Sirona Biochem Corp. (TSX-V: SBM) (Frankfurt: ZSB) (Xetra: ZSB)

(the “

Company”) announced today that it has closed

an oversubscribed, non-brokered convertible debenture for gross

proceeds of $1,563,600. The private placement consists of 1,563

Debenture units, (the “

Debenture Units”) at a

price of $1,000 per Debenture Unit.

Dr. Howard Verrico, CEO, subscribed to $500,000

of Debenture Units. Dr. Verrico’s participation is a “related party

transaction” within the meaning of Multilateral Instrument 61-101

Protection of Minority Security Holders in Special Transactions.

The Company relied on the exemptions from the formal valuation and

minority shareholder-approval requirements of MI 61-101 in respect

of related party participation in the Offering. The MI 61-101

exemptions are available as the fair market value of the Debenture

Units, and the fair market value of the consideration for the

Debenture Units, insofar as it involves Dr. Verrico and other

interested parties, did not exceed 25% of the Company’s market

capitalization.

“Although we are in a challenging market, I am

confident the value of our platform technology will be recognized

as we advance our diverse pipeline. It is my intention to support

Sirona, as needed, both financially and by working with our team to

make Sirona a commercial success. We appreciate the contribution of

the long-term shareholders in this financing who share my vision,”

reports Dr. Howard Verrico.

Approximately 1/3 of the net proceeds from the

Offering will be used for general corporate purposes, and the

remainder of the proceeds will used for research and development

expenses (including but not limited to, laboratory staff salaries,

laboratory materials and intellectual property costs).

Each Debenture Unit has a face value of (the

“Face Value”) of $1,120, consisting of $1,000 in principal (the

“Principal”) and $120 in prepaid interest (the “Prepaid Interest”).

The Principal of the Debenture Units will accrue interest at a rate

of 12% per annum, which accrued interest (“Accrued Interest”) will

be paid semi-annually, in arrears. The Company will pay the Prepaid

Interest and Accrued Interest in cash or, subject to TSX Venture

Exchange (“TSXV”) acceptance, may elect to satisfy payment in kind

by issuing Shares (“Interest Shares”). In the event of payment in

kind, the number of Interest Shares due will be calculated using a

conversion price (the “Interest Conversion Price”) equal to,

subject to acceptance by the TSXV, the maximum Discounted Market

Price (as defined in TSXV policies) on the applicable payment due

date.

The holder may, at its option, convert in full

or in part, the Principal at any time prior to April 20, 2026 (the

“Maturity Date”) into units (the “Units”) of the Company at $0.10

per Unit (the “Conversion Price”). Upon conversion of the

Principal, the Company will pay Prepaid Interest and unpaid Accrued

Interest in cash or, subject to acceptance by the TSXV, in Interest

Shares issued at the Interest Conversion Price.

Each Unit consists of one Share and one

non-transferable share purchase warrant (a “Warrant”). Each Warrant

is exercisable by the holder thereof to purchase one Share (a

“Warrant Share”) at an exercise price of $0.15 at any time prior to

the Maturity Date.

The Company shall have the right to redeem the

Convertible Debentures prior to the Maturity Date at any time after

6 months from the issue date, by paying holders in cash the Face

Value of the Convertible Debentures, together with all Prepaid and

Accrued Interest and a redemption penalty payment of 8% of the Face

Value. The Company shall give the holders 30 business days’ notice

(the “Redemption Notice”) to do so. On receipt of a Redemption

Notice, a holder may elect to convert all or part of the Principal

of the Convertible Debenture into Units at the Conversion Price.

All Prepaid and Accrued Interest in respect of the Principal amount

so converted shall be, at the election of the holder, either paid

in cash or, subject to acceptance by the TSXV, converted into

Shares at the Interest Conversion Price, by giving the Company

notice (the “Conversion Notice”) within 10 business days of receipt

of the Redemption Notice.

The Company compensated finder, PI Financial

Corp. (the “Finder”), by way of cash fees of $12,500 and 125,000

warrants (the “Finder’s Warrants”). Each Finder’s Warrant entitles

the Finder to acquire common shares of the Company (each, a

“Finder’s Warrant Share”) at $0.15 per Finder’s Warrant Share for a

period of 36 months from the date of

issuance.

About Sirona Biochem Corp.

Sirona Biochem is a cosmetic ingredient and drug

discovery company with a proprietary platform technology. Sirona

specializes in stabilizing carbohydrate molecules with the goal of

improving efficacy and safety. New compounds are patented for

maximum revenue potential.

Sirona’s compounds are licensed to leading

companies around the world in return for licensing fees, milestone

fees and ongoing royalty payments. Sirona’s laboratory, TFChem, is

located in France and is the recipient of multiple French national

scientific awards and European Union and French government grants.

For more information please visit www.sironabiochem.com.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

For more information regarding this press release, please

contact:

Christopher Hopton, CFOSirona Biochem Corp. Phone:

1.604.282.6064Email: chopton@sironabiochem.com

Sirona Biochem cautions you that statements

included in this press release that are not a description of

historical facts may be forward-looking statements. Forward-looking

statements are only predictions based upon current expectations and

involve known and unknown risks and uncertainties. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of release of the

relevant information, unless explicitly stated otherwise. Actual

results, performance or achievement could differ materially from

those expressed in, or implied by, Sirona Biochem’s forward-looking

statements due to the risks and uncertainties inherent in Sirona

Biochem’s business including, without limitation, statements about:

the progress and timing of its clinical trials; difficulties or

delays in development, testing, obtaining regulatory approval,

producing and marketing its products; unexpected adverse side

effects or inadequate therapeutic efficacy of its products that

could delay or prevent product development or commercialization;

the scope and validity of patent protection for its products;

competition from other pharmaceutical or biotechnology companies;

and its ability to obtain additional financing to support its

operations. Sirona Biochem does not assume any obligation to update

any forward-looking statements except as required by law.

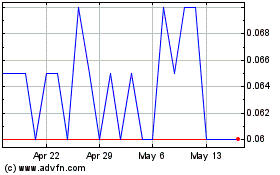

Sirona Biochem (TSXV:SBM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Sirona Biochem (TSXV:SBM)

Historical Stock Chart

From Jan 2024 to Jan 2025