Prospera Energy Inc. Debt Settlement

28 April 2024 - 1:21AM

Prospera Energy Inc. (”Prospera“ or the ”Corporation”) (PEI: TSX-V;

OF6A:FRA) announced that it has agreed to settle claims from a

former executive by the payment of $120,000 over a period of 6

months, and by the issuance of 2,181,818 common shares at a deemed

price of $0.055 per share.

This share issuance is subject to the approval

of the TSX Venture Exchange. The shares, when issued, will be

subject to trading restriction of four months and a day.

About Prospera

Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF,

FRA: OF6B) is a publicly traded energy company based in Western

Canada, specializing in the exploration, development, and

production of crude oil and natural gas. Prospera is primarily

focused on optimizing hydrocarbon recovery from legacy fields

through environmentally safe and efficient reservoir development

methods and production practices. Prospera was restructured in the

first quarter of 2021 to become profitable and in compliance with

regulatory, environmental, municipal, landowner, and service

stakeholders.

The company is in the midst of a three-stage

restructuring process aimed at prioritizing cost effective

operations while appreciating production capacity and reducing

liabilities. Prospera has completed the first phase by optimizing

low hanging opportunities, attaining free cash flow, while bringing

operation to safe operating condition, all while remaining

compliant. Currently, Prospera is executing phase II of the

restructuring process, the horizontal transformation intended to

accelerate growth and capture the significant oil in place (400

million bbls). These horizontal wells allow PEI to reduce its

environmental and surface footprint by eliminating the numerous

vertical well leases along the lateral path. Phase III of

Prospera’s corporate redevelopment strategy is to optimize recovery

through EOR applications. Furthermore, Prospera will pursue its

acquisition strategy to diversify its product mix and expand its

core area. Its goal is to attain 50% light oil, 40% heavy oil and

10% gas.

PEI continues to apply efforts to minimize its

environmental footprint. Also, efforts to reduce and eventually

eliminate emissions, alongside pursuing innovative ESG methods to

enhance API quality, thereby achieving higher margins and

eliminating the need for diluents.

For Further Information:

Shawn Mehler, PR Email:

investors@prosperaenergy.com Website:

www.prosperaenergy.com

FORWARD-LOOKING STATEMENTSThis

news release contains forward-looking statements relating to the

future operations of the Corporation and other statements that are

not historical facts. Forward-looking statements are often

identified by terms such as “will,” “may,” “should,” “anticipate,”

“expects” and similar expressions. All statements other than

statements of historical fact included in this release, including,

without limitation, statements regarding future plans and

objectives of the Corporation, are forward-looking statements that

involve risks and uncertainties. There can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Although Prospera believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Prospera can give no assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in

the preparation of any forward-looking information may prove to be

incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of Prospera. As a result, Prospera

cannot guarantee that any forward-looking statement will

materialize, and the reader is cautioned not to place undue

reliance on any forward- looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release, and Prospera does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by Canadian securities

law.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

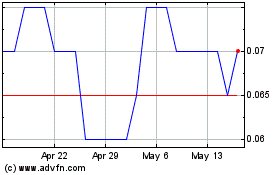

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Jan 2024 to Jan 2025