White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA:

29W) (the “Company”) is pleased to report additional assay

results from its 2022 diamond drilling program on the Ryan’s

Surprise and Ulli’s Ridge targets, as well as rotary air blast

(RAB) drilling results from previously undrilled targets along the

Ryan’s Trend, a 6.5km long north-northwest striking zone of

anomalous gold and arsenic in soils (Figure 1). The Ryan’s Surprise

and Ulli’s Ridge targets are located approximately 2km west of the

Company’s flagship Golden Saddle and Arc deposits and 11km south of

the Company’s VG deposit. The Golden Saddle and Arc deposits have a

combined mineral resource of 1,139,900 ounces Indicated at 2.28 g/t

Au and 402,100 ounces Inferred at 1.39 g/t Au(1) and the VG deposit

hosts an Inferred gold resource of 267,600 ounces at 1.62 g/t

Au(2). These assays represent additional positive results from the

Company’s $6 million 2022 exploration program on its extensive and

underexplored 350,000 hectare land package in the emerging White

Gold District, Yukon, supported by strategic partners including

Agnico Eagle Mines Limited and Kinross Gold Corporation.

“We are very pleased to see the significant

extension of mineralization at the Ryan’s Surprise almost doubling

its strike length as well as the discovery of gold mineralization

at multiple other targets in first ever drilling along this

underexplored trend which has now encountered gold mineralization

over a length of 5.5km. The abundance of gold mineralization and

its vicinity to our flagship gold deposits is very encouraging for

the continued expansion of our significant gold resources in this

area. Overall 2022 was an was a very successful year in which we

continued to demonstrate the growth potential of our flagship

project, which ranks amongst the largest high grade gold deposits

in the Yukon, and also expand our exciting new high grade Betty

discovery, contiguous to Newmont’s Coffee Project and Western

Copper and Gold’s Casino project,“ stated David D’Onofrio, CEO.

Maps accompanying this news release can be found

at https://whitegoldcorp.ca/news/.

Highlights:

- All 2022 diamond holes at Ryan’s

Surprise and the and widely spaced step out holes in the previously

untested Gap area between Ryan’s Surprise and Ulli’s Ridge

intersected gold mineralization.

- Maiden drilling in the Gap area

between Ryan’s Surprise and Ulli’s Ridge intersected multiple zones

of gold mineralization which appear consistent in tenor with the

zones at Ryan’s Surprise, with significant results including:

- WHTRS22D027: 1.43 g/t Au

over 11.45m from 145.50m depth

- WHTRS22D028: 6.01 g/t Au

over 2.35m from 296.50 depth

- 2022 drilling at Ryan's Surprise

followed up on drilling between 2018 and 2021 that identified

significant zones of gold mineralization, with highlights including

20.64g/t Au over 6.10m in WHTRYN18RC0001, 2.10 g/t Au over

31.78m in WHTRS19D012, 8.69 g/t Au over 12.30m in WHTRS20D018, and

17.40 g/t Au over 3.47m in WHTRS20D013.

- Following the success of the 2022

and previous diamond drill programs, a maiden resource estimate at

Ryan’s Surprise zone is currently underway with details to be

announced in the coming months.

- Hole WHTULR22D010 at Ulli’s Ridge

testing a previously undrilled area collared in mineralization and

intersected 1.49 g/t Au over 16.00 m from

6.00m.

- Maiden RAB drilling at the Teacher

target at the northern limit of the Ryan’s Trend intersected

multiple zones of near-surface gold mineralization with significant

results including:

- WHTTTC22RAB003: 3.40 g/t Au

over 6.10m from 1.52m depth

- WHTTTC22RAB004: 3.30 g/t Au

over 4.57m from 24.38m depth

- Gold mineralization has now been encountered in drilling over a

total strike length of 5.5km along the Ryan’s Trend which warrants

follow up drill testing.

Figure 1: White Gold Property 2022 Ryan’s

Trend Drilling accompanying this announcement is available

at

https://www.globenewswire.com/NewsRoom/AttachmentNg/999b2a84-21e7-447d-8db2-88fb2e633e22

Figure 2: White Gold Property 2022 Diamond

Drilling Overview accompanying this announcement is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/eba612a2-1522-4d35-9f71-5e672cb1a24a

Figure 3: Ryan’s Surprise and Ulli’s Ridge

Conceptual Model accompanying this announcement is

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/02afffce-12af-4d1b-999e-7d95098c6ed8

PDAC 2023

The Company will be exhibiting at PDAC 2023 at

the Investors Exchange, with full details below. Conference

attendees are encouraged to visit the Company booth to learn more

and ask any questions they may have. Management is also

participating in the PDAC One on One Meeting Program and will meet

with interested parties.

Booth

Number: 3028Dates: March 5th to

8th, 2023Exhibition Hours: 10 a.m. to 5 p.m.

ET

2022 Ryan’s Surprize & Ulli’s Ridge Exploration

Program

Diamond DrillingThe 2022

diamond drilling program at Ryan’s Surprise and Ulli’s Ridge

comprised 9 holes totalling 2,685m which further tested 3 separate

target areas with the following objectives (Figure 2):

- Drilling at Ryan’s Surprise to provide sufficient drill spacing

to conduct an initial mineral resource estimate;

- Drilling the Gap area between the Ryan’s Surprise and Ulli’s

Ridge targets to identify the possible continuation of

mineralization at the Ryan’s Surprise to the south and if Ryan’s

Surprise and Ulli’s Ridge may form part of the same mineralized

zone; and

- Drilling around the newly discovered high-grade gold zone at

Ulli’s Ridge, where hole WHTULR21D004 intersected 6.94 g/t

Au over 19.5m as well as an untested area of the soil

anomaly 300m northwest of the high-grade discovery.

Results for the Ryan’s Surprise drill holes

(target area 1 above) were reported in a Company news release dated

January 5th, 2023. The current news release presents results for

the gap area (area 2) and Ulli’s Ridge (area 3) target.

A summary of significant gold assay results is provided in

Tables 1 & 2 and drill collar details are shown in Table 3.

Results are discussed separately below for each target area.

Gap Area between Ryan’s Surprise & Ulli’s Ridge

Targets

Two widely spaced holes were drilled to test the

gap area between the Ryan’s Surprise and Ulli’s Ridge targets

(Figure 3). Both Gap area holes are located approximately 200m

southeast and 250m northwest of the limits of previous significant

drilling gold assay results at Ryan’s Surprise and Ulli’s Ridge

respectively and approximately 150m apart form each other.

Structural features which control mineralization at both targets

appear very similar, and the goal of the drilling was to test the

presence of gold mineralization in this undrilled area and between

the targets. The southernmost hole, WHTRS22D027 intersected 1.43

g/t Au over 11.45m from 145.50m downhole, and hole WHTRS22D028

drilled approximately 150m to the north-northeast of WHTRS22D027

intersected 6.01 g/t Au over 2.35m from 296.50m downhole as well as

multiple other zones grading from 1.2 to 3.5 g/t Au over widths of

1.5m to 4.5m. The mineralization in hole WHTRS22D027 and the upper

part of hole WHTRS22D028 is generally similar to hanging wall zones

seen at Ryan’s Surprise, whereas the zone from 296.50-298.85m which

graded 6.01 g/t Au over 2.35m is tentatively correlated with the

main Ryan’s Surprise mineralized structure. More closely spaced

drilling is required to properly correlate the intercepts from hole

to hole.

The Company considers these results as very

encouraging, and additional drilling in this area is warranted to

further test the continuity, grade and further extension of gold

mineralization in this area.

Table 1: Summary of Significant 2022

Diamond Drilling Results, Gap area.

|

Target / Hole ID |

From (m) |

To (m) |

Length (m)* |

Au (g/t) ** |

|

|

|

Ryan's Surprise - Ulli's Ridge Gap |

|

|

|

|

|

|

|

WHTRS22D027 |

90.15 |

95.35 |

5.20 |

0.88 |

|

|

|

incl. |

91.10 |

95.35 |

4.25 |

1.01 |

|

|

|

|

145.50 |

156.95 |

11.45 |

1.43 |

|

|

|

incl. |

149.50 |

156.95 |

7.45 |

1.99 |

|

|

|

WHTRS22D028 |

174.90 |

176.60 |

1.70 |

3.49 |

|

|

|

|

186.30 |

187.80 |

1.50 |

2.25 |

|

|

|

|

206.00 |

210.50 |

4.50 |

1.21 |

|

|

|

|

296.50 |

298.85 |

2.35 |

6.01 |

|

|

|

incl. |

296.50 |

298.00 |

1.50 |

8.73 |

|

|

|

|

338.70 |

341.90 |

3.20 |

1.52 |

|

|

|

|

362.00 |

364.40 |

2.40 |

1.95 |

|

|

| * All drill hole

intercepts reported herein are core lengths. Currently there is

insufficient data to estimate true thicknesses. |

| ** Gold assays are

uncapped. |

Ulli’s Ridge Target

Three holes were drilled at the Ulli’s Ridge

target. Hole WHTULR22D010, drilled approximately 300m to the

northwest, collared in mineralization and intersected a broad zone

of gold mineralization grading 1.49 g/t Au over 16.00m from 6.00m

downhole. This mineralization is open along strike and down-dip.

WHTULR22D010 was drilled to test a gold-in-soil anomaly that had

previously been tested by a single RAB hole which, based on the

current understanding of the target, was drilled at the wrong

orientation and consequently did not return any significant gold

values. This style of gold mineralization in terms of grade and

thickness is quite common at Ryan’s Surprise and its encouraging to

be encountering additional mineralization in this area. Holes

WHTULR22D008 and WHTULR22D009 tested for extensions of the

high-grade mineralization encountered in hole WHTULR21D004 which

graded 6.94 g/t Au over 19.5m. Hole WHTULR22D008 was collared

approximately 25m south of hole WHTULR21D004 and was designed to

test the high-grade mineralization down-dip, while hole

WHTULR22D009 was drilled to test along strike approximately 35m to

the east. Both holes intersected gold mineralization including 0.92

g/t Au over 3.10m from 136.45m downhole in WHTULR22D008, and 1.77

g/t Au over 1.87m from 106.88m in WHTULR22D009. The high-grade

mineralization encountered in WHTULR21D004 was not encountered.

Table 2: Summary of Significant 2022

Diamond Drilling Results, Ulli’s Ridge target.

|

Target / Hole ID |

From (m) |

To (m) |

Length (m)* |

Au (g/t) ** |

|

|

|

Ulli's Ridge |

|

|

|

|

|

|

|

WHTULR22D008 |

136.45 |

139.55 |

3.10 |

0.92 |

|

|

|

incl. |

138.85 |

139.55 |

0.70 |

2.41 |

|

|

|

WHTULR22D009 |

30.20 |

35.45 |

5.25 |

0.58 |

|

|

|

|

106.88 |

108.75 |

1.87 |

1.77 |

|

|

|

|

149.75 |

152.00 |

2.25 |

1.43 |

|

|

|

|

162.25 |

164.00 |

1.75 |

1.63 |

|

|

|

WHTULR22D010 |

6.00 |

22.00 |

16.00 |

1.49 |

|

|

|

|

54.00 |

56.00 |

2.00 |

0.97 |

|

|

|

|

141.10 |

142.00 |

0.90 |

1.09 |

|

|

| * All drill hole

intercepts reported herein are core lengths. Currently there is

insufficient data to estimate true thicknesses. |

| ** Gold assays are

uncapped. |

Table 3: Collar details for 2022 Diamond

Drilling at Ryan’s Surprise and Ulli’s Ridge targets.

|

Target / Hole ID |

Collar Location (UTM NAD83, Zone

7) |

Dip |

Azimuth |

Length |

|

|

Easting (m) |

Northing (m) |

Elevation (m) |

(deg) |

(deg) |

(m) |

|

Ryan's Surprise - Ulli's Ridge Gap |

|

|

|

|

|

|

WHTRS22D027 |

574,150 |

7,004,132 |

642 |

-60 |

20 |

300.0 |

|

WHTRS22D028 |

574,217 |

7,004,267 |

693 |

-60 |

18 |

482.0 |

|

Ryan's Surprise Infill |

|

|

|

|

|

|

|

WHTRS22D029* |

574,323 |

7,004,413 |

741 |

-60 |

355 |

303.0 |

|

WHTRS22D030* |

574,212 |

7,004,557 |

756 |

-65 |

0 |

200.0 |

|

WHTRS22D031* |

574,039 |

7,004,533 |

742 |

-60 |

25 |

320.0 |

|

WHTRS22D032* |

574,091 |

7,004,371 |

681 |

-60 |

20 |

411.0 |

|

Ulli's Ridge |

|

|

|

|

|

|

|

WHTULR22D008 |

574,576 |

7,003,558 |

627 |

-50 |

20 |

201.0 |

|

WHTULR22D009 |

574,612 |

7,003,563 |

634 |

-50 |

35 |

171.0 |

|

WHTULR22D010 |

574,348 |

7,003,772 |

713 |

-55 |

20 |

297.0 |

|

TOTAL |

|

|

|

|

|

2,685.0 |

| Note: * Results

reported in News Release issued on January 5, 2023. |

|

|

|

Rotary Air Blast (RAB) Drilling along Ryan’s

Trend

The 2022 RAB drilling program along the Ryan’s

Trend comprised 12 holes totalling 919m which tested four separate

targets: 1) Teacher (4 holes, 361.2m); 2) Principal Ridge (4 holes,

175.3m); 3) Ryan’s Surprise North (2 holes, 201.2m,); and 4) Tween

(2 holes, 181.4m). Gold mineralization hosted in metasedimentary

units along the Ryan’s Trend shows a close association with

anomalous arsenic, hence the RAB drilling focused on high arsenic

targets identified through previous soil sampling and 2022 detailed

prospecting. The 2022 RAB drilling program at Ryan’s Trend

represent maiden drilling at each of the four targets tested.

All 2022 RAB holes were surveyed with a borehole

optical televiewer, which provided continuous high resolution

digital imagery of walls of the holes, allowing for the detailed

structural interpretation of the zones. Interpretation of the zones

intersected in the 2022 RAB drilling program is currently underway

and will be used to guide any future proposed drilling

campaigns.

Significant results and interpretations are

discussed below and a summary of significant RAB gold assay results

is provided in Table 4 and drill collar details are shown in Table

5.

Teacher Target

The Teacher target is located at the

northernmost limit of the Ryan’s Trend on the eastern ridge of the

Yukon River. In the late 1990’s, Teck Resources Limited (“Teck”)

conducted a reconnaissance program of prospecting, sampling and

trenching in the Teacher area as they explored for Pogo-style gold

mineralization. The trenching returned significant values up to

12.15 g/t Au, 13.0 g/t Ag, 275 ppm Sb and > 10,000 ppm (1%) As.

Teck described the mineralization as being associated with

silicified and brecciated metasedimentary rocks adjacent to the

contact zones with granitic porphyry dykes. Subsequent sampling by

the Company in 2017 also returned high-grade gold and silver values

(up to 7.08 g/t Au and 137 g/t Ag) in grab samples.

In 2022 four RAB holes were drilled at the

Teacher target all intersected gold mineralization. The best

results were obtained from holes WHTTCS22RAB003 and WHTTCS22RAB004.

Hole WHTTCS22RAB003 intersected 3.40 g/t Au over 6.10m from 1.52m

depth and WHTTCS22RAB004 intersected 3.30 g/t Au over 4.57m from

24.38m depth. Holes WHTTCS22RAB001 and WHTTCS22RAB002 intersected

additional gold mineralization, including 0.20 g/t Au over 4.57m

from 1.52m depth in WHTTCS22RAB001 and 0.31 g/t Au over 16.76m from

3.05m depth in WHTTCS22RAB002.

Principal Ridge Target

The Principal Ridge target is located

approximately 1.5km south of the Teacher target and forms a

southern extension of the same gold in soil anomaly. Follow up

historical exploration work has also returned significant gold

values in trench samples up to 6.61 g/t Au and GT Probe samples up

to 1.83 g/t Au.

In 2022 four RAB holes were drilled at the

Principal Ridge target, with 3 of 4 holes (WHTPRR22RAB002 to 004)

terminated early (18-37m depth) due to bad ground conditions and

were unable to reach their targets. Nevertheless, hole

WHTPRR22RAB003 encountered surface gold mineralization grading 1.20

g/t Au over 4.57m from 1.52m depth. Hole WHTPRR22RAB001 was drilled

approximately 600m northwest of the other three holes and was

successfully completed to 100m. The hole encountered several gold

mineralized zones including 1.50 g/t Au over 4.57m from 25.91m

depth and 0.65 g/t Au over 3.05m from 74.68m depth.

Table 4: Summary of Significant 2022 RAB

Drilling Results, Ryan’s Trend.

|

Target / Hole ID |

From (m) |

To (m) |

Length (m)* |

Au (g/t)** |

|

TEACHER |

|

|

|

|

|

WHTTCS22RAB002 |

3.05 |

19.81 |

16.76 |

0.31 |

|

incl. |

16.76 |

18.29 |

1.52 |

1.00 |

|

WHTTCS22RAB003 |

1.52 |

7.62 |

6.10 |

3.40 |

|

incl. |

1.52 |

6.10 |

4.57 |

4.40 |

|

and incl. |

3.05 |

4.57 |

1.52 |

6.89 |

|

WHTTCS22RAB004 |

24.38 |

28.96 |

4.57 |

3.30 |

|

incl. |

24.38 |

25.91 |

1.52 |

9.64 |

|

PRINCIPAL RIDGE |

|

|

|

|

|

WHTPRR22RAB001 |

25.91 |

30.48 |

4.57 |

1.50 |

|

incl. |

25.91 |

27.43 |

1.52 |

3.74 |

|

|

50.29 |

68.58 |

18.29 |

0.26 |

|

|

74.68 |

77.72 |

3.05 |

0.65 |

|

WHTPRR22RAB003 |

1.52 |

6.10 |

4.57 |

1.20 |

|

incl. |

3.05 |

6.10 |

3.05 |

1.72 |

|

|

|

|

|

|

| * All drill hole

intercepts reported herein are measured in-hole lengths. Currently

there is insufficient data to estimate true thicknesses. |

| ** Gold assays are

uncapped. |

|

|

|

Table 5: Collar details for 2022 RAB

Drilling, Ryan’s Trend.

|

Target / Hole ID |

Collar Location (UTM NAD83, Zone 7) |

Dip |

Azimuth |

Length |

|

|

Easting (m) |

Northing (m) |

Elevation (m) |

(deg) |

(deg) |

(m) |

|

Teacher |

|

|

|

|

|

|

|

WHTTCS22RAB001 |

572291 |

7008633 |

448 |

-55 |

300 |

77.7 |

|

WHTTCS22RAB002 |

572264 |

7008507 |

508 |

-55 |

320 |

96.0 |

|

WHTTCS22RAB003 |

572261 |

7008553 |

488 |

-55 |

310 |

86.9 |

|

WHTTCS22RAB004 |

572292 |

7008487 |

495 |

-55 |

125 |

100.6 |

|

Principal Ridge |

|

|

|

|

|

|

|

WHTPRR22RAB001 |

572176 |

7007685 |

496 |

-55 |

200 |

100.6 |

|

WHTPRR22RAB002 |

572600 |

7007310 |

580 |

-55 |

315 |

19.8 |

|

WHTPRR22RAB003 |

572661 |

7007301 |

560 |

-55 |

315 |

36.6 |

|

WHTPRR22RAB004 |

572573 |

7007154 |

485 |

-55 |

210 |

18.3 |

|

Ryan's Surprise North |

|

|

|

|

|

|

|

WHTRSN22RAB001 |

573869 |

7005056 |

645 |

-55 |

200 |

100.6 |

|

WHTRSN22RAB002 |

573868 |

7004957 |

658 |

-55 |

340 |

100.6 |

|

Tween |

|

|

|

|

|

|

|

WHTTWN22RAB001 |

575735 |

7002487 |

831 |

-55 |

200 |

80.8 |

|

WHTTWN22RAB002 |

575715 |

7002441 |

846 |

-55 |

20 |

100.6 |

|

TOTAL |

|

|

|

|

|

919.0 |

Other Matters

The Company announces that a total of 5,800,000

options to purchase common shares of the Company have been granted

to directors, officers, employees and consultants at an exercise

price of $0.38 per share, expiring on February 1, 2028. The grant

is subject to regulatory approval.

QA/QCAnalytical work for the

2022 diamond drilling and RAB program was performed by Bureau

Veritas, an internationally recognized analytical services

provider, at its North Vancouver, British Columbia laboratory.

Sample preparation was carried out at its Whitehorse, Yukon

facility. Samples were prepared using the PRP70-250 package, where

samples were weighed, dried, and crushed to greater than 70%

passing a 2mm sieve, then pulverized to greater than 85% passing 75

microns). Samples were then analyzed in accordance with BV’s FA430

and MA250 packages, for both gold analysis by fire assay (30g fire

assay with AAS finish) and ultra-trace multi-element ICP analysis

(0.25 g, 4 acid digestion and ICP-MS analysis).

The reported diamond drilling and RAB sampling

program work was completed using industry standard procedures,

including a quality assurance/quality control (“QA/QC”) program

consisting of the insertion of standards and blank samples into the

sample stream. BV also runs a comprehensive QA/QC program of

standards, duplicates, and blanks within each sample stream.

About White Gold Corp.The

Company owns a portfolio of 17,584 quartz claims across 30

properties covering approximately 350,000 hectares representing

over 40% of the Yukon’s emerging White Gold District. The Company’s

flagship White Gold property hosts the Company’s Golden Saddle and

Arc deposits which have a mineral resource of 1,139,900 ounces

Indicated at 2.28 g/t Au and 402,100 ounces Inferred at 1.39 g/t

Au(1). Mineralization on the Golden Saddle and Arc is also known to

extend beyond the limits of the current resource estimate. The

Company’s recently acquired VG Deposit also hosts an Inferred gold

resource of 267,600 ounces at 1.62 g/t Au(2). Regional exploration

work has also produced several other new discoveries and

prospective targets on the Company’s claim packages which border

sizable gold discoveries including the Coffee project owned by

Newmont Corporation with Measured and Indicated Resources of 2.17

Moz at 1.46 g/t Au, and Inferred Resources of 0.50 Moz at 1.32 g/t

Au(3), and Western Copper and Gold Corporation’s Casino project

which has Measured and Indicated Resources of 14.8 Moz Au and 7.6

Blb Cu and Inferred Resources of 6.3 Moz Au and 3.1 Blb Cu(4). For

more information visit www.whitegoldcorp.ca.

(1) See White Gold Corp. technical report titled

“Technical Report for the White Gold Project, Dawson Range, Yukon

Canada”, Effective Date May 15, 2020, Report Date July 10, 2020,

prepared by Dr. Gilles Arseneau, P.Geo., and Andrew Hamilton,

P.Geo., available on SEDAR.(2) See White Gold Corp. technical

report titled “Technical Report for the QV Project, Yukon, Canada”,

Effective Date October 15, 2021, Report Date November 15, 2021,

available on SEDAR.(3) See Newmont Corporation news release titled

“Newmont Reports 2021 Mineral Reserves of 93 Million Gold Ounces

and 65 Million Gold Equivalent Ounces”, dated February 24, 2022:

https://www.newmont.com/investors/news-release/default.aspx.(4) See

Western Copper and Gold Corporation technical report titled “Casino

project, Form 43-101F1 Technical Report Feasibility Study, Yukon

Canada”, Effective Date June 13, 2022, Issue Date August 8, 2022,

prepared by Daniel Roth, PE, P.Eng., Mike Hester, F Aus IMM, John

M. Marek, P.E., Laurie M. Tahija, MMSA-QP, Carl Schulze, P.Geo.,

Daniel Friedman, P.Eng., Scott Weston, P.Geo., available on

SEDAR.

Qualified Person Terry Brace,

P.Geo. and Vice President of Exploration for the Company is a

“qualified person” as defined under National Instrument 43-101 –

Standards of Disclosure of Mineral Projects and has reviewed and

approved the content of this news release.

Cautionary Note Regarding Forward

Looking InformationThis news release contains

"forward-looking information" and "forward-looking statements"

(collectively, "forward-looking statements") within the meaning of

the applicable Canadian securities legislation. All statements,

other than statements of historical fact, are forward-looking

statements and are based on expectations, estimates and projections

as at the date of this news release. Any statement that involves

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions, future events or

performance (often but not always using phrases such as "expects",

or "does not expect", "is expected", "anticipates" or "does not

anticipate", "plans", “proposed”, "budget", "scheduled",

"forecasts", "estimates", "believes" or "intends" or variations of

such words and phrases or stating that certain actions, events or

results "may" or "could", "would", "might" or "will" be taken to

occur or be achieved) are not statements of historical fact and may

be forward-looking statements. In this news release,

forward-looking statements relate, among other things, the

Company’s objectives, goals and exploration activities conducted

and proposed to be conducted at the Company’s properties; future

growth potential of the Company, including whether any proposed

exploration programs at any of the Company’s properties will be

successful; exploration results; and future exploration plans and

costs and financing availability.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

materially differ from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include:the expected

benefits to the Company relating to the exploration conducted and

proposed to be conducted at the White Gold properties; the receipt

of all applicable regulatory approvals for the Offering; failure to

identify any additional mineral resources or significant

mineralization; the preliminary nature of metallurgical test

results; uncertainties relating to the availability and costs of

financing needed in the future, including to fund any exploration

programs on the Company’s properties; business integration risks;

fluctuations in general macroeconomic conditions; fluctuations in

securities markets; fluctuations in spot and forward prices of

gold, silver, base metals or certain other commodities;

fluctuations in currency markets (such as the Canadian dollar to

United States dollar exchange rate); change in national and local

government, legislation, taxation, controls, regulations and

political or economic developments; risks and hazards associated

with the business of mineral exploration, development and mining

(including environmental hazards, industrial accidents, unusual or

unexpected formations pressures, cave-ins and flooding); inability

to obtain adequate insurance to cover risks and hazards; the

presence of laws and regulations that may impose restrictions on

mining and mineral exploration; employee relations; relationships

with and claims by local communities and indigenous populations;

availability of increasing costs associated with mining inputs and

labour; the speculative nature of mineral exploration and

development (including the risks of obtaining necessary licenses,

permits and approvals from government authorities); the

unlikelihood that properties that are explored are ultimately

developed into producing mines; geological factors; actual results

of current and future exploration; changes in project parameters as

plans continue to be evaluated; soil sampling results being

preliminary in nature and are not conclusive evidence of the

likelihood of a mineral deposit; title to properties; ongoing

uncertainties relating to the COVID-19 pandemic; and those factors

described under the heading "Risks Factors" in the Company's annual

information form dated July 29, 2020 available on SEDAR. Although

the forward-looking statements contained in this news release are

based upon what management of the Company believes, or believed at

the time, to be reasonable assumptions, the Company cannot assure

shareholders that actual results will be consistent with such

forward-looking statements, as there may be other factors that

cause results not to be as anticipated, estimated or intended.

Accordingly, readers should not place undue reliance on

forward-looking statements and information. There can be no

assurance that forward-looking information, or the material factors

or assumptions used to develop such forward-looking information,

will prove to be accurate. The Company does not undertake to

release publicly any revisions for updating any voluntary

forward-looking statements, except as required by applicable

securities law.

Neither the TSXV nor its Regulation

Services Provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

news release.

For Further Information, Please

Contact:

Contact Information:David

D’OnofrioChief Executive OfficerWhite Gold Corp.(647) 930-1880

ir@whitegoldcorp.ca

To Book a Meeting with Management:

https://whitegoldcorp.ca/contact/request-information/

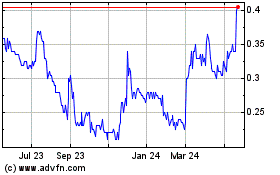

White Gold (TSXV:WGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

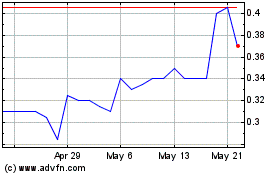

White Gold (TSXV:WGO)

Historical Stock Chart

From Dec 2023 to Dec 2024