Rugby Resources Ltd. Closes Oversubscribed Non-brokered Private Placement

24 February 2024 - 7:16AM

Rugby Resources

Ltd. (“Rugby” or

the “Company”)

(TSX-V: RUG) is pleased to

announce that further to the news releases dated February 7 and 12,

2024, it has closed an oversubscribed non-brokered private

placement and will issue 19,696,665 units (the

“

Units”) of the Company at a price of $0.06 per

Unit for gross proceeds of $1,181,800 (the

“

Offering”).

Each Unit consists of one (1) common share and

one common share purchase warrant (a “Warrant”).

Each Warrant will entitle the holder thereof to purchase one (1)

additional common share of the Company at an exercise price of

$0.10 for a period of two (2) years from the Closing Date.

Finder’s fees in an aggregate amount of $31,248

were paid to qualified parties in connection with the Offering. All

securities issued pursuant to the Offering are subject to a

statutory hold period of four months plus a day from issuance in

accordance with applicable securities laws of Canada. Closing of

the Offering is subject to receipt of all necessary regulatory

approvals and final acceptance by the TSX Venture Exchange.

Proceeds of the Offering will be used for

exploration and general expenses.

MI 61-101 Disclosure

Certain insiders of the Company participated in

the Offering for an aggregate total of 2,350,000 Units. The

participation by such insiders is considered a “related-party

transaction” within the meaning of Multilateral Instrument 61-101 -

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). The Company has relied on exemptions from the formal

valuation and minority shareholder approval requirements of MI

61-101 contained in sections 5.5(a) and 5.7(1)(a) of MI 61-101 in

respect of related party participation in the Offering as neither

the fair market value (as determined under MI 61-101) of the

subject matter of, nor the fair market value of the consideration

for, the transaction, insofar as it involved the related parties,

exceeded 25% of the Company’s market capitalization (as determined

under MI 61- 101).

Early Warning Disclosure

Rowen Company Limited (“Rowen”) a company

controlled by Bryce Roxburgh, a director and officer of the

Company, acquired 2,000,000 Units under the Offering. Prior to the

Offering, Bryce Roxburgh and Rowen, held 11.24% of the Company's

issued and outstanding common shares on a non-diluted and 14.14% on

a fully diluted basis. After giving effect to the Private

Placement, Bryce Roxburgh and Rowen beneficially own and control

collectively 11.17% of the Company's issued and outstanding common

shares on a non-diluted and 14.37% on a fully diluted basis. Rowen

and Bryce Roxburgh acquired the Units for investment purposes.

Rowen and Bryce Roxburgh intend to evaluate their investment in the

Company and to increase or decrease their shareholdings from time

to time as they may determine appropriate. A copy of the early

warning report being filed by Rowen and Bryce Roxburgh may be

obtained by contacting the Company at 604-687-2038.

For additional information you are invited to

visit the Rugby Resources Ltd. website

at: www.rugbyresourcesltd.com

|

Rob Grey, VP Corporate Communications |

Suite 1890 – 1075 West Georgia St. |

| Tel: 604-688-4941 Fax:

604-688-9532 |

Vancouver, BC Canada. V6E 3C9 |

| Toll free: 1-855-688-4941 |

info@rugbyresourcesltd.com |

| |

|

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE

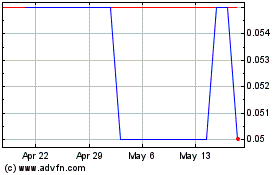

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

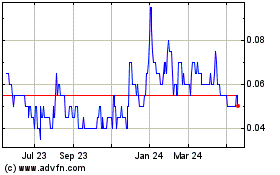

Rugby Resources (TSXV:RUG)

Historical Stock Chart

From Nov 2023 to Nov 2024