Mayfair Gold Corp. (“

Mayfair” or the

“

Company”) (

TSX-V:

MFG; OTCQB:

MFGCF) today announced that leading independent

proxy advisory firm Glass Lewis has issued a report recommending

that Mayfair shareholders vote the WHITE Proxy or voting

instruction form FOR the management slate and all management

resolutions at the upcoming Annual General and Special Meeting of

Shareholders to be held on June 5, 2024 (the

“

Meeting”).

Glass Lewis becomes the second proxy advisory

firm to recommend in favour of all management resolutions,

following a similar report issued last week by ISS. Glass Lewis

recommends that shareholders vote FOR each of Mayfair’s highly

qualified director nominees: Harry Pokrandt, Patrick Evans,

Christopher Reynolds and Douglas Cater, and AGAINST all proposals

and nominees put forward by Muddy Waters Capital LLC

(“Muddy Waters”).

In its Recommendation section, Glass Lewis

states the following:

“Having evaluated the

arguments provided by [Muddy Waters], as well as the incumbent

board’s response, we do not believe there exists a sufficiently

compelling case for incremental change at this time. In this case,

we believe [Muddy Waters] has failed to provide not only adequate

support to its allegations against the incumbent Board’s alleged

mismanagement and inadequate performance, but also any form of

disclosure pertaining to a credible plan for the Company’s

future.”

Harry Pokrandt, Chairman of the Board of

Directors of the Company (the “Board”),

commented:

“This is now the

second independent advisory firm that has questioned Muddy Waters’

case for removing the current board. With the voting deadline

rapidly approaching, shareholders should protect their interests by

voting to re-elect the experienced directors and retain the proven

management team at Mayfair.”

The Glass Lewis report makes it clear that Muddy

Waters has built its case on one unsubstantiated claim after

another and, in some cases, misleading statements. We believe

shareholders should hold them to a higher standard, starting at a

minimum with clearly articulated reasons for their actions and

specific details on their alternative strategy.

This is now the second independent advisory firm

that has explicitly called out Muddy Waters’ failure to make its

case for removing the current board. Muddy Waters offered no

response to the first report, and we can presume they will remain

silent about this latest one from Glass Lewis.

With the voting deadline rapidly approaching, it

has now become urgent for shareholders to protect their interests

by voting to re-elect the experienced directors and retain the

proven management team at Mayfair.

Glass Lewis commentary relating to specific

claims advanced by Muddy Waters also included the following

observations:

- On its

attempts to nominate directors: “[Muddy Waters’] claims of

being denied proper representation on the Company’s Board despite

its alleged attempts at reaching an amicable solution appear to be

deceiving … [Muddy Waters’] approach throughout the whole process

shows a lack of respect for basic governance principles … [Muddy

Waters] decided to adopt an openly hostile stance, launching its

campaign to reconstitute the Company’s Board in its entirety and

trying to intimidate the incumbent Board to tender resignation

through threatening tactics.”

- On

total shareholder

returns: “Our TSR analysis suggests that, since

its inception, the Company has consistently outperformed its peers,

showing that the incumbent board and the Company’s management

possess the right skills, experience and vision to guide the

Company toward success.”

- On

allegations of repeated delays: “Despite

quoting repeated delays on a number of key objectives, [Muddy

Waters] did not detail, in its arguments, any specific point in

relation to how these delays affected the Company, its financial

and operational performance, or the creation of shareholder

value.”

- On plans

for the Company and the board: “[Muddy Waters] did not

make any public statement pertaining to its future strategy for the

Company, while also proposing a group of nominees, all affiliated

with [Muddy Waters], with no prior experience operating a mining or

mineral exploration company, proposing a board composition that

does not meet the independence requirement required of audit

committee members by law.”

- On the

claim about excessive distribution of stock options: “We

note that the Company’s stock option plan is capped at 10% of the

Company’s share capital, in line with best practices.”

Vote for Experience. Vote the WHITE

Proxy Card.

The Board advises shareholders to vote the WHITE

Proxy or voting instruction form well in advance of the deadline at

2:00 p.m. (Pacific time) on June 3, 2024, in connection

with the upcoming Meeting. Shareholders who have any questions

relating to the Meeting or about the completion and delivery of the

WHITE Proxy or voting instruction form, may contact Alliance

Advisors, LLC by telephone at 844-858-7380 or email at

Mayfair@allianceadvisors.com.

Additional details relating to the matters to be

voted upon at the Meeting and the Board’s recommendations are

included in the management information circular dated May 6, 2024,

which is available on www.sedarplus.ca, as well as the Investor

Resources section of the Company’s website at

https://mayfairgold.ca/investor-resources/.

Scientific and Technical

Information

Scientific and technical information contained

in this news release has been derived, in part, from the Company’s

technical report titled “National Instrument 43-101 Technical

Report Fenn–Gib Project, Ontario, Canada” with an effective date of

April 6, 2023, and reviewed and approved by Tim Maunula, an

independent “qualified person” pursuant to National Instrument

43-101 – Standards of Disclosure for Mineral Projects.

About Mayfair

Mayfair Gold is a Canadian mineral exploration

company focused on advancing the 100% controlled Fenn-Gib gold

project in the Timmins region of Northern Ontario. The Fenn-Gib

gold deposit is Mayfair’s flagship asset and currently hosts an

updated NI 43-101 resource estimate with an effective date of April

6, 2023 with a total Indicated Resource of 113.69M tonnes

containing 3.38M ounces at a grade of 0.93 g/t Au and an Inferred

Resource of 5.72M tonnes containing 0.16M ounces at a grade of 0.85

g/t Au at a 0.40 g/t Au cut-off grade. The Fenn-Gib deposit has a

strike length of over 1.5km with widths ranging over 500m. The gold

mineralized zones remain open at depth and along strike to the east

and west. Recently completed metallurgical tests confirm that the

Fenn-Gib deposit can deliver robust gold recoveries of up to

94%.

ON BEHALF OF THE BOARD OF DIRECTORS

For further information contact:Patrick Evans,

President and CEOPhone: (416) 670-5114Email:

patrick@mayfairgold.caWeb: www.mayfairgold.ca

Media contact:John Vincic, Oakstrom

AdvisorsPhone: (647) 402-6375Email: john@oakstrom.com

For information on voting:Alliance Advisors,

LLC Phone: 1-844-858-7380Email: Mayfair@allianceadvisors.com

Forward Looking Statements

This news release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities legislation (collectively,

“forward-looking statements”) that relate to

Mayfair’s current expectations and views of future events,

including the inadequacy of Muddy Waters’ proposals.

Forward-looking statements and may involve estimates, assumptions

and uncertainties which could cause actual results or outcomes to

differ materially from those expressed in such forward-looking

statements. No assurance can be given that these expectations will

prove to be correct and such forward-looking statements included in

this news release should not be unduly relied upon. These

statements speak only as of the date of this news release.

Forward-looking statements are based on a number

of assumptions and are subject to a number of risks and

uncertainties, many of which are beyond Mayfair’s control, which

could cause actual results and events to differ materially from

those that are disclosed in or implied by such forward-looking

statements. Mayfair undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by law. New factors emerge from time to time, and it is not

possible for Mayfair to predict all of them, or assess the impact

of each such factor or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. Any

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

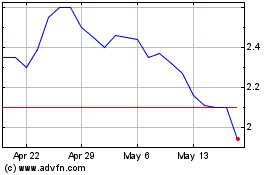

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Dec 2023 to Dec 2024