365,716 333,775 742,102 (47,354)

-------------------------------------------------------------------------

Investing activities

Additions to

marketable securities - - (209,207) 1,099,673

Proceeds on disposal

of marketable

securities - (1,400) 1,404,375 (2,326)

Additions to

property and

equipment (98,349) - (203,452) -

Proceeds on disposal

of property and

equipment 1,783 - 12,172 -

-------------------------------------------------------------------------

Cash flow relating

to financing

activities (96,566) (1,400) 1,003,888 1,097,347

-------------------------------------------------------------------------

Increase in cash and

cash equivalents

during the quater 269,150 332,375 1,745,990 1,049,993

-------------------------------------------------------------------------

Cash and cash

equivalents

- Beginning of

period 1,848,936 1,066,370 372,096 348,752

-------------------------------------------------------------------------

Cash and cash

equivalents

- End of period 2,118,086 1,398,745 2,118,086 1,398,745

-------------------------------------------------------------------------

-------------------------------------------------------------------------

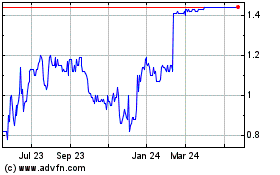

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

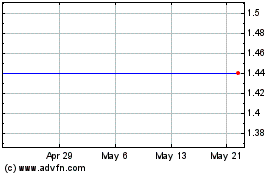

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Jan 2024 to Jan 2025