Standard Uranium Ltd. (“

Standard Uranium” or the

“

Company”) (TSX-V: STND) (OTCQB: STTDF)

(Frankfurt: FWB:9SU) has determined, given the current strength in

the global uranium sector, and uranium’s increasing importance as a

green energy source, the timing is right to return to drill its

flagship Davidson River project (the “

Project”).

To advance the Project, the board of directors

has resolved to proceed with a non-brokered private placement to

raise gross proceeds of up to C$3,000,000 (the

“Offering”), conditional upon the completion of

the continuation of the Company into the Province of British

Columbia (the “Continuation”) and a consolidation

of the outstanding share capital of the Company on a one-for-five

basis (the “Consolidation”).

The Offering will consist of any combination of

units of the Company (each, a “Unit”) at a price

of C$0.25 per Unit, and charity flow-through units of the Company

(each, a “CFT Unit”, and collectively with the

Units, the “Offered Securities”)

at a price of C$0.38 per CFT Unit. Each Unit will consist of one

post-Consolidation common share of the Company (each a

“Unit Share”) and one-half of one common share

purchase warrant (each whole warrant, a

“Warrant”). Each CFT Unit will consist of one

post-Consolidation common share of the Company to be issued as a

“charity flow-through share” within the meaning of the Income Tax

Act (Canada) (each, a “CFT Share”) and one-half of

one Warrant. Each whole Warrant shall entitle the holder to

purchase one post-Consolidation common share of the Company (each,

a “Warrant Share”) at a price of C$0.38 at any

time on or before that date which is twenty-four months after the

closing date of the Offering.

The net proceeds raised from the Offering will

be used for the exploration of the Company's Davidson River Project

and for working capital purposes. Proceeds from the sale of CFT

Shares will be used to incur “Canadian exploration expenses” as

defined in subsection 66.1(6) of the Income Tax Act and “flow

through mining expenditures” as defined in subsection 127(9) of the

Income Tax Act. Such proceeds will be renounced to the purchasers

of CFT Shares with an effective date not later than December 31,

2024, in the aggregate amount of not less than the total amount of

gross proceeds raised from the issue of the CFT Shares.

Red Cloud Securities Inc. has agreed to act as a

finder for the Company in connection with the Offering. The Company

will pay finders’ fees to eligible parties who have assisted in

introducing subscribers to the Offering. All securities issued in

connection with the Offering will have a hold period of four months

and one day from the closing date. Completion of the Offering,

Continuation and Consolidation remain subject to the approval of

the TSX Venture Exchange. Completion of the Offering is contingent

on completion of the Continuation and the Consolidation.

Continuation

As approved by shareholders at the annual

general and special meeting (the “Meeting”) held

on March 26, 2024, the Company intends to continue its corporate

existence from the Canada Business Corporations Act to the Business

Corporations Act (British Columbia). The Continuation is intended

to reduce operating costs and better align the jurisdiction of

incorporation with the location of management and the head office

of the Company.

The Continuation will not result in the

formation of a new legal entity, nor will it affect the continuity

of the Company or result in any change its operational activities

or assets. For further information regarding the Continuation, and

a comparison of the provisions of the Canada Business Corporations

Act and the Business Corporations Act (British Columbia), readers

are encouraged to review the management information circular

prepared by the Company in connection with the Meeting, a copy of

which is available under the profile for the Company on SEDAR+

(www.sedarplus.ca).

Share Consolidation

In connection with the Offering, the Company

intends to complete the Consolidation to increase flexibility and

competitiveness in the market, and to make the Company’s securities

more attractive to a wider audience of potential investors.

As a result of the Consolidation, the Company’s

currently issued and outstanding 230,649,292 common shares will be

reduced to approximately 46,129,859 common shares prior to

completion of the Offering. No fractional common shares will be

issued as a result of the Consolidation. Instead, any fractional

common shares will be rounded down to the nearest whole number of

common shares. In accordance with the Articles of the Company

adopted in connection with the Continuation, the Consolidation does

not require approval of the shareholders of the Company.

The Company will issue a news release providing

further details regarding the Consolidation once the effective date

for the Consolidation is determined.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy the Offered

Securities, nor shall there be any sale of the Offered Securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction. The Offered Securities

being offered will not be, and have not been, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold within the United States or to, or for the account

or benefit of, a U.S. person.

Davidson River Drill Program

In 2023, the Company expanded its flagship

Davidson River Project (“Davidson River”) in the

southwest corner of the Basin to cover more than 37,700 hectares

(Figure 1). Standard Uranium plans to follow up on prospective

drilling results from previous programs and test brand new

high-priority targets located within the new southeast claim blocks

that are akin to the neighboring JR Zone discovery (Figure 2).

Drilling in H2 2024 will comprise a follow-up

campaign on Davidson River, located in the southwestern uranium

district of the Athabasca Basin.

- The summer 2022

program revealed the best intersections of prospective alteration

and structure to date along the Bronco and Thunderbird trends,

including wide graphitic structural zones on Bronco and oxidized

alteration on Thunderbird, in addition to elevated radioactivity1

and dravite alteration (Figure 2).

- 2024 drilling

will follow up on the most prospective basement structures and

alteration zones intersected to date and begin testing new target

areas within recently staked claim blocks, incorporating new

cutting-edge targeting vectors.

- Data-driven

machine learning techniques will contribute to drill targeting at

Davidson River through anomaly detection and mapping of

electromagnetic (EM) data, in addition to anomaly matching based on

known world-class uranium deposits in the area including the Arrow

and Triple-R uranium deposits. The machine learning techniques will

also be applied to the Company’s internal drilling and geochemical

databases.

- Additional

geophysical surveys over high-priority areas are being considered

to add more data layers into the Company’s targeting strategy on

the Project.

- More than 70

kilometres of graphitic conductors provide discovery potential at

Davidson River, with massive blue-sky potential to host a

world-class high-grade2 uranium deposit.

Figure 1. Overview of the Southwest Athabasca

Uranium District highlighting Standard Uranium’s flagship Davidson

River project and regional geological relationships to known

high-grade uranium deposits.

Figure 2. Overview of the Davidson River Project

highlighting conductive corridors, interpreted faults, and

prospective results intersected to date with first vertical

derivative magnetics in the background.

1 The Company considers radioactivity readings

greater than 300 counts per second (cps) to be “anomalous”.2 The

Company considers uranium mineralization with concentrations

greater than 1.0 wt% U3O8 to be “high-grade”.

The scientific and technical information

contained in this news release has been reviewed, verified, and

approved by Sean Hillacre, P.Geo., President and VP Exploration of

the Company and a “qualified person” as defined in NI 43-101.

About Standard Uranium (TSX-V:

STND)

We find the fuel to power a

clean energy future

Standard Uranium is a uranium exploration

company and emerging project generator poised for discovery in the

world’s richest uranium district. The Company holds interest in

over 209,867 acres (84,930 hectares) in the world-class Athabasca

Basin in Saskatchewan, Canada. Since its establishment, Standard

Uranium has focused on the identification, acquisition, and

exploration of Athabasca-style uranium targets with a view to

discovery and future development.

Standard Uranium has successfully completed four

joint venture earn in partnerships on their Sun Dog, Canary,

Atlantic and Ascent projects totaling over $31M in work commitments

over the next three years from 2024-2027.

Standard Uranium’s Davidson River Project, in

the southwest part of the Athabasca Basin, Saskatchewan, comprises

ten mineral claims over 30,737 hectares. Davidson River is highly

prospective for basement-hosted uranium deposits due to its

location along trend from recent high-grade uranium discoveries.

However, owing to the large project size with multiple targets, it

remains broadly under-tested by drilling. Recent intersections of

wide, structurally deformed and strongly altered shear zones

provide significant confidence in the exploration model and future

success is expected.

Standard Uranium’s eight eastern Athabasca

projects comprise thirty mineral claims over 32,838 hectares. The

eastern basin projects are highly prospective for unconformity

related and/or basement hosted uranium deposits based on historical

uranium occurrences, recently identified geophysical anomalies, and

location along trend from several high-grade uranium

discoveries.

Standard Uranium's Sun Dog project, in the

northwest part of the Athabasca Basin, Saskatchewan,

is comprised of nine mineral claims over 19,603 hectares. The Sun

Dog project is highly prospective for basement and unconformity

hosted uranium deposits yet remains largely untested by sufficient

drilling despite its location proximal to uranium discoveries in

the area.

For further information contact:

Jon Bey, Chief Executive Officer, and ChairmanSuite 918, 1030

West Georgia StreetVancouver, British Columbia, V6E 2Y3Tel: 1 (306)

850-6699E-mail: info@standarduranium.ca

Cautionary Statement Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” or “forward-looking information” (collectively,

“forward-looking statements”) within the meaning of applicable

securities legislation. All statements, other than statements of

historical fact, are forward-looking statements and are based on

expectations, estimates and projections as of the date of this news

release. Forward-looking statements include, but are not limited

to, statements regarding: the timing and content of upcoming work

programs; geological interpretations; timing of the Company’s

exploration programs; the completion of the Offering, the

Continuation and the Consolidation; and estimates of market

conditions.

Forward-looking statements are subject to a

variety of known and unknown risks, uncertainties and other factors

that could cause actual events or results to differ from those

expressed or implied by forward-looking statements contained

herein. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Certain

important factors that could cause actual results, performance or

achievements to differ materially from those in the forward-looking

statements are highlighted in the “Risks and Uncertainties” in the

Company’s management discussion and analysis for the fiscal year

ended April 30, 2023.

Forward-looking statements are based upon a

number of estimates and assumptions that, while considered

reasonable by the Company at this time, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies that may cause the Company’s actual financial

results, performance, or achievements to be materially different

from those expressed or implied herein. Some of the material

factors or assumptions used to develop forward-looking statements

include, without limitation: that the transaction with the Optionee

will proceed as planned; the completion of the Continuation and the

Consolidation; the future price of uranium; anticipated costs and

the Company’s ability to raise additional capital if and when

necessary, including the size and completion of the Offering;

volatility in the market price of the Company’s securities; future

sales of the Company’s securities; the Company’s ability to carry

on exploration and development activities; the success of

exploration, development and operations activities; the timing and

results of drilling programs; the discovery of mineral resources on

the Company’s mineral properties; the costs of operating and

exploration expenditures; the presence of laws and regulations that

may impose restrictions on mining; employee relations;

relationships with and claims by local communities and indigenous

populations; availability of increasing costs associated with

mining inputs and labour; the speculative nature of mineral

exploration and development (including the risks of obtaining

necessary licenses, permits and approvals from government

authorities); uncertainties related to title to mineral properties;

assessments by taxation authorities; fluctuations in general

macroeconomic conditions.

The forward-looking statements contained in this

news release are expressly qualified by this cautionary statement.

Any forward-looking statements and the assumptions made with

respect thereto are made as of the date of this news release and,

accordingly, are subject to change after such date. The Company

disclaims any obligation to update any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities laws. There can

be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

Neither the TSX-V nor its Regulation Services

Provider (as that term is defined in the policies of the TSX-V)

accepts responsibility for the adequacy or accuracy of this news

release.

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/53cce81a-d9f6-4852-b1cb-b45bf7c1df6ehttps://www.globenewswire.com/NewsRoom/AttachmentNg/e15a5994-50ca-4118-a3ee-1b895ff7bfaf

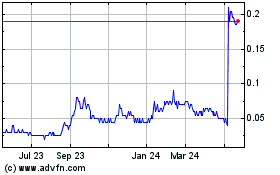

Standard Uranium (TSXV:STND)

Historical Stock Chart

From Dec 2024 to Jan 2025

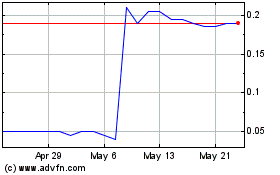

Standard Uranium (TSXV:STND)

Historical Stock Chart

From Jan 2024 to Jan 2025