Sama Resources Inc. (“Sama” or the “Company”)

(TSX-V: SME OTC PINK SHEETS: SAMMF) is pleased to announce

results of a Preliminary Economic Assessment

(“

PEA”) for the development of its Samapleu

Nickel-Copper project located in Ivory Coast, West Africa. The PEA

was prepared by DRA Global’s office, in Montreal, Canada through

DRA Met-Chem (“

DRA”). All dollar figures are in

United States dollars.

“These results highlight the value of the

Samapleu Nickel-Copper asset for the company,” said Dr Marc-Antoine

Audet, President and Chief Executive Officer of Sama

Resources. Dr. Audet added, “That said, the Sama-HPX team

will continue with its exploration efforts aiming at delineating

massive sulphide accumulation that could be the source of

high-grade nickel, copper and palladium lenses intersected in drill

holes at the Samapleu deposits.”

Over the life of mine, the Samapleu project will

produce an average of 3,900 t of carbonyl nickel powder, 8,400 t of

carbonyl iron powder and 14,100 t of copper concentrate per year.

Nickel and iron powders produced by CVMR®’s carbonyl process are

used in batteries, 3D Printing, Metal Injection Moulding (MIM),

aerospace and automotive parts manufacturing, medical instruments,

computer parts, electronic parts, moulds and tools, super alloys

and sophisticated shapes for use in the defence and aerospace

industries.

A technical report detailing the PEA and

completed in accordance with National Instrument (NI) 43–101

guidelines, will be filed and available on SEDAR within 45 days

from May 27, 2020. The effective date of the technical report is

May 22, 2019. The effective date of the Mineral Resources is

October 26, 2018.

The PEA completed for the Company is preliminary

in nature and includes inferred mineral resources, considered too

speculative in nature to be categorized as mineral reserves.

Mineral resources that are not mineral reserves have not

demonstrated economic viability. Additional trenching and/or

drilling will be required to convert inferred mineral resources to

indicated or measured mineral resources. There is no certainty that

the resources development, production, and economic forecasts on

which this PEA is based will be realized.

PRICES, REVENUES & ECONOMIC

SENSITIVITIES

The current average sale price for the three

products is $6,463/t, based on carbonyl nickel powder sale price of

$25,483/t, carbonyl iron powder sale price of $8,389/t and copper

concentrate sale price of $966/t. Given the volatility of metal

prices in recent years and the bilateral nature of sales contracts

a sensitivity analysis of project economics is presented below

in Table 1.

Table 1

Project Economics Sensitivity Analysis

|

LOM Products Average Sale Price ($/t) |

5,170 |

|

5,816 |

|

6,4631 |

|

7,109 |

|

7,755 |

|

|

LOM Products Average Sale Price (%) |

-20 |

% |

-10 |

% |

0 |

|

+10 |

% |

+20 |

% |

|

Pre-tax returns |

|

NPV ($million) @ 8% discount rate |

325 |

|

470 |

|

615 |

|

760 |

|

905 |

|

|

IRR (%) |

21.9 |

% |

27.3 |

% |

32.5 |

% |

37.4 |

% |

42.2 |

% |

|

After-tax returns |

|

NPV ($million) @ 8% discount rate |

169 |

|

280 |

|

391 |

|

502 |

|

613 |

|

|

IRR (%) |

16.7 |

% |

22.1 |

% |

27.2 |

% |

32.2 |

% |

37.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

1. Base Case

MINERAL RESOURCES ESTIMATE

The mineral resources estimate for the Samapleu

nickel and copper deposits contains, at a Nickel Equivalent (NiEq =

Ni + 0.167*Cu) Cut-Off Grade of 0.1%, 33.18 Mt of Indicated Mineral

Resources at an average of 0.27% NiEq and 0.24% Ni and 17.78 Mt of

Inferred Mineral Resources at an average of 0.25% NiEq and 0.22%

Ni.

A summary of the Mineral Resources is provided

in Table 2.

Table 2

Mineral Resources Summary (Cut-Off Grade of 0.1%

NiEq)

|

Category |

Resources (Mt) |

NiEq (%) |

Ni (%) |

|

Measured 1,2,3 |

- |

- |

- |

|

Indicated 1,2,3 |

33.18 |

0.269 |

0.238 |

|

Meas. + Ind. |

33.18 |

0.269 |

0.238 |

|

Inferred 1,2,3,4 |

17.78 |

0.248 |

0.224 |

|

|

|

|

|

- Mineral Resources are exclusive of

Mineral Reserves

- Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. There is

no certainty that all or any part of the Mineral Resources

estimated will be converted into Mineral Reserves. The estimate of

Mineral Resources may be materially affected by environmental,

permitting, legal, title, taxation, socio-political, marketing, or

other relevant issues

- The CIM definitions were followed

for the classification of Indicated and Inferred Mineral

Resources.

- The quantity and grade of reported

Inferred Resources in this estimation are uncertain in nature and

there has been insufficient exploration to define these Inferred

Resources as an Indicated or Measured Mineral Resource. It is

reasonably expected that a portion of Inferred Mineral Resources

could be upgraded with continued exploration.

- Pit shell defined using 52-degree

pit slope, copper concentrate price of $2.1/lb and nickel powder

price of $13.5/lb, $3/t mining costs, $15/t of processing and

G&A costs, and a resulting cut-off grade of 0.1% NiEq.

The mineral resources estimate was performed by

Schadrac Ibrango, P. Geo, Ph.D, MBA, senior consulting geologist,

in association with Dr. Marc Antoine Audet of Sama Resources.

Mr. Ibrango is a Qualified Person (QP)

independent from Sama Resources. The resource classification

follows the CIM definition for classification of Indicated and

Inferred Mineral Resources. The criteria used by the QP for

classifying the estimated mineral resources are based on confidence

and continuity of geology and grades.

MINING

The mining method selected for Samapleu is a

conventional open pit operation with off-highway haul trucks,

hydraulic excavators, and wheel loaders. The mineralised material,

contained in three (3) pits, are intended to be mined by surface

operations. It is estimated that approximately 44.42 Mt of

mineralised material is extractable over a 20-year mine life. The

average grade fed to the processing plant over the 20-year mine

life is 0.24% Ni, 0.18% Cu and 11.86% Fe.

Table 3 provides a summary of mining

highlights.

Table 3

Mining Highlights

|

Average feed grade (% Ni) |

0.24 |

% |

|

Average feed grade (% Cu) |

0.18 |

% |

|

Average feed grade (% Fe) |

11.86 |

% |

|

Stripping ratio (waste/ore) |

1.17 |

|

|

Average mineralised material mined per year (Mtpy) |

2.3 |

|

|

Mine Life (years) |

20 |

|

|

|

|

|

PROCESS

The mineral processing plant is designed to

process 2.4 Mtpy of run-of-mine mineralised material to produce

39,000 tpy of nickel concentrate at 10.34% Ni grade and 15,000 tpy

of copper concentrate at 23.00% Cu grade. The copper concentrate

will be a saleable product and the nickel concentrate will be fed

to the carbonyl refining plant, which supports the production of

3,900 tpy of carbonyl nickel powder and 8,400 tpy of carbonyl iron

powder.

Table 4 provides a summary of process

highlights.

Table 4

Process highlights

|

Nickel recovery to nickel concentrate (%) |

71 |

% |

|

Copper recovery to copper concentrate (%) |

80 |

% |

|

Copper concentrate grade (%Cu) |

23.00 |

% |

|

Nickel concentrate grade (%Ni) |

10.34 |

% |

|

Nickel concentrate grade (%Fe) |

26.58 |

% |

|

Nickel recovery to carbonyl nickel powder |

97.5 |

% |

|

Iron recovery to carbonyl iron powder |

80 |

% |

|

Carbonyl nickel powder grade |

99.84 |

% |

|

Carbonyl iron powder grade |

98.5 |

% |

|

|

|

|

Mineral Processing Plant

The mineral processing plant consists of

crushing, grinding, rougher flotation, and cleaner flotation. The

back end of the concentrator includes tailings and concentrate

thickening, concentrate filtration, and material handling. The

nickel and copper concentrates will be recovered by a conventional

flotation process. The potential acid generating tailings

from the concentrator will be filtered by a filter press and

stacked outside the concentrator area. The non-acid generating

tailings from the concentrator will be thickened and pumped to the

tailings pond. Reclaiming water from the tailings pond has been

considered in the process design to minimise freshwater make-up to

the concentrator. Further test work will be completed to confirm

these results in subsequent stages of study.

Figure 1 depicts the process flowsheet of the

concentrator.

Figure 1

Flow Sheet of Samapleu Concentrator is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/85158d45-d7ec-42cb-a15c-327af7d40f9b

Carbonyl Refining Plant

The nickel concentrate from the concentrator

will be sent to the carbonyl refining plant to extract nickel and

iron. The concentrate will be roasted to convert the sulfide

minerals to oxides in a fluid bed roaster. If the concentrate is

too fine, the feed may have to be pelletized prior to feeding the

fluid bed roaster. Calcined concentrate will then be reduced in a

rotary kiln, with hydrogen to convert the nickel and iron oxides to

metallic nickel and iron respectively. Nickel and iron will be

extracted from reduced concentrate in the form of volatile metal

carbonyls through CVMR®’s carbonyl process, then separated and

decomposed to metal nickel and iron products. Figure 2 depicts the

process flowsheet of the carbonyl refining plant.

Figure 2

Flow Sheet of Samapleu Carbonyl Refining

Plant is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/aa4f43fa-1ca4-4fd8-92ad-1ef0cfe5cb3c

CAPITAL AND OPERATING COSTS

The initial capital costs for the project are

presented below in Table 5. The sustaining capital expenditure

over a 20-year period is $179.7M. Table 6 presents the LOM average

annual operating costs as well as cost per t milled.

Table 5

Initial Capital Costs Summary

|

Area Description |

Total Costs (M$) |

|

Direct Costs |

|

|

Mining |

19.5 |

|

Crushing |

5.0 |

|

Concentrator |

48.3 |

|

Tailings Management System |

29.2 |

|

General Site Infrastructure |

22.2 |

|

Power |

23.0 |

|

Carbonyl Refining Facilities |

38.7 |

|

Subtotal – Direct Costs |

185.9 |

|

Indirect Costs |

|

|

Indirect Costs |

59.3 |

|

Contingency |

36.8 |

|

Subtotal – Indirect Costs |

96.1 |

|

Total Initial Capital Costs |

282.0 |

|

|

|

Table 6

Operating Costs Summary

|

Description |

LOM Average Annual Cost (M$) 2 |

Cost /t milled ($/t) |

|

Mining |

9.2 |

4.01 |

|

Concentrator Processing |

27.6 |

12.11 |

|

Carbonyl Refining Processing |

11.6 |

5.12 |

|

Water and Tailings Management 3 |

0.05 |

0.02 |

|

Products Transportation |

2.9 |

1.26 |

|

General and Administration 3 |

3.4 |

1.45 |

|

Total Opex 1 |

54.8 |

23.96 |

|

|

|

|

- The totals may not add-up due to rounding errors.

- Excludes first and last year.

QUALITY CONTROL AND

ASSURANCE

Qualified Persons (“QP”) have reviewed and

verified that the technical information with respect to the PEA

contained in this press release is accurate and have approved the

written disclosure of such information. For readers to fully

understand the information in this press release, they should read

the Technical Report in its entirety when it is available on SEDAR,

including all qualifications, assumptions, and exclusions that

relate to the information to be set out in the Technical Report,

The Technical Report is intended to be read as a whole, and

sections should not be read or relied upon out of context.

The QPs who will prepare the Technical Report

are:

- DRA: Daniel M. Gagnon, P.Eng.

(Project Sponsor, Mining and Economic Analysis), Schadrac Ibrango,

P. Geo, Ph.D, MBA (Geology and Mineral Resources), Nalini Singh,

P.Eng. (Mineral Processing Test work), Ryan Cunningham, P.Eng.

(Mineral Processing Plant), Volodymyr Liskovych, Ph.D, P.Eng.

(Carbonyl Refining).

- GCM: Marie-Claude Dion St-Pierre,

P.Eng. (Environmental Studies, Permitting and Social or Community

Impact)

By virtue of education and relevant experience,

the aforementioned are independent QPs for the purpose of NI

43-101. Other than as set forth above, all scientific and technical

information contained in this press release has been reviewed,

verified, and approved by Dr. Marc-Antoine Audet, P.Geo the

President and CEO of Sama, and a QP, as defined by National

Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT MET-CHEM AND DRA

GLOBAL

Met-Chem, a wholly owned subsidiarity of DRA

Global Ltd., was originally established in 1969 as a consulting

engineering company, headquartered in Montreal, and provides a wide

range of technical and engineering services. DRA Global is a

diversified global engineering, project delivery and operations

management group headquartered in Perth, Australia. With expertise

in the areas of project development, mining, mineral processing,

plant optimisation, operational readiness, systems integration,

operations & maintenance and related water, energy, industrial

and infrastructure requirements, DRA delivers truly comprehensive

solutions to the resources sector. DRA employs over 4500 people and

offers flexible engineering & operations management services

worldwide through 18 offices.

ABOUT SAMA RESOURCES INC.

Sama is a Canadian-based mineral exploration and

development company with projects in West Africa. On October 23,

2017, Sama announced that it had entered into a binding term sheet

in view of forming a strategic partnership with HPX TechCo Inc., a

private mineral exploration company in which mining entrepreneur

Robert Friedland is a significant stakeholder, in order to develop

its Côte d’Ivoire Nickel-Copper and Cobalt project in Côte

d’Ivoire, West-Africa. For more information about Sama, please

visit Sama’s website at http://www.samaresources.com.

ABOUT HPX

HPX is a privately-owned, metals-focused

exploration company deploying proprietary in-house geophysical

technologies to rapidly evaluate buried geophysical targets. The

HPX technology cluster comprises geological and geophysical systems

for targeting, modelling, survey optimization, acquisition,

processing and interpretation. HPX has a highly experienced board

and management team led by Chief Executive Officer Robert Friedland

and President Eric Finlayson, a former head of exploration at Rio

Tinto. For further information, please visit

www.hpxploration.com.

ABOUT CVMR® CORPORATION

CVMR® is a privately held corporation based in

Toronto with 36 years of vapour metal refining experience. The

proprietary vapour metallurgy processes (Carbonyl Process) used by

CVMR® refine nickel and iron by chemically vaporizing them at

relatively low pressure and low temperatures. CVMR®’s carbonyl

process refines and produce various metal powders and complex metal

shapes, as part of the same process. CVMR® processes do not melt

the metals as is done in the usual smelting processes. CVMR®'s

refining plants are pollution free and neutral to the environment.

All gases used in vaporizing metals are recycled. CVMR®’s refining

plants are built on a modular basis, enabling a substantial degree

of flexibility, allowing a plant to be built and to grow in size

gradually. Each module is capable of producing pure metal products

with a very high degree of purity (www.cvmr.ca).

ABOUT GCM CONSULTANTS INC.

GCM Consultants has been an engineering firm

since 1994, with more than 300 qualified professionals. GCM is

owned by approximately 50 shareholders, all of whom work full time

within the company. GCM offers environmental, process, building,

mechanical, civil, electrical, instrumentation and control

engineering services under one roof, in addition to offering a wide

range of specialized services. (www.draglobal.com).

FOR FURTHER INFORMATION, PLEASE

CONTACT:

SAMA RESOURCES INC./RESSOURCES SAMA INC.Dr.

Marc-Antoine Audet, President and CEOTel: (514) 726-4158ORMr. Matt

Johnston, Corporate Development AdvisorTel: (604) 443-3835Toll

Free: 1 (877) 792-6688, Ext. 5

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Statements

Certain of the statements made and information

contained herein are "forward-looking statements" or

“forward-looking information” within the meaning of Canadian

securities legislation. Forward-looking statements and

forward-looking information such as “will”, could”, “expect”,

“estimate”, “evidence”, “potential”, “appears”, “seems”, “suggest”,

are subject to a variety of risks and uncertainties which could

cause actual events or results to differ from those reflected in

the forward-looking statements or forward-looking information,

including, without limitation, the ability of the company to

convert resources in reserves, its ability to see through the next

phase of development on the project, its ability to produce a

pre-feasibility study or a feasibility study regarding the project,

its ability to execute on its development plans in terms of

metallurgy or exploration, the availability of financing for

activities, risks and uncertainties relating to the interpretation

of drill results and the estimation of mineral resources and

reserves, the geology, grade and continuity of mineral deposits,

the possibility that future exploration, development or mining

results will not be consistent with the Company's expectations,

metal price fluctuations, environmental and regulatory

requirements, availability of permits, escalating costs of

remediation and mitigation, risk of title loss, the effects of

accidents, equipment breakdowns, labour disputes or other

unanticipated difficulties with or interruptions in exploration or

development, the potential for delays in exploration or development

activities, the inherent uncertainty of cost estimates and the

potential for unexpected costs and expenses, commodity price

fluctuations, currency fluctuations, expectations and beliefs of

management and other risks and uncertainties.

In addition, forward-looking statements and

forward-looking information are based on various assumptions.

Should one or more of these risks and uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those described in forward-looking information

or forward-looking statements. Accordingly, readers are advised not

to place undue reliance on forward-looking statements or

forward-looking information. Except as required under applicable

securities legislation, the Company undertakes no obligation to

publicly update or revise forward-looking statements or

forward-looking information, whether as a result of new

information, future events or otherwise.

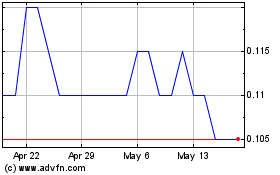

Sama Resources (TSXV:SME)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sama Resources (TSXV:SME)

Historical Stock Chart

From Mar 2024 to Mar 2025