Quisitive Technology Solutions Inc.

(“Quisitive” or the “Company”) (TSXV: QUIS, OTCQX:

QUISF), a premier Microsoft Cloud and AI solutions

provider, today reported financial results for the full year ended

December 31, 2023.

Management Commentary"In recent

months, we've successfully executed two major divestitures,

significantly streamlining Quisitive's operations and sharpening

our focus on our core mission as a premier provider of Microsoft

Cloud and AI solutions," said Quisitive CEO Mike Reinhart. "The

divestiture of our payments division has removed financial

constraints, allowing us to reallocate growth enabling resources to

our Cloud operations. The foundational strength and competitive

edge of Quisitive is our deep partnership with Microsoft. To

bolster our position as a leader in cloud and AI solutions, we have

been collaborating with Microsoft to develop AI go-to-market

strategies and service offerings. We expect these initiatives to

begin producing revenue within the next twelve months, driven by

expanding momentum in the AI market for these offerings."

"Admittedly the IT industry for professional

services was challenging in 2023, but we responded quickly by

reducing our workforce, shifting our revenue mix towards recurring

services, and identifying new growth opportunities in AI and data.

These strategic changes resulted in gross margins that exceeded the

industry average, reaching 43% in the latter half of 2023, and have

effectively positioned Quisitive for future growth. With a

streamlined organization, a deleveraged balance sheet, and a

strengthened leadership team in place, we are well-positioned to

drive organic growth and enhance shareholder value in the coming

year and beyond."

Full Year 2023 Financial

ResultsThe Company’s condensed consolidated financial

statements for the full year ended December 31, 2023 and related

management’s discussion and analysis can be found on the Company’s

website and on the Company’s issuer profile on SEDAR at

www.sedarplus.com. All figures are expressed in United States

dollars unless otherwise stated.

- Revenue from continuing operations

was $121.2 million compared to $137.8 million for the full year

ended December 31, 2022. The decline was driven by reduced market

demand for professional services revenue and the Company’s

corresponding reduction in revenue-generating headcount.

- Gross profit from continuing

operations as a percentage of revenue increased to 40.2% compared

to 39.8% for the full year ended December 31, 2022.

- Gross profit from continuing

operations was $48.8 million compared to $54.8 million for the full

year ended December 31, 2022.

- Adjusted EBITDA from continuing

operations was $13.0 million compared to $15.5 million for the full

year ended December 31, 2022. Pro Forma Adjusted EBITDA (as if the

divestures of BankCard and PayiQ (which were completed in January

and April 2024, respectively) closed on January 1, 2023) was $16.4

million for the full year ended December 31, 2023, or 14% of

revenue.

- The Company’s total senior debt to

Adjusted EBITDA ratio was 3.04:1.00 at December 31, 2023. Following

the close of the sale of Bankcard and the Company’s amended and

restated credit agreement, the Company’s total senior debt to

Adjusted EBITDA ratio is approximately 2.1:1.0.

Fourth Quarter and Full Year 2023 and

Recent Operational Highlights

- Appointed Dan Kunz as Executive

Vice President of Microsoft Cloud and AI Global Delivery

Organization

- Announced and completed the sale of

BankCard USA

- Announced the upcoming launch of

MazikCare copilot and previewed at the 2024 HIMSS Conference

- Participated alongside Microsoft at

the 2024 HIMSS Conference

- Awarded the AI and Machine Learning

in Microsoft Azure Specialization

- Announced and completed the sale of

PayiQ

- Recognized as the 2023 Solution

Partner of the Year by Board International at the Board Americas

Partner Summit for its outstanding channel marketing collaboration

and introduction of the Microsoft Dynamics 365 Trial Balance

Extractor solution to Board

- Announced the appointment of two

new directors to the board of directors

- Collaborated with Microsoft to

leverage new healthcare data solutions in Microsoft Fabric for

Ontario Workers Network, the Ottawa Hospital, and other hospitals

in the network

Capitalization Table

|

|

|

Shares |

| Current Outstanding Shares (As

of April 29, 2024) |

|

275,924,122(1) |

| RSU/DSU and Stock Options |

|

17,739,137 |

| Fully Diluted Shares |

|

293,663,259 |

Note:(1) Reflects the cancellation of 133,095,168 common shares

of Quisitive following the completion of the sale of BankCard.

Fiscal Year 2024

GuidanceQuisitive is providing the following guidance for

fiscal year 2024:

|

|

Low (US$) |

High (US$) |

| Fiscal Year 2024 Revenue |

123,000,000 |

137,000,000 |

| Fiscal Year 2024 Pro Forma

Adjusted EBITDA |

15,000,000 |

18,000,000 |

Pro Forma Adjusted EBITDA further adjusts

Adjusted EBITDA for the impact of (i) certain cost savings realized

by the continuing operation following the divestitures of PayiQ and

Bankcard, and (ii) headcount reductions made in response to market

demand during the year ended December 31, 2023 as if the savings

from those reductions had been realized as of January 1, 2023,

offset by the removal of the benefit of variable compensation

recognized during the year.

The Revenue and Pro Forma Adjusted EBITDA for

fiscal year 2023 is based on the assumption that both the sale of

PayiQ and BankCard, which were completed in January and April 2024,

respectively, were finalized on January 1, 2023. This calculation

only includes outcomes for the remaining Cloud segment and

corporate expenses. For fiscal year 2024, the Revenue and Pro Forma

Adjusted EBITDA projections also assume the completion of the sale

of PayiQ and BankCard on December 31, 2023, focusing solely on

financial forecasts for the remaining Cloud segment and corporate

costs.

Quisitive Reaffirms Strategic

RoadmapQuisitive reaffirms its strategic commitment to

refocus its corporate vision to capitalize on the expanding

opportunities emerging from AI advancements, enabled by the

Microsoft Cloud. Leveraging a rich legacy of integrating both

custom and proprietary technologies for transformative results,

Quisitive is set to innovate further in its service offerings by

enhancing its AI capabilities. This includes developing more

intuitive and predictive solutions tailored to meet the varied

needs of its broad clientele across all sectors. Building on its

robust foundation in cloud solutions and its partnership with

Microsoft, Quisitive is determined to lead the market in creating

customized AI-driven solutions. These solutions aim to not only

boost operational efficiencies for its customers but also forge new

avenues for growth and competitive advantage in a rapidly evolving

digital landscape.

Conference CallQuisitive

management will hold a conference call today (April 29, 2024) at

4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these

results.

Company CEO Mike Reinhart and CFO Scott Meriwether will host the

call, followed by a question-and-answer period.

Toll Free dial-in: 1-877-704-4453International dial-in:

1-201-389-0920Webcast Link: Here

Please call the conference telephone number 10 minutes prior to

the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Group at 949-574-3860.

A telephonic replay of the conference call will be available

after 7:30 p.m. Eastern time today and will expire after Monday,

May 13, 2024.

Toll-free replay number: 1-844-512-2921International replay

number: 1-412-317-6671Replay ID: 13746060

For additional information, please visit the Investor Relations

section of Quisitive’s website

at: https://quisitive.com/investor-relations/.

The following tables summarize results for the three months and

full year ended December 31, 2023 and 2022:

| |

Three Months Ended |

|

Year Ended |

| |

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

|

Revenue |

$ |

28,410 |

|

|

$ |

32,420 |

|

|

$ |

121,224 |

|

|

$ |

137,764 |

|

| Cost of

Revenue |

|

16,340 |

|

|

|

19,662 |

|

|

|

72,435 |

|

|

|

82,966 |

|

| Gross

Margin |

|

12,070 |

|

|

|

12,758 |

|

|

|

48,789 |

|

|

|

54,798 |

|

| |

|

42 |

% |

|

|

39 |

% |

|

|

40 |

% |

|

|

40 |

% |

| Operating

Expenses |

|

|

|

|

|

|

|

| Sales and marketing

expense |

|

3,265 |

|

|

|

2,879 |

|

|

|

12,576 |

|

|

|

11,805 |

|

| General and

administrative |

|

6,458 |

|

|

|

6,497 |

|

|

|

23,829 |

|

|

|

27,511 |

|

| Development |

|

103 |

|

|

|

117 |

|

|

|

435 |

|

|

|

434 |

|

| Share-based compensation |

|

694 |

|

|

|

751 |

|

|

|

3,904 |

|

|

|

3,325 |

|

| Interest expense |

|

1,909 |

|

|

|

1,496 |

|

|

|

6,759 |

|

|

|

4,620 |

|

| Amortization |

|

2,116 |

|

|

|

2,080 |

|

|

|

7,767 |

|

|

|

8,258 |

|

| Earn-out settlement loss |

|

- |

|

|

|

3,750 |

|

|

|

- |

|

|

|

5,228 |

|

| Acquisition related

compensation |

|

- |

|

|

|

620 |

|

|

|

638 |

|

|

|

2,772 |

|

| Depreciation |

|

266 |

|

|

|

302 |

|

|

|

1,076 |

|

|

|

1,287 |

|

| Foreign exchange loss

(gain) |

|

201 |

|

|

|

35 |

|

|

|

255 |

|

|

|

(219 |

) |

| Acquisition-related,

transaction and other expenses |

|

1,006 |

|

|

|

272 |

|

|

|

3,171 |

|

|

|

688 |

|

| Other expense (income) |

|

71 |

|

|

|

(225 |

) |

|

|

(24 |

) |

|

|

(241 |

) |

| Net Loss from

continuing operations before income taxes |

$ |

(4,019 |

) |

|

$ |

(5,816 |

) |

|

$ |

(11,597 |

) |

|

$ |

(10,670 |

) |

| |

|

|

|

|

|

|

|

| Income tax expense —

current |

|

(660 |

) |

|

|

300 |

|

|

|

1,202 |

|

|

|

2,132 |

|

| Deferred income tax expense

(recovery) |

|

1,216 |

|

|

|

(75 |

) |

|

|

2 |

|

|

|

(1,928 |

) |

| Net Loss from

continuing operations |

$ |

(4,575 |

) |

|

$ |

(6,041 |

) |

|

$ |

(12,801 |

) |

|

$ |

(10,874 |

) |

| |

|

|

|

|

|

|

|

| Discontinued

Operations |

|

|

|

|

|

|

|

| Profit (loss) from

discontinued operations, net of tax |

|

(80,426 |

) |

|

|

934 |

|

|

|

(79,485 |

) |

|

|

1,596 |

|

| |

|

|

|

|

|

|

|

| Net Loss for the

Period |

$ |

(85,001 |

) |

|

$ |

(5,107 |

) |

|

$ |

(92,286 |

) |

|

$ |

(9,278 |

) |

| |

Three Months Ended December 31, |

|

|

Year Ended December 31, |

| |

|

2023 |

|

|

|

2022 |

|

|

|

|

2023 |

|

|

2022* |

|

Net loss for the period |

$ |

(85,001 |

) |

|

$ |

(5,107 |

) |

|

Net loss for the period |

$ |

(92,286 |

) |

|

$ |

(9,278 |

) |

| Loss (income) from

discontinued operations, net of tax |

|

80,426 |

|

|

|

(934 |

) |

|

Loss (income) from

discontinued operations |

|

79,485 |

|

|

|

(1,596 |

) |

| Net loss from continued

operations |

|

(4,575 |

) |

|

|

(6,041 |

) |

|

Net loss from continued

operations |

|

(12,801 |

) |

|

|

(10,874 |

) |

| Deferred income tax

recovery |

|

556 |

|

|

|

225 |

|

|

Deferred income tax

expense |

|

1,204 |

|

|

|

204 |

|

| Transaction related

expenses |

|

1,006 |

|

|

|

272 |

|

|

Transaction related

expenses |

|

3,172 |

|

|

|

687 |

|

| Foreign exchange |

|

201 |

|

|

|

35 |

|

|

Foreign exchange |

|

254 |

|

|

|

(220 |

) |

| Depreciation |

|

266 |

|

|

|

302 |

|

|

Depreciation |

|

1,076 |

|

|

|

1,289 |

|

| Amortization |

|

2,116 |

|

|

|

2,080 |

|

|

Amortization |

|

7,768 |

|

|

|

8,258 |

|

| Interest |

|

1,909 |

|

|

|

1,496 |

|

|

Interest |

|

6,759 |

|

|

|

4,620 |

|

| Share-based compensation |

|

694 |

|

|

|

751 |

|

|

Share-based compensation |

|

3,903 |

|

|

|

3,325 |

|

| Acquisition related

compensation |

|

- |

|

|

|

620 |

|

|

Acquisition related

compensation |

|

638 |

|

|

|

2,772 |

|

| Earn-out settlement loss |

|

- |

|

|

|

3,750 |

|

|

Earn out settlement loss |

|

- |

|

|

|

5,228 |

|

| Gain/loss on asset sale |

|

48 |

|

|

|

- |

|

|

Gain/loss on asset sale |

|

48 |

|

|

|

(9 |

) |

| Other expense (income) |

|

499 |

|

|

|

(225 |

) |

|

Other income |

|

515 |

|

|

|

(197 |

) |

| Development |

|

103 |

|

|

|

117 |

|

|

Development |

|

435 |

|

|

|

434 |

|

| Adjusted EBITDA |

$ |

2,823 |

|

|

$ |

3,382 |

|

|

Adjusted EBITDA |

$ |

12,971 |

|

|

$ |

15,517 |

|

| Adjusted EBITDA as a

percentage of revenue |

|

10 |

% |

|

|

10 |

% |

|

Adjusted EBITDA as a

percentage of revenue |

|

11 |

% |

|

|

11 |

% |

| Revenue |

$ |

28,410 |

|

|

$ |

32,420 |

|

|

Revenue |

$ |

121,224 |

|

|

$ |

137,764 |

|

| |

Year ended December 31, 2023 |

|

Adjusted EBITDA |

12,971 |

|

| Reductions in headcount within

continued operations, inclusive of wages and benefits |

4,180 |

|

| Remove benefit to variable and

incentive compensation recognized during year |

(1,166 |

) |

| Specific impacts from

divestiture of Payments Solutions segment - reduced corporate

insurance and increased licensing |

436 |

|

| Pro Forma Adjusted

EBITDA |

16,421 |

|

| Pro Forma Adjusted EBITDA as a

percentage of revenue |

14 |

% |

About Quisitive:Quisitive (TSXV: QUIS, OTCQX:

QUISF) is a premier, global Microsoft partner leveraging the power

of the Microsoft cloud platform and artificial intelligence,

alongside custom and proprietary technologies, to drive

transformative outcomes for its customers. The Company focuses on

helping enterprises across industries leverage the Microsoft

platform to adopt, innovate, and thrive in the era of AI. For more

information, visit www.Quisitive.com and follow @BeQuisitive.

Quisitive Investor ContactMatt Glover and John

YiGateway GroupQUIS@gateway-grp.com 949-574-3860

Tami AndersChief of

Stafftami.anders@quisitive.com972.573.0995

Reconciliation of Non-GAAP Financial

Measures - Adjusted EBITDA

Financial Measures and Adjusted EBITDA

There are measures included in this news release

that do not have a standardized meaning under generally accepted

accounting principles (GAAP) and therefore may not be comparable to

similarly titled measures and metrics presented by other publicly

traded companies. The Company includes these measures because it

believes certain investors use these measures and metrics as a

means of assessing financial performance. EBITDA (earnings before

interest, taxes, depreciation and amortization is calculated as net

earnings before finance costs (net of finance income), income tax

expense, and depreciation and amortization of intangibles) is a

non-GAAP financial measure that does not have any standardized

meaning prescribed by IFRS and may not be comparable to similar

measures presented by other companies.

We prepare and release quarterly unaudited and

annual audited financial statements prepared in accordance with

IFRS. We also disclose and discuss certain non-GAAP financial

information, used to evaluate our performance, in this and other

earnings releases and investor conference calls as a complement to

results provided in accordance with IFRS. We believe that current

shareholders and potential investors in the Company use non-GAAP

financial measures, such as Adjusted EBITDA, in making investment

decisions about the Company and measuring our operational

results.

The term "Adjusted EBITDA" refers to a financial

measure that we define as earnings before certain charges that

management considers to be non-operating expenses and which consist

of interest, taxes, depreciation, amortization, stock-based

compensation (for which we include related fees and taxes), changes

in fair value of derivatives, transaction and acquisition-related

expenses, US payroll protection plan loan forgiveness, and earn-out

settlement losses.

Management considers these non-operating

expenses to be outside the scope of Quisitive' ongoing operations

and the related expenses are not used by management to measure

operations. Accordingly, these expenses are excluded from Adjusted

EBITDA, which we reference to both measure our operations and as a

basis of comparison of our operations from period-to-period.

Management believes that investors and financial

analysts measure our business on the same basis, and we are

providing the Adjusted EBITDA financial metric to assist in this

evaluation and to provide a higher level of transparency into how

we measure our own business. However, Adjusted EBITDA is a non-GAAP

financial measure and may not be comparable to similarly titled

measures reported by other companies. Adjusted EBITDA should not be

construed as a substitute for net income determined in accordance

with IFRS or other non-GAAP measures that may be used by other

companies, such as EBITDA. The use of Adjusted EBITDA does have

limitations as, Some investors may consider these charges and

expenses as a recurring part of operations rather than expenses

that are not part of operations.

Cautionary Note Regarding Forward Looking

Information

This news release contains certain

“forward‐looking information” and “forward‐looking statements”

(collectively, “forward‐ looking statements”) within the meaning of

applicable Canadian securities legislation regarding Quisitive and

its business. Any statement that involves discussions with respect

to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as “expects”, or “does not expect”,

“is expected”, “anticipates” or “does not anticipate”, “plans”,

“budget”, “scheduled”, “forecasts”, “estimates”, “believes” or

“intends” or variations of such words and phrases or stating that

certain actions, events or results “may” or “could, “would”,

“might” or “will” be taken to occur or be achieved) are not

statements of historical fact and may be forward‐looking

statements. Forward‐ looking statements are necessarily based upon

a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward‐looking statements. These forward-looking statements

include, but are not limited to, statements relating to: the

anticipated benefits of the sale of PayiQ and BankCard to Quisitive

and its shareholders; the future growth potential of the Company

and its cloud solutions business; the financial outlook of the

Company following the divestitures of PayiQ and BankCard, including

growth projections, capital allocation and cost savings;, potential

for growth and expectations regarding the Company’s ability to

capitalize on the expanding opportunities emerging from AI

advancements.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: the expected

results from the completion of the sale of BankCard; fluctuations

in general macroeconomic conditions; fluctuations in securities

markets; the ability to realize on cost saving measures; the

Company’s limited operating history; future capital needs and

uncertainty of additional financing; the competitive nature of the

technology industry; unproven markets for the Company’s product

offerings; lack of regulation and customer protection; the need for

the Company to manage its future strategic plans; the effects of

product development and need for continued technology change;

protection of proprietary rights; network security risks; the

ability of the Company to maintain properly working systems;

foreign currency trading risks; use and storage of personal

information and compliance with privacy laws; use of the Company’s

services for improper or illegal purposes; global economic and

financial market conditions; uninsurable risks; changes in project

parameters as plans continue to be evaluated; and those factors

described under the heading "Risks Factors" in the Company's annual

information form dated May 23, 2023 available on SEDAR+ at

www.sedarplus.ca. Although the forward-looking statements contained

in this news release are based upon what management of the Company

believes, or believed at the time, to be reasonable assumptions,

the Company cannot assure shareholders that actual results will be

consistent with such forward-looking statements, as there may be

other factors that cause results not to be as anticipated,

estimated or intended. Accordingly, readers should not place undue

reliance on forward-looking statements and information. There can

be no assurance that forward-looking information, or the material

factors or assumptions used to develop such forward-looking

information, will prove to be accurate. The Company does not

undertake any obligations to release publicly any revisions for

updating any voluntary forward-looking statements, except as

required by applicable securities law.

This news release also contains future-oriented

financial information and financial outlook information (together,

“FOFI”) about the Company’s prospective results of operations,

including statements regarding expected pro-forma Adjusted EBITDA

following the completion of the sale of BankCard. FOFI is subject

to the same assumptions, risk factors, limitations and

qualifications as set forth in the above paragraph. The Company has

included the FOFI to provide an outlook of management’s

expectations regarding the Company on a post-Transaction basis and

other anticipated activities and results, and such information may

not be appropriate for other purposes. The Company and management

believe that the FOFI has been prepared on a reasonable basis,

reflecting management’s reasonable estimates and judgements;

however, actual results of operations and the resulting financial

results may vary from the amounts set forth herein. Any financial

outlook information speaks only as of the date on which it is made

and the Company undertakes no obligation to publicly update or

revise any financial outlook information except as required by

applicable securities laws.

Neither the TSX Venture Exchange nor its

Regulation Services provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

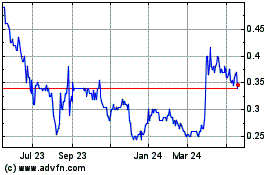

Quisitive Technology Sol... (TSXV:QUIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

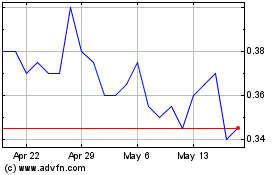

Quisitive Technology Sol... (TSXV:QUIS)

Historical Stock Chart

From Dec 2023 to Dec 2024