Prospera Energy Inc. (TSX.V: PEI, OTC: GXRFF)

("

Prospera", “

PEI” or the

"

Corporation")

This report continues Prospera’s monthly

production updates, ensuring stakeholders receive consistent and

timely insights into operational performance and key field

developments. All production numbers referenced are sales numbers

of the Company at its current working interest, pre-royalties.

However, the company continues to receive revenue for JV partners

in default in both its Cuthbert and Brooks properties.

Additionally, a significant portion of the company’s natural gas

production is consumed within the field for fuel gas and is thus

not included in sales numbers.

In December, field production was estimated to

be 661 boe/d (91% oil). From January 1st to January 19th, field

production estimated sales at 682 boe/d (92% oil), with production

peaking on January 16th at 751 boe/d (92% oil) as the company

continues to bring production online. The average production

weighted working interest for PEI throughout this period was

91%.

As 2024 concluded, the company successfully

completed its nine-well workover program, yielding strong results

across all wells while achieving exceptional capital efficiency at

less than $3,500 per boe/d. A standout performer in the program is

well 13-13-36-26W3, a horizontal Waseca well distinguished by

higher API oil grades, lower oil viscosity, and greater reservoir

exposure compared to other wells in the Luseland pool. This well is

currently producing 59boe/d (18% oil), with daily monitoring of

water cuts and fluid levels to ensure optimal performance.

The average cost of the first seven workovers

was under $35,000 per job, reflecting operational efficiencies

achieved through pre-planning, streamlined decision making, and

strong collaboration among field operations teams. The 2025 service

rig program commenced in early January with the successful repair

of the 03-02 injector well in Cuthbert. The rig is currently

working on the fourth well of a four-well program in Cuthbert and

is scheduled to then move to Hearts Hill for an extensive eleven

well initiative. In parallel, the company is finalizing plans for

Luseland’s program, which targets higher-potential wells. These

wells require additional surface equipment and advanced planning to

effectively address sand production challenges.

Winterization activities have been successfully

implemented and now stress-tested across all pools, enhancing the

Corporation's ability to maintain production during severe weather

conditions. These measures have resulted in improved runtime, more

efficient field operations, and reduced operating costs

MER non-compliances continue to be addressed

with crucial and timely progress, including the completion of

signage issues, surface casing vent repairs, packer leak fixes,

housekeeping improvements, and most importantly the removal and

disposal of two spill piles.

Additionally, pipeline cutouts from both Hearts

Hill pipeline failures have been excavated and removed. The failure

analysis report is now complete, and a third-party engineering firm

is conducting engineering assessments. The conclusions of these

evaluations will be presented and taken into account as Prospera

develops and adjusts its field-wide go-forward plan.

In Brooks, the company has accelerated well

production with increased drawdown of fluid levels and implementing

casing gas compression to alleviate pressure on the reservoir.

These efforts have led to increased production, with additional

optimization capacity available on both fronts. Preparatory work in

Brooks includes evaluations of acid fracs versus cross-linked gel

fracs and optimal matrix stimulation techniques for the Pekisko

wells. Additionally, Prospera’s joint venture partner in the Brooks

field is in arrears of approximately $4.2 million, and

investigations into this matter are ongoing.

The company is conducting extensive reviews on

the nine Horizontal wells drilled in 2023 in the Cuthbert pool as

only three of the wells are preforming to expectations. Four of the

lower producing wells have been analyzed through reservoir

engineering, geological analysis, and drilling post-mortem

analysis, with plans to complete workovers on all four wells. One

of the wells will undergo a packer install to block off the 1/3 of

well closest to the heel, and one well will require a blank

installed where the well dipped too far down the reservoir into a

water zone. Two of the wells require the closest injector to the

well being completely shut-off. Analysis on the remaining two low

producing wells will be completed over the next two weeks.

As previously mentioned, the company has begun

replacing worn out field equipment with a total of five new or

rebuilt engine installations completed in the Cuthbert field thus

far in January. Lease operating cost reviews are now conducted on a

more frequent basis with a current focus on optimizing electricity

costs, flushby costs, and the transportation of oil from our

batteries to sales points. Additionally, the company has

successfully implemented defoam and enhanced demulsifier chemicals,

achieving less than 20 PPM oil in the water injection system,

further improving operational efficiency.

Escalating WTI prices, Canadian heavy oil

differentials at tight levels, and increasing production have

allowed the company to generate significant and rising field

operating cash flows to cover general and administrative expenses,

interest, accounts payable arrears, and ongoing rig activities

aimed at further boosting production.

In line with our commitment to greater

transparency, the company is pleased to announce the launch of an

updated website and a refreshed corporate presentation, now

available at prosperaenergy.com. The corporate presentation will be

updated monthly going forward.

About Prospera

Prospera Energy Inc. is a publicly traded

Canadian energy company specializing in the exploration,

development, and production of crude oil and natural gas.

Headquartered in Calgary, Alberta, Prospera is dedicated to

optimizing recovery from legacy fields using environmentally safe

and efficient reservoir development methods and production

practices. The company’s core properties are strategically located

in Saskatchewan and Alberta, including Cuthbert, Luseland, Hearts

Hill, and Brooks. Prospera Energy Inc. is listed on the TSX Venture

Exchange under the symbol PEI and the U.S. OTC Market under

GXRFF.

For Further Information:

Shawn Mehler, PR Email:

investors@prosperaenergy.com

Chris Ludtke, CFOEmail:

cludtke@prosperaenergy.com

Shubham Garg, Chairman of the BoardEmail:

sgarg@prosperaenergy.com

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking

statements relating to the future operations of the Corporation and

other statements that are not historical facts. Forward-looking

statements are often identified by terms such as “will,” “may,”

“should,” “anticipate,” “expects” and similar expressions. All

statements other than statements of historical fact included in

this release, including, without limitation, statements regarding

future plans and objectives of the Corporation, are forward-looking

statements that involve risks and uncertainties. There can be no

assurance that such statements will prove to be accurate and actual

results and future events could differ materially from those

anticipated in such statements.

Although Prospera believes that the expectations

and assumptions on which the forward-looking statements are based

are reasonable, undue reliance should not be placed on the

forward-looking statements because Prospera can give no assurance

that they will prove to be correct. Since forward-looking

statements address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Actual

results could differ materially from those currently anticipated

due to a number of factors and risks. These include, but are not

limited to, risks associated with the oil and gas industry in

general (e.g., operational risks in development, exploration and

production; delays or changes in plans with respect to exploration

or development projects or capital expenditures; the uncertainty of

reserve estimates; the uncertainty of estimates and projections

relating to production, costs and expenses, and health, safety and

environmental risks), commodity price and exchange rate

fluctuations and uncertainties resulting from potential delays or

changes in plans with respect to exploration or development

projects or capital expenditures.

The reader is cautioned that assumptions used in

the preparation of any forward-looking information may prove to be

incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties, and other factors, many of

which are beyond the control of Prospera. As a result, Prospera

cannot guarantee that any forward-looking statement will

materialize, and the reader is cautioned not to place undue

reliance on any forward- looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release, and Prospera does not undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as expressly required by Canadian securities

law.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

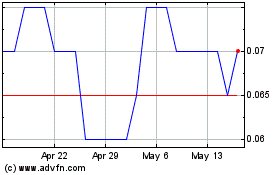

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Prospera Energy (TSXV:PEI)

Historical Stock Chart

From Jan 2024 to Jan 2025