LSL Pharma Group Secures $1.5 Million as the First Closing of Its Non-Brokered Private Placement

28 June 2024 - 12:27AM

LSL PHARMA GROUP INC. (TSXV: LSL, LSL.DB) (the "Corporation" or

"LSL Pharma"), a Canadian integrated pharmaceutical company,

announced that it has met the closing conditions of a non-brokered

private placement for $1,5 million representing the first closing

of the private placement financing announced on June 5, 2024 (the

“Financing”).

Pursuant to the Financing, the Corporation has

issued 3,727,000 units (the “Units”) at a price of $0.40 per unit

for aggregate gross cash proceeds of $1,490,800 out of a maximum of

$3.0 million (7.5 million Units). Each Unit consists of one class A

share of the Corporation (a “Common Share”) and one Common Share

purchase warrant (a “Warrant”). Each Warrant entitles the holder,

subject to adjustments in certain cases, to purchase one (1) Common

Share (a “Warrant Share”) at a price of $0.70 for a period of 24

months following the closing of the Financing. The proceeds of the

Financing will be used to further expand production capacity at

each of the LSL Laboratory and Steri-Med Pharma plants and for

general working capital purposes.

“We are encouraged by the sustained interest in

our Company as demonstrated by the continued demand from new

investors to participate in our financings” said Francois Roberge,

President and CEO of the Corporation. “LSL Pharma is experiencing

continuous organic growth as well as expansion of its operations

following the recent acquisition of Virage Santé. This financing

will help us maintain a healthy balance sheet as we continue

executing our growth plan”, added Mr. Roberge.

In connection with this Financing, the

Corporation paid to finders dealing at arm’s length with the

Corporation, finders’ fees for a total of $37,790 in cash and

issued 94,475 finders’ warrants. Each Finder’s Warrant entitles the

holder to purchase one (1) Common Share at a price of $0.70 for a

period of 18 months following the closing of the Financing.

Each issued Unit, Common Share, Warrant, Warrant

Share, Finder’s Warrant and Common Share issued upon the exercise

of the Finder’s Warrant will be subject to a four month hold period

under the applicable securities laws. The Financing is subject to

the regulatory approvals, including the TSX Venture Exchange.

Within this first tranche of the Financing,

Mario Paradis, a director of the Company (the

“Insider”), has received 250,000 Units pursuant to

the Financing for an aggregate subscription price of $100,000. Its

direct or indirect holding, on a non-diluted basis, was nil prior

to the Financing and reaches now 0.22% following the Financing

while, on a partially diluted basis, was of 0.13% prior to the

Financing and reaches now 0.35%, approximately. The board of

directors of the Company has considered the issuance of the Units

to the Insider as a related party transaction subject to Regulation

61-101 respecting Protection of Minority Security Holders in

Special Transactions (the “Regulation 61-101”) and

has unanimously approved the issuance but excluding Mario Paradis.

This transaction is exempt from the formal valuation and minority

shareholder approval requirements of Regulation 61-101 as the

Company is listed on the TSX Venture Exchange and the fair market

value of any security issued to, or the consideration paid, does

not exceed 25% of the Company's market capitalization. LSL Pharma

did not file a material change report pertaining to the Insider’s

interest more than 21 days prior to the date of the closing of the

Financing, as such interest was not determined at that time. The

board members of the Company, but excluding Mario Paradis, reviewed

its financial conditions and the state of the financial market and

unanimously determined that the terms and conditions of the

Financing, including the issuance to the Insider, were fair and

equitable and represented the best strategic option available. In

addition, neither the Company nor the Insider have knowledge of any

material information concerning the Company or its securities that

has not been generally disclosed.

INVESTOR RELATIONS

As announced on June 11, 2024, LSL Pharma had

engaged Red Cloud Securities (“Red Cloud”) to provide market

stability and liquidity services. LSL Pharma confirms that Red

Cloud will use its own funds or securities for the market-making

activities and Adam Smith will be responsible for the trading

activities. It is further confirmed that Red Cloud and/or its

clients have and may acquire interests, directly or indirectly, in

the securities of LSL Pharma.

CAUTION

REGARDING FORWARD-LOOKING

STATEMENTS

This press release may contain forward-looking

statements as defined under applicable Canadian securities

legislation. Forward-looking statements can generally be identified

by the use of forward-looking terminology such as "may", "will",

"expect", "intend", "estimate", "continue" or similar expressions.

Forward-looking statements are based on a number of assumptions and

are subject to various known and unknown risks and uncertainties,

many of which are beyond the Corporation's ability to control or

predict, that could cause actual results or performance to differ

materially from those expressed or implied in such forward-looking

statements. These risks and uncertainties include, but are not

limited to, those identified in the Corporation's filings with

Canadian securities regulatory authorities, such as legislative or

regulatory developments, increased competition, technological

change and general economic conditions. All forward-looking

statements made herein should be read in conjunction with such

documents.

Readers are cautioned not to place undue

reliance on forward-looking statements. No assurance can be given

that any of the events referred to in the forward-looking

statements will transpire, and if any of them do, the actual

results, performance or achievements of the Corporation may differ

materially from those expressed or implied by the forward-looking

statements. All forward-looking statements contained in this press

release speak only as of the date of this press release. The

Corporation does not undertake to update these forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

ABOUT LSL

PHARMA GROUP

INC.

LSL Pharma Group Inc. is an integrated Canadian

pharmaceutical company specializing in the development,

manufacturing, and commercialization of high-quality sterile

ophthalmic pharmaceuticals, as well as natural health products in

solid dosage forms. For further information, please visit the

following website www.groupelslpharma.com.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CONTACT

François Roberge

President and Chief Executive Officer

(514) 664-7700

E-mail: Investors@groupelslpharma.com

OR

Luc Mainville

Executive VP & Chief Financial Officer

(514) 664-7700 ext.: 301

E-mail : lmainville@groupelslpharma.com

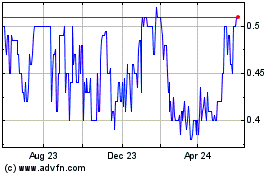

LSL Pharma (TSXV:LSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

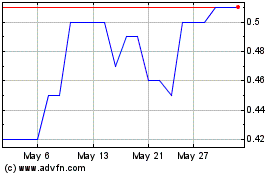

LSL Pharma (TSXV:LSL)

Historical Stock Chart

From Dec 2023 to Dec 2024