Nova Leap Health Corp. Posts Q3 2024 Results that include a Continuation of Consistent Operating Results and a Strong Balance Sheet.

08 November 2024 - 9:02AM

NOVA LEAP HEALTH CORP. (TSXV: NLH) (“Nova Leap” or “the Company”),

a growing home health care organization, is pleased to announce the

release of financial results for the quarter ended September 30,

2024.

All amounts are in United States dollars unless

otherwise specified.

Nova Leap Q3 2024 Financial

Results

Financial results for the third quarter ended

September 30, 2024 include the following:

-

Nova Leap recorded positive Adjusted EBITDA and positive net cash

flows with no bank debt, maintaining borrowing capacity for future

acquisitions.

-

Q3 was the Company’s 11th consecutive quarter with positive

Adjusted EBITDA and 6th consecutive quarter of positive operating

income.

-

Q3 2024 revenues of $6,406,528 increased by 1.1% relative to Q2

2024 revenues of $6,338,532 and decreased by 2.2% relative to Q3

2023 revenues of $6,553,724.

- Q3 2024 Adjusted EBITDA of $379,116 was a decrease of 7.1% over

Q2 2024 Adjusted EBITDA of $407,896 and 12.7% over Q3 2023 Adjusted

EBITDA of $434,192 (see calculation of Adjusted EBITDA below).

- Adjusted EBITDA for the 12-month period from Q4 2023 to Q3 2024

was $1,720,084.

-

Gross profit margin as a percentage of revenues remained strong at

38.0% in Q3 2024. Gross profit margin percentage was 38.4% in Q2

2024 and 37.4% in Q3 2023.

-

The Company generated income from operating activities in Q3 2024

of $208,110, a decrease of $39,599 from Q2 2024 and $370 from Q3

2023.

-

The Company recorded a net loss of $207,871 in Q3 2024 as compared

to net income of $226,998 in Q2 2024 and $380,353 in Q3 2023.

-

The Company had available cash of $1,361,000 as of September 30,

2024 as well as full access to the unutilized revolving credit

facility of $1,111,193 (CAD$1,500,000). The Company’s cash balance

increased by $195,632 in Q3 2024.

-

On October 11, 2024, the Company executed a definitive agreement to

acquire the business assets of a home care services company located

in Florida, United States. Under the terms of the agreement, the

acquisition is to be made for total consideration of $1,636,000 of

which $1,316,00 is payable with cash on closing and $320,000 by way

of a promissory note repayable over a three-year period. The

acquisition is expected to close in November 2024. See press

release dated October 15, 2024 for additional information related

to the planned acquisition.

-

On October 29, 2024, the Company executed a definitive agreement to

acquire all of the shares of two affiliated home care services

companies with operations in Nova Scotia. Under the terms of the

agreement, the acquisition is to be made for total consideration of

CAD$1,380,000 with the full amount payable with cash on closing.

The acquisition is expected to close in December 2024. See press

release dated October 29, 2024 for additional information related

to the planned acquisition.

President & CEO’s

Comments

“Q3 was another steady quarter as the Company

has been a model of consistency the past six quarters”, said Chris

Dobbin, President & CEO of Nova Leap. “As a company, we

continued to produce positive operating results, generate positive

cash flows and have no outstanding bank debt. We are actively

working on growth acquisition opportunities, two of which have been

recently announced, where we have the ability to utilize the

Company’s borrowing capacity and strong balance sheet.”

This news release should be read in conjunction

with the Unaudited Condensed Interim Consolidated Financial

Statements for the three and nine months ended September 30, 2024

and 2023 including the notes to the financial statements and

Management's Discussion and Analysis dated November 7, 2024, which

have been filed on SEDAR+.

About Nova Leap

Nova Leap is an acquisitive home health care

services company operating in one of the fastest-growing industries

in the U.S. & Canada. The Company performs a vital role within

the continuum of care with an individual and family centered focus,

particularly those requiring dementia care. Nova Leap achieved the

#42 ranking on the 2021 Report on Business ranking of Canada’s Top

Growing Companies, the #2 ranking on the 2020 Report on Business

ranking of Canada’s Top Growing Companies and the #10 Ranking in

the 2019 TSX Venture 50™ in the Clean Technology & Life

Sciences sector. The Company is geographically diversified with

operations in 10 different U.S. states within the New England,

Southeastern, South Central and Midwest regions as well as in Nova

Scotia, Canada.

NON-IFRS AND OTHER

MEASURES:

This release contains references to certain

measures that do not have a standardized meaning under IFRS as

prescribed by the International Accounting Standards Board (“IASB”)

and are therefore unlikely to be comparable to similar measures

presented by other companies. Rather, these measures are provided

as additional information to complement IFRS measures by providing

a further understanding of operations from management’s

perspective. Accordingly, non-IFRS financial measures should not be

considered in isolation or as a substitute for analysis of

financial information reported under IFRS. The Company presents

non-IFRS financial measures, specifically Adjusted EBITDA (as such

term is hereinafter defined), as well as supplementary financial

measures such as annualized revenue and annualized adjusted EBITDA.

The Company believes these non-IFRS financial measures are

frequently used by lenders, securities analysts, investors and

other interested parties as a measure of financial performance, and

it is therefore helpful to provide supplemental measures of

operating performance and thus highlight trends that may not

otherwise be apparent when relying solely on IFRS financial

measures.

Adjusted Earnings before interest, taxes,

amortization and depreciation (“Adjusted EBITDA”), is calculated as

income from operating activities plus amortization and depreciation

and stock-based compensation expense. The most directly comparable

IFRS measure is income from operating activities.

The reconciliation of Adjusted EBITDA to the

income from operating activities is as follows:

|

|

Q3 2024 $ |

Q3 2023 $ |

Q2 2024$ |

|

Income from operating activities |

208,110 |

208,480 |

247,709 |

|

Amortization and depreciation |

146,169 |

204,587 |

138,893 |

|

Stock-based compensation |

24,837 |

21,125 |

21,294 |

|

Adjusted EBITDA |

379,116 |

434,192 |

407,896 |

|

|

FORWARD LOOKING

INFORMATION:

Certain information in this press release may

contain forward-looking statements, such as statements regarding

future expansions and cost savings and plans regarding future

acquisitions and business growth, including anticipated annualized

revenue or annualized recurring revenue run rate growth and

anticipated consolidated Adjusted EBITDA margins. This information

is based on current expectations and assumptions, including

assumptions described elsewhere in this release and those

concerning general economic and market conditions, availability of

working capital necessary for conducting Nova Leap’s operations,

availability of desirable acquisition targets and financing to fund

such acquisitions, and Nova Leap’s ability to integrate its

acquired businesses and maintain previously achieved service hour

and revenue levels, that are subject to significant risks and

uncertainties that are difficult to predict. Actual results might

differ materially from results suggested in any forward-looking

statements. All forward-looking statements, including any financial

outlook or future-oriented financial information, contained in this

press release are made as of the date of this release and included

for the purpose of providing information about management's current

expectations and plans relating to the future, and these statements

may not be appropriate for other purposes. The Company assumes no

obligation to update the forward-looking statements, or to update

the reasons why actual results could differ from those reflected in

the forward-looking statements unless and until required by

securities laws applicable to the Company. Additional information

identifying risks and uncertainties is contained in the Company's

filings with the Canadian securities regulators, which filings are

available at www.sedarplus.com.

CAUTIONARY STATEMENT:

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Photos accompanying this announcement are available

at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/86a7fbd6-2212-4f33-8713-f7b25dc1dc46

https://www.globenewswire.com/NewsRoom/AttachmentNg/d387c631-c84c-4af3-846c-eb8de889ce0e

For further information:

Chris Dobbin, CPA, ICD.D

Director, President and CEO

E: cdobbin@novaleaphealth.com

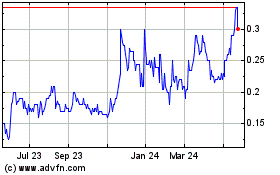

Nova Leap Health (TSXV:NLH)

Historical Stock Chart

From Nov 2024 to Dec 2024

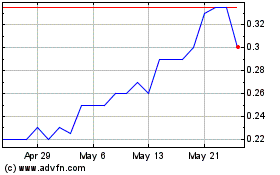

Nova Leap Health (TSXV:NLH)

Historical Stock Chart

From Dec 2023 to Dec 2024