IBEX Technologies Inc. (TSX VENTURE: IBT), today reported its

financial results for the year ended July 31, 2010.

FINANCIAL RESULTS FOR THE FISCAL YEAR

"As expected, the Company strengthened its balance sheet during

Fiscal 2010, while sales and profits decreased due to changes in

currency and a tough US economy which affected some of our major

customers' ordering patterns" said Paul Baehr, IBEX President and

CEO. "We expect the weak business environment in our respective

markets to continue in Fiscal 2011 before recovering in Fiscal

2012", said Baehr.

Our total cash, cash equivalents, and marketable securities

improved 34% over the year to $3,033,556 from $2,260,344. Working

capital improved to $3,287,875 as at July 31, 2010 from $2,881,146

as at July 31, 2009.

Sales for the year ended July 31, 2010 were $2,628,746 compared

to $3,544,282 for the same period in the prior year, representing a

decrease of 26%. The net decrease of $915,536 in sales vs. year ago

was mainly due to changes in currency, ($586,105) and to a downturn

in volume ($329,432) stemming from a reduction in orders from one

of our major customers who apparently has an excess inventory due

to reduced sales in the US hospital market.

Expenses for the year ended July 31, 2010 decreased $78,160 (4%)

to $2,122,384. Expenses did not decline in proportion to sales due

to the fixed cost nature of the IBEX business.

Net earnings for the year ended July 31, 2010 were $506,362,

compared to net earnings of $1,343,738, for the previous fiscal

year. It is worth mentioning that, Fiscal 2009 was an unusual year,

benefitting from a high US dollar, profits from our successful

currency hedging program ($386,534) along with strong sales, a

combination of events which was not forecasted to repeat in Fiscal

2010).

Financial Summary for the year ending:

--------------------------------------------------------------------------

July 31, July 31,

2010 2009

Revenues $2,628,746 $3,544,282

Earning Before Interests, Tax, Depreciation &

Amortization $624,367 $1,409,367

Depreciation & Amortization $131,161 $83,810

Net Earnings $506,362 $1,343,738

Net Earnings per Share $0.02 $0.05

Cash, Cash Equivalents & Marketable Securities $3,033,556 $2,260,344

Working Capital $3,278,875 $2,881,146

Outstanding shares at report date (Common

Shares) 24,703,244 24,703,244

FINANCIAL RESULTS FOR THE FOURTH QUARTER

Cash, cash equivalents, and marketable securities increased 2%

during the quarter to $3,033,556. The Company's working capital

decreased 6% during the quarter to $3,278,875 (down from $3,482,086

as at the end of the prior quarter ending April 30, 2010) due to

accrued expenses (which increased the current liabilities) and

impact of lower sales (which reduced receivables).

Sales for the quarter ended July 31, 2010 totaled $641,550, a

decrease of 26% as compared to $863,691 in the same period year

ago. Excluding the currency impacts, enzymes sales increased 26%

versus the previous quarter but have decreased 13% versus the same

quarter year ago. Sales of arthritis assays were equal to last

year's same quarter, although down 24% vs. the previous

quarter.

Expenses excluding the foreign exchange gain, write-off and gain

on asset disposal, as compared to year ago, increased to $736,115

from $543,678 in the same quarter a year ago. The increase in

expenses is due to several factors such as a non-cash entry related

to the grant of stock options, higher amortization expense, higher

inventory allocation and expenses related to new R&D projects.

Included in the Q4 expenses was a reversal of a reserve the Company

had taken some years ago in connection with a disposal of

assets.

Net loss for the quarter ended July 31, 2010 was $128,436,

compared to net earnings of $474,632, for the fourth quarter of

fiscal year 2009.

Despite lower sales and the weakness of the US dollar, the

decrease in reported net earnings for the fourth quarter of Fiscal

2010 when compared to the same period a year ago, is largely

attributable to a non-cash calculation related to granted stock

options ($51,052) and a higher inventory allocation cost ($100,963)

as well as higher amortization expenses ($37,534) due to the

purchases of equipment and to the commencement of new R&D

projects ($42,367).

LOOKING FORWARD

Fiscal 2011 looks to be a difficult year for IBEX's major US

customers, and therefore for IBEX. Additionally, the Canadian

dollar is forecast to remain strong against the US dollar, which

does not work in our favour. We therefore do not expect to have

positive net earnings in Fiscal 2011, but expect to return to

profitability in Fiscal 2012, as the US economy improves.

Despite difficult outlook for Fiscal 2011 we will continue to

invest in the future. IBEX will add additional manufacturing

capacity, and will continue with the development of our improved

immuno- assays, which are scheduled for introduction in calendar

2011, with benefits accruing in Fiscal 2012.

ABOUT IBEX

The Company manufactures and markets a series of proprietary

enzymes (heparinases and chondroitinases). These enzymes are used

in pharmaceutical research, quality assurance, and in the case of

Heparinase I, in diagnostic devices which measure hemostasis in

patients.

IBEX also manufactures and markets a series of arthritis assays

which are widely used in pharmaceutical research. These assays

enable the measurement of both the synthesis and degradation of

cartilage components, and are powerful tools in the study of osteo-

and rheumatoid arthritis.

For more information, please visit the Company's web site at

www.ibex.ca.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy of this release

Safe Harbor Statement

All of the statements contained in this news release, other than

statements of fact that are independently verifiable at the date

hereof, are forward-looking statements. Such statements, based as

they are on the current expectations of management, inherently

involve numerous risks and uncertainties, known and unknown. Some

examples of known risks are: the impact of general economic

conditions, general conditions in the pharmaceutical industry,

changes in the regulatory environment in the jurisdictions in which

IBEX does business, stock market volatility, fluctuations in costs,

and changes to the competitive environment due to consolidation or

otherwise. Consequently, actual future results may differ

materially from the anticipated results expressed in the

forward-looking statements. IBEX disclaims any intention or

obligation to update these statements.

Contacts: IBEX Technologies Inc. Paul Baehr President & CEO

514-344-4004 x 143 514-344-8827 (FAX) www.ibex.ca

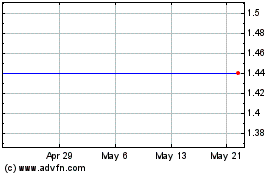

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

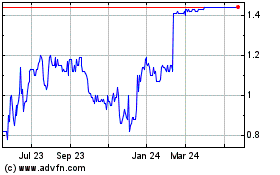

Ibex Technologies (TSXV:IBT)

Historical Stock Chart

From Dec 2023 to Dec 2024