NuLegacy

Gold commences a private placement of

100,000,000 units (“

Units”) at a price of

C$0.01 per Unit for gross proceeds of

C$1.0 million (the “

Offering”)

sufficient to maintain the ownership and advance the value of its

100% ownership/controlling interest in the highly prospective Red

Hill property in the Cortez Gold trend of Nevada through to

December 2025.

Each Unit consists of one common share of the

Company (a “Common Share”) and one transferable

warrant to purchase an additional Common Share for a period of five

years at a nominal1 exercise price of C$0.05 per share (a

“Warrant”).

NuLegacy Gold is pleased to report that Crescat

Capital, together with NuLegacy’s directors and advisors have

provided a minimum lead commitment of C$550,000 to purchase 55

million Units of the total 100 million Unit Offering (the

“Lead Commitment”) described herein. Use of

proceeds:

|

Expenditure Item |

Assuming 100% of the

Offering |

|

Mineral Properties Maintenance

Costs2 |

$399,000 |

|

General and Administrative |

$300,000 |

|

Issue expenses est’d. |

75,000 |

|

Related party expenses |

65,000 |

|

Unallocated Working Capital |

$161,200 |

|

Total: |

$1,000,000 |

Exploration Update: Since

December 2023, our Exploration Manager Charles Weakly, and our team

of successful3 Carlin deposit discovery geologists completed a deep

dive into the Red Hill database:

- Affirming4 the promise of the

previously identified as yet untested targets (four) in the Mid and

South-rifts, and,

-

Adding two new targets, one of which is outside the previous focus

of exploration area, thus warranting this disclosure:

-

Located well to the west and identified by the tried and true

‘hand-calculations and cross-section creation’ of Robert

Leonardson5, long considered the ‘dean’ of Carlin-type gold system

geologists, and

-

Geologically analogous to the prolific Cambrian dolomite/Eureka

gold systems just south of Red Hill in the Cortez trend, further

details to follow upon full team review.

An Annual General Meeting is being

called for October 7th, 2024, to

approve capitalization restructuring: With the change of

scale in the Company’s operations (see “More on Business and

further cost rationalization” below), it is considered the

appropriate time for a roll back/reverse split of the Company’s

issued capital to assist the Company in re-establishing itself as a

‘viable’ enterprise.

NuLegacy Gold intends to seek shareholder and

TSX Venture Exchange (the “Exchange”) approvals

for a consolidation or reverse split of its capital stock on the

basis of a 25 old shares to 1 new share ratio (the

“Consolidation”). The Consolidation shall be

subject to approval of 50% plus 1 vote of the votes cast at the

Company’s 2024 annual general meeting of shareholders as planned

for October 7, 2024, to consider and, if deemed appropriate,

approve the Consolidation.

Following the approvals and implementation of

the Consolidation, the post-consolidated Warrant exercise price

would be deemed to be C$1.25; however, the Company intends to apply

to the Exchange6 to have the Warrant exercise price amended to an

exercise price of C$0.50 (the “Price Amendment”).

Effectively that would make the warrant exercisable at C$0.02 per

share on a pre-reverse split basis, and the Company’s new

capitalization will be substantially as follows on a pre and post

25:1 reverse split (RS) basis:

|

|

|

Pre-RS |

Post RS |

|

Current shares outstanding |

636,573,953 |

25,462,958 |

63.8 |

% |

|

Planned PP financing |

|

100,000,000 |

4,000,000 |

10.0 |

% |

|

Property cost reduction |

|

42,000,000 |

1,680,000 |

4.2 |

% |

|

Sub-total of additions |

|

142,000,000 |

5,680,000 |

14.2 |

% |

|

|

|

|

|

|

|

New total shares outstanding |

778,573,953 |

31,142,958 |

78.1 |

% |

|

New wts with planned offering and |

|

|

|

property cost reduction |

|

142,000,000 |

5,680,000 |

14.2 |

% |

|

Existing wts |

|

40,742,400 |

1,629,696 |

4.1 |

% |

|

Existing options |

|

36,200,000 |

1,448,000 |

3.6 |

% |

|

Sub-totals of dilutables |

|

218,942,400 |

8,757,696 |

21.9 |

% |

|

|

|

|

|

|

|

Fully diluted totals outstanding |

997,516,353 |

39,900,654 |

100.0 |

% |

As a condition for acceptance of the Price

Amendment, the Exchange will require that if, for any 10

consecutive trading days during the unexpired term of the Warrants

(the “Premium Trading Days”), the closing price of

the Company’s shares as traded on the Exchange exceeds the new

exercise price by 25% or more (i.e., C$0.625 or more), then the

Warrants shall have a reduced exercise period of 30 days (the

“Accelerated Exercise Period”) which will begin no

more than seven (7) calendar days after the tenth Premium Trading

Day.

Property cost rationalization:

NuLegacy Gold also announces that its subsidiary, NuLegacy Gold

Corporation NV (“NuLegacy US”), and Idaho

Resources Corporation, a subsidiary of Metalla Royalty &

Streaming Ltd. (“Metalla”), have amended NuLegacy

US’ mining lease over a portion of the unpatented lode mining

claims comprising the Red Hill Property (the “Idaho

Claims”) to eliminate NuLegacy US’ obligation to incur

annual exploration expenditures of ~US$150,000 per annum on or for

the benefit of the Idaho Claims for calendar years 2024 and 2025 in

consideration for NuLegacy Gold issuing, subject to acceptance of

the Exchange, a total of 42,000,000 units (the “Amendment

Units”) to Metalla at a deemed price of C$0.01 per

Amendment Unit and having an aggregate deemed price of C$420,000.

The Amendment Units will be issued on the same basis as the Units

being offered under the Offering including, upon completion of the

Consolidation and Exchange acceptance, the Price Amendment and

Accelerated Exercise Period. The Company shall also discharge the

2% GSR in favour of NuLegacy Gold on the claims covered by the

Idaho lease.

Mini-Max Participation: Apart

from the Lead Commitment, the minimum ‘individual’ participation

has been set at C$3,500/US$2,500, to provide our many long-term

individual shareholders with the opportunity to participate. As

most of the Company’s expenditures are in US$ we are happy to

receive subscription payments in US$ at a conversion price set at

US$1=C$1.40.

Minimum/Maximum Subscriptions:

Initial closing is scheduled for August 27th, 2024.

|

Subscriber |

Minimum |

Maximum |

|

Individual |

C$3,500 (US$2,500) |

C$140,000 (US$100,000) |

|

Institutional |

C$70,000 (US$50,000) |

C$280,000 (US$200,000) |

|

|

Business and further cost

rationalization:

-

As reported above, with the generous cooperation of the lessor of

the Idaho Claims, we have reduced Red Hill’s ‘claims maintenance

budget’ to a more manageable US$ ~275,000/year for 2024 and 2025

(from the ~US$ 500,000 of BLM fees and minimum exploration

expenditures, etc.).

-

Since suspending drilling in December 2023, costs have been reduced

significantly while advancing Red Hill’s value (see above under

“Target/Exploration Update”):

-

Executive management personnel have been reduced by half, and the

salaries/fees of the remaining executives have been reduced by

25%.

- Administrative staffing has also

been reduced to the minimum required for maintenance of the

Company’s continuing business.

- Currently, NuLegacy Gold has four

directors, and a search has begun to add two new directors, thus

allowing our aging founding director Dr. Steininger the opportunity

to retire, and to add new energy to the Company by having one of

the candidates possibly assume the role of CEO, allowing Mr.

Matter, who has had some health issues, to reduce his executive

commitment to the Company.

Offering Notes: The Offering is

subject to, among other things, acceptance of the Exchange and all

securities issued pursuant to the Offering will be subject to a

four month hold period from the date of Closing. In addition to any

applicable resale restrictions under Securities Laws, all

securities issued at a price or deemed price that is less than

$0.05, will be subject to the Exchange Hold Period of four months

and legended accordingly. The Company may pay 7% finder’s fees in

cash or Common Shares or any combination thereof to certain finders

and/or advisors in connection with the sale of Units in accordance

with the policies of the Exchange.

Pursuant to the Lead Commitment, insiders of the

Company have committed to subscribe for a minimum of 55 million

Units of the Offering. Such insider participation will be exempt

from the valuation and minority shareholder approval requirements

of Multilateral Instrument 61-101 ("MI 61-101") by

virtue of the exemptions contained in sections 5.5(a) and 5.7(1)

(a) of MI 61-101 on the basis that the fair market value of the

consideration for the Units to be issued to the insiders will not

exceed 25% of the Company’s market capitalization.

The Company expects to file a material change

report in connection with, inter alia the Offering less than 21

days before the expected closing of the Offering as the Company

wishes to close on an expedited basis in order to fund the annual

BLM and county maintenance fees for the Red Hill property prior to

the September 1, 2024 deadline and for sound business reasons.

The securities described herein have not been,

and will not be, registered under the United States Securities Act

of 1933, as amended (the "U.S. Securities Act"),

or any state securities laws, and accordingly, may not be offered

or sold within the United States except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation to buy any securities in any jurisdiction.

About NuLegacy Gold:

Exploration: NuLegacy is focused on exploring for

high-grade Carlin-style gold deposits on its premier 108

sq. km (42 sq. mile) district scale Red Hill property. The Red Hill

is on trend/adjacentI to three of Nevada Gold Mines’ most

profitable multi-million ounce

Carlin-type gold mines; the Pipeline, Cortez and

GoldrushII with their massive 50+ million ounces gold endowment.

These are three of the world’s thirty largest, lowest cost, highest

grade, and politically safest gold mines, producing annually circa

3% of the world’s gold.

- The

similarity and proximity of these deposits in the Cortez Trend

including Goldrush are not necessarily indicative of the gold

mineralization in NuLegacy’s Red Hill Property.

- Currently structured as an

underground mine Goldrush contains P&P: 7.8 M oz @ 7.29 g/t;

M&I: 8.5 M oz @ 7.07 g/t (inclusive of P&P); and Inferred:

4.5 M oz @ 6.0 g/t (as of December 31, 2021). Source: Corporate

presentation of Nevada Gold Mines – Goldrush Underground dated

September 22, 2022.

On Behalf Of The Board Of NuLegacy Gold

Corporation

Albert J. Matter, Chief Executive Officer &

Cofounding Director Tel: +1 (604) 639-3640; Email:

albert@nuggold.com

For more information about NuLegacy visit:

www.nulegacygold.com or www.sedarplus.ca

Dr. Roger Steininger, a Director of NuLegacy, is

a Certified Professional Geologist (CPG 7417) and the qualified

person as defined by NI 43-101, Standards of Disclosure for Mineral

Projects, responsible for approving the scientific and technical

information contained in this news release.

Cautionary Statement on Forward-Looking

Information: This news release contains forward-looking

information and statements under applicable securities laws, which

information and/or statements relate to future events or future

performance (including, but not limited to, the Offering, the

proposed size, timing and use of proceeds therefrom and the

anticipated Lead Commitment for and participation of insiders in

the Offering, the prospective nature of the Red Hill Property

including the targets identified thereon and the proposed

Consolidation, Warrant Price Amendment and post-Consolidation

capitalization of the Company) and reflect management’s current

expectations and beliefs based on assumptions made by and

information currently available to the Company. Readers are

cautioned that such forward-looking information and statements are

neither promises nor guarantees, and are subject to risks and

uncertainties that may cause future results to differ materially

from those expected including, but not limited to, market

conditions, availability of financing, actual results of

exploration activities and drilling, unanticipated geological,

stratigraphic and structural formations, misinterpretation or

incorrect analysis of projected geological structures, alterations

and mineralization, environmental risks, operating risks, adverse

weather conditions, accidents, labour issues, delays in obtaining

governmental approvals and permits, inability to secure drilling

equipment and/or contractors on a timely basis or at all, delays in

receipt of assay results from third party laboratories, inflation,

future prices for gold, changes in personnel and other risks in the

mining industry. There are no assurances that the net proceeds from

the Offering will be sufficient to maintain and advance the Red

Hill Property and the Company’s continued operations through

December 2025, that the Consolidation will be approved by the

Company’s shareholders and the Exchange or that the Warrant Price

Amendment will be affected on the basis contemplated herein or at

all. Furthermore, there are no known mineral resources or reserves

in the Red Hill Property and the presence of gold resources on

properties adjacent or near the Red Hill Property including the

Goldrush deposit is not necessarily indicative of the gold

mineralization on the Red Hill Property. Future exploration

programs on the Red Hill Property, if any, will be exploratory

searches for ore. There is also uncertainty surrounding elevated

inflation and high interest rates, the ongoing wars in Ukraine and

Gaza and the continued spread and severity of COVID-19, and the

impact they will have on the NuLegacy’s operations, personnel,

supply chains, ability to raise capital, access properties or

procure exploration equipment, supplies, contractors, and other

personnel on a timely basis or at all and economic activity in

general. All the forward-looking information and statements made in

this news release are qualified by these cautionary statements and

those in our continuous disclosure filings available on SEDAR+ at

www.sedarplus.ca. The forward-looking information and statements in

this news release are made as of the date hereof and the Company

does not assume any obligation to update or revise them to reflect

new events or circumstances save as required by applicable law.

Accordingly, readers should not place undue reliance on

forward-looking information and statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

1 Application to be reduced - pending.2 For 2024 and 2025.3

https://bit.ly/NUGgeos4 Review session on July 30-31, 2024, Elko,

NV.5 Versus computer generated, as more ounces have been found with

a pen than with a drill!6 Company has had preliminary conversations

with the Exchange regarding the Price Amendment.

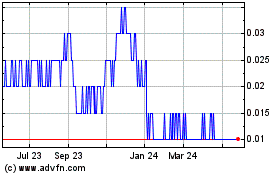

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Jan 2025 to Feb 2025

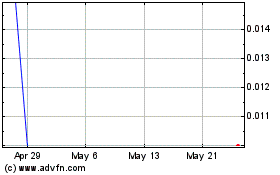

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Feb 2024 to Feb 2025