Marksmen Energy Inc. (“

Marksmen” or the

“

Company”) announces that it has completed the

first closing of its previously announced non-brokered private

placement of units (the “

Units”) of Marksmen (the

“

Offering”). The Company issued 2,490,000 Units at

a price of $0.05 per Unit for aggregate gross proceeds of $124,500.

Each Unit is comprised of one (1) common share (“

Common

Share”) and one (1) share purchase warrant

(“

Warrant”) of Marksmen. Each whole Warrant

entitles the holder thereof to purchase one Common Share at a price

of $0.10 per share expiring two (2) years from the date of

issuance, subject to acceleration provisions (see news release

dated July 12, 2023).

Pursuant to the first closing of the Offering,

Marksmen paid cash commissions to a qualified non-related party of

$2,000 and issued 40,000 broker warrants, each broker warrant

entitling the holder to acquire one Common Share at a price of

$0.05 per share for a period of one (1) year from the date of

issuance.

Marksmen intends to use the net proceeds of

$122,500 from the first closing of the Offering to complete an

upper zone in a well in Pickaway County, Ohio.

Completion of the Offering is subject to

regulatory approval including, but not limited to, the approval of

The TSX Venture Exchange Inc. (“TSXV”). The

securities issued are subject to a four month hold period from the

date of issuance.

The Company expects to complete a second closing

on or before September 29, 2023.

Related Party Participation in the Private

Placement

Insiders subscribed for an aggregate of 890,000

Units in the first closing of the Offering for a total of 36%. As

insiders of Marksmen participated in this first closing of the

Offering, it is deemed to be a “related party transaction” as

defined under Multilateral Instrument 61-101-Protection of Minority

Security Holders in Special Transactions (“MI

61-101”).

Neither the Company, nor to the knowledge of the

Company after reasonable inquiry, a related party, has knowledge of

any material information concerning the Company or its securities

that has not been generally disclosed.

The Offering is exempt from the formal valuation

and minority shareholder approval requirements of MI 61-101

(pursuant to subsections 5.5(c) and 5.7(1)(b)) as it was a

distribution of securities for cash and neither the fair market

value of the Units distributed to, nor the consideration received

from, interested parties exceeded $2,500,000.

The Company did not file a material change

report more than 21 days before the expected closing of the

Offering because the details of the participation therein by

related parties of the Company were not settled until shortly prior

to the first closing of the Offering and the Company wished to

close on an expedited basis for business reasons.

Early Warning Report

In connection with the first closing of the

Offering, the Company issued 300,000 Units to Mr. Archie Nesbitt,

indirectly, for total consideration of $15,000.

As at the date of Mr. Nesbitt's previously filed

early warning report of November 25, 2019, Mr. Nesbitt held,

directly and indirectly, 10,832,697 Common Shares representing

9.67% of the issued and outstanding Common Shares, 1,198,327 vested

stock options ("Options") and 1,925,833 Warrants.

Assuming the exercise of the Warrants and Options, Mr. Nesbitt

would have had control or direction over 14,447,530 Common Shares,

representing 12.51% of the issued and outstanding Common Shares as

of November 22, 2019. Since that time, the Company has increased

the number of Common Shares issued and outstanding pursuant to the

completion of private placements and the exercise by shareholders

of convertible securities. The increase to the Company's issued and

outstanding Common Shares and the acquisition of the Units resulted

in a decrease to Mr. Nesbitt's diluted and undiluted holdings of

2.88% and 2.72%, respectively, which triggered the requirement to

file an early warning report.

Immediately after the first closing of the

Offering, Mr. Nesbitt held, directly and indirectly, 13,210,497

Common Shares, representing 6.95% of the issued and outstanding

Common Shares, 2,705,833 Warrants and 2,925,000 Options. Assuming

the exercise of the Warrants and Options, Mr. Nesbitt will have

control or direction over 18,841,330 Common Shares, representing

9.63% of the issued and outstanding Common Shares.

Mr. Nesbitt's acquisition of the Units was made

for investment purposes and Mr. Nesbitt intends to increase or

decrease his holdings in the Company depending on market conditions

and as circumstances warrant.

A report respecting this acquisition has been

filed with the applicable securities commissions using the Canadian

System for Electronic Document Analysis and Retrieval (SEDAR+) and

is available for viewing on the Company's profile at

www.sedarplus.ca.

For additional information regarding this news

release please contact Archie Nesbitt, Director, and CEO of the

Company at (403) 265-7270 or e-mail

ajnesbitt@marksmenenergy.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

This news release may contain certain

forward-looking information and statements, including without

limitation, the second closing of the private placement, statements

pertaining to the use of proceeds, the Company's ability to obtain

necessary approvals from the TSX Venture Exchange and Mr. Nesbitt’s

intentions regarding his holdings of securities of the Company. All

statements included herein, other than statements of historical

fact, are forward-looking information and such information involves

various risks and uncertainties. There can be no assurance that

such information will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such information. A description of assumptions used to develop such

forward-looking information and a description of risk factors that

may cause actual results to differ materially from forward-looking

information can be found in Marksmen’s disclosure documents on the

SEDAR+ website at www.sedarplus.ca. Marksmen does not undertake to

update any forward-looking information except in accordance with

applicable securities laws.

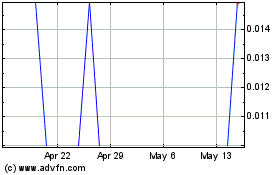

Marksmen Energy (TSXV:MAH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Marksmen Energy (TSXV:MAH)

Historical Stock Chart

From Feb 2024 to Feb 2025