Sierra Geothermal Power Corp. (TSX VENTURE: SRA) ("SGP") today

cautioned its shareholders that the "concerned shareholder" behind

a dissident proxy circular is not concerned with the interests of

all Sierra shareholders. The "concerned shareholder" is attempting

to seize control of Sierra's Board at a special meeting scheduled

for January 26, 2010.

In a letter to shareholders, Sierra's President and Chief

Executive Officer Gary Thompson noted the dissident's principal has

strong economic ties to Sierra's competitor, Ram Power, Corp.

Sierra believes these ties may compromise the loyalty of the

dissident's hand-picked nominees.

In contrast to the dissident's conflicting loyalties, Mr.

Thompson highlights the independence and experience of Sierra's

current board, which has successfully unlocked value for Sierra

shareholders during a turbulent market. He also provides detail on

the various strategic options currently being considered by the

company to unlock value. These options include the advancement of

projects, joint venture project agreements, equity financings and a

sale of the company.

Below is the text of Mr. Thompson's letter.

You may have received a dissident circular from Exploration

Capital Partners 2005 Limited Partnership, which styles itself as a

"concerned shareholder." Make no mistake. The dissident's principal

has strong economic ties to Sierra's competitor, Ram Power,

Corp.

To protect your interest in Sierra, it is important that you do

not sign or return the dissident proxy form. Instead, vote the

GREEN Proxy today against the dissident and in support of your

board and management.

Sierra's strategy is unlocking shareholder value

Sierra's strategy is to use both corporate equity and joint

venture partners to build a leading geothermal developer. Because

we also understand the obvious financial constraints, a special

committee of independent directors has been formed to carefully

consider all strategic alternatives with the assistance of a

financial advisory firm. The strategic alternatives are focused on

creating value for all Sierra shareholders and include the

following:

- Advancement of Projects - Sierra has access to cash and grants

that total nearly $20 million, allowing us to drill wells with

production potential that could advance projects towards

feasibility this year. Within the month we expect to commence a

drill program at Silver Peak and Alum that will include three holes

at each project: a core well, a slim well and a production

well.

- Joint Venture Project Agreements - Sierra is in joint venture

discussions at the project level which could provide alternatives

to equity financing and help one or more projects to bankable

feasibility - a significant event for value creation.

- Equity Financings - Absent a joint venture, we may need to

raise $30 million to follow our previously disclosed strategy of

bringing 50 MW to bankable feasibility by the end of this year.

Warrant holders who are in the money could provide much of that

amount and we may sell non-core assets to reduce dilution.

Investors have expressed interest in participating in future

financings.

- Sale of the Company - Sierra's asset portfolio is one of the

largest remaining high quality US land packages. Various well

funded utilities and developers have expressed a keen interest in

considering an acquisition of Sierra through a formal auction

process. Sierra's Board believes that a sale of the company might

be an attractive alternative to its current business plan, but only

if we receive a reasonable offer. We have yet to receive a

reasonable offer.

Given the various on-going strategies discussed, now is the time

to support your current board of directors to allow them the time

to maximize the value of your investment.

Your board has unlocked value during a turbulent market

Sierra has emerged intact from the global economic crisis. We

are capitalized and our strategic assets are of interest to a

variety of different partners and suitors. The increase in our

share price over the past few months reflects Sierra's tremendous

progress:

- Sierra secured $12.35 million in financings, all at prices

above Ram Power's $0.186 discount proposal. This amount includes

$1.35 million received upon the exercise of warrants by a large

institutional shareholder earlier this week at a price of $0.27 per

share, again well above Ram Power's discount proposal.

- Sierra was awarded US$10 million in US Department of Energy

grants, twice the US$5 million awarded to Ram Power.

- Sierra is successfully advancing its Tier One projects toward

bankable feasibility with drill results that increased the

estimated minimum megawatt capacity.

While there are constraints to being a small geothermal company,

there are also benefits to our pure-play focus on Nevada and

California. The size and strategic location of our high-quality

assets is garnering attention. Our success is creating

opportunities and your current board is reviewing all strategies to

unlock value, including a possible sale or joint venture. We will

act if the terms are beneficial and unlock value.

The dissident's ties are stronger to Ram Power than to

Sierra

We believe the dissident's only strategy for Sierra is

consolidation with Ram Power. In so doing, the dissident, and those

that control it, will consolidate their interests and ignore yours.

The dissident has the following strong economic ties to Ram

Power:

- Companies under common control with the dissident, when taken

together, are Ram Power's largest shareholder, with an aggregate of

nearly 10% of Ram's shares and a current value of more than $50

million. This is much greater than the dissident's ownership of 5%

of Sierra, with a current value of $2 million.

- All seven of the dissident's nominees helped to create Ram

Power last year.

- Two of the dissident's nominees are directors of Ram Power

with large stock option positions.

We believe that Ram Power has not made a reasonable offer for

the company because it is waiting for its allies to get control of

Sierra's board and facilitate a sale at a discount.

The dissident's criticisms are unfounded

In its circular, the dissident alleges Sierra "missed the boat"

but our stock's performance says otherwise. On Friday, January 8,

2010, Sierra closed at $0.33, up 46% from our value in July when we

received the discount price proposal from Ram Power, Corp.

As illustrated in the table below, you gained 41% because your

board questioned the Ram Power proposal. You would not have had

this gain if Sierra had listened to the dissident's principal and

participated in the Ram Power transaction in July.

Your Board would have forgone value by accepting the Ram Power

offer

--------------------------------------------------------------------------

July 2009 (3) Jan. 8, 2010 Gain

--------------------------------------------------------------------------

Sierra's real market gain $0.226 $0.33 46%

--------------------------------------------------------------------------

Ram Power's gain $3.00 (1) $3.78 26%

--------------------------------------------------------------------------

Equivalent increase from discount proposal $0.186 (2) $0.234 26%

--------------------------------------------------------------------------

What Sierra holders would have gained with

Ram Power $0.226 $0.234 3.54%

--------------------------------------------------------------------------

Extra value because Sierra questioned the

Ram Power proposal $0.234 $0.33 4%

--------------------------------------------------------------------------

(1) Ram Power's deemed value for the July proposal was $3.00

(2) Ram Power's proposal for Sierra was an 18% discount to July market value

(3) Except for $0.234, which is the Jan. 8, 2010 deemed value of Sierra if

it had participated in the Ram Power proposal.

If a sale, especially to Ram Power, proves to be the right path

for Sierra, your current board is better positioned to handle the

negotiations than a board dominated by the dissident's nominees.

Your current board is not compromised and can and will continue to

vigorously advocate on behalf of Sierra.

The dissident says Sierra does not have the capacity to finance

yet it criticizes Sierra's dilution when we do finance. Given the

discount price at which the dissident proposed to sell the entire

company, it is not in a position to comment on dilution now.

The Board accepts that dilution may be necessary and will

continue to carefully consider any appropriate means by which to

minimize it. For example, by working hard to win US$10 million in

government grants we effectively doubled the value of every dollar

Sierra raised in equity financings last year without any additional

dilution. For a company of our size, that is a big benefit for all

shareholders.

Our conclusion is that the sole purpose of this proxy battle is

to re-engage with Ram Power though the back door. In coming months,

Sierra will need strong advocates in any negotiations. If you elect

the dissident's nominees, don't expect all of them to sit on

Sierra's side of the table when the negotiations commence.

Our board is independent and experienced

The Sierra board takes seriously its fiduciary duty of loyalty

to Sierra and discharges its actions in good faith and in the best

interest of Sierra. Our track record is proven. We did not crumble

when the dissident pressured us to accept a discount takeover last

July.

The dissident's hand-picked nominees, with their conflicting

loyalties, should not be relied on to advance the interest of

Sierra. The dissident is concerned with its interests, which

include Ram Power. The dissident's principal does not deny that he

would have sold Sierra at less than 20 cents a share.

Your current board is independent and knows how to negotiate

with Ram Power or any other interested party. Moreover, the current

Sierra directors have a depth of relevant geothermal industry and

business experience. We know and understand your company and our

successful strategy is steadily and consistently raising the share

price - all to the benefit of Sierra shareholders.

As part of our focus to continue to deliver value to

shareholders, your Board commits to you:

- We will not be pressured to accept a discounted offer.

- We will continue to thoroughly evaluate all offers

- We will always be open to ideas to enhance the value of

Sierra.

- We will continue to practice strong corporate governance to

protect shareholders.

Yours truly

Gary Thompson, Chief Executive Officer, President and

Director

Sierra Geothermal Power Corp.

To support your board, vote the Green Proxy:

- Against the resolution to increase the size of the Board,

and

- Withhold your vote on the resolution to elect seven

dissidents.

How to Cast Your Vote

The Management Circular and related proxy materials, including

the GREEN proxy, have been mailed to persons who were shareholders

of record as of the close of business on December 15, 2009.

Investors and security holders may obtain a free copy of these

documents on our website at www.sierrageopower.com/proxy at the

Canadian securities regulators web site www.sedar.com and by mail.

You can request the materials by contacting SGP's Investor

Relations department, Sierra Geothermal Power Corp., Suite 500 -

666 Burrard Street, Vancouver, B.C., Canada, V6C 3P6, or by

telephone: 1-800-563-5631, or by email at

info@sierrageopower.com.

SGP and its directors, executive officers and other members of

its management and employees may be deemed to be participants in

the solicitation of proxies from SGP's shareholders in connection

with the proposed acquisition. Information concerning the interests

of SGP's management who are participating in the solicitation is

set forth in the Management Circular.

If you have any questions or need assistance in completing your

GREEN proxy, please call Laurel Hill Advisory Group at toll free

1-888-534-1149 or email at assistance@laurelhillag.com and they

will be happy to help.

About Sierra Geothermal Power Corp

Sierra Geothermal Power Corp. is a renewable energy company

focused on the exploration and development of clean, sustainable

geothermal power. It is based in Vancouver, British Columbia and

listed on the TSX Venture Exchange under the symbol SRA. Its

portfolio of geothermal projects located in Nevada and California

exceeds 365 square kilometres (90,000 acres) and has a combined

total estimated capacity of greater than 500 MW. SGP intends to

finance development by utilizing a combination of corporate equity,

joint venture partnerships and project debt, with the support of US

government grants and loan guarantees. To find out more about

Sierra Geothermal Power Corp. (TSX VENTURE: SRA) visit our website

at www.sierrageopower.com.

On behalf of the Board of Directors

Gary Thompson, Chief Executive Officer, President and

Director

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This news release may contain forward-looking statements. All

statements, other than statements of historical fact, included or

incorporated by reference in this news release are forward-looking

statements, including, without limitation, statements regarding

activities, events or developments that Sierra expects or

anticipates may occur in the future. Forward-looking statements can

be identified by the use of forward-looking words such as "may",

"would", "could", "expect", "intend", "plan", "estimate",

"anticipate", "believe" or "continue" or similar words or the

negative thereof.

Forward-looking statements in this news release include

statements about the timing and design of Sierra's proposed drill

program, that joint venture discussions could lead to alternatives

to equity financing that would help carry one or more of Sierra's

projects to bankable feasibility, that Sierra might need to raise

additional money to fund its business plan, that it can do so

through the sale of equity, that it can reduce the dilution that

results from equity financings if it can arrange project level

joint venture financing or the sell non-core assets, its

expectation that current discussions can result in joint venture or

other project level financing alternatives, that the current Board

can maximize the value of your investment, that the dissident's

objective is to sell Sierra to Ram Power, Corp. at a discount

price, that Ram Power would make such an offer and that, if

elected, the dissident's nominees would support such a transaction.

There can be no assurance that the plans, intentions or

expectations upon which these forward-looking statements are based

will occur. Readers are cautioned not to place undue reliance on

these forward-looking statements, which are not a guarantee of

performance and are subject to a number of uncertainties and other

factors that could cause actual results to differ materially from

those expressed or implied by such forward-looking statements.

These factors include general economic and market conditions,

changes in the law, actions of competitors, drill results and other

changes in circumstance, and Sierra's ability to implement business

strategies and pursue its business plan. In addition, all

forward-looking statements involve risks and uncertainties,

including the risks and uncertainties detailed in Sierra's filings

with the applicable Canadian securities commissions, copies of

which are available at www.sedar.com. We urge you to carefully

consider these factors.

All of the forward-looking statements contained in this news

release are expressly qualified in their entirety by this

cautionary statement. The forward-looking statements included in

this news release are made as of the date of this news release and

Sierra undertakes no obligation to publicly update such

forward-looking statements to reflect new information, subsequent

events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services

Provider accepts responsibility for the adequacy or accuracy of

this release.

Contacts: Sierra Geothermal Power Corp. Gary Thompson President

& CEO (604) 683-0332 / 1-800-563-5631 info@sierrageopower.com

Sierra Geothermal Power Corp. Anthony Srdanovic Investor Relations

(604) 642-6179 asrdanovic@sierrageopower.com

www.sierrageopower.com

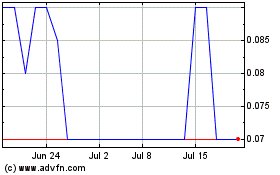

Stria Lithium (TSXV:SRA)

Historical Stock Chart

From Jun 2024 to Jul 2024

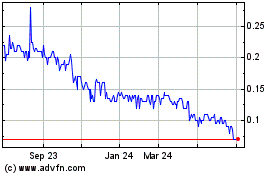

Stria Lithium (TSXV:SRA)

Historical Stock Chart

From Jul 2023 to Jul 2024