NowVertical Group Inc. (TSX-V: NOW) (OTCQB: NOWVF) (“NOW” or the

“Company”), a leading data analytics and AI solutions company,

today announced its financial results for the three months ended

March 31, 2024.

"We made significant progress in the first

quarter on multiple fronts, including leadership and governance,

reconfiguring our go-to-market strategy, and implementing an

aggressive strategic integration and restructuring plan," said

Sandeep Mendiratta, CEO of NOW. "This quarter was a transitional

period as we initiated implementation of our One Brand, One

Business strategy. Supported by our operator-first model, we are

executing this strategy across multiple dimensions of our business.

These changes enable us to focus on profitability and

sustainability and long-term value creation, with positive results

expected to build quarter over quarter as we move forward with our

growth plan."

Selected Financial

Highlights:

- Revenue – Revenue

was $12.9 million in Q1 2024, an increase of 3% from $12.6 million

in Q1 2023 and Adjusted Revenue was $13.0 million in Q1 2024

compared to $12.7 million in Q1 2023.

- Gross Profit –

Gross Profit was $6.3 million in Q1 2024, an increase of 2% from

$6.2 million in Q1 2023.

- Income from

Operations – Income from Operations was $0.2 million in Q1

2024, an increase of 120% from a $1.0 million loss in Q1 2023.

- Adjusted EBITDA –

Adjusted EBITDA was $1.6 million in Q1 2024, an increase of 314%

from $0.4 million in Q1 2023.

- Administrative

Expenses – Administrative Expenses were $6.1 million in Q1

2024, a decrease of 16% from $7.2 million in Q1 2023.

- Net Loss – Net

Loss was $1.5 million and Net Loss per fully diluted share was

$0.02 in Q1 2024, consistent with a $1.5 million Net Loss and a Net

Loss per basic and diluted share of $0.02 in Q1 2023.

Q1 2024 and Subsequent Business

Highlights:

- January 8, 2023, NOW added two

highly qualified directors, David Charron and Chris Ford, to the

Company’s Board of Directors and appointed Christine Nelson as

Interim Chief Financial Officer of the Company effective as

February 1, 2024.

- January 15, 2024, NOW appointed

Sandeep Mendiratta as Chief Executive Officer of the Company. Mr.

Mendiratta’s appointment was a critical step in the strategic

reorganization of the Company, designed to fast-track the

integration of its global asset base.

- On March 5, 2024, NOW announced a

renewed contract with one of the oldest of South Africa’s “big

four” banks for its NOW Privacy software. With this third

consecutive renewal, the Customer agreed to a 3-year $1.5 million

commitment paid in the first half of 2024.

- On April 23, 2024, NOW announced

amendments to its Acrotrend obligations that enabled it to improve

its balance sheet by reducing its overall cash payment obligations,

repay a substantial portion of the 2023 earn-out consideration due

to the Acrotrend sellers in shares, and defer and cap certain

future payments.

- On May 1, 2024, NOW announced

amendments to its Smartlytics agreement to complete its product

group integration.

- On May 14, 2024, NOW welcomed David

Doritty as an independent director of the Company.

- On May 27, 2024, the Company

announced the strategic disposition of Allegient Defense, Inc. to a

subsidiary of BCS, LLC for a gross consideration of up to $12.5

million, clearing $3.8 million of debt from NOW’s balance sheet,

reducing deferred liabilities and supporting growth plans for its

integrated business, enabling strategic investments in its core

data analytics and AI solutions business.

Investor Webinar:

NOW invites shareholders, analysts, investors,

media representatives, and other stakeholders to attend our

upcoming webinar. Management will discuss Q1 2024 results, followed

by a question-and-answer session.

Investor Webinar

Registration:

Time: May 31, 2024, 09:30 AM in Eastern

Time (US and Canada)Register here:

https://bit.ly/NOW_Q1_2024_Webinar

A recording of the webinar and supporting

materials will be made available in the investor’s section of the

company’s website at https://ir.nowvertical.com/news-and-media.

Related links:

https://www.nowvertical.com

Additional Information:

The Company's unaudited first quarter 2024

condensed consolidated interim financial statements, notes to

financial statements, and management's discussion and analysis for

the three months ended March 31, 2024, are available on the

Company's SEDAR+ profile at www.sedarplus.com. Unless

otherwise indicated, all references to "$" in this press release

refer to US dollars, and all references to "CAD$" in this press

release refer to Canadian dollars.

About NowVertical Group

Inc.

The Company is a data analytics and AI solutions

company offering comprehensive solutions, software and services. As

a global provider, we deliver cutting-edge data, technology, and

artificial intelligence (AI) applications to private and public

enterprises. Our solutions form the bedrock of modern enterprises,

converting data investments into business solutions. NOW is growing

organically and through strategic acquisitions. For further details

about NOW, please visit www.nowvertical.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information, please

contact: Andre Garber, CDOIR@nowvertical.com

Glen Nelson, Investor Relations and

Communications: glen.nelson@nowvertical.com t: (403) 763-9797

Cautionary Note Regarding Non-IFRS

Measures:

This news release refers to certain non-IFRS

measures. These measures are not recognized measures under IFRS, do

not have a standardized meaning prescribed by IFRS and are

therefore unlikely to be comparable to similar measures presented

by other companies. Rather, these measures are provided as

additional information to complement those IFRS measures by

providing further understanding of the Company’s results of

operations from management’s perspective. The Company’s definitions

of non-IFRS measures used in this news release may not be the same

as the definitions for such measures used by other companies in

their reporting. Non-IFRS measures have limitations as analytical

tools and should not be considered in isolation nor as a substitute

for analysis of the Company’s financial information reported under

IFRS. The Company uses non-IFRS financial measures including

“Adjusted Revenue”, “EBITDA”, and “Adjusted EBITDA”. These non-IFRS

measures are used to provide investors with supplemental measures

of our operating performance and to eliminate items that have less

bearing on our operational performance or operating conditions and

thus highlight trends in our core business that may not otherwise

be apparent when relying solely on IFRS measures. The Company

believes that securities analysts, investors and other interested

parties frequently use non-IFRS financial measures in the

evaluation of issuers. The Company’s management also uses non-IFRS

financial measures to facilitate operating performance comparisons

from period to period and prepare annual budgets and forecasts.

Non-IFRS Measures:

The non-IFRS financial measures referred to in

this news release are defined below. The management discussion and

analysis for the quarter ended March 31, 2024 (the “Q1 2024

MD&A”), available at nowvertical.com and on SEDAR+ and

www.sedarplus.com, also contains supporting calculations for

Adjusted Revenue, EBITDA, and Adjusted EBITDA.

“Adjusted Revenue” adjusts

revenue to eliminate the effects of acquisition accounting on the

Company’s revenues.

“EBITDA” adjusts net income

(loss) before depreciation and amortization expenses, net interest

costs, and provision for income taxes.

“Adjusted EBITDA” adjusts

EBITDA for revenue adjustments in “Adjusted Revenue” and items such

as acquisition accounting adjustments, transaction expenses related

to acquisitions, transactional gains or losses on assets, asset

impairment charges, non-recurring expense items, non-cash stock

compensation costs, and the full-year impact of cost synergies

related to the reduction of employees in relation to

acquisitions.

Forward‐Looking Statements:

This news release contains forward-looking

information and forward-looking information within the meaning of

applicable Canadian securities laws (together

“forward-looking statements”), including, without

limitation: the aggregate consideration to be received from sale of

Defense, Inc. and expectations regarding NOW’s business, finances

and operations. Forward-looking statements are necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by management, are inherently subject to significant

business, economic and competitive uncertainties, and

contingencies. Forward-looking statements generally can be

identified by the use of forward-looking words such as “may”,

“should”, “will”, “could”, “intend”, “estimate”, “plan”,

“anticipate”, “expect”, “believe” or “continue”, or the negative

thereof or similar variations. Forward-looking statements involve

known and unknown risks, uncertainties and other factors that may

cause future results, performance, or achievements to be materially

different from the estimated future results, performance or

achievements expressed or implied by the forward-looking statements

and the forward-looking statements are not guarantees of future

performance. Forward-looking statements are qualified in their

entirety by inherent risks and uncertainties, including: adverse

market conditions; risks inherent in the data analytics and

artificial intelligence sectors in general; regulatory and

legislative changes; that future results may vary from historical

results; inability to obtain any requisite future financing on

suitable terms; any inability to realize the expected benefits and

synergies of acquisitions or dispositions; that market competition

may affect the business, results and financial condition of the

Company and other risk factors identified in documents filed by the

Company under its profile at www.sedarplus.com, including the

Company’s managements discussion and analysis for the year ended

December 31, 2023. Further, these forward-looking statements are

made as of the date of this news release and, except as expressly

required by applicable law, the Company assumes no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

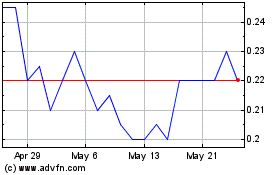

NowVertical (TSXV:NOW)

Historical Stock Chart

From Nov 2024 to Dec 2024

NowVertical (TSXV:NOW)

Historical Stock Chart

From Dec 2023 to Dec 2024