SG DevCo Common Shares to Trade on Nasdaq Stock

Market Under the Symbol “SGD”

Safe & Green Holdings Corp. (NASDAQ: SGBX) (“SG Holdings” or

the “Company”), a leading developer, designer, and fabricator of

modular structures for residential, commercial, and point-of-care

medicine, today announced that Nasdaq has approved the Company’s

application to list the common stock of Safe and Green Development

Corporation (“SG DevCo”), the Company’s real estate development

subsidiary, on the Nasdaq Stock Market under the symbol “SGD”.

Paul Galvin, Chairman and CEO, stated, “Our team has dedicated

over a year to reach this significant milestone and we are now

approaching the finish line. Considering that a third-party

analysis has set SG DevCo's fair market value at $74 million,

significantly surpassing SG Holdings' market cap, we believe that

this spin-off will create significant value for our investors. The

spin-off will effectively provide current SG Holdings stockholders

with two separate opportunities to participate in the value created

by SG DevCo as they will now own approximately 30% of SG DevCo,

while still maintaining their pro rata ownership in SG

Holdings.”

David Villarreal, President & CEO of Safe and Green

Development Corporation, commented, “SG DevCo’s outlook is

exceptionally bright, with a current project pipeline exceeding

$800 million and plans to develop over 4,000 units. The spin-off of

SG DevCo will create a pivotal moment for the Company.”

Stockholders who hold SG Holdings common stock at the close of

business on the record date, today, September 8th, 2023, will be

eligible to receive a distribution of 0.930886 shares of SG DevCo

for every 5 shares of SG Holdings common stock held. No action is

required by SG Holdings stockholders to receive shares of SG

DevCo’s common stock in the distribution. More detailed information

on the distribution can be found in the section entitled

“Distribution Information.”

Distribution Information

As previously announced, the separation will occur by means of a

pro rata distribution by the Company of approximately thirty

percent of the outstanding shares of SG DevCo common stock to the

Company’s current stockholders (the “Distribution”). SG Holdings

will retain approximately seventy percent of SG DevCo common stock

immediately following the Distribution.

SG Holdings plans to set a new date to distribute (the

“Distribution Date”) the shares of SG DevCo to holders of record as

of the close of business on the record date, September 8, 2023.

Each SG Holdings stockholder will receive precisely 0.930886 shares

of SG DevCo common stock for every five (5) shares of SG Holdings

common stock held as of the close of business on the record date.

No fractional shares of SG DevCo common stock will be issued in the

Distribution, and stockholders will receive cash in lieu of

fractional shares. SG Holdings' transfer agent and registrar,

American Stock Transfer and Trust Company, LLC, will serve as

transfer agent and registrar for SG DevCo as well, and act as

distribution agent in connection with the Distribution. The Company

will provide further updates regarding the Distribution Date when

available.

The Distribution remains subject to the satisfaction or waiver

of the conditions described in SG DevCo’s Registration Statement on

Form 10, as amended, including the U.S. Securities and Exchange

Commission (SEC) having declared effective the Form 10. The Form 10

has been filed by SG DevCo with the SEC and is publicly available

at www.sec.gov.

SG Holdings expects to make available an information statement

to all stockholders entitled to receive the distribution of shares

of SG DevCo’s common stock. The information statement is filed as

an exhibit to SG DevCo’s Registration Statement on Form 10 and

describes SG DevCo and certain risks of owning SG DevCo common

stock and provides other information regarding the spin-off.

SG Holdings stockholders who hold shares of common stock on the

record date of September 8, 2023, and decide to sell any of those

shares before the Distribution Date, should consult their

stockbroker, bank, or other nominee to understand whether the

shares of SG Holdings common stock will be sold with or without

entitlement to SG DevCo common stock pursuant to the

Distribution.

The Company will provide further updates, including the

Distribution Date and the date that the SG DevCo shares will begin

trading on Nasdaq when that information is available.

About Safe & Green Holdings

Corp.

Safe & Green Holdings Corp., a leading modular solutions

company, operates under core capabilities which include the

development, design, and fabrication of modular structures, meeting

the demand for safe and green solutions across various industries.

The firm supports third party and in-house developers, architects,

builders, and owners in achieving faster execution, greener

construction, and buildings of higher value. The Company’s

subsidiary, Safe and Green Development Corporation, is a leading

real estate development company. Formed in 2021, it focuses on the

development of sites using purpose built, prefabricated modules

built from both wood and steel, sourced from one of SG Holdings’

factories and operated by the SG Echo subsidiary. For more

information, visit https://www.safeandgreenholdings.com/ and follow

us at @SGHcorp on Twitter.

Safe Harbor Statement

Certain statements in this press release constitute

"forward-looking statements" within the meaning of the federal

securities laws. Words such as "may," "might," "will," "should,"

"believe," "expect," "anticipate," "estimate," "continue,"

"predict," "forecast," "project," "plan," "intend" or similar

expressions, or statements regarding intent, belief, or current

expectations, are forward-looking statements. These forward-looking

statements are based upon current estimates and assumptions and

include statements regarding plans to spin-off the Company’s real

estate development subsidiary SG DevCo, expecting to generate

significant value for stockholders, and SG DevCo’s pipeline. While

the Company believes these forward-looking statements are

reasonable, undue reliance should not be placed on any such

forward-looking statements, which are based on information

available to us on the date of this release. These forward-looking

statements are subject to various risks and uncertainties, many of

which are difficult to predict that could cause actual results to

differ materially from current expectations and assumptions from

those set forth or implied by any forward-looking statements.

Important factors that could cause actual results to differ

materially from current expectations include, among others, the

Company’s ability to complete the spin-off of SG DevCo as planned,

the Company’s ability to list SG DevCo on the Nasdaq as planned, SG

DevCo’s ability to execute on its projected pipeline, and the other

factors discussed in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022 and its subsequent filings with

the SEC, including subsequent periodic reports on Forms 10-Q and

8-K, and in the Form 10 registration statement filed by SG DevCo.

The information in this release is provided only as of the date of

this release, and we undertake no obligation to update any

forward-looking statements contained in this release on account of

new information, future events, or otherwise, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230908530072/en/

Investor Relations: Crescendo Communications, LLC

212-671-1020 SGBX@crescendo-ir.com

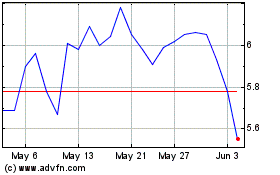

Snowline Gold (TSXV:SGD)

Historical Stock Chart

From Jan 2025 to Feb 2025

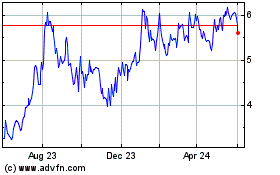

Snowline Gold (TSXV:SGD)

Historical Stock Chart

From Feb 2024 to Feb 2025