Richmond Minerals Inc.

(TSX-V: RMD) (“Richmond” or the

“Company”) is pleased to announce the closing of a

non-brokered private placement of common shares at a price of $0.05

per share, for gross proceeds of up to $340,000 (the "Private

Placement"). Two of the subscribers in the Private Placement are

related parties of the Company.

The company is also pleased to provide an update

for exploration work at the Company’s Ridley Lake Gold Project (the

“Property”) located in the west central area of the Swayze

Greenstone belt approximately 35 kilometres east of Newmont's

Borden Gold Project.

Furthermore the company informs about the future

holdings and strategy for the Austrian exploration projects.

Private Placement

The Company completed the Private Placement and

issued a total of 6,800,000 common shares at a price of $0.05 per

share. As a result of the Private Placement, KNP Group Inc., a

company controlled by Phillip Chong, the CFO of the Company, has

become a new insider of the Company. KNP Group Inc. acquired

4,000,000 common shares in the capital of the Company, representing

approximately 11% of the issued and outstanding shares of the

Company. Prior to the completion of the Private Placement neither

Mr. Chong nor KNP Group Inc. held any common shares of the

Company.

Share for Debt Transaction

The Company also completed a share for debt

transaction with two related parties of the Company settling an

aggregate debt of $52,725.35. The Company issued a total of

1,054,507 common shares to satisfy such debts at a deemed price per

share of $0.05 (the "Share for Debt Transaction"). The creditors

include Franz Kozich, the CEO and a director of the Company, and a

company affiliated with Thomas Unterweissacher, a director of the

Company, each of whom is a related party to the Company.

The Private Placement and the Share for Debt

Transaction each constitute a “related party transaction” under

Multilateral Instrument 61-101 - Protection of Minority

Securityholders in Special Transactions (“MI 61-101”), in respect

of the related parties participating in such transaction. However,

each transaction is exempt from: (i) the valuation requirements of

MI 61-101 by virtue of the exemption contained in Section 5.5(b) of

MI 61-101, as the common shares of the Company are not listed on a

market specified in MI 61-101, and (ii) from the minority

shareholder approval requirements of MI 61-101, by virtue of the

exemption contained in Section 5.7(1)(a) of MI 61-101, as the fair

market value of the common shares to be issued in such transactions

will not exceed 25% of the Company's market capitalization. The

participation by related parties in the Private Placement and the

Share for Debt Transaction has been approved by directors of the

Company who are independent in respect of such transactions.

Exploration at Ridley Lake Gold

ProjectAs reported in 2015 and 2016 IP and Magnetic

surveys were successful in identifying well-defined geophysical

anomalies characterized by high chargeability and resistivity with

prominent coincidental magnetic anomalies (the “Aguara East

anomalies”), having a northeast orientation and a strike length in

excess of 825 metres. Modeling of the data obtained from the July

2015 and November 2016 combined surveys identified multiple targets

at vertical depths down to the IP survey limit of approximately 200

metres. Drill testing of these IP/Mag targets in the Aguara Zone in

2017 and 2020 yielded drill intersections high-lighted by 18.3 g/t

gold over 3 m in hole RS-20-33 (from 329m to 332m) and 0.33 g/t

gold over 136 m in hole RS-17-30. In December 2023 the Company

completed 17.15 km of Spectral Induced Polarization

(IP)/Resistivity (dipole-dipole, a=50 m, n= 1 to 6) and Magnetic

surveys (the "Survey") to test for anomalous responses at the Cyril

Knight Zone located approximately 800 m due north of the Aguara

Zone.

Overall the IP/Resistivity Survey of the Cyril

Knight Grid resulted in unusual anomalies. The contour map apparent

chargeability (mV/V), derived from the combined data of the Cyril

Knight, Aguara East and, Aguara West Grids, show two, markedly

different apparent chargeability regimes. The southern Regime IP-A,

that covers the Aguara East and Aguara West grids is characterized

by northwest striking, discrete, well defined IP anomalous trends,

as opposed to the northern Cyril Knight Zone Regime IP-B where the

anomalous responses are broad and continuous along almost entire

survey lines.

Specifically,

seven IP anomalous horizons were identified within

the IP-B regime. The trends are sub-parallel and confirm with the

northeast trending geology. The trends are identified as

trends RW-1, RW-4, RW-5, RIP-6 and the

discontinuous trend RW-7.

The significant trend is RW-1 and may form the

westerly continuation of the Trend RIP-1A of the Aguara East Grid

and is centered about the Cyril Knight Grid base line 0 extending

to L600W located between Lines 75W and 150W. The trend is

associated with apparent resistivities exceeding 10,000 ohm-m and

is suggestive of possible strong alteration within this area of the

Property.

The prominent apparent chargeability anomalous

trend identified as RW-5 extends from L225W to L750W and is found

within the northern area of the grid and may represent the

extension of Trend RIP-5 of the Aguara East Gri. RW-5 is

characterized by apparent resistivities of 1,000 ohm-m or lower.

Further west of L750W the signatures become complex and imply the

depth of these wide source(s) may be 100 m or greater.

Trend RW-6 consists of anomalous IP responses

that were observed at dipole separations n=8 and n=9, and are

indicative of deeper sources. The associated resistivities here

exceed 10,000 ohm-m and may also be associated with strong

alteration. It is noted the wide anomalous IP responses with larger

dipole separations (n=7, 8 and 9) at L900W may be in part of the

northwesterly extension of RW-6.

Trend RW-7 is detected intermittently at larger

dipole separations indicating greater depths to the sources. The

trend is located between Trend RW-5 in the north and RW-1 on the

south and is well defined along Lines 525W 375W and 300W.

Significantly, the associated apparent resistivities are more than

10,000 ohm-m. Company management believes this trend is very

promising and worthy of follow-up drill testing.

Trend RW-4 is noted in pseudo-sections from L75W

to L375W. It is characterized by apparent chargeabilities exceeding

10 mV/V. RW-4 is the westerly extension of RIP-6 of the East

grid. A formational source is suspected.

Multiple drill hole collar locations have been

recommended for follow-up testing of these new targets. Plans are

underway for the resumption of drilling in early summer of

2024.

Austrian Projects Update

Oberzeiring Polymetallic ProjectThe 99

exploration licenses near the village of Oberzeiring expired on

31st December 2023. The licenses had been acquired from Silbermine

Zeiring GmbH on March 12 2020. A number of unpredictably burdensome

circumstances arose relating to this project, and the company

decided to halt exploration activities and focus on its more

promising Canadian projects. Richmond plans to phase out all

Austrian projects in the coming months.

Warren Hawkins, P.Eng, a “Qualified Person”,

within the meaning of Nation Instrument 43-101- Standards of

Disclosure for Minerals Projects, has reviewed and approved the

scientific and technical information contained in this news

release. Mr. Hawkins is not considered to be “independent” of the

Corporation (as defined in National Instrument 43-101), as he

currently holds securities of the Corporation.

Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this news

release.

On Behalf of Richmond

Minerals,

David

Ellis

President, Richmond

Minerals Inc.

For further

information: David Ellis at (416) 603-2114

Cautionary Note

Regarding Forward-Looking Statements: Certain disclosure in this

release constitutes forward-looking statements. In making the

forward-looking statements in this release, the Company has applied

certain factors and assumptions that are based on the Company’s

current beliefs as well as assumptions made by and information

currently available to the Company. Although the Company considers

these assumptions to be reasonable based on information currently

available to it, they may prove to be incorrect, and the

forward-looking statements in this release are subject to numerous

risks, uncertainties and other factors that may cause future

results to differ materially from those expressed or implied in

such forward-looking statements. Readers are cautioned not to place

undue reliance on forward-looking statements. The Company

does not intend, and expressly disclaims

any intention or obligation to update

or revise any forward-looking statements whether as

a result of new information, future events or otherwise, except as

required by law.

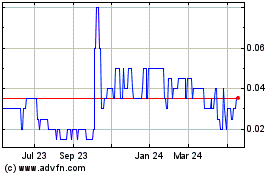

Richmond Minerals (TSXV:RMD)

Historical Stock Chart

From Oct 2024 to Nov 2024

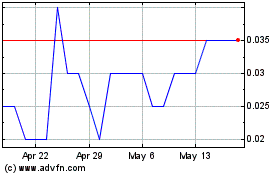

Richmond Minerals (TSXV:RMD)

Historical Stock Chart

From Nov 2023 to Nov 2024