Mayfair Gold Corp. (“

Mayfair” or the

“

Company”) (

TSX-V:

MFG; OTCQB:

MFGCF) today published a letter to shareholders

from the Independent Chairman of its Board of Directors, Harry

Pokrandt. The letter summarizes the recent actions the Company’s

Board of Directors (the “

Board”) has taken to

protect the Company and its stakeholders over the course of the

proxy contest with Muddy Waters Capital LLC (“

Muddy

Waters”), set to culminate at the upcoming Annual General

and Special Meeting of Shareholders to be held on June 5, 2024

(the “

Meeting”). The full text of the letter

follows.

Dear Valued Shareholder,

We have now reached the final days before you

must make a decision on the future of your company. If you have not

yet voted, please do so and submit your vote as soon as possible to

meet the deadline of Monday, June 3 at 2:00 p.m. (Pacific

time). It is important that all voices are heard.

A large volume of information has been made

available to you since the initiation of the proxy contest by Muddy

Waters in late March. Many misleading statements have been made by

Muddy Waters. On behalf of my colleagues on the Board, I would like

to recap some of the most significant developments of the past few

months.

The Board’s obligation is to consider the

interests of the Company. In doing so, the Board may look to the

interests of various stakeholders, including shareholders,

employees and contractors, creditors, governments, including First

Nations, and the environment. I am enormously proud of the way our

Company has respected and balanced the needs of each of these

groups over the past several years, and in particular, during this

proxy contest. I believe we have done everything in our power to

honour our commitments and account for a diverse set of

interests.

We have maintained open communications with the

local communities most affected by our operations, including the

Apitipi Anicinapek Nation (the “AAN”) on whose territory the

Fenn-Gib Project is located. The AAN has expressed its

disappointment that Muddy Waters has made no efforts to contact

them, despite the fundamental risks that may pose to the

continuation of the project.

When our senior employees moved to terminate

their employment, on the basis that the actions of Muddy Waters

constituted a change of control event under their employment

contracts, we reached a settlement agreement to ensure they remain

in their positions until at least the date of the Meeting. In that

regard, we have been diligent in honouring Mayfair’s contracts with

the individuals who have contributed so much of their time and

expertise to create value for all stakeholders. It is worth noting

that no independent director stands to benefit from any change of

control payments; to the contrary, we have all been threatened with

litigation for causing the Company to respect its contractual

obligations and seeking to protect the interest of all

stakeholders, particularly minority shareholders and employees.

Ultimately, Mayfair’s future will be decided by

its shareholders. To this group, the Board has demonstrated a firm

commitment in recent months, including:

- First and

foremost, we maintained the focus on running the Company despite

the significant distractions, highlighted by the appointment of a

Vice President, Technical Services, the initiation of a

pre-feasibility study at Fenn-Gib, the initiation of a major

environmental field program in support of permitting, and the

preservation of management continuity.

- We duly

considered all proposals brought forward by a subset of our

shareholders led by Muddy Waters, making every effort to engage

with them in a constructive manner, while avoiding their requests

to deviate from sound governance practices such as undertaking a

basic screening process for proposed directors.

- We initiated

multiple attempts to negotiate a settlement with Muddy Waters that

could avoid the potential turmoil of the departure of the entire

senior team, but to no avail.

- We fought to

preserve your right to vote for the directors of your choice at the

Meeting.

- We have striven

for full transparency in our disclosure materials so that

shareholders have complete information about the implications of

their vote.

- Equally

important, we have called attention to the inadequate disclosure

from Muddy Waters and the unacceptable risks to the Company should

their proposals and nominees prevail.

- We sought and

accepted the advice of legal counsel to help us remain in

compliance with all applicable legal requirements and governance

principles.

Our position on each of these points has been

fully validated by two separate independent proxy advisors, ISS and

Glass Lewis, who specialize in reviewing information in proxy

contests like this one and make voting recommendations. Both firms

issued reports recommending that shareholders vote for the

management resolutions in their entirety, and against all Muddy

Waters resolutions.

Throughout this period, our sole motivation has

been a sincere desire to do what we consider to be in the best

interest for Mayfair Gold and its multiple stakeholder groups.

There has been no attempt at entrenchment by the Board. We take our

fiduciary obligations seriously.

Thank you for your continued support.

|

|

Very truly yours, |

| |

(signed) “Harry Pokrandt”Harry PokrandtChairman |

|

|

|

Vote for Experience. Vote the WHITE

Proxy Card.

The Board advises shareholders to vote the WHITE

Proxy or voting instruction form well in advance of the deadline at

2:00 p.m. (Pacific time) on June 3, 2024, in connection

with the upcoming Meeting. Shareholders who have any questions

relating to the Meeting or about the completion and delivery of the

WHITE Proxy or voting instruction form, may contact Alliance

Advisors, LLC by telephone at 844-858-7380 or email at

Mayfair@allianceadvisors.com.

Additional details relating to the matters to be

voted upon at the Meeting and the Board’s recommendations are

included in the management information circular dated May 6, 2024,

which is available on www.sedarplus.ca, as well as the Investor

Resources section of the Company’s website at

https://mayfairgold.ca/investor-resources/.

Scientific and Technical

Information

Scientific and technical information contained

in this news release has been derived, in part, from the Company’s

technical report titled “National Instrument 43-101 Technical

Report Fenn–Gib Project, Ontario, Canada” with an effective date of

April 6, 2023, and reviewed and approved by Tim Maunula, an

independent “qualified person” pursuant to National Instrument

43-101 – Standards of Disclosure for Mineral Projects.

About Mayfair

Mayfair Gold is a Canadian mineral exploration

company focused on advancing the 100% controlled Fenn-Gib gold

project in the Timmins region of Northern Ontario. The Fenn-Gib

gold deposit is Mayfair’s flagship asset and currently hosts an

updated NI 43-101 resource estimate with an effective date of April

6, 2023 with a total Indicated Resource of 113.69M tonnes

containing 3.38M ounces at a grade of 0.93 g/t Au and an Inferred

Resource of 5.72M tonnes containing 0.16M ounces at a grade of 0.85

g/t Au at a 0.40 g/t Au cut-off grade. The Fenn-Gib deposit has a

strike length of over 1.5km with widths ranging over 500m. The gold

mineralized zones remain open at depth and along strike to the east

and west. Recently completed metallurgical tests confirm that the

Fenn-Gib deposit can deliver robust gold recoveries of up to

94%.

ON BEHALF OF THE BOARD OF DIRECTORS

For further information contact:Patrick Evans,

President and CEOPhone: (416) 670-5114Email:

patrick@mayfairgold.caWeb: www.mayfairgold.ca

Media contact:John Vincic, Oakstrom

AdvisorsPhone: (647) 402-6375Email: john@oakstrom.com

For information on voting:Alliance Advisors,

LLC Phone: 1-844-858-7380Email: Mayfair@allianceadvisors.com

Forward Looking Statements

This news release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities legislation (collectively,

“forward-looking statements”) that relate to

Mayfair’s current expectations and views of future events,

including risks to the Company from Muddy Waters’ proposals and

nominees. Forward-looking statements and may involve estimates,

assumptions and uncertainties which could cause actual results or

outcomes to differ materially from those expressed in such

forward-looking statements. No assurance can be given that these

expectations will prove to be correct and such forward-looking

statements included in this news release should not be unduly

relied upon. These statements speak only as of the date of this

news release.

Forward-looking statements are based on a number

of assumptions and are subject to a number of risks and

uncertainties, many of which are beyond Mayfair’s control, which

could cause actual results and events to differ materially from

those that are disclosed in or implied by such forward-looking

statements. Mayfair undertakes no obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by law. New factors emerge from time to time, and it is not

possible for Mayfair to predict all of them, or assess the impact

of each such factor or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. Any

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

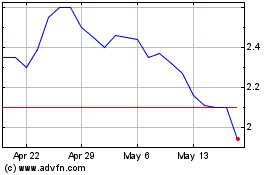

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Mayfair Gold (TSXV:MFG)

Historical Stock Chart

From Mar 2024 to Mar 2025