Prospera Energy Inc. Announces Q3 2024 Financial Results

27 November 2024 - 6:00PM

Prospera Energy Inc. (PEI: TSX-V; OF6B: FRA)

("

Prospera" or the "

Corporation")

Prospera Energy Inc. (TSXV: PEI) (“Prospera” or

the “Company”) is pleased to announce its operating and financial

results for the three and nine months ended September 30th, 2024.

Selected financial and operating information should be read in

conjunction with Prospera’s unaudited consolidated financial

statements and related management’s discussion and analysis

(“MD&A“) for the three and nine months ended September 30,

2024. These filings are available on SEDAR+ at

www.sedarplus.ca.

Financial & Operational

Highlights

|

(expressed in $, except number of shares) |

Q3 2024 |

|

Q3 2023 |

YTD 2024 |

|

YTD 2023 |

|

|

P&NG sales revenue |

4,727,708 |

|

3,920,428 |

13,807,274 |

|

8,524,001 |

|

| Income (loss) for the

period |

(1,285,725 |

) |

71,011 |

(1,827,016 |

) |

(2,279,541 |

) |

| Income (loss) per share |

(0.00 |

) |

0.00 |

(0.00 |

) |

(0.01 |

) |

| Funds flow provided by (used

in) operations |

651,692 |

|

1,099,567 |

2,828,098 |

|

279,465 |

|

| Net cash flows provided by

(used in) operating activities |

(3,927,657 |

) |

4,237,560 |

(3,275,900 |

) |

(2,515,610 |

) |

| Net cash per share – operating

activities |

(0.01 |

) |

0.01 |

(0.01 |

) |

(0.01 |

) |

|

Weighted average number of shares – basic |

426,954,797 |

|

385,599,221 |

424,797,150 |

|

341,460,783 |

|

Operating Netback

|

|

|

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

|

P&NG sales revenue ($) |

|

4,727,708 |

|

3,920,428 |

|

13,807,274 |

|

8,524,001 |

|

| Royalties ($) |

|

(490,330 |

) |

(424,448 |

) |

(1,105,956 |

) |

(955,682 |

) |

|

Operating costs ($) |

|

(2,496,800 |

) |

(1,978,034 |

) |

(6,841,939 |

) |

(5,479,529 |

) |

|

Operating netback ($) |

|

1,740,578 |

|

1,517,946 |

|

5,859,379 |

|

2,088,790 |

|

|

|

|

Per BOE, except total BOE sales volumes |

|

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

|

P&NG sales revenue ($) |

|

79.39 |

|

82.15 |

|

76.23 |

|

72.36 |

|

| Royalties ($) |

|

(8.23 |

) |

(8.89 |

) |

(6.11 |

) |

(8.11 |

) |

|

Operating costs ($) |

|

(41.93 |

) |

(41.45 |

) |

(37.78 |

) |

(46.52 |

) |

|

Operating netback per BOE ($) |

|

29.23 |

|

31.81 |

|

32.35 |

|

17.73 |

|

Sales Volumes

|

|

|

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

|

Oil and condensate (bbls) |

|

58,785 |

|

42,595 |

|

171,835 |

|

110,488 |

|

| Natural

gas (mcf) |

|

4,529 |

|

30,716 |

|

55,696 |

|

43,763 |

|

| Total

BOE |

|

59,548 |

|

47,723 |

|

181,117 |

|

117,788 |

|

| Liquids

composition |

|

99% |

|

89% |

|

95% |

|

94% |

|

| Oil and condensate bbls per

day |

|

639 |

|

463 |

|

627 |

|

405 |

|

| Natural

gas mcf per day |

|

49 |

|

334 |

|

203 |

|

160 |

|

|

Total BOE per day |

|

647 |

|

519 |

|

661 |

|

431 |

|

Selected Financial

Information

|

(expressed in $, except shares outstanding) |

September 30, 2024 |

|

December 31, 2023 |

|

|

Current assets |

9,072,026 |

|

4,433,398 |

|

| Current

liabilities |

17,816,441 |

|

21,910,157 |

|

|

Working capital |

(8,744,415 |

) |

(17,476,759 |

) |

|

Property and equipment |

48,630,094 |

|

39,331,690 |

|

|

Total assets |

61,754,512 |

|

49,168,314 |

|

|

Non-current financial liabilities |

21,957,983 |

|

9,245,121 |

|

|

Share capital |

31,201,163 |

|

30,516,664 |

|

|

Total common shares outstanding |

426,954,767 |

|

421,191,515 |

|

Q3 Highlights:During the third quarter of 2024,

Prospera successfully completed the following strategic

objectives:

- Executed a

successful multi-well drilling program in the company's Brooks

light/medium oil property, in turn adding significant production

and reserve value.

- Acquired an

additional 10% working interest in the company’s core Saskatchewan

properties (Cuthbert, Luseland & Hearts Hill) from a working

interest partner in exchange for full settlement of the partner’s

accounts receivable balance. As a result of this working interest

acquisition, Prospera's corporate weighted average working interest

increased to an average of 95% in its core Saskatchewan

assets.

- Closed term

debt financing of $11 million in July 2024, providing strategic

funding for the company’s development and optimization

programs.

Operational highlights for the quarter

are as follows:

- PEI realized average net sales of

647 boe/d in Q3 2024, an increase of 25% from Q3 2023 net sales of

519 boe/d. The increase was due to additional production realized

from the 2023 and 2024 development programs and the increased

working interest in PEI’s core Saskatchewan properties.

- Due to higher production levels, PEI realized a 21% increase in

sales revenue to $4,727,708 in Q3 2024 compared to $3,920,428 in Q3

2023, despite a decrease in sales price decrease to $79.39/boe in

Q3 2024, compared to $82.15/boe in Q3 2023.

- Consequently, the higher working interest attributed to an

increase in operating costs totalling $2,496,800 in Q3 2024

compared to $1,978,034 in Q3 2023, however, operating costs per boe

remained flat at $41.93/boe in Q3 2024 compared to $41.45/boe in Q3

2023.

- PEI earned an operating netback of $1,740,578 ($29.23/boe) in

Q3 2024 compared to $1,517,946 ($31.81/boe) in Q3 2023 and

$5,859,379 ($32.35/boe) in YTD 2024 as compared to $2,088,790

($17.73/boe) in YTD 2023.

- As of September 30, 2024, Prospera

reduced its accounts payable arrears by $4 million to $16.5

million, compared to $20.5 million on December 31, 2023. This has

resulted in the improvement of company financial health, including

a decrease in working capital deficit to $8.7 million at September

30, 2024, compared to $17.5 million at December 31, 2023.

About Prospera

Prospera Energy Inc. is a publicly traded

Canadian energy company specializing in the exploration,

development, and production of crude oil and natural gas.

Headquartered in Calgary, Alberta, Prospera is dedicated to

optimizing recovery from legacy fields using environmentally safe

and efficient reservoir development methods and production

practices. The company’s core properties are strategically located

in Saskatchewan and Alberta, including Cuthbert, Luseland, Heart

Hills, Red Earth, and Pouce Coupe. Prospera Energy Inc. is listed

on the TSX Venture Exchange under the symbol PEI and the U.S. OTC

Market under GXRFF.

For Further Information: Shawn Mehler, PR

Email: Investors@prosperaenergy.comWebsite:

www.prosperaenergy.com

FORWARD-LOOKING STATEMENTSThis

news release contains forward-looking statements relating to the

future operations of the Corporation and other statements that are

not historical facts. Forward-looking statements are often

identified by terms such as “will,” “may,” “should,” “anticipate,”

“expects” and similar expressions. All statements other than

statements of historical fact included in this release, including,

without limitation, statements regarding future plans and

objectives of the Corporation, are forward-looking statements that

involve risks and uncertainties. There can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those anticipated in

such statements.

Although Prospera believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Prospera can give no assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in

the preparation of any forward-looking information may prove to be

incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of Prospera. As a result, Prospera

cannot guarantee that any forward-looking statement will

materialize, and the reader is cautioned not to place undue

reliance on any forward- looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release, and Prospera does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by Canadian securities

law.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

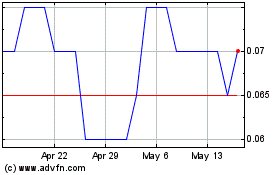

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Feb 2024 to Feb 2025