White Gold Corp. (TSX.V: WGO, OTC – Nasdaq Intl: WHGOF,

FRA: 29W) (the “

Company” or

“

White Gold”) is pleased to announce it has closed

its previously announced brokered private placement consisting of

the sale of units (the “

Units”), premium

flow-through units (the “

FT Units”) and common

shares issued as “flow-through shares” (the “

FT

Shares”, and together with the Units and FT Units, the

“

Offered Securities”), for aggregate gross

proceeds of approximately $4.18 million (the

“

Offering”).

“We are very grateful for the continued support

of our major shareholders and the other participants in this

financing. Our 2021 field season is now well underway, focused on

highly anticipated new targets, recent discoveries, and our

existing mineral resources as we seek to further demonstrate the

expansiveness of gold mineralization in the White Gold District,

and the effectiveness of our exploration methodologies. Further

details to be provided in due course,” stated David D’Onofrio,

Chief Executive Officer.

The Offering was conducted by Clarus Securities

Inc. (“Clarus” or the “Lead

Agent”) and a syndicate of agents including Eight Capital

and Stifel GMP (together with the Lead Agent the

“Agents”), which consisted of the sale of:

1,302,000 Units (including the partial exercise of the Agents’

over-allotment option) at a price of $0.65 per Unit, 2,538,462 FT

Units at a price of $0.87 per FT Unit, and 1,507,400 FT Shares at a

price of $0.75 per FT Share. Each Unit was comprised of one common

share in the capital of the Company (“Common

Share”) and one-half of one Common Share purchase warrant

(each whole warrant, a “Warrant”). Each Warrant

shall entitle the holder thereof to purchase one Common Share at a

price of $0.80 for a period of 24 months following the closing date

of the Offering. Each FT Unit was comprised of one FT Share and

one-half of one Warrant. The Warrants were issued pursuant to a

warrant indenture dated July 29, 2021 between the Company and

Computershare Trust Company of Canada, as warrant agent. The FT

Shares and the FT Shares underlying the FT Units were issued as

“flow-through shares” as defined in the subsection 66(15) of the

Income Tax Act (Canada).

The gross proceeds from the sale of the FT Units

and the FT Shares will be used by the Company to incur exploration

expenditures on its properties in the White Gold District of the

Yukon Territory (the “Qualifying Expenditures”)

prior to December 31, 2022. The Qualifying Expenditures will be

renounced to subscribers of FT Units and FT Shares for the fiscal

year ended December 31, 2021. The gross proceeds from the sale of

the Units will be used for general corporate expenses.

As consideration for the Agents’ services in

connection with the Offering, the Agents received a cash commission

equal to 6.0% of the gross proceeds from the Offering, excluding

gross proceeds from the issuance of Offered Securities on a

president’s list (the “President’s List”) for

which a commission of 2.0% of such gross proceeds were paid by the

Company to Agents. The Company also issued to the Agents

non-transferable compensation options (the “Compensation

Options”) equal to 6.0% of the number of Offered

Securities sold under the Offering excluding the President's List

and 2.0% of the number of Offered Securities sold under the

Offering to subscribers on the President's List. Each Compensation

Option entitles the holder to acquire one Common Share at a price

equal to the following: (i) if the security sold is a Unit, $0.65

per Compensation Share; (ii) if the security sold is an FT Unit,

$0.87 per Compensation Share; and (iii) if the security sold is an

FT Share, $0.75 per Compensation Share, in each case, until the

date that is 24 months following the Closing Date.

All securities issued pursuant to the Offering,

including any underlying securities, are subject to a four-month

and one day hold period in accordance with applicable Canadian

securities laws.

Pursuant to existing investor rights agreements

between the Company and each of Agnico Eagle Mines Limited (TSX:

AEM, NYSE: AEM) (“Agnico”) and Kinross Gold

Corporation (TSX: K, NYSE: KGC) (“Kinross”), both

Agnico and Kinross exercised the right to participate in the

Offering in order to maintain their respective interests in the

Company.

Participation by Agnico and Kinross, and any

other insiders of the Company (collectively, the “Insiders”), in

the Offering was considered a “related party transaction” pursuant

to Multilateral Instrument 61- 101 – Protection of Minority

Security Holders in Special Transactions (“MI

61-101”). The Company was exempt from the requirements to

obtain a formal valuation or minority shareholder approval in

connection with the Insiders’ participation in the Offering in

reliance of sections 5.5(a) and 5.7(1)(a) of MI 61-101. A material

change report will be filed in connection with the participation of

Insiders in the Offering less than 21 days in advance of the

closing of the Offering, which the Company deemed reasonable in the

circumstances so as to be able to avail itself of potential

financing opportunities and complete the Offering in an expeditious

manner.

About White Gold Corp.

The Company owns a portfolio of 21,111 quartz

claims across 31 properties covering over 420,000 hectares

representing over 40% of the Yukon’s prolific White Gold District.

The Company’s flagship White Gold property hosts the Company’s

Golden Saddle and Arc deposits which have a mineral resource of

1,139,900 ounces Indicated at 2.28 g/t Au and 402,100 ounces

Inferred at 1.39 g/t Au(1). Mineralization on the Golden Saddle and

Arc is also known to extend beyond the limits of the current

resource estimate. The Company’s recently acquired VG Deposit also

hosts a historic Inferred gold resource of 230,000 ounces at 1.65

g/t Au(2). Regional exploration work has also produced several

other new discoveries and prospective targets on the Company’s

claim packages which border sizable gold discoveries including the

Coffee project owned by Newmont Corporation with Measured and

Indicated Resources of 2.17 Moz at 1.46 g/t Au, and Inferred

Resources of 0.50 Moz at 1.32 g/t Au(3), and Western Copper and

Gold Corporation’s Casino project which has Measured and Indicated

Resources of 14.5 Moz Au and 7.6 Blb Cu and Inferred Resources of

6.6 Moz Au and 3.3 Blb Cu(4). For more information visit

www.whitegoldcorp.ca.

(1) See White Gold Corp. technical report titled

“Technical Report for the White Gold Project, Dawson Range, Yukon

Canada”, dated July 10, 2020, prepared by Dr. Gilles Arseneau,

P.Geo., and Andrew Hamilton, P.Geo., available on SEDAR.

(2) See Comstock Metals Ltd. technical report

titled “NI 43-101 TECHNICAL REPORT on the QV PROJECT”, dated August

19, 2014, prepared by Jean Pautler, P.Geo., and Ali Shahkar,

P.Eng., available on SEDAR.

(3) See Newmont Corporation press release titled

“Newmont Reports 2019 Gold Mineral Reserves of 100 Million Ounces,

Largest in Company History”, dated February 13, 2020, available on

SEDAR.

(4) See Western Copper and Gold Corporation

press release titled “Western Copper and Gold Announces Significant

Resource Increase at Casino”, dated July 14, 2020, available on

SEDAR.

Qualified Person

Terry Brace, P.Geo. and Vice President of

Exploration for the Company is a “qualified person” as defined

under National Instrument 43-101 – Standards of Disclosure of

Mineral Projects and has reviewed and approved the content of this

news release.

Cautionary Note Regarding Forward

Looking Information

This news release contains "forward-looking

information" and "forward-looking statements" (collectively,

"forward-looking statements") within the meaning of the applicable

Canadian securities legislation. All statements, other than

statements of historical fact, are forward-looking statements and

are based on expectations, estimates and projections as at the date

of this news release. Any statement that involves discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, assumptions, future events or performance (often but

not always using phrases such as "expects", or "does not expect",

"is expected", "anticipates" or "does not anticipate", "plans",

“proposed”, "budget", "scheduled", "forecasts", "estimates",

"believes" or "intends" or variations of such words and phrases or

stating that certain actions, events or results "may" or "could",

"would", "might" or "will" be taken to occur or be achieved) are

not statements of historical fact and may be forward-looking

statements. In this news release, forward-looking statements

relate, among other things, the Offering, the use of proceeds from

the Offering, the Company’s objectives, goals and exploration

activities conducted and proposed to be conducted at the Company’s

properties; future growth potential of the Company, including

whether any proposed exploration programs at any of the Company’s

properties will be successful; exploration results; and future

exploration plans and costs and financing availability. These

forward-looking statements are based on reasonable assumptions and

estimates of management of the Company at the time such statements

were made. Actual future results may differ materially as

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to materially differ

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Such factors, among

other things, include: the expected benefits to the Company

relating to the exploration conducted and proposed to be conducted

at the White Gold properties; the receipt of all applicable

regulatory approvals for the Offering; failure to identify any

additional mineral resources or significant mineralization; the

preliminary nature of metallurgical test results; uncertainties

relating to the availability and costs of financing needed in the

future, including to fund any exploration programs on the Company’s

properties; business integration risks; fluctuations in general

macroeconomic conditions; fluctuations in securities markets;

fluctuations in spot and forward prices of gold, silver, base

metals or certain other commodities; fluctuations in currency

markets (such as the Canadian dollar to United States dollar

exchange rate); change in national and local government,

legislation, taxation, controls, regulations and political or

economic developments; risks and hazards associated with the

business of mineral exploration, development and mining (including

environmental hazards, industrial accidents, unusual or unexpected

formations pressures, cave-ins and flooding); inability to obtain

adequate insurance to cover risks and hazards; the presence of laws

and regulations that may impose restrictions on mining and mineral

exploration; employee relations; relationships with and claims by

local communities and indigenous populations; availability of

increasing costs associated with mining inputs and labour; the

speculative nature of mineral exploration and development

(including the risks of obtaining necessary licenses, permits and

approvals from government authorities); the unlikelihood that

properties that are explored are ultimately developed into

producing mines; geological factors; actual results of current and

future exploration; changes in project parameters as plans continue

to be evaluated; soil sampling results being preliminary in nature

and are not conclusive evidence of the likelihood of a mineral

deposit; title to properties; ongoing uncertainties relating to the

COVID-19 pandemic; and those factors described under the heading

"Risks Factors" in the Company's annual information form dated July

29, 2020 available on SEDAR. Although the forward-looking

statements contained in this news release are based upon what

management of the Company believes, or believed at the time, to be

reasonable assumptions, the Company cannot assure shareholders that

actual results will be consistent with such forward-looking

statements, as there may be other factors that cause results not to

be as anticipated, estimated or intended. Accordingly, readers

should not place undue reliance on forward-looking statements and

information. There can be no assurance that forward-looking

information, or the material factors or assumptions used to develop

such forward-looking information, will prove to be accurate. The

Company does not undertake to release publicly any revisions for

updating any voluntary forward-looking statements, except as

required by applicable securities law.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

news release.

For Further Information, Please

Contact:

Contact Information:

David D’Onofrio Chief Executive Officer White

Gold Corp. (647) 930-1880 ir@whitegoldcorp.ca

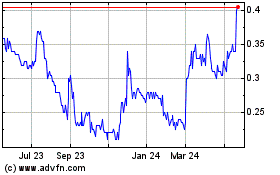

White Gold (TSXV:WGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

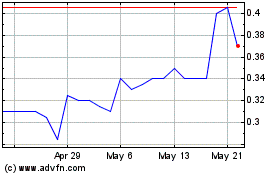

White Gold (TSXV:WGO)

Historical Stock Chart

From Dec 2023 to Dec 2024