Kane Biotech Inc. (TSX-V:KNE OTCQB:KNBIF) (the

“

Company”, “

Kane” or

“

Kane Biotech”) announces that on September 11,

2023 it has fully subscribed and closed its previously announced

non-brokered private placement offering (the

“

Offering”) of units of the Company

(“

Units”). Kane issued 6,250,000 Units at a price

of $0.08 per Unit for aggregate gross proceeds of $500,000. Each

Unit is comprised of one common share of the Company (a

“

Share”) and one-half of one Share purchase

warrant (each whole warrant, a “

Warrant”). Each

full Warrant entitles the holder thereof to purchase one additional

Share of the Company for a period of 18 months at an exercise price

of $0.10 per Share.

After a period of four months from the closing

date of the Offering, in the event that the Shares traded on the

TSX Venture Exchange (the “TSXV”) have a closing

price at or exceeding $0.20 per Share for five (5) consecutive

trading days, the Company reserves the right to call the Warrants,

at their exercise price of $0.10 per Warrant (the “Call

Right”). If the Company wishes to call the Warrants, the

Company must provide written notice to the holders of the Warrants

that it is calling the Warrants. Investors will have thirty (30)

days from the date of such notice to exercise the Warrants and, in

the event that any Warrants are not exercised, such Warrants shall

be cancelled. Holders of Warrants shall be restricted from

exercising any number of Warrants that will cause the holder to own

such number of Shares that will equal or exceed 20% of the then

issued and outstanding Shares.

“The closing of this Private Placement, during a

period of very challenging external capital market conditions,

comes at an opportune time as we proceed towards three major

milestones: (1) The commercial launch of our coactiv+TM

Antimicrobial Wound Gel cleared by the U.S. Food and Drug

Administration in May 2023, (2) The kick-off of our U.S. Department

of Defense funded Phase 1 clinical trial for our DispersinB® Wound

Gel and (3) The strategic review of our STEM Animal Health

subsidiary,” said Ray Dupuis, Chief Financial Officer.

President and Chief Executive Officer, Marc

Edwards, and Chief Financial Officer, Raymond Dupuis participated

in the Offering (the “Insider Subscription”). The

Insider Subscription is deemed to be a "related party transaction"

as defined under Multilateral Instrument 61-101- Protection of

Minority Security Holders in Special Transactions ("MI

61-101"). The Company is exempt from the formal valuation

and minority approval requirements for related party transactions

pursuant to Subsection 5.5(a) and Subsection 5.7(a) of MI 61-101,

respectively.

The net proceeds of the Offering will be used

for working capital and general corporate purposes.

All securities issued in connection with the

Offering are subject to a hold period of four-months and one day in

Canada.

The closing of the Offering remains subject to

the final approval of the TSX Venture Exchange.

The Company also announces that on September 11,

2023, the Company and Pivot Financial I Limited Partnership

(“Pivot”) entered into a definitive agreement to

amend the terms of the Company’s amended and restated credit

agreement between Pivot and the Company dated August 31, 2021, as

amended (the “Credit Facility”), by, among other

things, increasing the size of the Credit Facility from $5 million

to $6 million and extending the maturity date of the Credit

Facility from August 31, 2023 to November 30, 2023 (the

“Amended Credit Facility”). The Amended Credit

Facility has an interest rate of 15% per annum.

Under the terms of the Amended Credit Facility,

Pivot and the third party guarantor of $1,000,000 of the Amended

Credit Facility (the “Guarantor”), each received

2,500,000 compensation warrants (“Compensation

Warrants”). Subject to the Call Right, each

Compensation Warrant is exercisable into one Share for a period of

12 months at an exercise price of $0.10 per Share. In accordance

with the policies of the TSXV, the 2,500,000 compensation warrants

previously issued to the Guarantor on April 20, 2023 will expire on

the closing date of the Amended Credit Facility and will be of no

further force or effect.

“I’d like to once again thank Pivot for their

ongoing support,” added Mr. Dupuis.

The closing of the Amended Credit Facility

remains subject to the final approval of the TSX Venture

Exchange.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy these securities,

nor shall it constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale is unlawful.

These securities have not been, and will not be, registered under

the United States Securities Act of 1933, as amended, or any state

securities laws, and may not be offered or sold in the United

States or to U.S. persons unless registered or exempt

therefrom.

About Kane Biotech

Kane Biotech is a biotechnology company engaged

in the research, development and commercialization of technologies

and products that prevent and remove microbial biofilms. The

Company has a portfolio of biotechnologies, intellectual property

(80 patents and patents pending, trade secrets and trademarks) and

products developed by the Company's own biofilm research expertise

and acquired from leading research institutions. StrixNB™,

DispersinB®, Aledex™, bluestem™, bluestem®, silkstem™, goldstem™,

coactiv+™, coactiv+®, DermaKB™ and DermaKB Biofilm™ are trademarks

of Kane Biotech Inc. The Company is listed on the TSXV under the

symbol "KNE" and on the OTCQB Venture Market under the symbol

“KNBIF.”

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Caution Regarding Forward-Looking

InformationThis press release contains certain statements regarding

Kane Biotech Inc. that constitute forward-looking information under

applicable securities law. These statements reflect

management’s current beliefs and are based on information currently

available to management. Certain material factors or assumptions

are applied in making forward-looking statements, and actual

results may differ materially from those expressed or implied in

such statements. These risks and uncertainties include, but are not

limited to, risks relating to the Company’s: (a) financial

condition, including lack of significant revenues to date and

reliance on equity and other financing; (b) business, including its

early stage of development, government regulation, market

acceptance for its products, rapid technological change and

dependence on key personnel; (c) intellectual property including

the ability of the Company to protect its intellectual property and

dependence on its strategic partners; and (d) capital structure,

including its lack of dividends on its common shares, volatility of

the market price of its common shares and public company costs.

Further information about these and other risks and uncertainties

can be found in the disclosure documents filed by the Company with

applicable securities regulatory authorities, available

at www.sedar.com. The Company cautions that the foregoing list

of factors that may affect future results is

not exhaustive.

For more information:

Marc Edwards

Chief Executive Officer

Kane Biotech Inc

medwards@kanebiotech.com

Ray Dupuis

Chief Financial Officer

Kane Biotech Inc

rdupuis@kanebiotech.com

Nicole Sendey

Investor Relations/PR

Kane Biotech Inc

nsendey@kanebiotech.com

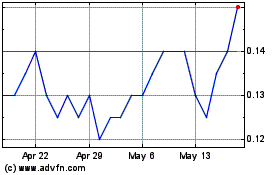

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Kane Biotech (TSXV:KNE)

Historical Stock Chart

From Jan 2024 to Jan 2025