Skyharbour Resources Ltd.

(TSX-V: SYH

) (OTCQX:

SYHBF

) (Frankfurt: SC1P

) (“Skyharbour” or the

“Company”) is pleased to announce that is has closed the brokered

private placement previously announced by the Company on December

2, 2024, as upsized on December 3, 2024 (the “Brokered Offering”),

and has additionally closed a concurrent non-brokered private

placement (the “Non-Brokered Offering”, and together with the

Brokered Offering, the “Offering”), for aggregate gross proceeds to

the Company of C$10,020,000.

Jordan Trimble, President and CEO of Skyharbour,

stated: “Skyharbour is very well-funded for its drilling and

exploration plans in 2025, with the majority of the Offering placed

with several strategic institutional and corporate investors. Over

the next year, the Company anticipates the largest combined

drilling and exploration campaign at its core projects of Russell

Lake and Moore. This will follow up on successful drilling in 2024

at both projects, which included high-grade drill results and new

uranium discoveries. The Company also expects continuous cash and

share payments, as well as news flow, from its prospect generator

business, consisting of partner companies advancing numerous other

uranium projects throughout the Athabasca Basin.”

The Brokered Offering was completed through a

syndicate of agents co-led by Haywood Securities Inc. and Red Cloud

Securities Inc. (collectively, the “Agents”). Pursuant to the

Brokered Offering, the Company issued: (i) 5,000,000 hard dollar

units of the Company (the “Units”) at a price of C$0.40 per Unit;

(ii) 2,368,420 charity flow-through shares (the “Charity FT

Shares”) at a price per Charity FT Share of C$0.59; and (iii)

13,310,070 traditional flow-through shares (the “Traditional FT

Shares”) at a price per Traditional FT Share of C$0.46, for

aggregate gross proceeds under the Brokered Offering of

C$9,520,000.

Additionally, the Company has completed a

concurrent Non-Brokered Offering through the issuance of 1,250,000

Units at C$0.40 per Unit, for additional gross proceeds under the

Non-Brokered Offering of C$500,000 with one strategic investor.

Each Unit consists of one common share of the

Company (a “Share”) plus one-half of one common share purchase

warrant (each whole such warrant, a “Warrant”). Each Warrant

entitles the holder thereof to purchase one Share (a “Warrant

Share”) at an exercise price of C$0.55 until June 20, 2027.

The gross proceeds from the sale of the Charity

FT Shares and the Traditional FT Shares will be used by the Company

to incur eligible “Canadian exploration expenses” that qualify as

“flow-through critical mineral mining expenditures” as both terms

are defined in the Income Tax Act (Canada), and will also be used

to incur “eligible flow-through mining expenditures” as defined in

The Mineral Exploration Tax Credit Regulations, 2014 (Saskatchewan)

(collectively, the “Qualifying Expenditures”) related to the

Company’s projects in Saskatchewan, on or before December 31, 2025,

and to renounce all Qualifying Expenditures in favour of such

subscribers effective December 31, 2024. The net proceeds from the

sale of Units will be used for the 2025 exploration and drilling

programs at the Company’s uranium projects in Saskatchewan, as well

as for general working capital purposes.

The Offering was conducted in accordance with

available prospectus exemptions pursuant to applicable Canadian

securities laws, with the securities issuable under the Offering

subject to a statutory hold period expiring on April 21, 2025.

In consideration for the services provided by

the Agents in connection with the Brokered Offering, on closing the

Company paid to the Agents a cash commission of 6.5% of the gross

proceeds raised under the Brokered Offering, and issued to the

Agents compensation options equal to 6.5% of the total number of

securities sold under the Brokered Offering (the “Compensation

Options”), other than with respect to president’s list orders for

which a 3.25% cash fee was paid and 3.25% Compensation Options were

issued. Each Compensation Option is exercisable at C$0.50 until

June 20, 2027. In connection with the Brokered Offering, the

Company paid aggregate cash commission fees of $589,550 and issued

1,294,525 Compensation Options. No fees were paid in connection

with the Non-Brokered Offering.

Directors and officers of the Company subscribed

for an aggregate of C$49,900 in gross proceeds under the Offering.

Participation by insiders of the Company constitutes a “related

party transaction” under Multilateral Instrument 61-101

- Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). Pursuant to sections 5.5(b) and

5.7(1)(a) of MI 61-101, the Company is exempt from obtaining formal

valuation and minority approval of the Company’s shareholders

respecting the purchase of securities under the Offering by related

parties as the fair market value of securities to be purchased

under the Offering is below 25% of the Company's market

capitalization as determined in accordance with MI 61-101.

The securities offered have not been, nor will

they be, registered under the U.S. Securities Act, as amended, or

any state securities law, and may not be offered, sold or

delivered, directly or indirectly, within the United States, or to

or for the account or benefit of U.S. persons, absent registration

or an exemption from such registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy nor shall there be any sale of securities in any

state in the United States in which such offer, solicitation or

sale would be unlawful.

About Skyharbour Resources Ltd.:

Skyharbour holds an extensive portfolio of

uranium exploration projects in Canada's Athabasca Basin and is

well positioned to benefit from improving uranium market

fundamentals with interest in twenty-nine projects, ten of which

are drill-ready, covering over 580,000 hectares (over 1.4 million

acres) of land. Skyharbour has acquired from Denison Mines, a large

strategic shareholder of the Company, a 100% interest in the Moore

Uranium Project, which is located 15 kilometres east of Denison's

Wheeler River project and 39 kilometres south of Cameco's McArthur

River uranium mine. Moore is an advanced-stage uranium exploration

property with high-grade uranium mineralization at the Maverick

Zone that returned drill results of up to 6.0% U3O8 over 5.9

metres, including 20.8% U3O8 over 1.5 metres at a vertical

depth of 265 metres. Adjacent to the Moore Project is the Russell

Lake Uranium Project, in which Skyharbour is an operator with

joint-venture partner Rio Tinto. The project hosts several

high-grade uranium drill intercepts over a large property area with

robust exploration upside potential. The Company is actively

advancing these projects through exploration and drill

programs.

Skyharbour also has joint ventures with industry

leader Orano Canada Inc., Azincourt Energy, and Thunderbird

Resources at the Preston, East Preston, and Hook Lake Projects

respectively. The Company also has several active earn-in option

partners, including CSE-listed Basin Uranium Corp. at the Mann Lake

Uranium Project; CSE-listed Medaro Mining Corp. at the Yurchison

Project; TSX-V listed North Shore Uranium at the Falcon Project;

UraEx Resources at the South Dufferin and Bolt Projects; Hatchet

Uranium at the Highway Project; Mustang Energy at the 914W Project;

and TSX-V listed Terra Clean Energy at the South Falcon East

Project which hosts the Fraser Lakes Zone B uranium and thorium

deposit. In aggregate, Skyharbour has now signed earn-in option

agreements with partners that total over $41 million in

partner-funded exploration expenditures, over $30 million worth of

shares being issued, and over $22 million in cash payments coming

into Skyharbour, assuming that these partner companies complete

their entire earn-ins at the respective projects.

Skyharbour's goal is to maximize shareholder

value through new mineral discoveries, committed long-term

partnerships, and the advancement of exploration projects in

geopolitically favourable jurisdictions.

Skyharbour’s Uranium Project Map in the

Athabasca Basin:

https://www.skyharbourltd.com/_resources/images/SKY_SaskProject_Locator_2024-02-14_V2.jpg

To find out more about Skyharbour Resources Ltd.

(TSX-V: SYH) visit the Company’s website

at www.skyharbourltd.com.

SKYHARBOUR RESOURCES LTD.

“Jordan Trimble”

Jordan Trimble

President and CEO

For further information contact myself or:Nicholas

ColturaInvestor Relations ManagerSkyharbour Resources

Ltd.Telephone: 604-558-5847Toll Free: 800-567-8181Facsimile:

604-687-3119Email: info@skyharbourltd.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER ACCEPTS RESPONSIBILITY FOR THE

ADEQUACY OR ACCURACY OF THE CONTENT OF THIS NEWS RELEASE.

Forward-Looking Information

This news release contains “forward‐looking

information or statements” within the meaning of applicable

securities laws, which may include, without limitation, the

intended use of proceeds from the Offering, the ability of the

Company to renounce Qualifying Expenditures in favour of the

subscribers, tax treatment of the Charity FT Shares and the

Traditional FT Shares, future results of operations, performance

and achievements of the Company, completing ongoing and planned

work on its projects including drilling and the expected timing of

such work programs, and other statements relating to the technical,

financial and business prospects of the Company, its projects and

other matters. All statements in this news release, other than

statements of historical facts, that address events or developments

that the Company expects to occur, are forward-looking statements.

Although the Company believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results may differ materially from those in the forward-looking

statements. Such statements and information are based on numerous

assumptions regarding present and future business strategies and

the environment in which the Company will operate in the future,

including the price of uranium, the ability to achieve its goals,

that general business and economic conditions will not change in a

material adverse manner, that financing will be available if and

when needed and on reasonable terms. Such forward-looking

information reflects the Company’s views with respect to future

events and is subject to risks, uncertainties and assumptions,

including the risks and uncertainties relating to the

interpretation of exploration results, risks related to the

inherent uncertainty of exploration and cost estimates and the

potential for unexpected costs and expenses, and those filed under

the Company’s profile on SEDAR+ at www.sedarplus.ca. Factors that

could cause actual results to differ materially from those in

forward looking statements include, but are not limited to,

continued availability of capital and financing and general

economic, market or business conditions, adverse weather or climate

conditions, failure to obtain or maintain all necessary government

permits, approvals and authorizations, failure to obtain or

maintain community acceptance (including First Nations), decrease

in the price of uranium and other metals, increase in costs,

litigation, and failure of counterparties to perform their

contractual obligations. The Company does not undertake to update

forward‐looking statements or forward‐looking information, except

as required by law.

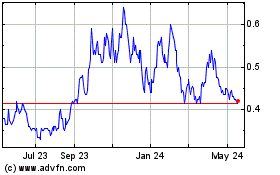

Skyharbour Resources (TSXV:SYH)

Historical Stock Chart

From Dec 2024 to Jan 2025

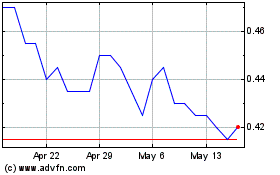

Skyharbour Resources (TSXV:SYH)

Historical Stock Chart

From Jan 2024 to Jan 2025