IBEX Technologies Inc. (“IBEX” or the “Company”) (TSX Venture: IBT)

today reported its financial results for the second quarter and the

six months ended January 31, 2024.

“We were pleased to see revenues continue to

increase as Q2 revenues were up 12% versus a year ago and the

six-month revenues up 15%. The increase in revenues can mainly be

attributed to the strong performance of customers in the hemostasis

market” said Paul Baehr, President & CEO. Net earnings were

down due to the expenses associated with the proposed acquisition

of IBEX by BBI Solutions OEM Limited (“BBI”).

Note: All figures are in Canadian dollars unless

otherwise stated. The Company’s audited consolidated financial

statements for the year ended July 31, 2023, and the

accompanying notes and the related management’s discussion and

analysis can be found on the Company’s website at www.ibex.ca or

under the Company’s profile on SEDAR+ at www.sedarplus.ca.

SALE OF IBEX AT $1.45 PER SHARE

IBEX reminds shareholders that an annual and

special meeting of shareholders will be held in Montreal, Québec on

April 3, 2024 at which IBEX shareholders will consider the

previously-announced proposed amalgamation

(the “Amalgamation”) of IBEX and 15720273 Canada Inc., a

newly-incorporated, wholly-owned subsidiary of BBI, whereby BBI

will acquire all of the issued and outstanding shares of IBEX at a

price of $1.45 per share in cash. The Board of Directors of IBEX

unanimously recommends that shareholders vote for the special

resolution approving the Amalgamation. IBEX’s management proxy

circular for the meeting is available on IBEX’s website at

www.ibex.ca and under IBEX’s profile on SEDAR+ at

www.sedarplus.ca.

FINANCIAL RESULTS FOR THE SECOND QUARTER OF FISCAL

2024

Revenues for the quarter ended January 31, 2024

totaled $1,922,000, up $199,930 (12%) from $1,722,070 for the same

period the prior year.

Expenses totaled $1,766,600 (excluding Income

Tax), an increase of $144,563 versus $1,622,037 for the same period

the prior year. The increase in expenses is mainly due to General

and Administrative expenses, related to professional and legal fees

associated with the previously-announced transaction with BBI.

Net earnings totaled $49,664, a decrease of

$50,369 as compared to Q2 FY2023 with the increase in revenues

offset by income taxes from FY2023 and increase in expenses as

described above.

The Company recorded EBITDA of $199,043 versus

$117,247 in the same period a year ago, an increase of $81,796

primarily due to the reduction in net earnings.

It should be noted that “EBITDA” (Earnings

Before Interest, Tax, Depreciation & Amortization) is not a

performance measure defined by IFRS, but we, as well as investors

and analysts, consider that this performance measure facilitates

the evaluation of our ongoing operations and our ability to

generate cash flows to fund our cash requirements, including our

capital expenditures program. Note that our definition of this

measure may differ from the ones used by other public

corporations.

|

EBITDA for the three months ended |

|

|

|

|

January 31,2024 |

January 31,2023 |

|

Net earnings |

|

$49,663 |

|

$100,033 |

| Depreciation of property,

plant, equipment and intangible assets |

|

$60,399 |

|

$36,825 |

| Depreciation of right-of-use

assets |

|

$73,718 |

|

$65,769 |

| Interest – Net |

|

($90,474) |

|

($85,380) |

| Income tax expense |

|

$105,736 |

|

- |

| Earnings before interest, tax,

depreciation and amortization |

|

$199,043 |

|

$117,247 |

FINANCIAL RESULTS FOR THE SIX MONTHS

ENDED JANUARY 31, 2024

Revenues for the six months ended January 31,

2024 totaled $3,980,206, an increase of $506,565 (15%) as compared

to $3,473,641 in the same period a year ago. The increase in

revenues stems from the continuing strength of the hemostasis

market.

Total Expenses at $3,120,263 increased by

$425,162. The increase relates mainly to professional fees

associated with the aforementioned BBI transaction and provision

for income tax.

Net earnings totaled $859,943, up $81,403 versus

the same period a year ago as a result of the increase in revenues

of $506,565 and increase in expenses of $425,162 as mentioned

above.

The Company recorded EBITDA of $1,055,892, up

$197,411 versus $858,481 in the same period a year ago. The

difference is attributed to the increase in net earnings of

$81,403, an increase in net interest revenue, partially offset by

an increase in depreciation and income taxes.

|

Financial Summary for the six months ended |

|

|

January 31,2024 |

January 31,2023 |

|

Revenues |

|

$3,980,206 |

|

$3,473,641 |

| Earnings before interest, tax,

depreciation & amortization (EBITDA) |

|

$1,055,892 |

|

$858,481 |

| Depreciation of property,

plant, equipment and intangible assets |

|

$120,150 |

|

$70,687 |

| Depreciation of right-of-use

assets |

|

$147,281 |

|

$131,502 |

| Net earnings |

|

$859,943 |

|

$778,540 |

| Earnings per share |

|

$0.03 |

|

$0.03 |

| |

|

|

|

EBITDA for the six months ended |

|

|

|

|

January 31,2024 |

January 31,2023 |

| Net earnings |

|

$859,943 |

|

$778,540 |

| Depreciation of property,

plant, equipment and intangible assets |

|

$120,150 |

|

$70,687 |

| Depreciation of right-of-use

assets |

|

$147,281 |

|

$131,502 |

| Interest - Net |

|

($177,218) |

|

($122,248) |

| Income tax expense |

|

$105,736 |

|

- |

| Earnings before interest,

taxes, depreciation and amortization |

|

$1,055,892 |

|

$858,481 |

The Company’s substantial cash balance of

$8,692,197 increased by $78,351 from $8,547,043 due to the results

mentioned above.

Net working capital increased by $389,684 during

the six months ended January 31, 2024 as compared to the year

ended July 31, 2023.

|

Balance Sheet Summary as at |

|

|

January 31,2024 |

July 31,2023 |

|

Cash and cash equivalents |

|

$8,692,197 |

|

$8,547,043 |

| Net working capital |

|

$8,819,448 |

|

$8,429,764 |

| Outstanding shares at report

date (common shares) |

|

24,507,644 |

|

24,758,644 |

LOOKING FORWARD

As mentioned above, IBEX has entered into an

agreement for the sale of the Company. Subject to shareholder

approval on April 3, 2024, the transaction is expected to close on

April 8, 2024, following which the Company will be delisted from

the TSX Venture Exchange.

In the unlikely event that the transaction does

not close, IBEX would expect to report Fiscal 2024 earnings in line

with the Fiscal 2023 results.

ABOUT IBEX

IBEX manufactures and markets proteins for

biomedical use through its wholly-owned subsidiary IBEX

Pharmaceuticals Inc. (Montréal, QC). IBEX Pharmaceuticals also

manufactures and markets a series of arthritis assays, which are

widely used in osteoarthritis research.

For more information, please visit the Company’s

website at www.ibex.ca.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Safe Harbor Statement

All of the statements contained in this news

release, other than statements of fact that are independently

verifiable at the date hereof, are forward-looking statements. Such

statements, as they are based on the current assessment or

expectations of management, inherently involve numerous risks and

uncertainties, known and unknown. Some examples of known risks are:

the impact of general economic conditions, general conditions in

the pharmaceutical industry, changes in the regulatory environment

in the jurisdictions in which IBEX does business, stock market

volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual

future results may differ materially from the anticipated results

expressed in the forward-looking statements. In particular,

completion of the proposed acquisition of IBEX by BBI is subject to

numerous conditions, termination rights and other risks and

uncertainties, including the ability of IBEX to satisfy closing

conditions, which includes shareholder approval. Accordingly, there

can be no assurance that the proposed transaction with BBI will

occur, or that it will occur on the timetable or on the terms and

conditions contemplated. IBEX disclaims any intention or obligation

to update these statements, except if required by applicable

laws.

Contact:

Paul BaehrChairman, President & CEOIBEX

Technologies Inc.514-344-4004 x 143

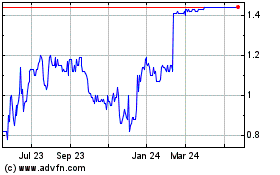

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

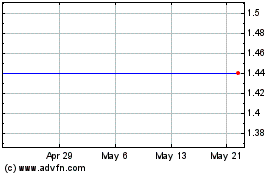

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2023 to Dec 2024