IBEX Files Addendum to Management Proxy Circular for Sale of the Company at $1.45 Per Share

14 March 2024 - 7:14PM

IBEX Technologies Inc. (“

IBEX” or

the “

Company”) (TSX Venture: IBT) announces

that it has filed an addendum to its management proxy circular

dated February 23, 2024 for the annual and special meeting of

shareholders to be held in Montreal, Québec on April 3, 2024.

The addendum is available on IBEX’s website at www.ibex.ca and

under IBEX’s profile on SEDAR+ at www.sedarplus.ca.

The addendum provides that the proposed

amalgamation (the “Amalgamation”) of IBEX and

15720273 Canada Inc. (the “Purchaser”),

a newly-incorporated, wholly-owned subsidiary of BBI Solutions

OEM Limited (“BBI”), whereby BBI will acquire all

of the issued and outstanding shares of IBEX at a price of $1.45

per share in cash, must be approved by a “majority of the minority”

vote under Multilateral Instrument 61-101 Protection of Minority

Security Holders in Special Transactions. As set out in the

addendum, the only shareholder whose shares will be excluded for

the purposes of such minority approval vote is Paul Baehr,

Chairman, President and Chief Executive Officer of IBEX. As a

result, the special resolution approving the Amalgamation requires

the affirmative vote of a simple majority (50% +1) of the votes

cast by all holders of shares present in person or represented by

proxy at the meeting and entitled to vote other than

Mr. Baehr. As disclosed in IBEX’s management proxy circular,

Mr. Baehr held 2,456,477 shares on February 22,

2024, the record date for the shareholders’ meeting, representing

10.02% of IBEX’s outstanding shares.

Under the Canada Business Corporations Act, the

transaction is also subject to IBEX shareholders approving the

Amalgamation by a vote of at least two-thirds of all votes cast by

shareholders present in person at the meeting or represented by

proxy and entitled to vote.

Support and Voting Agreements

Representing 59.15% of Outstanding Shares

IBEX also announces that three additional

shareholders, holding an aggregate of 2,941,038 shares, have

entered into Support and Voting Agreements with the Purchaser under

which they have each agreed irrevocably to support and vote their

shares in favour of the Amalgamation. When combined with

previously-announced Support and Voting Agreements, shareholders

holding in the aggregate approximately 59.15% of IBEX’s outstanding

shares have now entered into Support and Voting Agreements with the

Purchaser.

Unanimous Board

Recommendation

The Board of Directors of IBEX unanimously

recommends that shareholders vote for the special resolution

approving the Amalgamation. IBEX encourages all shareholders to

vote by proxy prior to the meeting. Shareholders are eligible to

vote their IBEX shares if they were an IBEX shareholder of record

at the close of business on February 22, 2024. All proxy forms

should be submitted well in advance of 5:00 p.m. (eastern

time) on April 1, 2024.

About IBEX

IBEX manufactures and markets enzymes for

biomedical use through its wholly-owned subsidiary IBEX

Pharmaceuticals Inc. (Montréal, QC).

For more information, please visit the Company’s

website at www.ibex.ca.

About BBI

BBI is an international provider of immunoassay

products and services to the global diagnostics and life sciences

industries. The company offers high-performance recombinant and

native reagents across the entire immunodiagnostic workflow,

including antigens, antibodies, enzymes and complementary reagents.

It also offers a one-stop service for lateral flow assay

development and lateral flow point of care manufacturing. Our core

purpose is serving the science of diagnostics and in doing so we

supply the majority of the main IVD players globally.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Safe Harbor Statement

All of the statements contained in this news

release, other than statements of fact that are independently

verifiable at the date hereof, are forward-looking statements. Such

statements, as they are based on the current assessment or

expectations of management, inherently involve numerous risks and

uncertainties, known and unknown. Some examples of known risks are:

the impact of general economic conditions, general conditions in

the pharmaceutical industry, changes in the regulatory environment

in the jurisdictions in which IBEX does business, stock market

volatility, fluctuations in costs, and changes to the competitive

environment due to consolidation or otherwise. Consequently, actual

future results may differ materially from the anticipated results

expressed in the forward-looking statements. In particular,

completion of the proposed Amalgamation is subject to numerous

conditions, termination rights and other risks and uncertainties,

including the ability of IBEX to satisfy closing conditions for the

Amalgamation, which includes shareholder approval. Accordingly,

there can be no assurance that the proposed Amalgamation will

occur, or that it will occur on the timetable or on the terms and

conditions contemplated. IBEX disclaims any intention or obligation

to update these statements, except if required by applicable

laws.

Contact:

Paul Baehr, Chairman, President & CEOIBEX

Technologies Inc. 514-344-4004 x 143

Shareholder Questions and

Assistance

Shareholders who have questions relating to the

Amalgamation may also contact IBEX’s proxy solicitation agent and

shareholder communications advisor:

Laurel Hill Advisory Group Toll free:

1-877-452-7184 (+1-416-304-0211 outside North America) Email:

assistance@laurelhill.com

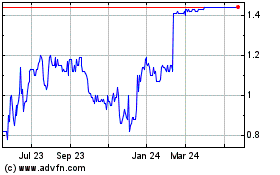

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2024 to Jan 2025

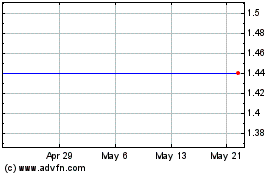

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Jan 2024 to Jan 2025