InvestmentPitch Media Video Discusses MAS Gold’s Results from Remaining 30 Diamond Drill Holes at North Lake Deposit in La Ronge Gold Belt Including 8.79 g/t Gold over 3.0 Meters

10 August 2022 - 8:00PM

MAS Gold Corp. (TSXV:MAS) (OTCQB:MSGCF) (FSE:63G) released results

from the remaining 30 drill holes from its successful 2022 winter

diamond drill program in Saskatchewan. MAS Gold, a Canadian mineral

exploration company focused on advancing its gold exploration

projects in the prospective La Ronge Gold Belt of Saskatchewan,

operates six properties including the Preview-North, Greywacke

Lake, Preview SW, Contact Lake, Elizabeth Lake, and Henry Lake

Properties totalling 35,176 hectares or 86,921 acres. These

properties extend along the geologically prospective La Ronge,

Kisseynew and Glennie Domains that make up the La Ronge Gold Belt.

A Media Snippet accompanying this announcement is

available by clicking on the image or link below:

For more information, please view the

InvestmentPitch Media video which provides additional information

about this news and the company. The video is available for viewing

on “InvestmentPitch” and on

“YouTube”. If these links are not enabled, please

visit www.InvestmentPitch.com and enter “MAS Gold”

in the search box.

These results include the remaining 22 holes from

the North Lake Deposit which are highlighted by high-grade

mineralization in the most southern hole, NL22-101 which reported

8.79 g/t gold over 3 meters and 7.0 g/t gold over 1.0 meter.

Further evaluation of NL22-101 is planned to assist in developing

an exploration strategy to follow up the high-grade results.

The table in the video shows all the results from

the winter program at the North Lake Deposit, with the systematic

infill drill program successfully intersecting near-surface gold

mineralization at less than 50 meters below surface. This data will

be used to upgrade the North Lake deposit resource model with a

focus on near surface mineralization with open pit potential,

bringing the company one step closer towards mine development.

Results from the remaining 4 holes at the Point

Deposit show an extension by an estimated 295 meters to the south

as well as down dip extension of the deposit. Drill hole RM22-060

intersected 3.00 g/t gold over 4.9 meters, including 6.65 g/t gold

over 0.8 meters along strike to the south of the historic drill

hole RM85-019. This is a notable discovery and confirms the

potential to significantly expand this deposit. Drill hole RM22-057

successfully extended down dip mineralization intersecting multiple

zones highlighted by 8.60 g/t gold over 2 meters including 14.50

g/t gold over 1 meter.

The four holes from the Preview SW Property were

split between the Preview SW Deposit, with hole PR22-188

successfully intersecting multiple mineralized zones at depth

highlighted by 13.40 g/t gold over 1.55 meters, 8.85 g/t gold over

0.7 meters and 9.47 g/t gold over 1.00 meter, and the Adit Zone

which continued to intersect mineralization along strike, with hole

PR22-109A reporting 6.55 g/t gold over 1.1 meters and 1.44 g/t gold

over 4.2 meters.

Darren Slugoski, Chief Geologist, stated: “We are

extremely excited by the positive results we have received from our

winter drill program. Drill hole NL22-101 intersected on our North

Lake deposit confirms a southern extension of the deposit as well

as an additional potential high-grade zone. The results from the

Point deposit demonstrates a strong potential for a significant

upside with 295m of untested ground between the southern edge of

the Point deposit and drill hole RM22-060. The Preview SW Deposit

continues to be an integral spoke demonstrated by the gold grades

intersected in PR22-188. Results from these thirty holes in the

Winter Program at North Lake Deposit, Point Deposit and

Preview SW Property have exceeded our team’s expectations as

they help sling-shot MAS into further developing the Hub and Spoke

Model.”

Jim Engdahl, CEO, added: “The winter drill results

together with the acquisitions of the Preview SW Deposit and

Contact Lake Mine allows MAS Gold to move towards restarting the

PEA (Prefeasibility Economic Study) in 2023. Our North Lake Deposit

continues to demonstrate feasibility of being the hub in MAS Gold’s

Hub and Spoke model along with the Preview SW deposit and the

Contact Lake Mine being the primary spokes. Management is extremely

pleased with this latest round of thirty diamond drilling

results.”

MAS Gold plans to provide a summary by late next

week of the entire Winter Drill program as well as an overview of

our plans moving forward to increase our resource and develop the

Hub and Spoke Model to create value for MAS Gold and its

shareholders.

The company recently concluded a channel sampling

program at its North Lake Deposit, which was successful in

identifying and sampling the felsite unit up to five hundred meters

along strike to the northeast of the North Lake Deposit. The

felsite is known to host the North Lake Deposit which includes an

Inferred Mineral Resource of 18,100,000 t grading 0.85 g/t Au,

representing 494,000 contained ounces of gold.

The shares are trading at $0.075. For more

information, including the resource estimates for both the

Greywacke North and Preview SW deposits, please visit the company’s

website at www.MASgoldcorp.com, contact Jim Engdahl, CEO, at

306-262-4964 or by email at Jim@MASgoldcorp.com. For investor

relations, contact Laurie Thomas, VP Investor Relations and

Business Development at laurie@MASgoldcorp.com.

Disclaimer

The information in this InvestmentPitch Media Ltd

video is for the viewers information only. MAS Gold Corp has paid a

fee not exceeding $2,000 in cash to have its current news release

produced in video format. The corporate information is based on

information that is publicly available. Any information provided by

InvestmentPitch Media Ltd., through its media services is not to be

construed as a recommendation or suggestion or offer to buy or sell

securities but is provided solely as an informational media

service. InvestmentPitch Media Ltd makes no warranties or

undertakings as to the accuracy or completeness of this

information. All due diligence should be done by the viewer or

their financial advisor. Investing in securities is speculative and

carries risk.

About InvestmentPitch Media

InvestmentPitch Media leverages the power of

video, which together with its extensive distribution, positions a

company’s story ahead of the 1,000's of companies seeking awareness

and funding from the financial community. The company specializes

in producing short videos based on significant news releases,

research reports and other content of interest to investors.

CONTACT: InvestmentPitch Media Barry Morgan, CFO

bmorgan@investmentpitch.com

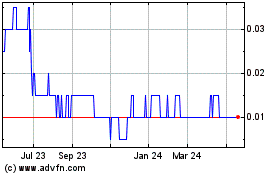

Mas Gold (TSXV:MAS)

Historical Stock Chart

From Oct 2024 to Nov 2024

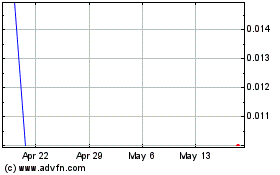

Mas Gold (TSXV:MAS)

Historical Stock Chart

From Nov 2023 to Nov 2024