LSL Pharma Group Announces the Upsizing of Its Private Placement From $3.5 Million to $7.5 Million

11 April 2024 - 9:00PM

LSL PHARMA GROUP INC. (TSXV: LSL)

(the "

Corporation" or "

LSL Pharma

"), a Canadian integrated pharmaceutical company, today announced

the upsizing of its previously communicated non-brokered private

placement financing of Units (as defined hereinafter) to maximum

gross proceeds of $7.5 million (188 750 000 Units) (the

“

Financing”). The upsizing follows an initial

first closing of $2.68 million announced on March 18, 2024

concurrent to conversion of debt into units for $3.75 million.

Each Unit to be issued pursuant to the Financing

will be at a price of $0.40 (the “Units”) and will

consist of one (1) class A share of the Corporation (a

“Common Share”) and one (1) Common Share purchase

warrant (a “Warrant”). Each Warrant will entitle

the holder, subject to adjustments in certain cases, to purchase

one (1) Common Share (a “Warrant Share”) at a

price of $0.70 for a period of 36 months following the closing of

the Financing.

Although the Financing is non-brokered, the

Corporation may pay finders’ fees of up to 5% of the gross proceeds

raised from investors introduced to the Corporation by a finder,

payable in cash; and finders’ warrants of up to 5% of the number of

Units issued to investors introduced to the Corporation by a

finder. Each Finder’s Warrant will entitle the holder, subject to

adjustments in certain cases, to purchase one (1) Common Share at a

price of $0.70 for a period of 18 months following the closing of

the Financing (the “Finder’s Warrants”).

Each Unit, Common Share, Warrant, Warrant Share,

Finder’s Warrant and Common Share issued upon the exercise of the

Finder’s Warrant will be subject to a four month hold period under

the applicable securities laws. The Financing and the Units for

Debts are subject to the regulatory approvals, including the TSX

Venture Exchange.

INVESTOR RELATIONS

As announced on October 6, 2023, LSL Pharma had

engaged Relations Publiques Paradox Inc. (“Paradox”) to provide

investor relations services on its behalf. LSL Pharma wishes to

confirm that at the time of its appointment, Paradox was an arm's

length party to LSL Pharma. The directors of Paradox are

Jean-François Meilleur, acting President, Carl Desjardins and Karl

Mansour. Paradox Équité Partenaires Ltée, itself controlled by

Gestion Jean-François Meilleur Inc., Gestion Carl Desjardins Inc.

and Gestion Karl Mansour Inc., is the majority shareholder of

Paradox. Jean-François Meilleur, Carl Desjardins and Karl Mansour

were the persons providing the services to LSL Pharma. Paradox's

head office is situated at 306, Sherbrooke Street East, 1st floor,

Montréal, Québec. At the time of his appointment, with the

exception of a holding of less than 2% of the shares issued and

outstanding on a non-diluted and diluted basis, Paradox had no

other participation, direct or indirect, in LSL Pharma or its

securities, nor the right or the intention to acquire additional

participation. Otherwise, Paradox's monthly fees were payable from

LSL Pharma's cash and cash equivalents. The contract with Paradox

was terminated on January 31, 2024.

CAUTION REGARDING FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking

statements as defined under applicable Canadian securities

legislation. Forward-looking statements can generally be identified

by the use of forward-looking terminology such as "may", "will",

"expect", "intend", "estimate", "continue" or similar expressions.

Forward-looking statements are based on a number of assumptions and

are subject to various known and unknown risks and uncertainties,

many of which are beyond the Corporation's ability to control or

predict, that could cause actual results or performance to differ

materially from those expressed or implied in such forward-looking

statements. These risks and uncertainties include, but are not

limited to, those identified in the Corporation's filings with

Canadian securities regulatory authorities, such as legislative or

regulatory developments, increased competition, technological

change, and general economic conditions. All forward-looking

statements made herein should be read in conjunction with such

documents.

Readers are cautioned not to place undue

reliance on forward-looking statements. No assurance can be given

that any of the events referred to in the forward-looking

statements will transpire, and if any of them do, the actual

results, performance or achievements of the Corporation may differ

materially from those expressed or implied by the forward-looking

statements. All forward-looking statements contained in this press

release speak only as of the date of this press release. The

Corporation does not undertake to update these forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

ABOUT LSL PHARMA GROUP

INC.

LSL Pharma is an integrated Canadian

pharmaceutical company specializing in the development,

manufacturing and commercialization of high-quality sterile

ophthalmic pharmaceuticals, as well as natural health products in

solid dosage forms. For further information, please visit the

following websites www.groupelslpharma.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CONTACT

François Roberge, President and Chief Executive Officer

Telephone: (514) 664-7700

E-mail: Investors@groupelslpharma.com

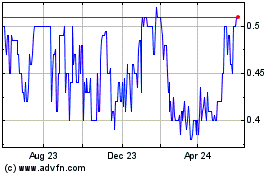

LSL Pharma (TSXV:LSL)

Historical Stock Chart

From Feb 2025 to Mar 2025

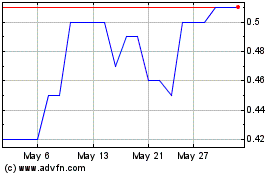

LSL Pharma (TSXV:LSL)

Historical Stock Chart

From Mar 2024 to Mar 2025