St. James Gold

Corp. (the

“Company”) (TSXV: LORD) (OTCQB:

LRDJF) (FSE: BVU3) is pleased to announce

the closing today of the second tranche of its previously announced

brokered private placement offering (the

“

Offering”). The second tranche consisted of

424,391 units of the Company (each, a “

Unit”) at a

price of $3.22 per Unit and 108,801 flow-through units of the

Company (each, a “

FT Unit”) at a price of $3.86

per FT Unit for aggregate gross proceeds to the Company of

approximately $1,786,511. Total gross proceeds to the Company

including the first tranche of the Offering, which closed on August

27, 2021, was approximately $4,015,687. The Offering was led by

Canaccord Genuity Corp. as sole lead agent (the

“

Agent”).

Each Unit consists of one common share in the

capital of the Company (each, a “Common Share”)

and one Common Share purchase warrant (each, a

“Warrant”), with each Warrant entitling the holder

thereof to purchase one additional Common Share at an exercise

price of $4.18 for a period of three (3) years from the issue

date.

Each FT Unit qualified as a “flow-through share”

as defined in subsection 66(15) of the Income Tax Act (Canada) (the

“Tax Act”) and is comprised of one Common Share

and one Warrant, with each Warrant entitling the holder thereof to

purchase one additional Common Share (which will not qualify as a

“flow-through share”) at an exercise price of $4.18 for a period of

three (3) years from September 9, 2021 (the “Closing

Date”).

As consideration for its services in connection

with the closing of the second tranche of the Offering, the Company

paid the Agent a cash fee in the amount of $151,774 and issued the

Agent an aggregate of 43,271 broker warrants (each a

“Broker Warrant”). Each Broker Warrant is

exercisable to purchase one Unit for a period of three (3) years

from the Closing Date at an exercise price of $3.22. The Company

also issued the Agent an aggregate of 22,393 Units in satisfaction

of the corporate finance fee.

The Company intends to use the net proceeds of

the Offering to conduct drilling on the Florin Gold Project,

exploration on the Company’s Newfoundland properties and for

general corporate purposes. The gross proceeds raised from the sale

of FT Units will only be used to incur “Canadian exploration

expenses” that are “flow-through mining expenditures” (as such

terms are defined in the Tax Act) on the Company’s options on the

Florin Gold Project and Newfoundland properties.

Pursuant to applicable Canadian securities laws,

all securities issued and issuable in connection with the second

tranche of the Offering will be subject to a four (4) month hold

period ending January 10, 2022. The Offering remains subject to

final approval from the TSX Venture Exchange (the

“TSXV”).

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities to be offered have not been, and will not

be registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities

Act”) or under any U.S. state securities laws, and may not

be offered or sold in the United States or to, or for the account

or benefit of, U.S. persons, absent registration or an applicable

exemption from the registration requirements of the U.S. Securities

Act and applicable state securities laws.

About St James Gold Corp.

St. James Gold Corp. is a publicly traded

company listed on the TSXV under the trading symbol “LORD”, in the

U.S. Market listed on the OTCQB under the trading symbol “LRDJF”

and on the Frankfurt Stock Exchange under the trading symbol

“BVU3”. The Company is focused on creating shareholder value

through the discovery and development of economic mineral deposits

by acquiring prospective exploration projects with well delineated

geological theories, integrating all available geological,

geochemical and geophysical datasets, and funding efficient

exploration programs. The Company currently holds both an option to

acquire a 100% interest in 29 claims covering 1,791 acres in the

Gander gold district in north-central Newfoundland adjacent to New

Found Gold Corp.’s Queensway North project, and an option to

acquire a 100% interest in 28 claims covering 1,730 acres in

central Newfoundland adjacent to Marathon Gold’s Valentine Lake

property. The Company also announced an Option and Joint Venture

Agreement dated April 1, 2021, as amended, to acquire up to an 85%

interest in the Florin Gold Project, covering nearly 22,000

contiguous acres in the historic Tintina Gold Belt in the Yukon

Territory. For more corporate information please visit:

http://stjamesgold.com/

George Drazenovic, CPA, CGA, MBA, CFA

St. James Gold Corp.For further information,

please contact:George Drazenovic, Chief Executive OfficerTel:

1 (800)

278-2152Email: info@stjamesgold.com

Forward Looking Statements

This news release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities laws (collectively, “forward-looking

statements”). Forward-looking statements in this news

release relate to, among other things: the timing and receipt of

final approval from the TSXV for the Offering, the expected use of

the proceeds of the Offering, and all other statements that are not

historical facts, particularly statements that express, or involve

discussions as to, expectations, beliefs, plans, objectives,

assumptions or future events or performance of the Company. Often,

but not always, forward-looking statements can be identified

through the use of words or phrases such as “will likely result”,

“are expected to”, “expects”, “will continue”, “is anticipated”,

“anticipates”, “believes”, “estimated”, “intends”, “plans”,

“forecast”, “projection”, “strategy”, “objective” and “outlook”.

Forward-looking statements contained in this news release are made

based on reasonable estimates and assumptions made by management of

the Company at the relevant time in light of its experience and

perception of historical trends, current conditions and expected

future developments, as well as other factors that are believed to

be appropriate and reasonable in the circumstances. Forward-looking

statements contained in this news release are made as of the date

of this news release and the Company will not update any such

forward-looking statements as a result of new information or if

management’s beliefs, estimates, assumptions or opinions change,

except as required by law. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors, many of which are

beyond the Company’s control, which could cause actual results,

performance, achievements and events to differ materially from

those that are disclosed in or implied by such forward-looking

statements. Such risks and uncertainties include, but are not

limited to, the impact and progression of the COVID-19 pandemic and

other factors outlined in the Company’s Annual Information Form

dated July 26, 2021 (the “AIF”) filed under the

Company’s profile on SEDAR at www.sedar.com. The Company

cautions that the list of risk factors and uncertainties described

in its AIF on SEDAR are not exhaustive and other factors could

materially affect its results.

New factors emerge from time to time, and it is

not possible for the Company to consider all of them, or assess the

impact of each such factor or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. Any

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS

DEFINED IN THE POLICIES OF THE TSX VENTURE

EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF

THIS RELEASE.

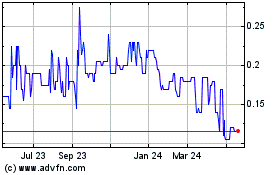

St James Gold (TSXV:LORD)

Historical Stock Chart

From Dec 2024 to Jan 2025

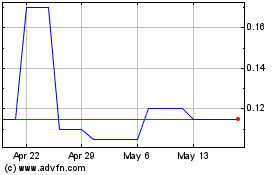

St James Gold (TSXV:LORD)

Historical Stock Chart

From Jan 2024 to Jan 2025