White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA:

29W) (the “Company”) is pleased to provide an exploration

update on the Bridget and Isaac porphyry targets located on the

Pedlar and Hayes properties, respectively. Exploration work

completed during 2023 included Induced Polarization (IP)

chargeability and resistivity survey lines and hyperspectral

analysis on 2022 prosecting rock samples. All data collected thus

far on these large early-stage targets continue to support a

porphyry deposit model.

The Pedlar and Hayes properties are situated in

the southern part of the Company’s 315,000 hectare (3,150 km2) land

package in the White Gold District, west-central Yukon (Figure 1).

Western Copper and Gold Corporation’s Casino copper-gold-molybdenum

porphyry deposit (Measured & Indicated Resources of 7.6 Blb

copper and 14.5 Moz gold and Inferred Resources of 3.3 Blb copper

and 6.6 Moz gold) sits approximately 30 km southwest and 40 km west

of the Bridget and Isaac targets respectively. Casino is one of the

largest undeveloped copper-gold projects in Canada, and since 2021

has seen strategic investments by major partners including Rio

Tinto Canada Inc. and Mitsubishi Materials Corporation. The Pedlar

and Hayes properties are also located 40 km and 72 km southeast,

respectively, of the Company’s flagship White Gold project which

contains an estimated 1,152,900 ounces of gold in Indicated

Resources and 942,400 ounces of gold in Inferred Resources(1).

Terry Brace, Vice President of Exploration

commented: “We are encouraged by results of the 2023 IP test lines

at the Bridget and Isaac targets which identified new anomalies and

structures that overall correlate well with the soil geochemistry

anomalies and current structural interpretations. The new IP looked

deeper than any previous geophysical surveys and demonstrates

potential at depth beneath these large multi-element soil

anomalies. The test results warrant full IP survey coverage over

the target areas which will aid in mapping these systems at depth

in support of future diamond drill testing.”

Shawn Ryan, co-founder, Chief Technical Advisor

and Director, commented further: “The Bridget target has an

interesting history as it was one of four top prospects that was

first discovered back in 1972 when Silver Standard Mines conducted

an extensive 14,000 plus regional silt survey looking for another

Casino. During the large regional silt survey, Silver Standard also

made the Minto Copper discovery and eventually focused all their

attention on that target. I staked the Bridget prospect back in

2004, and since then the property has seen extensive soil sampling

programs, airborne radiometric surveys and shallow RAB drilling.

The soil sampling program revealed a large copper, molybdenum and

bismuth soil anomaly. The molybdenum anomaly (2 to 322 ppm)

measures 4 km by 1.7 km and coincides with a very discrete bismuth

anomaly (2 to 154 ppm) of 3 km by 1.4 km and a copper core anomaly

(50 to 711 ppm) measuring 2.8 km by 1.3 km. A deep penetrating

dipole-dipole IP survey was undertaken in summer 2023 with one line

over the core of the soil anomaly and the results clearly show a

textbook porphyry geophysical signature of resistivity lows and

chargeability high anomalies sitting below the anomalous soils.

It’s now recommended to follow up with more IP survey lines to

cover this large developing porphyry target. I look forward to

first diamond drill holes into this exciting target.”

An overview of the Pedlar and Hayes properties,

including the Bridget and Isaac targets, was provided previously in

a news release dated April 5, 2023 which is available on the

Company’s website (https://whitegoldcorp.ca/news/) and on SEDAR+.

Maps and images accompanying this news release can be found at

http://whitegoldcorp.ca/investors/exploration-highlights/.

Highlights

- The Bridget and Isaac targets

represent large, early-stage, multi-element porphyry targets that

have never been diamond drill tested.

- Deep penetrating test IP survey

lines conducted over existing soil geochemistry anomalies have

identified a total of 13 chargeability anomalies, 5 at Bridget and

8 at Isaac.

- The Bridget soil anomaly on the

Pedlar property measures 3 km NW-SE by 3.5 km NE-SW and is

interpreted to represent a copper-molybdenum porphyry target. It is

geochemically zoned with a molybdenum-copper-bismuth core and a

silver-zinc-lead-tungsten halo.

- At Bridget, one 1st priority and

four 2nd priority chargeability anomalies were identified, with

target depths ranging from 40 to 330 m. The chargeability anomalies

underly a large molybdenum-copper soil anomaly, and a zone of

moderate to strong chargeability to the southwest appears to mark a

controlling WNW (290°) striking fault which correlates with

anomalous lead-zinc-arsenic in soils.

- The Isaac soil anomaly on the Hayes

property is a recently discovered target which measures 2 km E-W by

1.5 km N-S, and is interpreted to represent a copper-molybdenum

porphyry target. It is geochemically zoned with a

bismuth-arsenic-copper core and a silver-zinc-lead halo.

- At Isaac, four 1st priority, three

2nd priority and one 3rd priority chargeability anomalies were

identified, with target depths ranging from 50 to 550 m. The

bismuth and copper core of the soil anomaly is underlain by

multiple chargeability anomalies (S1, S2, M1 and W1 on Line 1E)

which sit above a resistivity low. Anomalous lead, zinc, and

silver, which form a halo around the core, are coincident with

fault structures on the south side and north side of the survey

area which trend NE (065°) and NW (290°) respectively.

- 2022 prospecting rock samples from

both the Bridget and Isaac targets show anomalous trace element

enrichments, including copper, molybdenum and silver, consistent

with proximal porphyry copper-style mineralization.

- Hyperspectral analysis results for

the prosecting rock samples at both Bridget and Isaac show

alteration mineralogy consistent with a porphyry deposit

model.

- The Company is currently planning

its fully funded 2024 exploration program, focusing on its existing

significant gold resources, new high grade gold discoveries and

other high priority gold and multi-element targets. The Company

will arrange a webinar to provide a more detailed overview of the

2023 exploration results and plans for 2024 at that time. Details

to be announced in due course.

Regional Setting – The Dawson

Range

The Dawson Range forms an east-southeast

trending mountain range which hosts several important mineral

deposits and prospects (Figure 2) including the Casino porphyry

Copper-Gold deposit in the west. In the southeast near the

community of Carmacks, the Minto Mine contains resources of 356 Mlb

copper, 189 Koz gold, and 1.7 Moz silver in Indicated Resources and

370 Mlb copper, 207 Koz gold, and 1.9 Moz silver in Inferred

Resources(5), and the Carmacks Copper project hosts 652 Mlb copper,

302 Koz gold, 3.8 Moz silver in Measured and Indicated Resources

and 38 Mlb copper, 13 Koz gold, and 215 Koz silver in Inferred

Resources(6) (Granite Creek Copper Ltd.), both interpreted to

represent metamorphosed copper-gold-silver porphyry deposits.

Porphyry deposits in the Dawson Range can be divided into 2 major

ages, Late Triassic (Minto, Carmacks) and Late Cretaceous (Casino,

Cash, Revenue). In addition to porphyry mineralization, epithermal,

skarn, and polymetallic to gold-dominant mineralized veins,

breccias and fracture zones also occur throughout the Dawson

Range(7). In recent years this area has drawn increased attention

and investment from both junior and major mining companies due to

its high mineral potential.

2023 IP Surveys

In August 2023, Simcoe Geoscience Limited

(Simcoe) carried out 7.2 line-km of time domain induced

polarization (IP) chargeability and resistivity surveying at the

Bridget and Isaac targets using their wireless 2D Alpha IP™ system

(see About IP Survey below). At Bridget, a single 3.0 km long IP

test line (line 1N) oriented NE-SW was completed using a

dipole-dipole configuration. At Isaac, two IP test lines totaling

4.2 km long were oriented perpendicular to each other at NE-SW

(line 4N) and NW-SE (line 1E) using a dipole-pole-dipole

configuration. Both configurations can detect anomalies up to 600+

m depth.

IP Results

At Bridget, five chargeability anomalies were

identified on Line 1N (Figure 3), including one 1st priority

anomaly (S1) and four 2nd priority anomalies (M1-M4). Anomaly S1

has a target depth of 130 m and is characterized by strong

chargeability and low resistivity. Target depths on the second

priority anomalies range from 40 m (M3, M4) to a maximum of 330 m

(M1). These are characterized by moderate to high chargeability and

low to high resistivity.

The Bridget chargeability anomalies are plotted

in relation to soil geochemistry results in Figure 4 (molybdenum,

copper, lead, zinc) and Figure 5 (copper). The chargeability

anomalies generally correspond with a zone of low resistivity which

underlie a large molybdenum-copper soil anomaly. A zone of moderate

(M1) to strong (S1) chargeability in the southwest delineates a

controlling west-northwest (WNW, 290°) striking fault structure,

closely correlated with lead, zinc, and arsenic soil anomalies. To

the northeast, a similar WNW (295°) anomaly in lead, zinc, and

arsenic defines the boundary of this chargeability anomaly and

coincides with a significant tungsten anomaly, positioned along the

northeastern fringe of a molybdenum anomaly. It is worth noting

that in 2018 the Company drilled 10 short rotary air blast (RAB)

drill holes totalling 548.6 m over the area between chargeability

anomalies M2 and S1. However, these RAB holes were testing surface

soil anomalies and drilled to a shallow maximum depth of only 70 m,

hence the newly IP chargeability anomalies identified are

completely untested.

At Isaac, 8 chargeability anomalies were

identified on Lines 1E and 4N. Five anomalies occur on Line 1E

(Figure 6), including three 1st priority anomalies (S1-S3), one 2nd

priority anomaly (M1) and one 3rd priority anomaly (W1). The 1st

priority anomalies are characterized by moderate chargeability and

low to high resistivity. Target depths of the 1st priority

anomalies range from 70 m (S3) to 250 m (S2). An additional three

anomalies occur on Line 4N (Figure 7), including one 1st priority

anomaly (S1) and two 2nd priority anomalies (M1-M2) (see Figure 7).

Target depths of these chargeability anomalies range from 220 – 550

m.

The Isaac chargeability anomalies on Line 1E,

oriented NW-SE, are plotted in relation to soil geochemistry

results for select elements (bismuth, copper, lead, silver) in

Figure 8. The bismuth anomaly appears to be controlled by faults

interpreted from the IP resistivity data. The bismuth and copper

core of the soil anomaly is underlain by multiple chargeability

anomalies (S1, S2, M1 and W1) which sit above a resistivity low

which is interpreted as a fault structure. Lead, zinc, and silver,

which form a halo around the core, are coincident with fault

structures on the south side and north side of the survey area

which trend NE (065°) and NW (290°) respectively. Isaac is a

recently recognized (2021) target and has never been drilled

tested.

2023 Hyperspectral Analysis &

Results

During 2023, crushed coarse rejects from 2022

prospecting rock samples from the Pedlar and Hayes properties were

analyzed with an ASD TerraSpec® 4 Hi-Res Mineral Spectrometer.

Results were uploaded and processed using IMDEX’s aiSIRIS™

cloud-based mineral interpretation AI software to produce

semi-quantitative, standardized mineral interpretations and

analytics (see About Hyperspectral Analysis below).

The Hyperspectral analysis results for the

prosecting rock samples show alteration mineralogy consistent with

a porphyry deposit model.

A total of 17 prospecting rock samples were

collected at the Bridget target and 19 samples at the Isaac target.

Samples from both the Bridget and Isaac targets show anomalous

trace element enrichments, including copper, molybdenum and silver,

consistent with proximal porphyry copper-style mineralization.

Hyperspectral data for the Isaac target samples provide evidence

for phyllic alteration characterized by muscovite and potassic

alteration, with evidence of propylitic alteration found only on

the southern edge of the sampled area where significant chlorite is

observed. The Bridget samples show no evidence of phyllic

alteration, however most samples show both geochemical and

hyperspectral evidence for widespread propylitic alteration

involving epidote, chlorite and albite, as well as minor potassic

alteration.

Next Steps

The Company is encouraged by the success of the

IP test lines in detecting chargeability and resistivity anomalies

beneath the soil geochemistry anomalies at the Bridget and Isaac

targets at depths from 40m to 550m below surface. These results

warrant full IP survey coverage over the target areas which will

aid in identifying targets at depth in support of future diamond

drill testing.

About the Bridget TargetThe

Bridget target area is located on the Pedlar property and was first

explored by Silver Standard Mines Ltd. (“Silver Standard”) and

Asarco Exploration Company of Canada Ltd. (“Asarco”) in the early

1970’s following the discovery of the Casino Copper-Gold-Molybdenum

porphyry deposit. A series of regional silt samples, soil sampling,

and geophysical surveys by Silver Standard in 1971 and 1972 led to

the discovery of a significant molybdenum-copper geochemical

anomaly, now known as the Bridget target. Historical exploration

work between 2004 and 2016 included soil sampling, prospecting,

geological mapping, and geophysical surveys. In 2016 the Company

acquired ownership of the property and has continued to expand the

large multi-element (molybdenum, copper, bismuth, tungsten, lead,

silver) soil geochemical anomaly that currently measures 3 km NW-SE

by 4.3 km NE-SW. In 2018, a maiden rotary air blast (RAB) drilling

program comprising 10 holes totalling 548.6 m was completed;

however, the RAB holes were short testing to a maximum vertical

depth of only 70 m, well short of potential porphyry mineralization

at depth beneath the anomalous soils. Porphyry targets

characterized by IP chargeability high anomalies remain completely

untested.

About the Isaac TargetThe Isaac

target is located on the Hayes property and was first recognized by

the Company as a prospective porphyry target in 2021 through soil

sampling. Gridded soil sampling (50 m spaced samples on 100 m

spaced survey lines) was conducted in an area located approximately

5 km south of the Yukon River where a 2017 reconnaissance soil

survey identified several isolated anomalous ridge and spur soil

samples. The 2021 sampling identified a new geochemically zoned

multi-element soil anomaly named the Isaac target, which measures

approximately 2 km east-west by 1.5 km north-south. The anomaly has

a central core measuring from 750 m to 1,000 m in diameter and

enriched in bismuth and arsenic, which is surrounded by a halo of

anomalous silver, lead and zinc that is greater than 400 m wide.

Anomalous copper occurs in the southern portion of the core, and a

relatively small area of anomalous molybdenum occurs near the

core’s northern margin. Geologically the soil anomaly is associated

with a plug of Late Cretaceous Prospector Mountain suite, which is

known to be prospective for porphyry copper-gold-molybdenum and

epithermal style mineralization. The geochemical zonation and

elemental distributions indicate that the anomaly may represent the

surface expression of a copper-molybdenum porphyry core surrounded

by distal or epithermal style silver-lead-zinc mineralization.

Follow-up geological mapping and prospecting in 2022 at the Isaac

target area returned anomalous copper values from the core area of

the soil anomaly, with three grab samples returning from 730.6 –

1269.2 ppm Copper.

About Hyperspectral

Analysis

Crushed coarse rejects from 2022 prospecting

rock samples were analyzed with an ASD TerraSpec® 4 Hi-Res Mineral

Spectrometer by Bureau Veritas Commodities Canada Ltd. at their

preparation laboratory in Whitehorse, Yukon. Results were uploaded

and processed using IMDEX’s aiSIRIS™ cloud-based mineral

interpretation AI software to produce semi-quantitative,

standardized mineral interpretations and analytics. TerraSpec and

aiSIRIS data were reviewed and interpreted by Dr. Dennis Arne, a

principal consulting geochemist with Telemark Geosciences Pty Ltd,

a geological consulting services company based in Victoria,

Australia.

About IP Survey

The 2023 IP surveys were completed by Simcoe

Geoscience Limited (Simcoe) using their wireless time domain 2D

Alpha IP™ system

(https://www.simcoegeoscience.com/wireless-alpha-ip). Survey data

was recorded in a Reverse & Forward array configuration with

readings taken every 100 m along the line. A dipole-dipole

configuration was used at the Bridget target, and a

dipole-pole-dipole configuration at the Isaac target. Once the IP

data satisfied the QA/QC process, the entire survey line file was

exported into UBC format to run the model 2D inversions. Results

were reviewed, interpreted and chargeability anomalies ranked by

Simcoe’s in-house geophysicist.

About White Gold Corp.The

Company owns a portfolio of 15,876 quartz claims across 26

properties covering approximately 315,000 hectares (3,150 km2)

representing over 40% of the Yukon’s emerging White Gold District.

The Company’s flagship White Gold project hosts four near-surface

gold deposits which collectively contain an estimated 1,152,900

ounces of gold in Indicated Resources and 942,400 ounces of gold in

Inferred Resources(1). Regional exploration work has also produced

several other new discoveries and prospective targets on the

Company’s claim packages which border sizable gold discoveries

including the Coffee project owned by Newmont Corporation with

Measured and Indicated Resources of 2.1 Moz at 1.28 g/t gold and

Inferred Resources of 0.2 Moz at 1.0 g/t gold(2), and Western

Copper and Gold Corporation’s Casino project which has Measured and

Indicated Resources of 7.6 Blb copper and 14.5 Moz gold and

Inferred Resources of 3.3 Blb copper and 6.6 Moz gold(3). For more

information visit www.whitegoldcorp.ca.

(1) See White Gold Corp. technical report titled

“2023 Technical Report for the White Gold Project, Dawson Range,

Yukon, Canada ”, Effective Date April 15, 2023, Report Date May 30,

2023, NI 43-101 Compliant Technical Report prepared by Dr. Gilles

Arseneau, P.Geo., available on SEDAR+.(2) See Newmont Corporation

Form 10-K: Annual report for the year ending December 31, 2023, in

the Measured, Indicated, and Inferred Resources section, dated

February 29, 2024, available on EDGAR. Reserves and resources

disclosed in this Form 10-K have been prepared in accordance with

the Regulation S-K 1300, and do not indicate NI43-101

compliance.(3) See Western Copper and Gold Corporation technical

report titled “Casino project, Form 43-101F1 Technical Report

Feasibility Study, Yukon Canada”, Effective Date June 13, 2022,

Issue Date August 8, 2022, NI 43-101 Compliant Technical Report

prepared by Daniel Roth, PE, P.Eng., Mike Hester, F Aus IMM, John

M. Marek, P.E., Laurie M. Tahija, MMSA-QP, Carl Schulze, P.Geo.,

Daniel Friedman, P.Eng., Scott Weston, P.Geo., available on

SEDAR+.(5) See Minto Metals Corp. technical report titled “Form

43-101F1 Preliminary Economic Assessment Technical Report, Minto,

Yukon Canada”, Effective Date March 31, 2021, Report Date May 7,

2021, prepared by Dino Pilotto, P.Eng., Tysen Hantelmann, P. Eng.,

Mike Levy, P.E., Sue Bird, P. Eng., Carl Schulze, P. Geo., Tad

Crowie, P. Eng., Cheibany Elemine, Ph. D., P. Geo., Sam Amiralaei,

P. Eng., John Kurylo, P. Eng., available on SEDAR.(6) See Granite

Creek Copper Ltd. technical report titled “Updated Mineral Resource

Estimates for the Carmacks Cu-Au-Ag Project Near Carmacks, Yukon,

Canada”, Effective Date February 25, 2022, Report Date April 29,

2022, prepared by Allan Armitage, Ph. D., P. Geo., available on

SEDAR.(7) Allan, M.M., Mortensen, J.K., Hart, C.J.R., Bailey, L.A.,

Sánchez, M.G., Ciolkiewicz, W., McKenzie, G.G. and Creaser, R.A.,

2013, Magmatic and Metallogenic Framework of West-Central Yukon and

Eastern Alaska: Society of Economic Geologists, Special Publication

17, pp. 111-168.

Qualified PersonTerry Brace,

P.Geo. and Vice President of Exploration for the Company is a

“qualified person” as defined under National Instrument 43-101 –

Standards of Disclosure of Mineral Projects and has reviewed and

approved the content of this news release.

Cautionary Note Regarding Forward

Looking InformationThis news release contains

“forward-looking information” and “forward-looking statements”

(collectively, “forward-looking statements”) within the meaning of

the applicable Canadian securities legislation. All statements,

other than statements of historical fact, are forward-looking

statements and are based on expectations, estimates and projections

as at the date of this news release. Any statement that involves

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often but not always using phrases such as “expects”,

or “does not expect”, “is expected”, “anticipates” or “does not

anticipate”, “plans”, “proposed”, “budget”, “scheduled”,

“forecasts”, “estimates”, “believes” or “intends” or variations of

such words and phrases or stating that certain actions, events or

results “may” or “could”, “would”, “might” or “will” be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking statements. In this news release,

forward-looking statements relate, among other things, the

Company’s objectives, goals and exploration activities conducted

and proposed to be conducted at the Company’s properties; future

growth potential of the Company, including whether any proposed

exploration programs at any of the Company’s properties will be

successful; exploration results; and future exploration plans and

costs and financing availability.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include:The expected

benefits to the Company relating to the exploration conducted and

proposed to be conducted at the White Gold properties; the receipt

of all applicable regulatory approvals for the Offering; failure to

identify any additional mineral resources or significant

mineralization; the preliminary nature of metallurgical test

results; uncertainties relating to the availability and costs of

financing needed in the future, including to fund any exploration

programs on the Company’s properties; business integration risks;

fluctuations in general macroeconomic conditions; fluctuations in

securities markets; fluctuations in spot and forward prices of

gold, silver, base metals or certain other commodities;

fluctuations in currency markets (such as the Canadian dollar to

United States dollar exchange rate); change in national and local

government, legislation, taxation, controls, regulations and

political or economic developments; risks and hazards associated

with the business of mineral exploration, development and mining

(including environmental hazards, industrial accidents, unusual or

unexpected formations pressures, cave-ins and flooding); inability

to obtain adequate insurance to cover risks and hazards; the

presence of laws and regulations that may impose restrictions on

mining and mineral exploration; employee relations; relationships

with and claims by local communities and indigenous populations;

availability of increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development (including the risks of obtaining necessary licenses,

permits and approvals from government authorities); the

unlikelihood that properties that are explored are ultimately

developed into producing mines; geological factors; actual results

of current and future exploration; changes in project parameters as

plans continue to be evaluated; soil sampling results being

preliminary in nature and are not conclusive evidence of the

likelihood of a mineral deposit; title to properties; ongoing

uncertainties relating to the COVID-19 pandemic; and those factors

described under the heading “Risks Factors” in the Company’s annual

information form dated July 29, 2020 available on SEDAR+. Although

the forward-looking statements contained in this news release are

based upon what management of the Company believes, or believed at

the time, to be reasonable assumptions, the Company cannot assure

shareholders that actual results will be consistent with such

forward-looking statements, as there may be other factors that

cause results not to be as anticipated, estimated or intended.

Accordingly, readers should not place undue reliance on

forward-looking statements and information. There can be no

assurance that forward-looking information, or the material factors

or assumptions used to develop such forward-looking information,

will prove to be accurate. The Company does not undertake to

release publicly any revisions for updating any voluntary

forward-looking statements, except as required by applicable

securities law.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

news release.

For Further Information, Please

Contact:

Contact Information:David

D’OnofrioChief Executive OfficerWhite Gold Corp.(647) 930-1880

ir@whitegoldcorp.ca

Request Meeting:

https://calendly.com/meet-with-wgo/15min

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/3565ebca-7da2-4641-903a-09b492f865d7https://www.globenewswire.com/NewsRoom/AttachmentNg/277ca605-08b7-4985-9f92-6b56ba50d2a7https://www.globenewswire.com/NewsRoom/AttachmentNg/764bdd43-765e-4324-a6d6-055e640131bdhttps://www.globenewswire.com/NewsRoom/AttachmentNg/3b94a896-9b97-4295-942e-3bb9a7242a6bhttps://www.globenewswire.com/NewsRoom/AttachmentNg/1abaa590-d02b-480e-b1e5-c8c88bdc29e3https://www.globenewswire.com/NewsRoom/AttachmentNg/17575276-737d-4098-a44f-bee919f5abaehttps://www.globenewswire.com/NewsRoom/AttachmentNg/e6499d90-5842-4522-8ae6-79aa6433c5abhttps://www.globenewswire.com/NewsRoom/AttachmentNg/9162969d-ab75-4a3d-8e12-37e46e9fb709

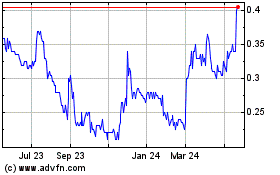

White Gold (TSXV:WGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

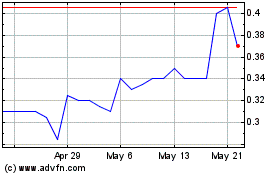

White Gold (TSXV:WGO)

Historical Stock Chart

From Dec 2023 to Dec 2024